Rapid changes in technology have raised expectations and standards in the world of cash management both in terms of what corporate treasurers require and the solutions that banks are able to provide.

Digitization has undoubtedly been at the forefront of this evolution, enabling the development of more innovative products to meet treasurers’ specific needs as they look to optimize performance, gain competitive advantage and ensure regulatory compliance.

As a leader in cash management technology and the digitization of treasury solutions, J.P. Morgan believes there are three specific areas that are having and will continue to have a profound impact on the future strategies of treasurers and how they run their treasury operations: robotics, virtual branches and data analytics.

Robots bring smarts to automation

Robotic Process Automation (RPA) has made significant advances in Asia over the past 18 months and it’s a trend that is set to continue as more regional and local institutions invest in this very relevant technology. Using software algorithms and sensors, RPA is a strong fit for any treasury department looking to strengthen their manual processes and increase operational efficiencies, enabling employees to focus on other areas within their organization where they can add real value.

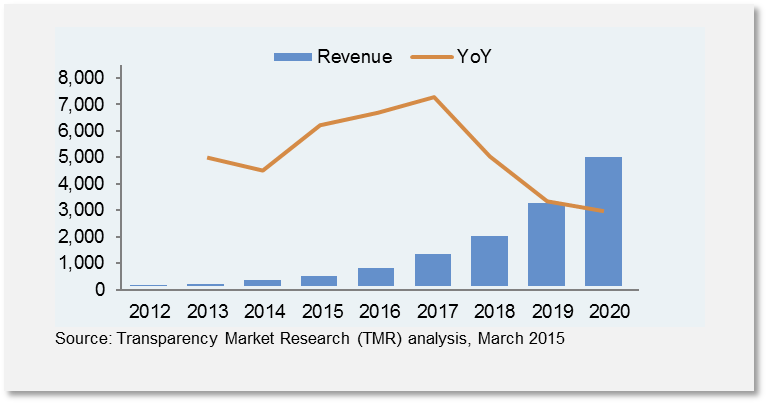

To give an indication of the rapid growth in the RPA sector, it’s estimated that the size of the global market in terms of revenues will reach around US$5 billion by 2020, which will have been achieved in just under a decade.

Global IT Robotic Automation Market Size, Forecast and Year-on-Year (YoY) Growth

One key component of RPA is the use of Task Bots and IQ Bots, which address both structured and unstructured manual processes and leverage machine learning. These bots are designed to drive process automation and augment the human workforce in operations by sourcing information from multiple repositories, and making decisions based on the information.

This bot-driven digital workforce addresses specific client requirements rather than building rules in the core application, automates manual processes such as data entry and reconciliation, and uses rules learned from the operations workforce to automate processes.

Implementing RPA has enabled J.P. Morgan to deliver new solutions to clients, onboard clients quicker, and eliminate human error. Beyond facilitating improvements, RPA has started to transform treasury operations by replacing manual processes and enhancing the integration of clearing infrastructure whilst avoiding the need for clients to develop new operations-driven manual processes.

The next phase of RPA is expected to include the deployment of intelligent robots that allow the utilization of machine learning and artificial intelligence to replace human handling of transactions and eliminate exceptions.

Virtual branches become reality

Bank branches are also experiencing significant change as physical branches are starting to be replaced by virtual branches.

Traditionally, clients were required to visit branch offices in order to submit the required documents for processing and conduct tax payments, particularly in markets like India and Indonesia.

Virtual branches not only eliminate the need to be physically present, they also enable corporates to initiate and approve payments online, gain complete visibility in all eTax payment transactions with detailed audit trails and improve efficiencies. Straight-through processing improves turnaround time and token identification provides an additional level of security.

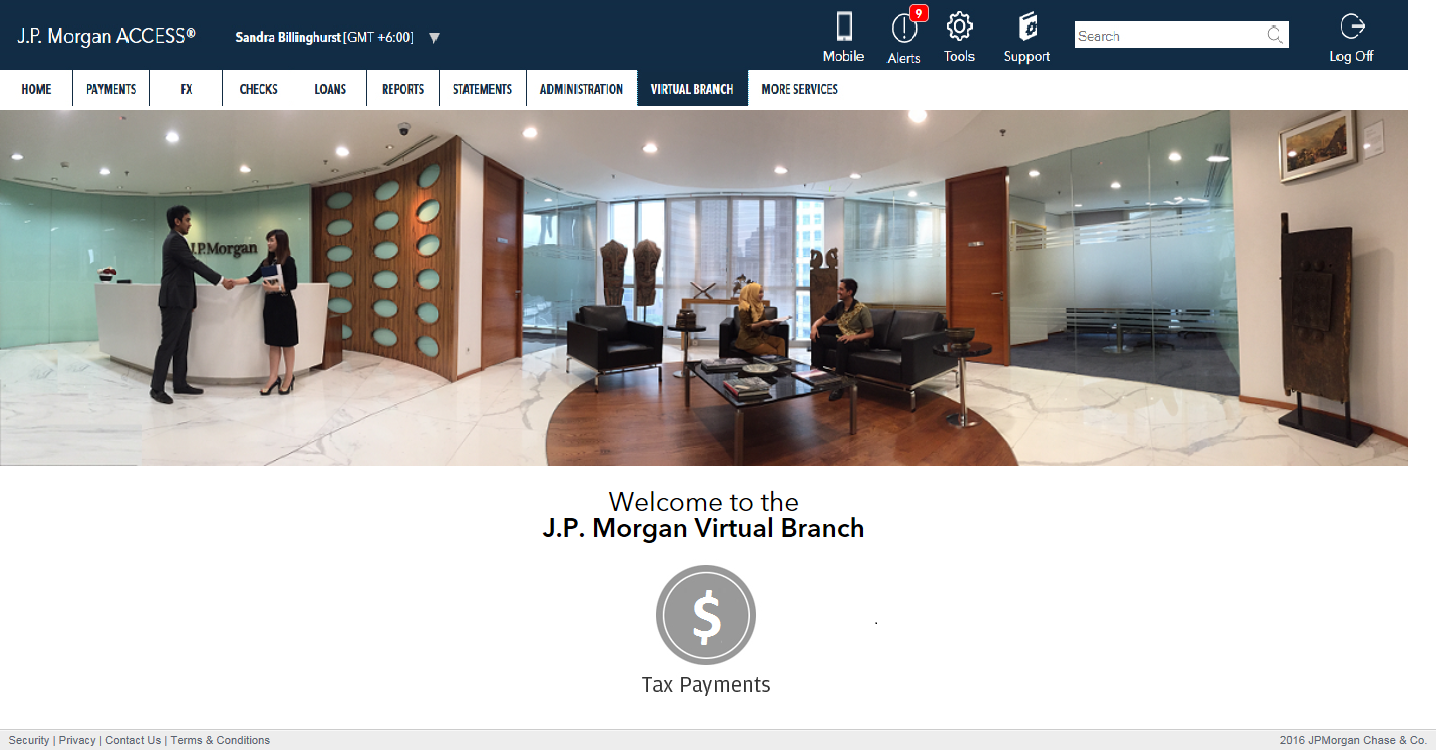

By using J.P. Morgan’s virtual branch solution, corporates now have access to an integrated and comprehensive suite of general and localized banking services through a single, innovative portal housed within the J.P. Morgan ACCESS® OnlineSM, from the comfort of their office.

The Virtual Branch is accessible via J.P. Morgan ACCESS® OnlineSM

Along with improvements in technology, regulatory changes have also allowed banks and corporations to make virtual branches a reality.

Providing insights with data analytics

Data analytics – which can provide valuable insights into areas such as customer behavior, the competitive landscape and internal processes – is quickly establishing itself as an invaluable tool for the corporate treasurer and within cash management. If used correctly data analytics can help drive growth strategies and provide guidance as to where investment is most needed.

Data analytics has also allowed banks to increase security, protect their clients’ own data and defend against cyber-crime, which is an unwelcome consequence of increased digitization.

J.P. Morgan is taking steps to enhance its capabilities to ensure that it can accept data in all formats, leverage the data and apply its analytics skills to provide critical intelligence to clients. Corporates can then use this to improve their operational process flows and to implement the necessary new solutions required. J.P. Morgan has been able to deliver even greater value by identifying changes in process patterns, benchmarking, and pulling information from its vast global network about money flows in order to offer further intelligence that will allow its clients to adjust their focus and realign their businesses accordingly to take advantage of any potential new opportunities to improve.

Choosing the right partner

Digitization has led to significant improvements in the client experience, including increased cash visibility, the delivery of real-time data flows, transition of physical cash to electronic cash and utilization of straight-through processing. Real-time processing, which is becoming the norm in many parts of Asia, has accelerated process change as well.

J.P. Morgan has taken a highly innovative approach in this rapidly-changing environment, enhancing its technology and developing new tools to deliver new digital processes and products that simplify and improve cash management for its clients.

Through innovation and digitization as well as close collaboration with fintechs and clients, J.P. Morgan has been able to evolve its platforms, significantly simplify processes and deliver a unique value proposition to clients in order to help protect, manage and grow their organizations. Integration of client software with J.P. Morgan’s digitized platforms and client usage of solutions such as host-to-host connectivity or APIs, allows clients to automate manual processes, increase productivity and eliminate bottlenecks.

While solutions that work for today are important, it’s critical for companies to implement solutions that prepare for expected expansion as well as new practices or technology that a corporations may not anticipate.

By leveraging J.P. Morgan’s position in supporting corporates’ cash management needs around the world, with its partnership approach and leadership in technology and digitization, companies can implement a solution today and constantly have access to new practices that give them a competitive advantage for the future.

LEARN MORE |

For more information, please contact:

Manoj Dugar

Abhijit Gupta |