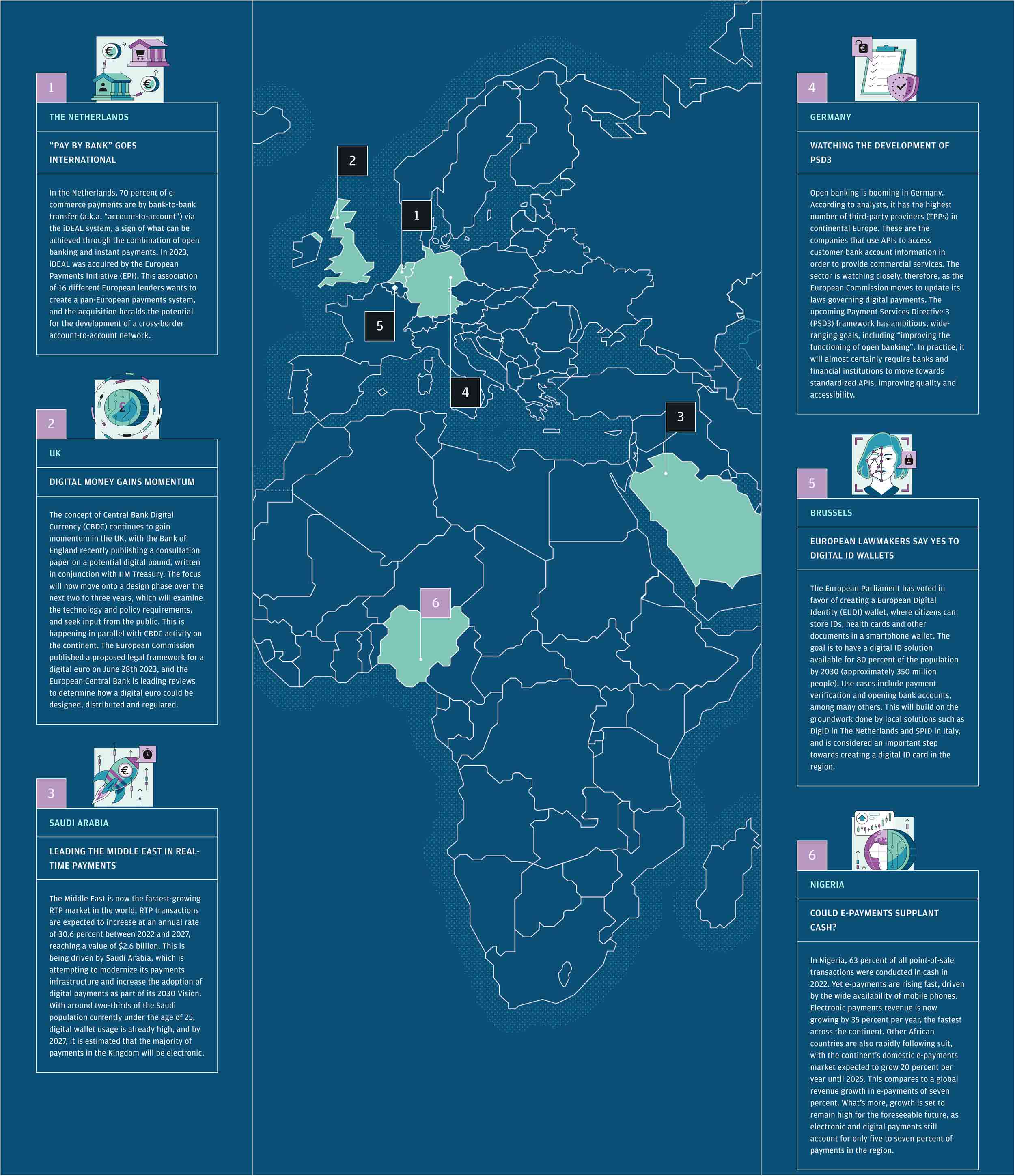

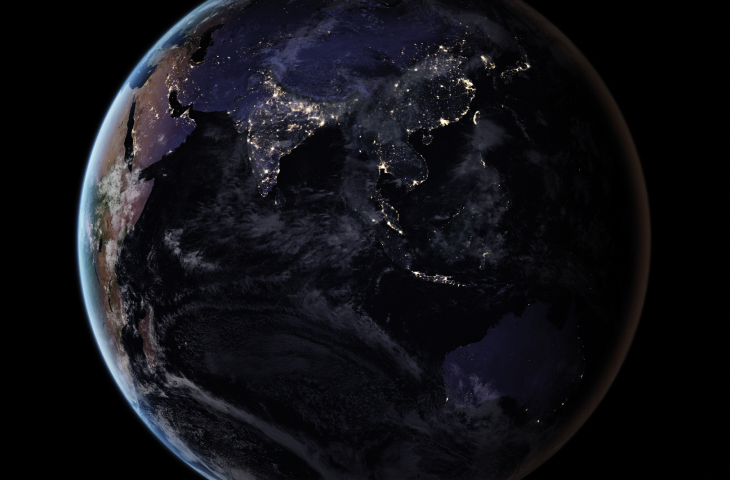

What’s the buzz in EMEA?

Europe, the Middle East and Africa are proving fertile grounds for innovation...

REGIONAL TRENDS WATCH

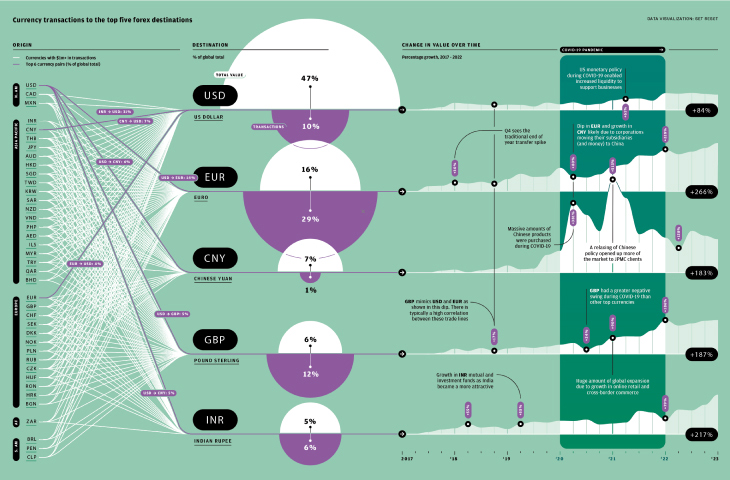

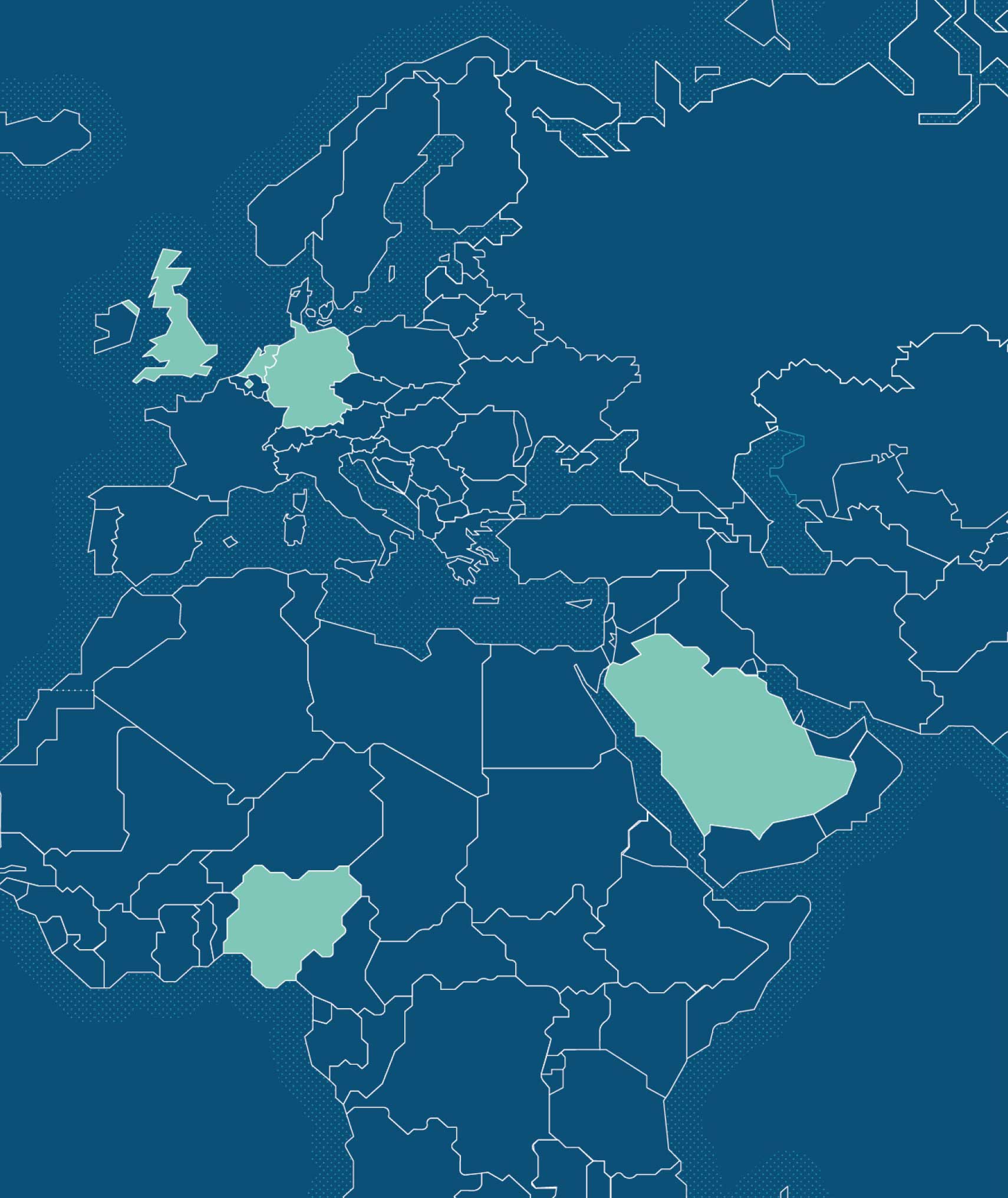

Europe, the Middle East and Africa (EMEA) comprises a diverse set of countries with a multiplicity of cultures, business environments and consumer preferences. What unites the whole region, however, is that payments innovation is typically driven by regulation. To navigate this diverse ecosystem, and the challenges and opportunities it presents, it is therefore essential to understand those regulatory drivers and the payments themes that are taking shape in response.

Click on a number below for more information on each country

Click below for more information on each country

India’s Unified Payments Interface (UPI), which allows instant peer-to-peer and person-to-merchant payments via mobile devices, is fast expanding internationally through partnerships in several countries including Singapore and the UAE. The National Payments Corporation of India (NPCI) is also enabling UPI capabilities using phone numbers for accounts in India held by Indian residents residing overseas. Developed by the NPCI in 2016, UPI is a major reason that India leads the world in real-time payments (RTP) – an estimated eight billion RTP transactions happen every month. The country’s central bank also recently launched India’s Central Bank Digital Currency (CBDC), the digital rupee. While still in its initial stages, a digital rupee on an interoperable blockchain can help facilitate real-time cross-border transactions without intermediaries and usher in an era of cheaper, more efficient currency management.

With the expansion of the digital renminbi or ‘e-CNY’ pilot for retail users in 23 cities in 2022, China became the largest economy to offer a Central Bank Digital Currency (CBDC) at scale. Users are now able to access their e-CNY in wallets on mobile apps. In parallel with the launch, the country’s popular online platforms are now allowing for e-CNY as a method of payment. Supported by the country’s existing retail payment infrastructure, the e-CNY system will help bolster China’s digital economy through a more secure form of currency, enhance financial inclusion, and drive greater efficiency. e-CNY has so far been used primarily for domestic retail payments, but there is potential for adoption across corporate and personal businesses in the near future.

A major international financial center in Asia, Hong Kong serves as an important gateway to mainland China and is the largest center for conducting offshore renminbi (CNH) financing activities. As the renminbi (RMB) grows in popularity as an international payment currency, there is increasing demand from both foreign multinationals and China headquartered companies for CNH payments capabilities, such as flexible CNH FX rate optimization. The city’s central bank is also committed to expanding RMB liquidity in the region through enhancements to the RMB Liquidity Facility, as well as introducing additional risk management products such as Swap Connect.

Singapore continues to make strides when it comes to pioneering innovative ideas across the payments ecosystem. In 2016, the Monetary Authority of Singapore (MAS) along with industry players including J.P. Morgan, began experimenting with blockchain under the banner ‘Project Ubin’. Over five years, this explored how distributed ledger technology (DLT) could be used in everything from decentralized netting of payments to the ‘delivery-vs-payment’ (DvP) settlement process commonly used for securities. The success of this work is paving the way for commercialization such as a joint venture among DBS Bank, J.P. Morgan, Temasek and Standard Chartered which plans to operate a blockchain based, multi-currency clearing and settlement platform called Patrior. Now, the MAS continues to work on key initiatives to further advance DLT usage such as instant cross-border exchange and settlement of foreign currency transactions, as well as the programmable digital Singapore dollar. Current work on decentralized finance (DeFi) applications looks at how tokenized government bonds, Japanese yen and Singapore dollar deposits can demonstrate new models of trading, clearing and settlement.

Despite a plethora of digital payment choices in addition to credit and debit cards, cash remains the dominant medium of exchange in Japan. That is likely to change as the authorities have introduced a “Cashless Vision”with an aim to increase cashless transactions to 40 percent by 2025. To help achieve its goals, the Japanese government is set to introduce a system that will allow companies to pay a portion of salaries into e-wallets on mobile devices by spring 2023, alleviating the need to draw cash from ATMs. Such convenience coupled with discounts offered by these new payment providers will likely help drive the shift towards a cashless society. The transition to cashless payments is also expected to help overseas workers receive salaries without needing to open bank accounts, further expand financial services innovation in the market, and promote growth.

The digital payment landscape in Australia and New Zealand has undergone significant changes in recent years. Cash and checks have been largely replaced as major forms of payments, with digital alternatives such as e-wallets, real-time peer-to-peer transfers and ‘buy now, pay later’ (BNPL) services achieving mainstream adoption. According to the Australian Treasury, almost half of the country’s population today make contactless payments using mobile and wearable devices. Real-time payments, launched in 2018, already account for a third of total peer-to-peer payments, and there are more than five million active BNPL users today. The trend towards a more digitized payments ecosystem is only expected to grow, driven by the rise in e-commerce, high mobile penetration and changing consumer behaviors that favor more instantaneous as well as convenient forms of payments.

One driver is new technological standards. The UK, South Africa and Switzerland, for instance, have all migrated to ISO 20022, and the Eurozone has expanded its existing use. This standard aims to move towards one common language for payment messaging, and enrich the data in payments messages for better, faster and more secure processing.

Another trend is the new series of regulations and initiatives in the Middle East that are enabling incredible progress towards real-time payments (RTP), with Saudi Arabia, Bahrain and the UAE leading the way.

And then there are the regulations relating to local programs such as UK Faster Payments and the Single Euro Payments Area, which are evolving as digital retail places ever-greater emphasis on the seamless secure processing of payments. For example, the UK has recently quadrupled its faster payments limit from £250,000 to £1 million.

Payments innovators within EMEA approach this fast changing landscape with expertise, curiosity, and a clear belief that payments can deliver more value tomorrow than ever before.

J.P. MORGAN PAYMENTS

FOR FURTHER DETAILS CONTACT YOUR J.P. MORGAN REPRESENTATIVE

SOURCES: WWW.JPMORGAN.COM/PAYMENTSUNBOUND/SOURCES

ILLUSTRATION: MANUEL BORTOLETTI