Table of contents

Other volumes

The future of payments is being written in code. As technology and finance become ever more intertwined, the builders creating the fast, frictionless and secure technologies powering payments are taking center stage. Explore the world they’re building in Volume 6 of Payments Unbound.

EXPLORE VOLUME

As new technology disrupts industries, take a look at how the most successful companies are exploring new organizational paradigms.

EXPLORE VOLUME

Explore unexpected connections between a business and a supplier, a gamer and a virtual world, a fintech and a community they serve—made possible by payments.

Explore volume

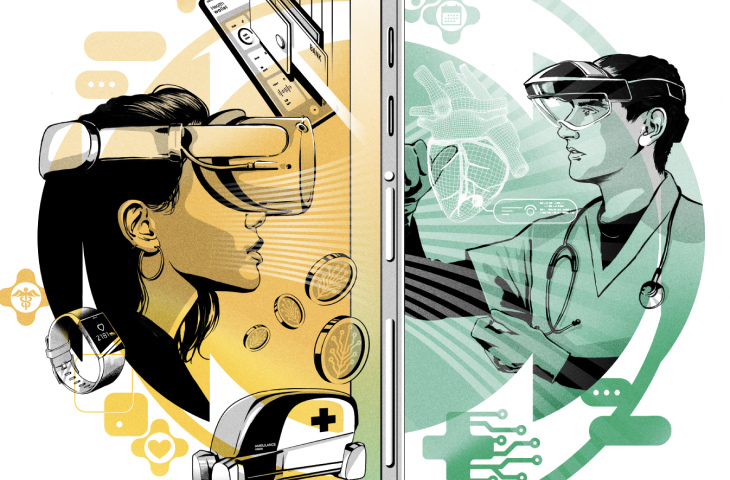

Learn about the impact of generative AI, how blockchain is changing the payments game and what stores will look like in the future.

EXPLORE VOLUME

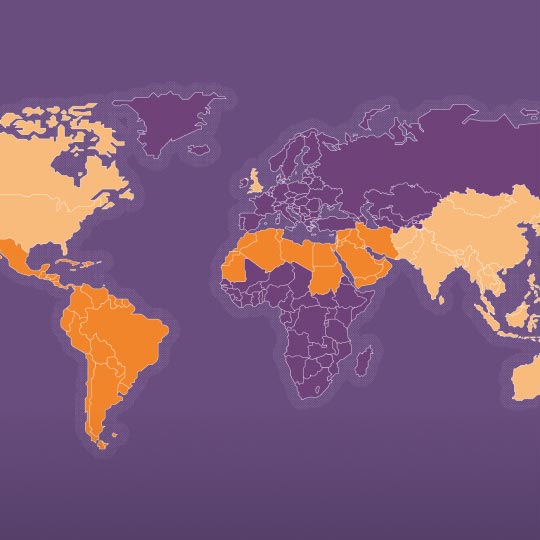

Economies are evolving, and the payments landscape is changing quickly. Everything from making doctors’ appointments to selling clothes to how you use your car is impacted. And that’s just the start.

EXPLORE VOLUME

How digital wallets are driving the connected-car economy & reshaping the future of payments.

EXPLORE VOLUME