In the last year, treasury management recovered in ways that revealed themes across the entire economy, but the road to permanent recovery might be long. J.P. Morgan’s annual Working Capital Index Report indicates that working capital has rebounded to pre-pandemic levels. However, geopolitical uncertainties, COVID-19 developments, and economic factors could impact the index moving forward. Read on for key trends like ESG and other main takeaways from the 2022 Working Capital Index.

Many companies recovered in 2021

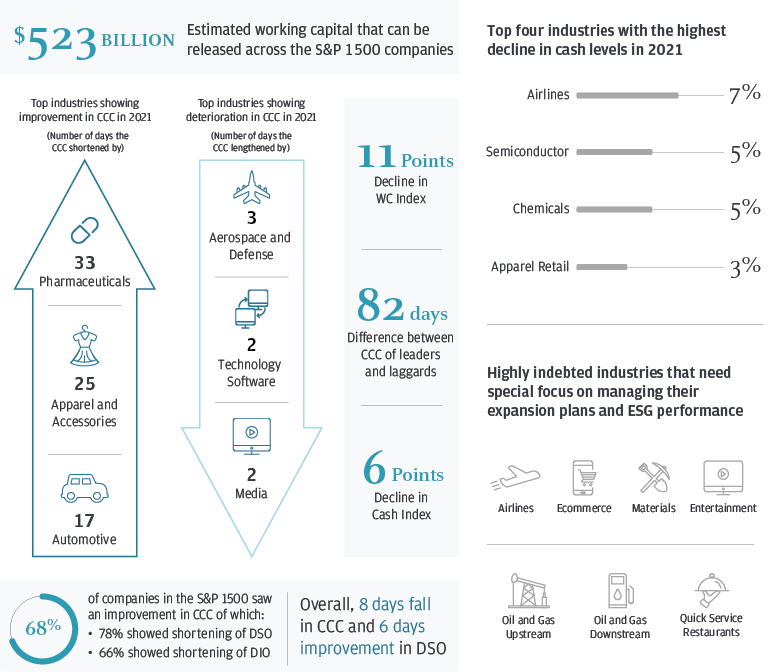

The Working Capital Index returned to pre-pandemic levels after significantly improving from the prior year. Roughly two-thirds of companies also improved Cash Conversion Cycle, which is how many days it takes for them to convert their inventory into cash flows and helps to quantify working capital efficiency. The pharmaceuticals, apparel & accessories, and automotive industries showed the greatest CCC improvement, while aerospace and defense, technology software, and media industries showed deterioration in CCC performance. The Cash Index also improved as S&P 1500 companies increased their spending of cash following a period of holding onto these funds.

Summary of findings

Working capital and cash conversion cycle takeaways

ESG and working capital

ESG impacts the ability to borrow and financing cost

1. Lower ESG score should result in increase in borrowing cost (instead of reduction)

2. ESG Score ↓, Optimize internal funding and working capital management

How industries are improving ESG scores:

-

Oil and Gas:

Diversify into clean energy and invest in Carbon Capture and Storage technologies -

Automotive:

Shift to electric vehicle production and phase out internal-combustion engine fuel cars -

Metals and Mining:

Prioritize operations around mining metals for energy transition and expand into used metals recycling

2021 emerging themes:

-

Supply Chain Diversification:

Companies are preventing future global supply-chain shortages by:

1. Localizing supply chains

2. Nearshoring

3. Diversifying supplier base

4. Digitizing procurement processes

5. Creating buffer stocks of essential components

-

Tech-Driven Business Models:

AI, IoT Blockchain, and Virtual Reality are unlocking additional revenue streams for corporates and could replace traditional ones.

-

Direct-to-Consumer:

The pandemic accelerated online shopping, which fostered direct-to-consumer models as companies reached customers with:

1. Omnichannel strategies

2. Marketplace models

3. Renewed loyalty programs

Considerations for 2022:

Potential adverse impacts to working capital:

- Geopolitical uncertainties.

- New COVID-19 variants.

- High inflation.

- Federal Reserve monetary policy.

Balancing short-term risks with long-term opportunities:

Short-term risks:

- Inflation: preserve profit margins as input costs rise.

- Interest rate rise: deleverage as cost of capital rises.

- Supply-chain risks: develop agile and resilient supply chains.

Long-term opportunities:

- ESG: streamline operations and work toward ESG targets.

- Recovery-led growth: use capital to support growth plans.

- New-age business models: modify operations amid evolving customer needs.

To learn more, please contact your J.P. Morgan representative.