Building a smart grid

FIRST WORD

When you hit a light switch, you just expect the bulb to go on. You don’t see the generators, the grid or any of the activities that happen behind the scenes to make it happen. In many ways, payments are the same.

Take a simple credit card payment. In the few moments that the customer is in contact with the point-of-sale terminal, that transaction could have hit perhaps eight different systems. It will have been back and forth between the acquiring network, the card issuer, and the bank. It will have gone through multiple risk platforms. Both the payment and the user will have been verified. Then there will have been compliance, clearing and settlement, as well as money flowing between multiple institutions. All of that happens in microseconds.

The more invisible a payment is, the smarter it is. If you think about it, that is the magic of ride sharing apps—the checkout experience is to just get out of the car. When the rider leaves the vehicle, the payment is automatically triggered. But that type of frictionless transaction is only possible if there is a partner that is able to handle all the back-end complexity. What people don’t realize is when you carry out a payment on most online marketplaces, that’s us. J.P. Morgan powers the grid.

As transactions grow in size the process becomes even more challenging. Moving $10 in real-time is relatively easy, but when it’s $10 million, well, then it starts to get interesting. If you send money to the wrong person, it can be extremely difficult to get it back.

With cross-border payments there’s an additional layer of complexity, as there are also compliance considerations and cultural nuances to factor in. In Germany, customers prefer to pay for goods on a 14-day invoice, which is a completely different payment flow to a credit card transaction in the US or a real-time transaction in Singapore. Being able to deal with all these moving parts, while ensuring absolute reliability and security is what makes the hidden world of payments so complicated.

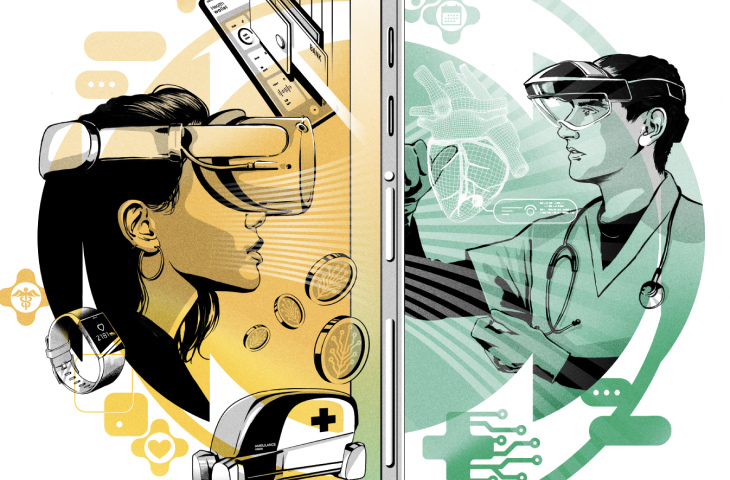

That’s why a key focus for the future of payments is proving identity. We are currently shifting from payments based on credentials such as valid card information to identity-based payments where the transaction is verified by establishing who’s actually behind it. There’s a variety of ways to do this, because preferences change depending on the age of the customer. Millennials or Gen-Zs are happy to scan their palm. Baby boomers might want to use their phone or other device.

Another technology we think could ensure reliability in the coming years is blockchain, as it could allow financial institutions to securely share information with each other. If banks pooled their customers’ account information, it would become possible to validate all the details in a payment before it was sent. You would know for certain it would complete and that could greatly speed up the process.

Innovations like this will ultimately help build a smarter payments grid, in which information, money, and assets can be moved in ways that will power the next generation of businesses.

Of course, all of this work is made possible by the ever-growing prominence of the developer. Developers create the integrations and experiences that make payments, however large or small, as simple and seamless as flicking on a lightbulb. It’s why, with our online Developer Portal, we will make key J.P. Morgan data, APIs and tools available to third party fintechs and firms. We believe the role of the developer and technologists will continue to grow as new payment innovations come to light, and we hope to empower them with the right tools and technology to build their dream solutions.

In this issue we will take you behind the scenes of payments, so you can see how these trends—and more—are transforming this unseen world. The companies and people driving them are quietly impacting all of our day-to-day lives. Enjoy reading their stories, and enjoy the magazine.

J.P. MORGAN PAYMENTS

SOURCES: WWW.JPMORGAN.COM/PAYMENTSUNBOUND/SOURCES

IMAGE: GETTY/ ANDRIY ONUFRIYENKO

ILLUSTRATION: ADI GILBERT