J.P. Morgan

Concourse™

The payments you need. The experience your customers and suppliers expect.

One connection for a whole world of payments

There are more ways to make and receive payments than ever before.

With one integration point Concourse enables you to initiate electronic payments to your customers and suppliers using their email address and an easy-to-use website that facilitates the payment.

Helping connect your business to your customers and suppliers

Leverage multiple payment types. Many methods of payments available to make and collect payments including ACH, real time payments, credit and debit cards, digital wallets, and more1. The solution is currently available in the U.S. and Canada.

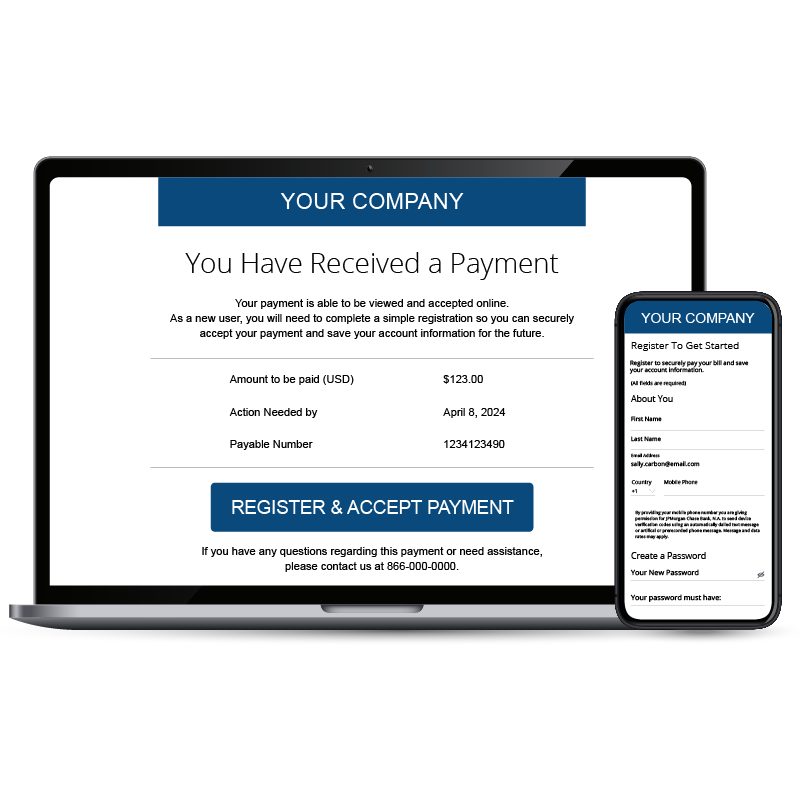

Connect from a single access point. Integrate your existing brand with customizable website design that can match your business logo, colors, and fonts—all from a single integration point.

Build customer loyalty, strengthen supplier relationships. Build a seamless website experience that helps take friction out of payments, enabling your customers and suppliers to make and receive payments with more options.

Offer your customers the payment types they want and expect. Give your customers the flexibility to choose from multiple options to pay—whether it’s credit or debit cards, digital wallets and more.

Guard your customers with fraud protection. J.P. Morgan’s industry-leading fraud prevention and monitoring capabilities2 help provide clients peace of mind. Store your customers’ sensitive payment information offsite with J.P. Morgan.

Reach your customers with customizable website experiences that look like your business. Help increase customer loyalty by offering a unified payment experience with a modern desktop and mobile interface that can be customized to match your brand, including your logo, colors and fonts.

Track and receive payments. Help facilitate the migration from paper checks to electronic payments to get your suppliers paid faster.

Help strengthen your supplier relationships. Create a frictionless payments experience that gives your suppliers the power to choose from multiple options to accept payment.

Reach your suppliers with automatic payments. Concourse offers the convenience of securely storing sensitive account information and enabling automatic payments which gives your Suppliers peace of mind and you more predicable cash flows.

SimpliHOM dramatically streamlines agent payments with J.P. Morgan

Sep 17, 2025

Learn how this real estate brokerage accelerated agent commission payments with hosted payments from J.P. Morgan.

Read more

How Concourse helps enhance your business

Whether your business is at the beginning of its digital transformation or further along, Concourse meets you where you are. Here’s how:

Integrate exactly to your needs

Use less of your own tech resources by using more of ours. Your Concourse website experience can scale up or down from a fully hosted website, to an embedded iFrame in your existing website to an API only experience taking advantage of our security and payment capabilities. You tell us your needs and we’ll deliver the right website experience for your business.

Connect to a world of payments in weeks, not years

With our turnkey solution, your business can initiate payments within weeks using our customizable website. And with a single integration point into your existing operations, it helps reduce your number of payment providers and processor relationships.

To learn more, please contact your J.P. Morgan Payments representative.

Contact us

Hide

Contact us

Hide