How payments ate the world

EXCLUSIVE FEATURE

At Acquired, we tell the stories of many of the world’s greatest companies, discovering the playbooks that helped them achieve their outsized success. Over the past 10 years, we have spoken to the founders and CEOs of some of the world’s most impressive businesses. One thing that has been noticeable through these conversations is just how central digital payments have become to the strategies of running dynamic, fast-paced, innovative businesses today.

What was once just a back-office function has, almost invisibly, become an opportunity for competitive advantage. Whether it’s the embedded payment that just “happens automatically” in the background when you use a ride-hailing app, or the one-click checkout on an ecommerce store that reduces cart abandonment, there are examples everywhere of successful businesses using payments as an innovation lever. New industries like streaming, and new business models like online marketplaces, have emerged over the past 15 years4 because of the ability to take fast, seamless payments from virtually anywhere in the world. It would literally be impossible to build these sorts of applications with the payment systems of old. When designing a new product or service, payments are now one of the first considerations—look at video games, where in-app transactions for character skins and other upgrades have become a major revenue driver. Given that these are often low-value transactions that need to happen in real-time in potentially any currency, this entire $100 billion-plus market4 would not exist without payments innovation powering it all.

It wasn’t always like this. Let’s take a quick jump back in time. We could go all the way back to the invention of the coin, check or credit card, but let’s start in recent history. After all, we don’t have our usual four hours to tell this story!

It’s 2010. The fastest way to move money on the same day from New York to London is to catch a flight and carry it with you. Over 90% of all transactions globally still happen in cash.5 Ecommerce is a niche industry, and sales are less than five percent of global retail.6 It’s crazy that this was only 15 years ago.

Compare that to the situation today. Now, two-thirds of all payments globally are digital—around 1.5 trillion transactions per year.7 With a simple tap of a card, swipe of a thumb on a smartphone or click of a mouse, people can pay for a practically limitless array of goods and services from virtually any location on the planet.

So how did we get from there to here? This is the story of how payments ate the world...

Growth of connectivity

Great design is about abstracting away complexity from the user. That’s why, to a customer, a digital payment might seem simple. Yet behind the scenes, it’s anything but.

Data has to be securely transferred between a number of platforms. The card terminal connects with the payment gateway, then the merchant’s bank, then the customer’s bank and so on. This all requires high-speed, reliable internet connections. The recent explosion in digital payments has therefore only been possible due to massive improvements in global connectivity.

Between 2010 and 2025, internet speeds have risen ten-fold,8 while the number of global internet users has almost tripled to 5.5 billion.9,10 A key element of this has been mobile internet. The roll-out of 4G and now ultra-fast 5G cellular networks has enabled people to access high-speed internet from their mobile phones at low cost, allowing them to browse, shop and transact with ease.

Smartphone surge

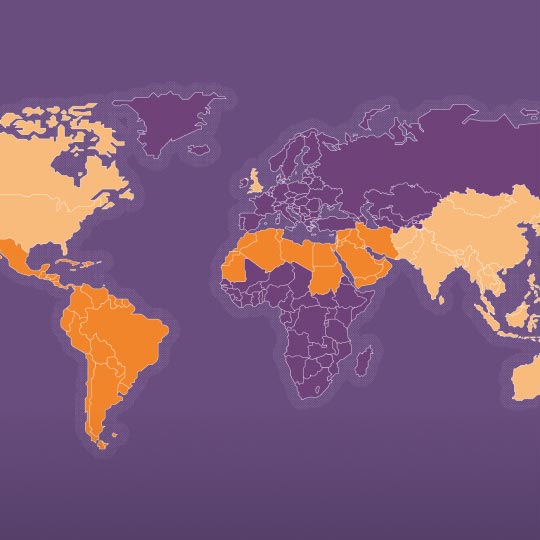

Of course, cellular internet is only useful if you have a device to connect to it. When smartphones were first launched around 1993,11 they were considered premium products aimed at a niche market. But as new manufacturers piled into the space, prices plummeted and access broadened. By 2026, over 90% of the world is expected to have a smartphone,12,13 giving people immediate access to the internet, as well as instantaneous communication across voice, video and text.

In the U.S., the birth of smartphones meant more devices. You were probably already internet-connected, but now you could do more computing more often. In the developing world, it was much more binary. Many low-income countries never had robust, fixed-line internet infrastructure, so the combination of cellular connectivity and cheap smartphones resulted in hundreds of millions more people joining the online economy for the first time.

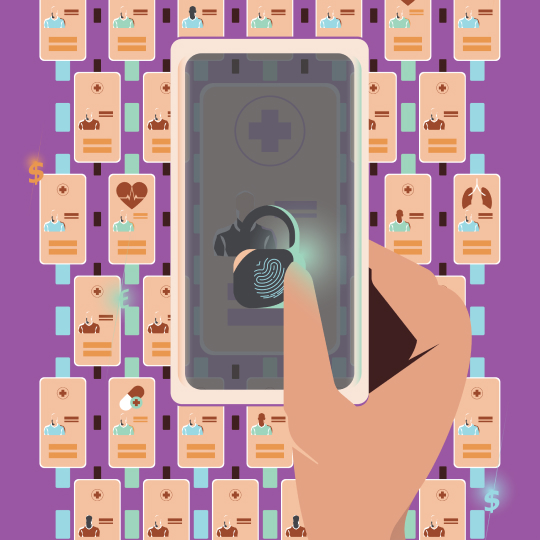

This all had a major impact on digital payments. Half of all online transactions are now made with mobile wallets,14 which allow you to store details of bank cards or other payment methods on your smartphone and make contactless payments. This shift is a quiet giant that many in the general public now takes for granted. Plus, with the addition of built-in biometric identification, smartphones can be more secure than chip-and-pin. This was technology that most people thought they’d never use, and then, very quickly, they couldn’t imagine life without it.

B2B payments: The behemoth beneath the surface

Speaking of the general public, most people don’t realize that consumer payments make up only a small fraction of global money movement. Although it doesn’t get the headlines, it’s the drive to cut friction in the far larger business-to-business payments ecosystem that has had the bigger impact on the growth of digital payments.

Getting here has involved overcoming some serious challenges. The infrastructure that powers B2B-specific payment rails was built in the 1970s and 1980s.15 These systems are reliable and secure, but they are also slow, inflexible and hard to replace. Try ripping out I-95 and see what happens to traffic in New York! That’s why, in the U.S., 75% of businesses still use paper checks,16 because that is what the core infrastructure is built for. But by using a network of APIs—protocols that allow software applications to speak with each other—banks are increasingly able to connect their systems with each other and work around legacy platforms, which is facilitating much faster electronic payments17 and encouraging people and firms to switch their payments over to digital systems.18,19 These digital interchanges can now allow some domestic B2B payments in the U.S. to complete instantly by directly connecting the bank accounts of the payee and recipient, although this is not available everywhere.

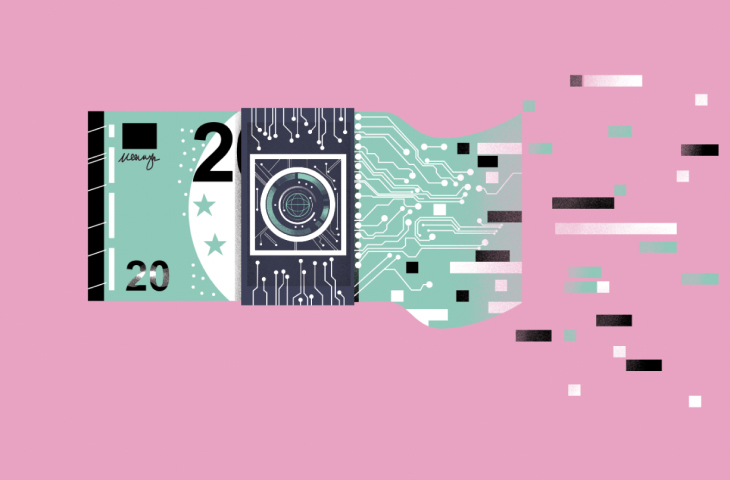

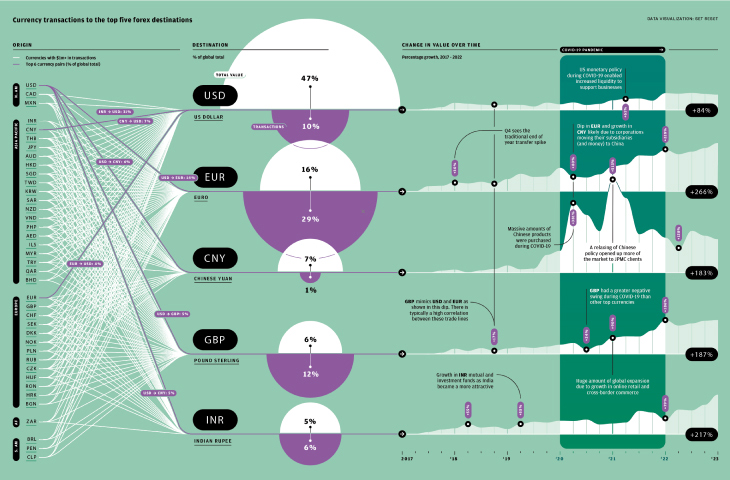

The use of APIs and other digital technologies has also accelerated times for cross-border payments by facilitating the sharing of information between banks in different countries. You no longer have to jump on a plane if you want to deliver cash quickly. The majority of payments on SWIFT—an international information network that helps banks to facilitate money transfers—can now settle in under an hour.

Rise of real-time

Digital transactions are not without issues. When a business accepts a digital payment, it can take hours or even days for the money to appear in their bank account. There are also charges—merchants paid an astonishing $138 billion in processing fees in 2022.20 These friction points are now being addressed with the creation of real-time payment (RTP) systems, which work by transferring money directly between bank accounts without intermediaries like card schemes. The transactions are typically completed in seconds and are often completely free, which has made them attractive to consumers and merchants alike. Consumer real-time payment systems, such as India’s United Payments Interface (UPI), normally involve a simple app and are easy to sign up for, which has made them accessible even for people who have been outside of the formal financial system. UPI has over 350 million users, many of whom were previously unbanked. It completed 170 billion transactions in 2024.21

Creating new forms of value: How digital payments are reshaping the economy

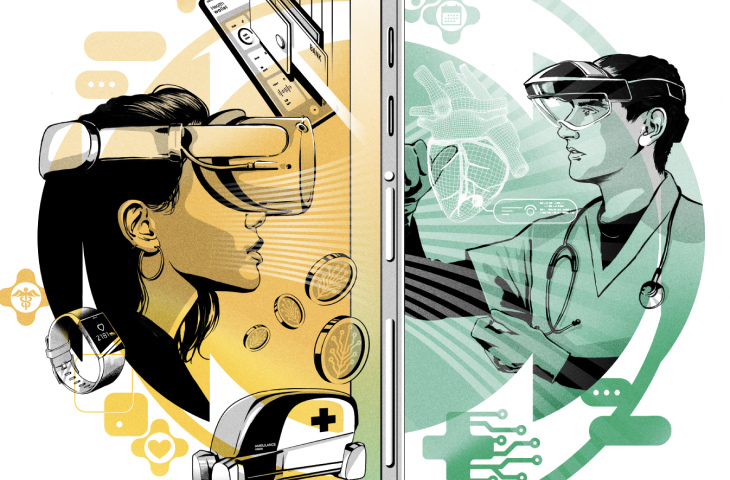

Innovation in digital payments has gone beyond enabling the simple transfer of funds and is now creating new forms of value. Digital banks—called neobanks—have emerged, which allow people to complete all of their banking services online without the need to visit a branch. Buy Now, Pay Later technology has revolutionized access to credit. Instant payouts are allowing gig workers and creators to get access to their earnings much faster.

Wherever you look, digital payments are disrupting and displacing traditional business models. Consider the rise of super apps. As technology and connectivity has improved, some online businesses have scaled massively to become all-encompassing platforms. These apps aggregate large numbers of different services, allowing consumers to transact seamlessly across them all. Think of a ride-hailing app where you can not only order taxis, but also scooters, e-bikes and food delivery. Some even offer financial services like loans or insurance. Typically, the glue that holds everything together is an embedded payments system that allows consumers to easily pay for anything they want, without ever having to leave the app.

Over the coming years, we believe that innovation will only accelerate in the payments space.

For a deeper dive into how we got here—plus an exploration of what’s coming next—watch us discuss further in our exclusive Acquired x Payments Unbound video

ILLUSTRATIONS: EMMA ROSE

SOURCES: WWW.JPMORGAN.COM/PAYMENTS-UNBOUND/SOURCES