Planning for productive partnerships

COMMUNITIES

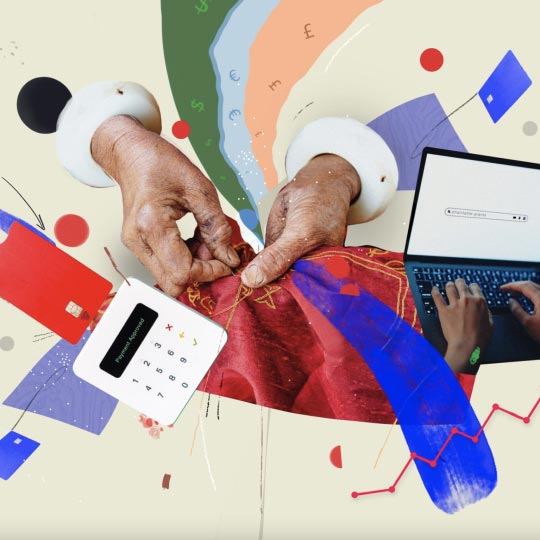

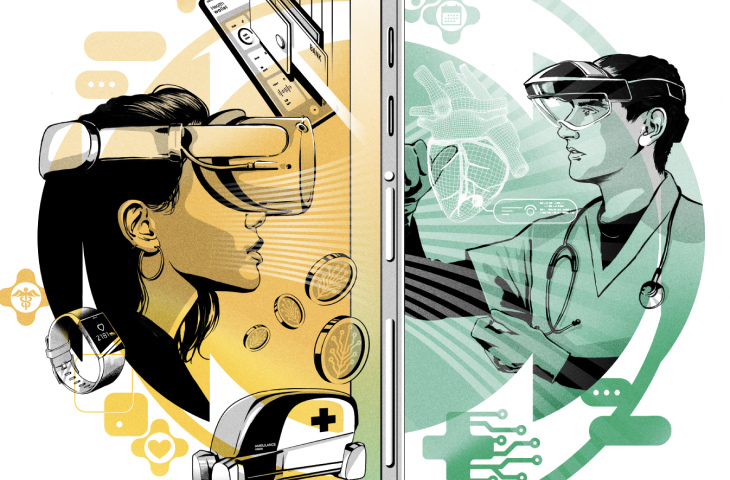

Payments were historically considered a back-office function, but they’ve evolved into a key strategic focus for many global companies. This shift requires product and treasury teams to collaborate more than ever—which is easier said than done. Both teams have different outlooks and priorities, so how can they effectively communicate their needs and work together?

To answer that question, we spoke with both a product lead and a treasury lead at two major global fintechs, who have considerable experience in creating successful internal partnerships. Here, they offer three essential tips for getting along better—and getting the best results from both teams.

1) Identify the problem

When teams have different areas of expertise, it’s crucial to clearly define the company’s objectives. This keeps everyone working toward the same goal. “Many companies have a technology, and they are searching for a problem,” says Levi. “In our case, we are led by a problem which is very well-defined—global payroll payments. And that makes our collaboration much better. First, we understand the business problem, the pain points, and then we develop the right technology solution as a team.”

2) Ensure everyone leans in equally

Product should see treasury as a co-pilot rather than a support team. This approach enables creative thinking which can lead to solving specific customer challenges. A good example is the use of cards in order to handle complex payroll needs for the maritime industry. “These employees are constantly moving around,” says Levi. “They lack reliable internet, which rules out many mobile tech solutions. With the introduction of payment cards to the ecosystem, such workers can use them in various local currencies.” They also need to exchange money in various locations, as well as send it back home in their country of origin’s local currency. For this, they can use cross-currency functionality, cross-currency functionality, which relies on a variety of payment rails.

3) Align while working

There’s no such thing as overcommunication between treasury and product, as pain points can arise when groups work in silo. “Sometimes payments will ask for a technical solution, such as a new payment method, but it is not feasible, or it is not worth the investment because too many other companies do it and it is not a differentiator,” explains Levi. Alternatively, a product architect can create a solution without considering regulatory limitations that results in treasurers being unable to support it and the organization being unable to use it. Non-stop communication is therefore key to success, and each team should view part of their job as educating the other.

1) Decide who from treasury collaborates with product

At Boku, treasury serves two roles: It manages all the corporate treasury tasks, but it also supports clients’ needs and collaborates with partners. Boku has thus split its treasury team into two units. The first group is Boku’s corporate treasury unit, which manages the company’s cash, handles accounting, and deals with auditors. The second group works most frequently with product development to design and launch new customer-facing solutions. “Formally separating those two units has made collaboration and innovation much easier, as everyone knows who to work with,” explains de Rougé.

2) Create a shared language

After creating the right structure for successful collaboration, treasurers should help product to build a shared technical language. That’s because jargon can quickly divide the groups. “It may seem mundane, but one of the key things is agreeing on vocabulary, on semantics, on defining things with the same word,” says de Rougé. “Having a clear definition of the goals, the target, the task, and the language can help a lot for a fruitful collaboration.” He adds that active listening is just as important.

3) Keep scanning the horizon

It’s crucial for treasurers to keep tabs on industry trends, as these insights can help inform product development. Treasurers at Boku identified the need to integrate multiple real-time payments into its platform. For them to build this innovation, they need close collaboration with product, as both groups need to carefully navigate local laws, licensing requirements, and compliance elements. “I think this has been one of the great collaborations between product and treasury at Boku,” says de Rougé.

What’s next?

What product trend should be on treasurers’ radars—and vice versa?

A forecast from Product:

“Payment methods like QR codes have taken off in many developing markets, where they have started to displace cash,” says Adam Lee, Chief Product Officer at Boku.

A forecast from Treasury:

“At some point there will be a shift in paradigm for the global payment industry,” says Jonathon Nash, Papaya Senior Director of Payments, Papaya Global.

SOURCES: WWW.JPMORGAN.COM/PAYMENTS-UNBOUND/SOURCES

ILLUSTRATION: JOE WALDRON