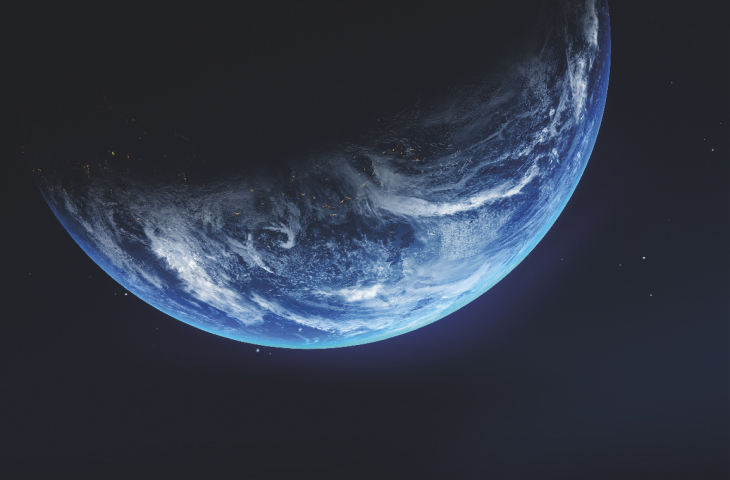

Welcome to the future of commerce

FIRST WORD

In the current operating environment, with economic growth slowing and interest rates rising, it is more important than ever for businesses to develop alternative revenue streams. That’s not only about meeting your customers wherever they are, but making those engagements as seamless as possible. One way to do this is through frictionless payments options or by embedding helpful financial services directly in the user experience. The goal is to first connect with customers, and then make their journey as intuitive and convenient as it can be.

In this issue, we look at how commerce is evolving. There has been a major shift, with new kinds of online marketplaces transforming almost every industry, as our feature starting on

p.26 explores. These digital platforms, designed to efficiently connect buyers and sellers, were once mainly associated with e-commerce, but are gaining traction in every sector, from healthcare and gaming to the automotive world. At the same time, the big e-commerce players are not standing still. They continue to expand their platforms, improve their offerings across all channels, and create new integrated online-offline experiences. Think of stores that allow customers to scan QR codes to pay with online accounts and arrange deliveries through their phone.

Importantly, the goal of this new breed of marketplaces is not just to sell directly to consumers. When I speak with companies, they are often looking to build platforms that can serve many different participants in their ecosystem; including suppliers, sellers, developers, content creators, and advertisers. A consumer goods company may develop a marketplace to allow small retailers and mom-and-pop stores to easily order new stock, helping it to generate more sales. It could even include competitor products on the platform. After all, a buyer will often want to purchase a basket of products from multiple brands rather than a single supplier. The marketplace can take a cut from these products, while simultaneously building a stronger customer relationship. So, the key for companies is to develop an open ecosystem mindset and think about the partners that can help them build that offering as well as grow alongside them.

Payments are an important enabler of this vision. They connect at every touchpoint in the marketplace, whether it’s billing, statements, pay-outs, or collecting funds. But they are also moving beyond being a back-end function. Now, when we strategize with a company, it is often about how payments can act as a revenue generator, a customer acquisition tool, or as a vital competitive differentiator.

Take a ride-hailing app: by embedding payments through a digital wallet, it can make transactions invisible, which encourages greater usage and keeps customers in the ecosystem. Once you have that engagement, it is then possible to offer the user related services—such as food delivery or bike rental—which can further increase monetization opportunities. On the pay-out side, being able to provide the app’s drivers and delivery workers with a fast and flexible way to access their earnings helps to build a stronger supplier base. This shows some of the diverse ways that payments can help the company build a winning product.

But as payments become more diversified, they also become more complex, creating a major bearing on a company’s offering. Can they also offer financing? Can they offer credit underwriting-related services? The list is extensive.

This is why partnership is crucial. An experienced provider can help a company set up their payment architecture and manage the regulatory environment. After all, if consumers want payments to be invisible, then so do companies, allowing them to focus on what they do best: serve their customers with ease, efficiency and choice, providing the best offering tailored to their unique needs.

I believe that partnerships across the entire payments ecosystem will play a vital role in supporting small and medium enterprises to intuitively develop customer-first solutions, transforming the future of shopping.

That future is now. Welcome to Payments Unbound.