Ways to win: Advice from small businesses

COMMUNITIES

It’s usually the world’s biggest corporations that take the lion’s share of headlines and opinion pieces. Big budgets, big campaigns...but are they missing the bigger picture? When you operate as a small business, it’s easy to feel like David and not the Goliath that small businesses (SMBs) collectively represent. At a time of high inflation and low consumer confidence, staying afloat is harder for smaller firms without large cash reserves to fall back on. But with the agility innate in this community, comes strength. Here, we look at what the SMB community can teach larger enterprises about rethinking payments to build resilience.

Do more with less

All businesses are facing challenges in the current economic climate. Larger companies typically have bigger cushions and are able to prepare themselves more effectively for periods of economic downturn. But why waste valuable resources when you don’t have to? SMBs typically don’t have that kind of cushion—so take a leaf from their playbook.

“To remain competitive, SMBs are being tasked with making the same decisions we are all facing on a personal, business, and societal level,” says Tomer Barel, Chief Operating Officer at Melio, a digital payments platform that specifically supports the small business community. “That means figuring out which activities are essential and trimming away or outsourcing the rest.”

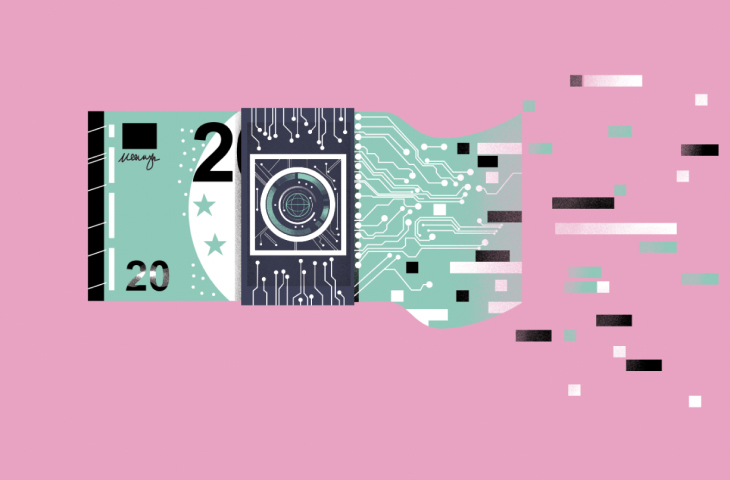

The problem is, it can be costly for SMBs to pay for outsourced work. One way around this is to use digital platforms to automate tasks that previously would have been done manually. Business-to-business (B2B) payments are a good example. A commonly cited figure is that 50 percent of B2B payments are still done via check in the US—many large enterprises have yet to make the switch. But a new range of digital tools can not only automate these payments but overcome the barriers to implementing those processes in the first place. Melio’s app, for instance, allows both sides of the transaction to use whatever method is convenient for them. An SMB may want to pay via a credit card, but it’s vendor may wish to receive a regular electronic funds transfer. Melio can sit in the middle and receive the credit card payment, and then send a transfer itself. “Melio’s intense focus on developing digital solutions that cater to business owners’ needs builds on J.P. Morgan’s core payment functionality, allowing small businesses to thrive,” states Melissa Smith, Head of Specialized Industries for Middle Market Banking, J.P. Morgan.

Engineer flexibility

SMBs tend to not have cumbersome legacy infrastructure—often they were born in the cloud—so they can jump relatively quickly to better software whenever it emerges. Larger firms typically do not want the risk or expense of changing a tool that is heavily embedded in their processes and functioning adequately. But this can leave them vulnerable in the

long-term, and this is why it’s essential that all companies think hard about digital transformation.

Consider the benefits that can come with being able to switch to optimal payments systems. Firstly, there are financial benefits. Cutting a check comes with a cost, plus three percent of the mail in the US gets lost. Engaging directly with their bank, as many SMBs do, enables a conversation to find the lowest cost solution and explore more ways to pay on their terms. Overall, this leads to a better customer experience – and potentially getting paid faster.

Secondly, modern systems save time, freeing businesses up from back room tasks and enabling them to get out there and compete in the market. Jennie Hernandez, Co-Founder of new startup Patriot Welding Supply, agrees: “Having a digital payments solution saves me from having to write a check, put a stamp on it, get an envelope and mail it. It is invaluable—time I can spend on winning new work.”

Learn from your community

Collaboration across the SMB community allows for knowledge sharing that is often lacking for large corporations.

So what’s one piece of payments advice from the community that larger companies may wish to heed? “As our small business users tell us every day, their main priority is serving their customers who are demanding easier ways to pay,” says Barel. “From providing more flexible payment options for B2C transactions to dedicating more time to customers by simplifying B2B transactions, how a small business manages payments plays a big role in customer satisfaction.” In large firms, it’s rare that a single person in the company will understand the whole customer journey and payments, especially, can be an afterthought. If they examine that side of the customer experience in greater detail, they have a better chance of building long-term loyalty and value.

J.P. MORGAN