[serene music]

[sounds of nature]

On screen:

This video opens on a farm at first light, as a farmer wearing a headlamp sorts through crates of produce. Clips show the farmer harvesting peppers, then the peppers frying in a hot pan and being served at a restaurant.

Morning sun beams down as the farmer picks herbs and sunflowers, then hoses down crates.

He drives and sells produce at a market.

Female Customer 1:

Thank you so much.

On screen:

He leaves a restaurant kitchen, and subtitles read:

Woman 1:

You got a cameraman today?

Man:

Yeah, yeah. Famous.

On screen:

A title appears over gray:

Text on screen:

'Rooted in Foley.'

On screen:

At first light, the farmer sorts produce into crates. Later, identifying text appears beside him as he sits in a greenhouse:

Text on screen:

'Kevin Johnson, Owner and Grower, Knievil Farms.'

Kevin Johnson:

My name is Kevin Johnson and I am the Owner and Grower at Knievil Farms.

On screen:

Kevin transfers graffiti eggplants into a crate and washes them. The sun peeks over the roof of a farmhouse.

Kevin Johnson:

The name of my farm, it goes back to high school. You know, how you had to do high school quote for, like, your senior yearbook? It was "Evel Knievel" and it was something along the lines of "A man can fail many times, but he's never a failure 'til he refuses to get up."

On screen:

Kevin drags a crate down a row of pepper plants, harvesting them as he goes.

Kevin Johnson:

To be a successful farmer, there's going to be a lot of failures. It takes a lot of hard work, dedication, sticking with it. That's Knievil Farms.

On screen:

A sign reads: 'City of Foley, Welcome!' and a Foley water tower stretches over the rural town. Clips show a farm and a white sand beach.

Kevin Johnson:

Currently, I'm in Baldwin County, Gulf Coast of Alabama, known for a lot of agriculture, and then also the beaches around us.

On screen:

Kevin bags micro greens, and close-ups show the wrinkled green skin of peppers, flower buds, and marigolds.

Kevin Johnson:

Later today, we'll be going to the wine bar making a few deliveries. It's a restaurant I used to work at before I started getting into farming. On screen:

Pedestrians stroll past the wine bar, housed in a historic building with brick archways. Kevin's truck parks in the lot, and he climbs into the bed as he stacks boxes of produce. He carries them into the wine bar's kitchen.

Kevin Johnson:

I've been in the restaurant industry for many years. I enjoyed working in restaurants, but it was just getting burned out in it and looking for something else to do.

On screen:

A chef admires Kevin's corn and peppers.

Greg Rodriguez:

Oh, yeah, baby!

Kevin Johnson:

Yeah, it turned out really good this year.

Greg Rodriguez:

I'll say. It looks fake.

Kevin Johnson:

Yeah. Yeah.

On screen:

Text appears as a man leans on a tomato box:

Text on screen:

'Greg Rodriguez, Chef, The Wine Bar on Palafox.'

Greg Rodriguez:

Kevin's the only cook I've had that's brought ingredients in for us to cook and grown them himself.

Kevin Johnson:

There's times I called in late, was like, "Hey, I'm gonna be a little late. I'm still finishing up in the garden." My very first garden was, it was at my parents' house. Consisted of two raised beds made with pallets.

On screen:

At the farm, Kevin picks fresh herbs and bands them together. He harvests peppers, and grins as he carries a full crate.

Kevin Johnson:

I saw opportunity with farming, so, went all in.

On screen:

He picks herbs in golden morning light, then an aerial view shows the neat rows of his small farm between two roads.

Kevin Johnson:

Currently, I lease property. As I've gotten more business, kind of expanded, and now maxed out. No more room to really grow here. My goal for my business is to keep expanding and eventually to make a land purchase of my own.

On screen:

Sunlight shines on the curled petals of a sunflower. Kevin harvests them and loads them into a bucket. He pulls away from the farm hauling a trailer of produce and equipment. At the wheel:

Kevin Johnson:

We are heading to the Coastal Alabama Farmers and Fishermens Market. This is my primary market where I make most of my money. Currently, it is peak season, right before summer, so you try to make as much as you can. Hopefully, today will be a good day and get me one step closer to my goal of buying some property.

On screen:

Vendor tents fill the lawn of a building with a sign: 'Coastal Alabama Farmer and Fishermens Market.' Folks move through the market in time-lapse, and Kevin bags produce for customers.

Ralph Hellmich:

The idea and the vision on the farmer's market was born in 2013.

On screen:

Text appears beside a man in a Foley polo shirt:

Text on screen:

'Ralph Hellmich, Mayor, Foley, AL.'

Ralph Hellmich:

The idea was to create a place of self, of community.

On screen:

Mayor Hellmich greets Kevin at the market.

Ralph Hellmich:

Hey Kevin.

Kevin Johnson:

Hey, how are you?

Ralph Hellmich:

Man, you're booming today. Look at all these vegetables, this is awesome. I'm not gonna hold this line up longer, they'll be very upset.

On screen:

Mayor Hellmich smiles as he strolls through the market.

Ralph Hellmich:

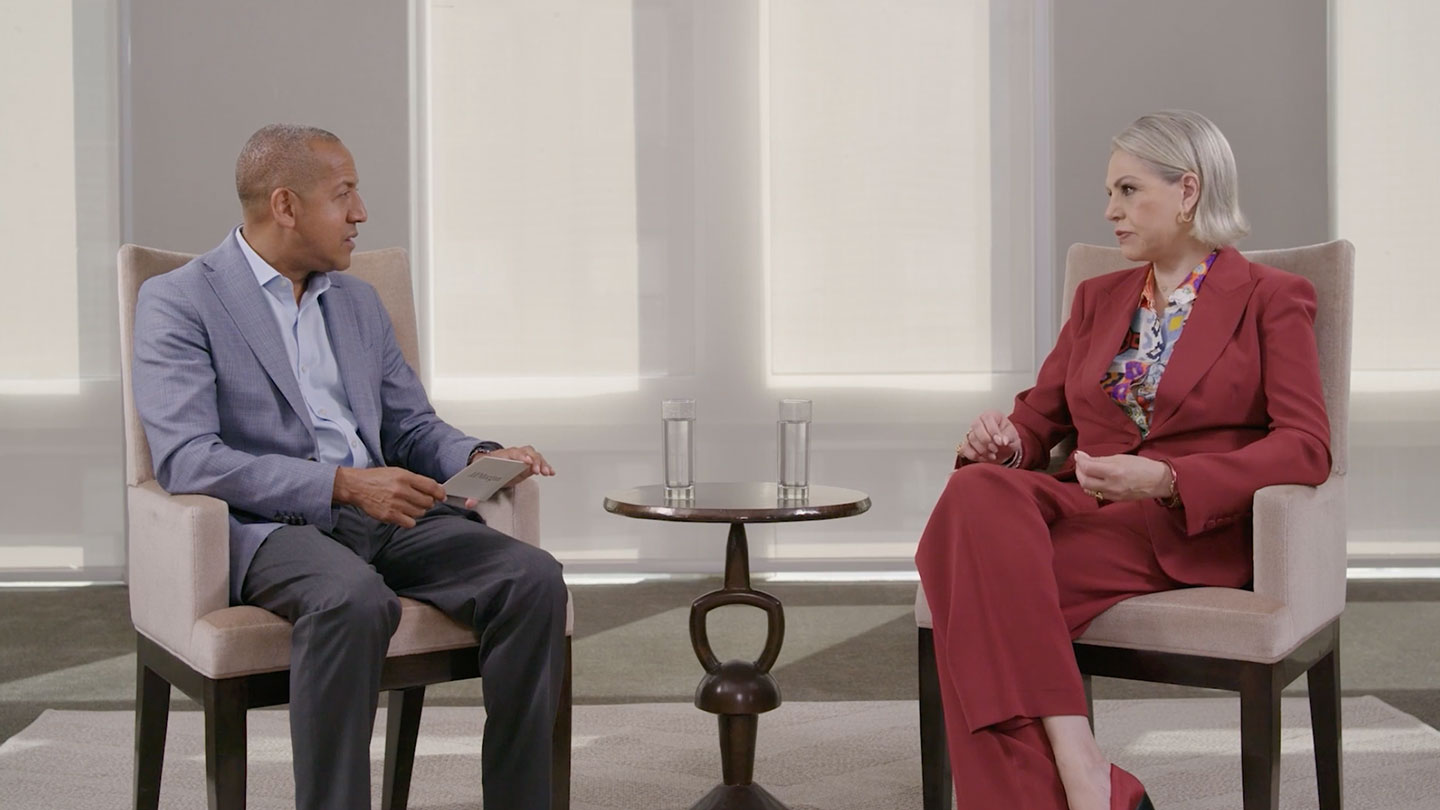

The funding mechanism that we used to build the farmer's market was the New Markets Tax Credit. JPMorganChase Bank was our financier. They were great partners. And as you can see, as you visit our Farmers and Fishermen Market, that it is a community gathering place and it supports our history: a very business-oriented, blue-collar town.

On screen:

Dozens of people move through the market, and Mayor Hellmich greets a young girl in a stroller. A vendor laughs, and Mayor Hellmich shakes a man's hand as he admires large scale wildlife photos. Text appears beside a blonde woman in a black and white striped top:

Text on screen:

Nancy Colbert, Market Regular:

Nancy Colbert:

It takes about an hour to get here, but I look forward to it. I get up, crack of dawn, and I'm usually one of the first people here. I just love it. It's a highlight of my week. I haven't missed coming here on a Saturday morning for years.

On screen:

A shopper's emotional support dog walks past a blowing fan, and Kevin loads a crate with tomatoes.

Kevin Johnson:

The Cherokee purples are gonna be these purple ones.

I look forward to seeing a lot of my regulars every week. I've met a lot of good people that have encouraged me to keep at it.

On screen:

A line forms at Kevin's stand as he chats with regulars.

Kevin Johnson:

Hey, how are you?

Female Customer 2:

I'm doing well, how are you doing?

Kevin Johnson:

Great, yeah, thank you.

Female Customer 2:

I'm here just to see you.

Kevin Johnson:

Yeah, well, thank you.

Female Customer 2:

I mean that, I've been enjoying your vegetables—

Kevin Johnson:

Yeah, so good.

Female Customer 2:

…this whole week, every week.

On screen:

The customer's subtitles read: "I'm here just to see you. I mean that. I've been enjoying your vegetables this whole week, every week."

Ralph Hellmich:

Our farmer's market is a fixed building, but the grounds are growing. On screen:

Cars park all around the market grounds, and the Mayor samples a vendor's berry.

Ralph Hellmich:

People have started with their ideas here and gone on to create a restaurant or a food vendor business somewhere else. And so, it's almost a[n] incubator for our farmers, and our fishermen, and our local businesses.

On screen:

Kevin hands a bag of produce to a customer.

Kevin Johnson:

Thank you very much. You have a great day.

Today was a great market, stayed busy throughout the whole day. A lot of my regulars came by, met a lot of new faces, sold a lot of corn. I think it was a great day.

[customers bustling]

[serene music]

On screen:

He selects tomatoes and smiles at customers. Then, the view drifts away from the bustling market, and fades to black.

The video ends with a logo:

Logo:

J.P.Morgan.

Side note:

Legal disclosures appear under a symbol of a house with an equals sign:

Text on screen:

'Equal Housing Lender.

Chase, J.P. Morgan, and JPMorgan Chase are marketing names for certain businesses of JPMorgan Chase & Co. and its affiliates and subsidiaries worldwide (collectively, “JPMC”, “We”, “Our” or “Us”, as the context may require).

We prepared these materials for discussion purposes only and for your sole and exclusive benefit. This information is confidential and proprietary to our firm and may only be used by you to evaluate the products and services described here. You may not copy, publish, disclose or use this information for any other purpose unless you receive our express authorization.

These materials do not represent an offer or commitment to provide any product or service. In preparing the information, we have relied upon, without independently verifying, the accuracy and completeness of publicly available information or information that you have provided to us. Our opinions, analyses and estimates included here reflect prevailing conditions and our views as of this date. These factors could change, and you should consider this information to be indicative, preliminary and for illustrative purposes only. This Information is provided as general market and/or economic commentary. It in no way constitutes research and should not be treated as such.

The information is not advice on legal, tax, investment, accounting, regulatory, technology or other matters. You should always consult your own financial, legal, tax, accounting, or similar advisors before entering into any agreement for our products or services. In no event shall JPMorgan Chase or any of its directors, officers, employees or agents be liable for any use of, for any decision made or action taken in reliance upon or for any inaccuracies or errors in, or omissions from, the information in this material.

The information does not include all applicable terms or issues and is not intended as an offer or solicitation for the purchase or sale of any product or service. Our products and services are subject to applicable laws and regulations, as well as our service terms and policies. Not all products and services are available in all geographic areas or to all customers. In addition, eligibility for particular products and services is subject to satisfaction of applicable legal, tax, risk, credit and other due diligence, JPMorgan Chase’s “know your customer,” anti-money laundering, anti-terrorism and other policies and procedures.

Products and services may be provided by Commercial Banking affiliates, securities affiliates or other JPMC affiliates or entities. In particular, securities brokerage services other than those that can be provided by Commercial Banking affiliates will be provided by appropriate registered broker/dealer affiliates, including J.P. Morgan Securities LLC and J.P. Morgan Institutional Investments Inc. Any securities provided or otherwise administered by such brokerage services are not deposits or other obligations of, and are not guaranteed by, any Commercial Banking affiliate and are not insured by the Federal Deposit Insurance Corporation.

JPMorgan Chase Bank, N.A. Member FDIC. Copyright 2025 JPMorgan Chase & Co. All rights reserved.'

END