Major corporations frequently use global cash pooling structures as a low-cost way of maximizing available liquidity. A subsidiary with a surplus of cash will send it to the global pool, where it is distributed to areas of the business that need it. Integrating company entities located in China into the global cash pool has traditionally been challenging due to restrictions on moving funds in and out of the country, as well as the regulatory burden of doing so. This is now changing as China revamps its legislation on cross-border liquidity management.

Chinese economy returns to grow, with implications for treasury operations

The pandemic had a major impact on the Chinese economy in the first half of 2020. However, since then the country has experienced a V-shaped recovery. In Q3 and Q4 2020 economic activity returned to pre-pandemic growth levels and in total economic expansion for the year stood at 2.3 percent.

Moving forward, China is undergoing a period of economic transformation, in order to promote further growth and innovation. China is already a digital leader in sectors such as e-commerce and is looking to expand this to other areas of the economy. Businesses are being encouraged to digitize, which includes their finance and treasury functions. Meanwhile, growing domestic consumption will support a further expansion in foreign direct investment (FDI) volumes. This will require streamlined regulations and infrastructure, especially in terms of cross-border liquidity management, in order to make the country an easier market in which to do business.

"Moving forward, China is undergoing a period of economic transformation in order to promote further growth and innovation."

Sandy Gu

APAC Liquidity Product Solutions Specialist

Recent developments for cross-border liquidity management in China

In 2019, China’s State Administration of Foreign Exchange (SAFE) issued new regulations to help liberalize cross-border cash movements. One J.P. Morgan client that has utilized these new structures is a global chemical company for which China is its largest market in terms of sales revenue and investment. From this hub, the company distributes products across the Asia-Pacific region. It also imports raw materials, which are procured via a globally centralized system. As a result, managing cross-border currency flows is a key operational requirement.

The company is amongst the first few to set up an U.S. dollar cross-border pooling structure under the new SAFE regulation, to move funds seamlessly to and from China, its biggest market. This will subsequently be integrated into its global liquidity structure via the header account based in New York. Previously, the company had been challenged moving U.S. dollars, the predominant currency for its trade flows, in and out of China. The company had a global cash pooling for US dollars, with all qualified international subsidiaries joining the program.

However, this system excluded China, due to regulatory requirements which necessitated a large number of supporting documents when moving cash in or out of the country. The company partnered with J.P. Morgan to integrate China into its global cash pool system and create treasury efficiencies in its biggest market.

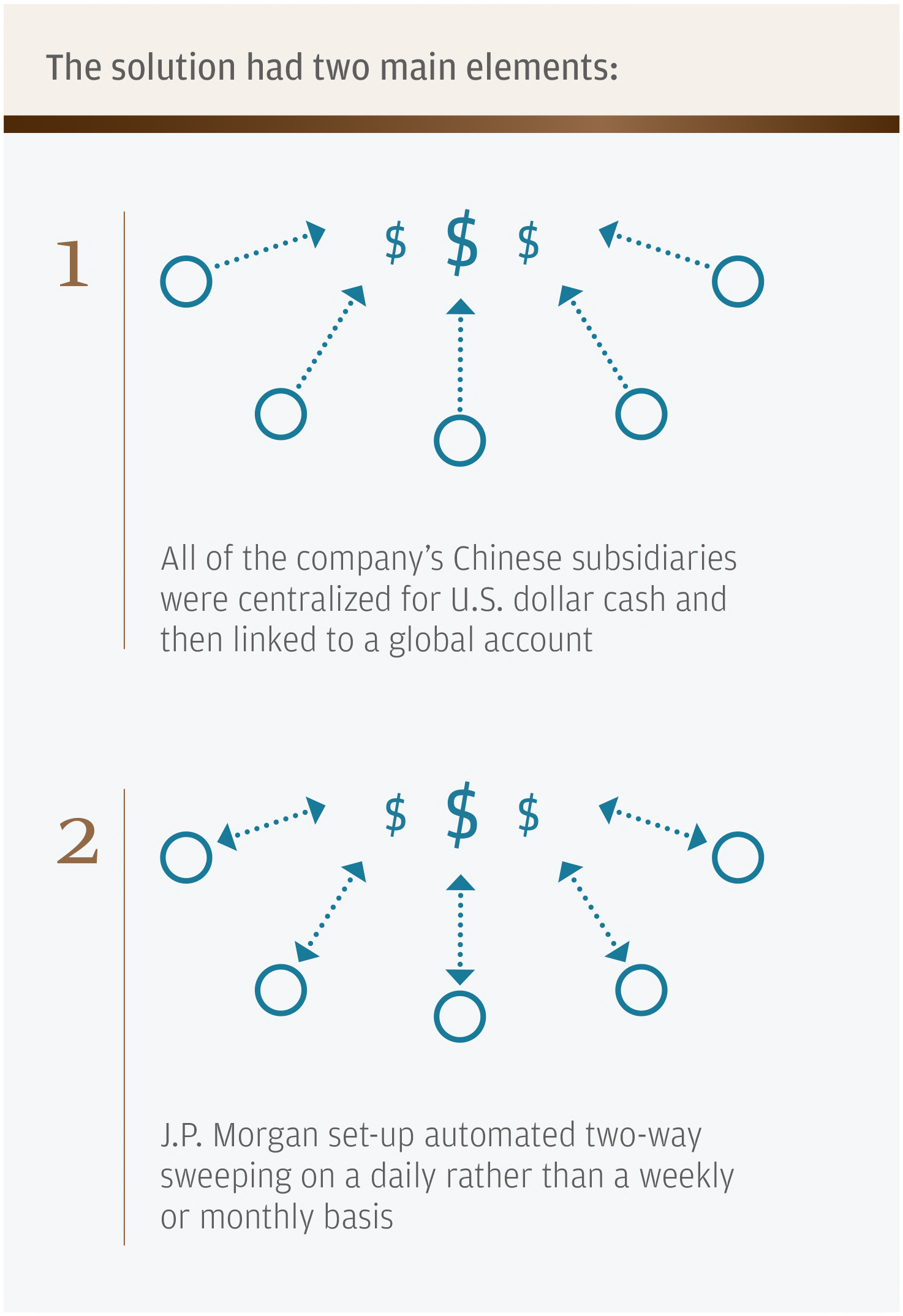

The solution had two main elements. Firstly, all of the company’s Chinese subsidiaries were centralized for U.S. dollar cash domestically and then linked to a global account in New York. Secondly, J.P. Morgan set-up automated two-way sweeping on a daily rather than a weekly or monthly basis. At the end of each day, the cash balance for the company’s Chinese subsidiary is zero, where funds will automatically be transferred into the China account to cover any intraday funding gaps, with surplus balances being sent to the global pool. Through this structure, the company achieved full centralization of a key currency and realized the greatest potential of self-funding and mobility of idle cash within the group.

Setting up this innovative new structure revealed several interesting operational elements. The structure requires just a one-off upfront registration with SAFE on the inflow and outflow quotas, where the borrowing limit is up to two times of the company’s total domestic equity and lending limit is at 30 percent of the total equity. Also, whereas previously in China, separate cross-border cash pool structures had to be set-up for each currency, now companies can establish a single cash pool that covers multiple currencies. Additionally, in most circumstances, it is possible to set up an onshore overdraft facility in China for a cross-border cash pool structure.

The benefits of digital reporting

J.P. Morgan has developed a suite of digital solutions to help facilitate the reporting process for cross-border liquidity management in China. But it also has solutions for managing and optimizing operational cash, which accounts for a sizeable chunk of an entity’s total liquidity and can prove challenging.

"J.P. Morgan provides a paperless solution that allows companies to provide digitized versions of the supporting documents via its virtual branch."

Sandy Gu

APAC Liquidity Product Solutions Specialist

For instance, when it comes to processing or settling payments, a large number of documents have to be supplied by the company to their bank. These can include the contract, invoice, custom declaring form and tax certificate. It can take up to two days to prepare these documents and courier them from one location to the bank, disrupting supply chains.

J.P. Morgan provides a paperless solution that allows companies to provide digitized versions of the supporting documents via its virtual branch. J.P. Morgan team can quickly check the files and send immediate feedback if anything is missing. Alternatively, companies can opt for a fully digital approach. J.P. Morgan has a direct connection via API with the customs and tax bureaus in China. It can send information from the company’s custom declaring form or the tax certificate straight to the authorities, which will then share the details of the necessary supporting documents already filed with them thereby speeding transactions processing.

Finally, there is the option to simplify cross-border payments, where certain companies can apply to the regulatory authorities for a simplified solution. With this approach, no documents are required. To process a payment from such a company, J.P. Morgan only requires a payment instruction and regulatory reporting form. By using big data analysis, J.P. Morgan is able to check that payments are on trend and within a reasonable scope.

While managing and optimizing cross-border liquidity for entities in China remains complex, J.P. Morgan understands Chinese authorities’ new position on cross-border liquidity management and is helping several clients navigate this new landscape.

To learn more about our growing suite of solutions for your cross-border liquidity challenges, please contact your J.P. Morgan representative.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of J.P. Morgan, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed to be reliable. Neither the author nor J.P. Morgan makes any representations or warranties as to the information’s accuracy or completeness. The information contained herein has been provided solely for informational purposes and does not constitute an offer, solicitation, advice or recommendation, to make any investment decisions or purchase any financial instruments, and may not be construed as such.

JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability