Could “on-demand” be the future of wages?

For many people, inflation means that bills are rising faster than income, which can put them under increased financial pressure. Enter: a new model for paying wages

J.P. MORGAN OP-ED

In the US alone, more than half the population—58 percent—are now living paycheck to paycheck, according to a 2023 CNBC report. Increasingly, people are turning to less optimal ways to borrow money—leaning on family and friends, taking on credit card debt, and in worse cases, turning to payday loan companies or unscrupulous loan sharks.

Almost 50 percent of US wage workers have no emergency savings, giving them no cash buffer and making it difficult for them to meet an unexpected bill. Many are forced to cut back on necessities, while others can find themselves falling into debt traps. We shouldn’t ignore, either, the stress that comes with constantly worrying about money—often feeding into a vicious cycle of poor financial decision-making.

Rethinking income

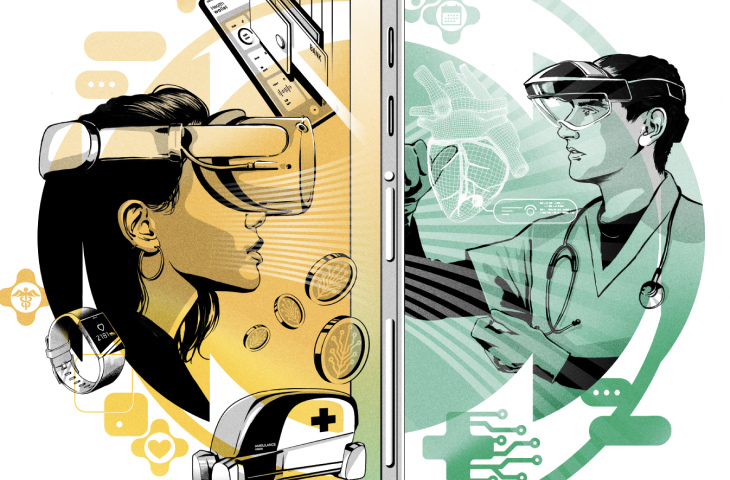

The good news is that an alternative to these stressful scenarios is emerging. In an effort to support financial security for their staff, many employers are now offering “earned wage access” (EWA) as a solution. This means giving workers access to the money they earn as soon as they earn it. It sounds like a simple idea, but in reality it represents a major change to how remuneration has traditionally been organized.

In the US, the majority of salaried employees are paid on a weekly or bi-weekly basis. In Asia-Pacific, monthly cycles are the norm, while in Europe, it can vary depending on the country and role. Meanwhile, freelancers and gig workers have little structure. They account for more than one third of the labor force in the US—but almost 75 percent do not get paid on time.

EWA allows employees or contractors to draw down their earned wages prior to a typical payroll cycle. For example, some workers may want to get paid twice a week, or even daily. But what if a worker could get their money directly into their bank account or to a digital wallet as soon as a shift is finished? What if a delivery driver could receive payment after each delivery? Platform companies, such as ride-hailing firms, could use EWA as a competitive advantage to reduce churn and ensure they have access to the best workers. But all types of employers can use EWA as an incentive, allowing their workers to access the money they have earned, faster and more efficiently.

Improving financial inclusion

Most significantly, the benefits of EWA can help individuals build better finance habits over the long term, as evidenced by data from EWA-enabling products. This supports the idea that earned money is often used more carefully and rationally than borrowed money, and that EWA could help steer workers away from high-cost unsecured debt. Also, EWA has the potential to reduce absenteeism and boost productivity levels, because it can help workers quickly obtain the means to get to work or receive medical aid when sick or injured.

How to make earned wage access work—responsibly

Matt Pierce is the CEO and Founder of Immediate, a fintech startup based in Birmingham, Alabama that helps companies offer EWA. He says the financial wellness benefits of EWA, done right, are clear. “Plainly speaking, what we’ve built is a responsible alternative to predatory lending services.” But while pay may be modernizing, bills are not. Larger monthly commitments, such as mortgage, rent, and utilities, continue to require forethought and budgeting. Perpetually taking pay in smaller increments may make it more difficult to cover these cost-of- living expenses. Ideally, EWA should be an opportunity to meet urgent needs without resorting to high-interest-rate alternatives, and should not create additional burdens.

Ethical lending principles are therefore essential, Pierce says, if EWA is to be effective. “We do it responsibly and flexibly,” he explains. “We believe in caps and guardrails. For example, we don’t think people should get paid every day. We don’t force people into opening a new account and getting a new card to access EWA. We meet people where they are and allow them to responsibly access and move their money.”

Pierce is excited about the future of EWA and predicts exponential uptake over the next decade. “The [user] market is still less than 20 percent penetrated. So there's a huge greenfield opportunity here. This is a solution where we can really impact millions and millions of lives, and help them improve, financially. My opinion is that by 2030, every company, at least in the US, will be offering some shape or form of this.”

J.P. MORGAN PAYMENTS

SOURCES: WWW.JPMORGAN.COM/PAYMENTSUNBOUND/SOURCES

IMAGES: GETTY/ ANTON VIERIETIN, GETTY/ JONATHAN KITCHEN

ILLUSTRATION: ADI GILBERT