One Card |

Corporate Card |

Purchasing Card |

Virtual Card |

|

|---|---|---|---|---|

Your goal |

“I need to simplify my card programs for all types of spend, such as T&E and procurement.” |

“I need my employees to be able to travel and pay for expenses seamlessly while I have controls and spend visibility.” |

“I need to optimize vendor payments, reduce misuse and fraud, and move away from manual paper-based payments.” |

“I need to digitize and automate manual B2B expenses, reduce fraud and increase working capital.” |

Key benefits |

Manage multiple types of spend, simplify administration, control purchasing, monetize expenses and improve cardholder experience. |

Give cardholders a hassle-free way to pay with a configurable T&E expense solution that can increase efficiency, establish controls and protect against fraud. |

Manage your B2B procurement spending more strategically while increasing rebate revenue potential, increasing security and optimizing supplier payments. |

Digitize supplier payments, increase security and extend days payable outstanding without impacting cash flow, and transform traditional areas of expense into potential revenue generators. |

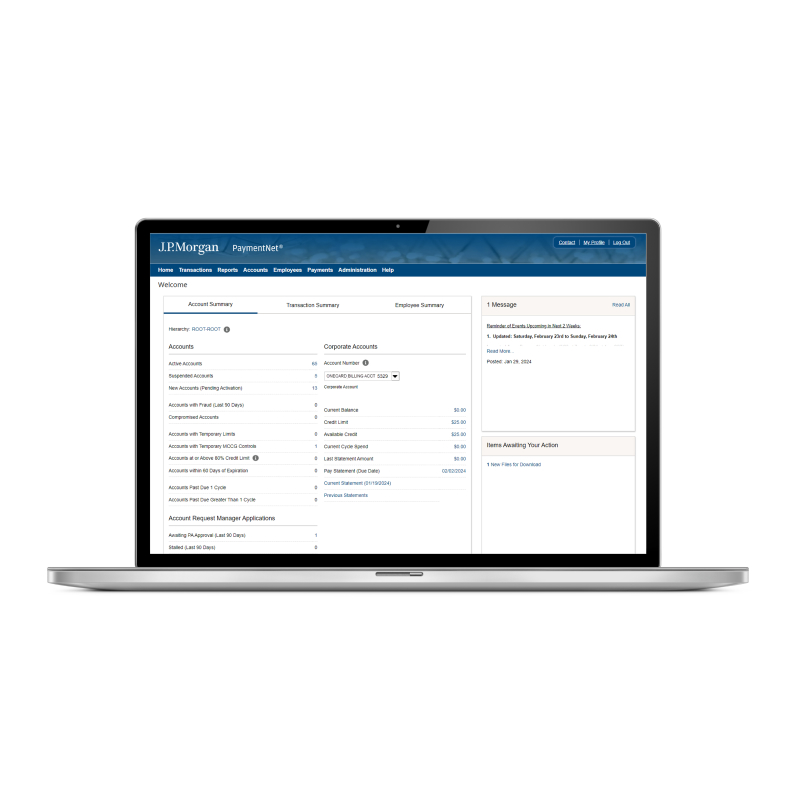

Automate administrative functions, simplify cardholder tasks and streamline account reconciliation.