For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Insights

- Treasury

- Trade & Working Capital

- China experienced mixed results for working capital metrics

China emerged as one of the first economies to recover from the pandemic. However, the global operating environment presented multi-faceted challenges in 2021 including lockdown impacts, reduced domestic demand growth, subsiding policy support, and reduced investment and export demand given strong economic recovery. As a result, the Working Capital Index deteriorated in 2021. The Cash Index improved with a similar trajectory to S&P 1500 companies as investment activities picked up and companies looked to sustain growth momentum through more aggressive cash deployment.

---------------------------------------

Summary of findings

In a global business environment, which continues to evolve under new uncertainties and opportunities, China’s corporates need to stay on the alert to address a multitude of issues

For 2021, China continued its journey of economic recovery from the pandemic from 2H2020, yet the momentum was disrupted. With multiple headwinds affecting the economy, businesses in China were faced with more challenging operational environment in 2021 and need to build resilience and readiness for the road ahead

- Compared to U.S. multinationals, Chinese companies in general have a 17.3-day longer CCC and a 17.3-percentage-point higher cash level

- Tier 1 sized companies have a 39.9-day advantage in CCC performance vs. Tier 2 sized counterparts

- China recovered from the pandemic half a year earlier than the rest of the world, driving Working Capital Index down quickly by 2020 for Chinese companies, before it rose back in 2021

- Looking ahead, some sectors in China (airlines, auto & auto parts and software) are expecting more challenges in 2022 with dampening outlook

Working capital and cash conversion cycle takeaways

The working capital index deteriorated by 4 points and returned to pre-pandemic levels for four reasons:

- Decreased domestic demand growth

- Subsiding policy support

- Decrease in Investments

- Lower export demand due to strong global economic recovery

The Cash Index improved 8 points as companies more strategically deployed cash:

Investments were a particular area where cash deployment increased

The Cash Conversion Cycle declined by 2 and is significantly higher for Tier 2 sized companies

This graph displays the CCC of Tier 1 sized companies and the CCC of Tier 2 sized companies from years 2016 to 2021.

For CCC of Tier 1 sized companies: 64.1 in 2016, 67.8 in 2017, 64.1 in 2018, 61.2 in 2019, 57.7 in 2020, 62.5 in 2021.

For CCC of Tier 2 sized companies: 111.7 in 2016, 106.0 in 2017, 101.8 in 2018, 105.9 in 2019, 104.7 in 2020, 102.4 in 2021.

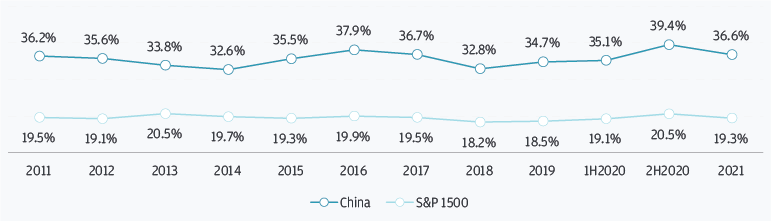

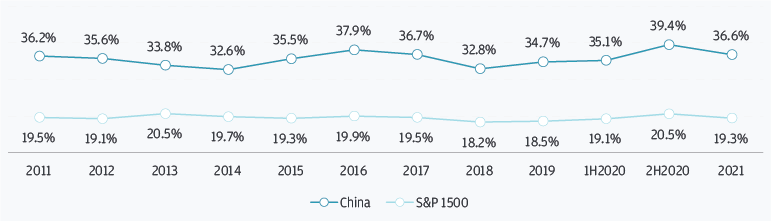

Chinese companies generally hold higher cash levels than their U.S. counterparts

This graph displays cash levels by percent for China and for S and P 1500 from years 2011 to 2021.

For China: 36.2 in 2011, 35.6 in 2012, 33.8 in 2013, 32.6 in 2014, 35.5 in 2015, 37.9 in 2016, 36.7 in 2017, 32.8 in 2018, 34.7 in 2019, 35.1 in first half of 2020, 39.4 in second half of 2020, 36.6 in 2021.

For S and P 1500: 19.5 in 2011, 19.1 in 2012, 20.5 in 2013, 19.7 in 2014, 19.3 in 2015, 19.9 in 2016, 19.5 in 2017, 18.2 in 2018, 18.5 in 2019, 19.1 in first half of 2020, 20.5 in second half of 2020, 19.3 in 2021.

Industry improvement opportunities

-

eCommerce

Raise operational efficiencies to keep their competitive edge -

Oil and Gas downstream

Prepare business models for a world with greater global clean energy consciousness -

Pharmaceuticals

Optimize financing resources given sophisticated operating environment -

Auto and auto parts

Focus on internal funding and WC structure optimization to prepare for liquidity challenges

To learn more about how we can support your business, please contact your J.P. Morgan representative.

Related insights

Treasury

Regional treasury centers: 5 myths and misunderstandings

Feb 10, 2026

Regional treasury centers (RTCs) remain shrouded in misconceptions. Here’s how to overcome them and unlock the full potential of RTCs for your business.

Treasury

Regional treasury centers’ strategic evolution

Feb 10, 2026

Regional treasury centers once played a largely transactional role for companies. In the past decade, however, they’ve evolved to drive strategy and business growth.

Treasury

Financing Resilience: Unlocking strategic capital in the defense industrial base

Feb 09, 2026

Rising inventory levels and longer program cycles are reshaping cash flow dynamics across the defense supply chain. A strategic approach to working capital can help unlock liquidity, support R&D investment, and strengthen resilience from primes to suppliers.

Treasury

9 practical steps for setting up a regional treasury center

Feb 02, 2026

Establishing a regional treasury center (RTC) is a strategic imperative for multinational businesses. The process is complex, but manageable. Get started with our guide.

Treasury

A strategic planning framework for Corporate Treasury to remain pragmatic as well as forward-looking, to capture key drivers of innovation and growth in the years to come

Treasury

Connect ERP and treasury systems for automated workflows

Jan 29, 2026

Eliminate manual data entry and payment delays by integrating your ERP with treasury systems. Get real-time cash visibility and automated workflows that reduce errors.

Treasury

Understanding the cash application process

Jan 12, 2026

Optimizing your cash application process can help fuel your company’s success. Find out how.

Treasury

Enhance your corporate treasury's risk management with FX exposure netting solutions

Nov 24, 2025

Discover how virtual netting can provide a scalable framework for currency risk management, optimizing treasury operations and driving financial performance in a complex global landscape.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.