J.P. Morgan Access®

The treasury tools you need. From a bank you can trust.

Login

Hide

Login

Hide

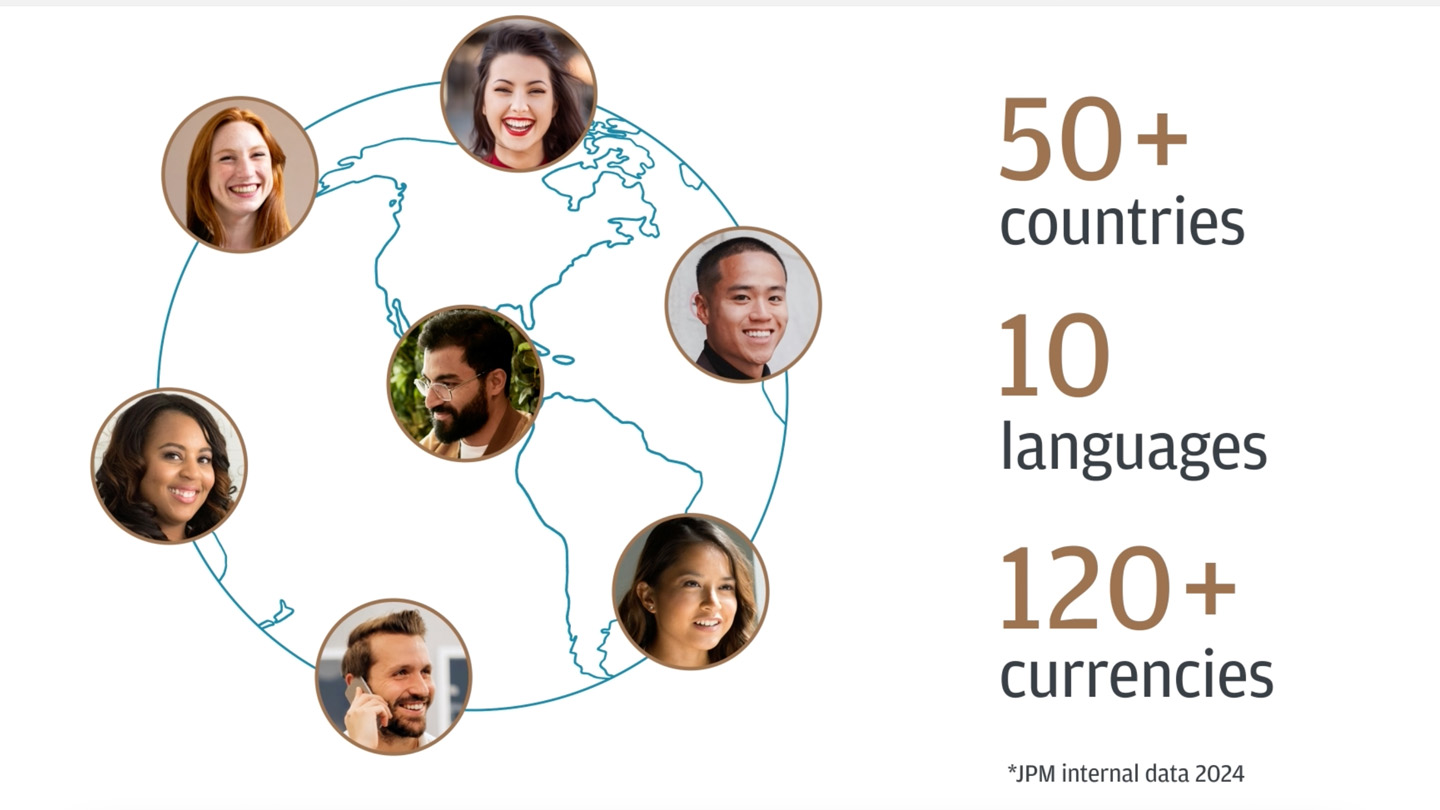

Access is a global cash management platform available in 50+ countries, 120+ currencies and 10 languages that offers a range of powerful tools that scale with you and help streamline your banking experience. One platform connects you to your payables and receivables needs through a single provider, with robust security and controls needed to help protect your business.

Unlock benefits that save you time and protect your business

Get self-service tools and support 24/7/365

From streamlined onboarding to local support, get the answers you need, when you need them.

Count on advanced fraud support

Get layers of payment security and user entitlements with features like Payment Control and Manager.

Gain cash flow visibility

Leverage transaction data and AI to support cash flow analytics and short-to-midterm forecasting.

Access has flexible connection options to help meet your needs

Access has flexible connection options to help meet your needs

Online

Manage your global treasury needs virtually through a single platform—whether it’s cash management, customized pay-ins for clients or reporting and reconciliation.

Mobile

Check balances, review payments and manage your liquidity on the go.

Direct

Connect to Access in the following ways, including:

- APIs

- File transmission

- SWIFT

Ranked #1 Globally

Crisil Coalition Greenwich recognizes J.P. Morgan Access® as No.1 across multiple performance categories, including: Payments & Treasury Management and Digital Channels1

Best API Project

J.P. Morgan and Autoneum recognized for Best API Project by Treasury Management International2

Related insights

Payments

Paramount Pictures streamlines global payments with J.P. Morgan Payments

Learn how Paramount Pictures optimizes vendor payments with cross-currency solutions.

Watch video

Treasury

Atlas overcomes financing challenges to streamline energy operations

Mar 03, 2025

Here’s how J.P. Morgan Payments helped tackle Atlas’ escrow-DDA dilemma with sustainable finance solutions.

Read more

Payments

J.P. Morgan Payments secures top marks from Crisil Coalition Greenwich

Mar 14, 2025

J.P. Morgan Access® and Chase Connect® both scored No. 1 positions in the 2024 Coalition Greenwich Digital Transformation Benchmarking Study.

Read moreReferences

Source: Treasury Management International Award for Innovation and Excellence