For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Insights

- Cybersecurity

- Business Email Compromise

- 4 callback do’s and don’ts to protect against BEC

Business email compromise (BEC) continues to be a big problem for companies of all industries and sizes. The FBI found that BEC led to nearly $2.7 billion in adjusted losses in 2022.

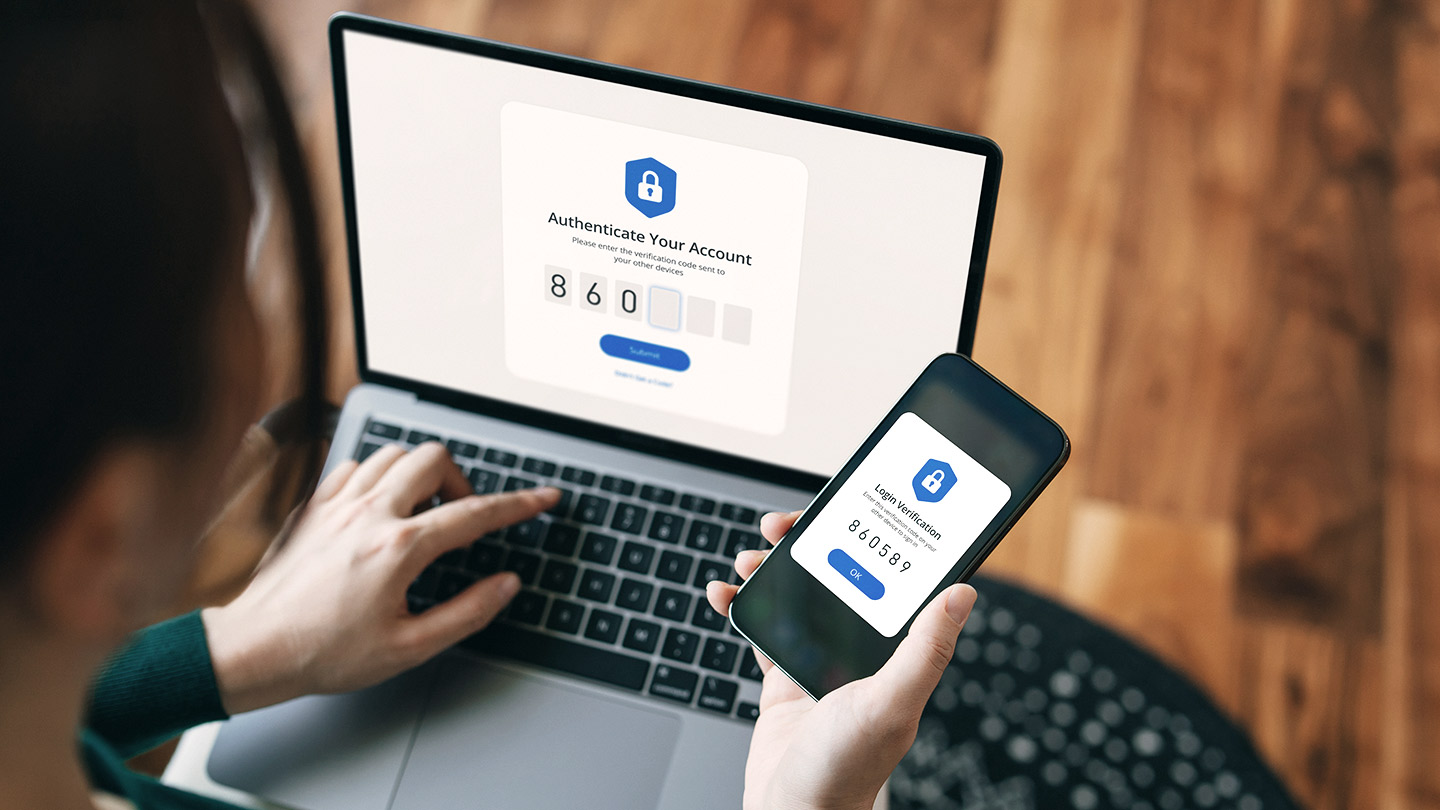

Typically, cybercriminals operating a BEC scheme impersonate a known party over email and ask for a change in payment instructions. It’s absolutely vital that your business verify these payment instructions whenever there is a change, or when new instructions are initially given. That means physically calling the requestor using a trusted number from a company directory to ensure the party is who they say they are. Under no circumstances should a number provided in an email be used for a callback.

Be careful, however, because callbacks can fail without formal and standardized procedures. Understanding how things go wrong can help your business implement stronger controls that protect against BEC.

4 callback mistakes

1. Relying on an inbound phone call

- Don’t: Ask that a vendor call you to validate instructions or rely on an inbound phone call to update vendor contact information.

- Do: Always conduct an outbound phone call to the party to confirm they are genuine.

- Why? Fraudsters may know that a callback is part of your payment controls if they’ve taken over a vendor’s email. They may then try to circumvent your defenses by placing an inbound call to advance the scheme.

2. Trusting the number provided

- Don’t: Use a phone number from an email thread, invoice or documentation provided to you via email or mail.

- Do: Use a known and trusted number from a system of record.

- Why? Criminals will provide phone numbers that, when used, result in the victim speaking with the fraudster—who will be all too happy to validate the transaction.

3. Not speaking directly with the requestor

- Don’t: Speak to just any employee at your vendor regarding the change in payment instructions.

- Do: Speak to the person who is personally accountable to the change in instructions.

- Why? Fraudsters will exploit emails between two parties. For example, say you call an accounting employee regarding a payment change and they email their CFO for validation. But— the CFO’s email has been hacked already. This would allow the criminal to get around your callback controls.

4. Assuming internal controls have been followed

- Don’t: Presume a callback was performed as expected if your bank flags a transaction.

- Do: Confirm controls were executed as intended and none of the above mistakes were made.

- Why? Human error happens. Minimize these risks by actively ensuring procedures have been followed as they were laid out.

How JPMorgan Chase can help you fight fraud

JPMorgan Chase is dedicated to fighting fraud, and we have a number of tools, products and resources to help protect your business.

Reach out to your banking relationship team to learn more about how we can help you improve cybersecurity and anti-fraud protections.

© 2023 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/cb-disclaimer for disclosures and disclaimers related to this content.

Related insights

Cybersecurity

3 cyber secure actions to add to your New Year’s resolutions

Jan 23, 2026

New year, new emerging cybersecurity threats. These tips will help keep your digital presence under lock.

Cybersecurity

Protect your business: Spot fake emails and websites

Jan 22, 2026

Spotting small changes in web addresses and emails can help you avoid scams and keep your business safe from online threats.

Cybersecurity

AI-powered scams: How you can help protect yourself

Dec 02, 2025

Fraudsters are now using AI to put a new, sophisticated spin on age-old scams, making personal and financial security more vital than ever. Learn what you can do to help protect yourself.

Cybersecurity

Your house may be spying on you. Save yourself.

Oct 27, 2025

All the smart devices embedded in our homes can put us at risk. Discover how to secure your IoT devices, and what you can do to protect yourself.

Cybersecurity

Parents, you need to teach your kids about financial fraud

Oct 23, 2025

With the increasing complexity of fraud schemes, it’s important your kids understand how to keep their accounts and personal information safe.

Cybersecurity

The social media seesaw: How family guidelines balance sharing with security

Oct 01, 2025

As individuals’ and families’ profiles and finances increase, so does their likelihood of becoming targets of cybercrime and facing reputational damage. Learn more here.

Cybersecurity

Unmasking social engineering: Protecting your wealth from deceptive cyber tactics

Oct 01, 2025

Social engineering is a powerful tool used by cybercriminals to manipulate individuals into revealing sensitive information, using tactics such as phishing, artificial intelligence and more. Discover how to recognize and thwart these tactics.

Cybersecurity

Mind your business: How to keep your company cyber secure

Sep 08, 2025

Does your business’ cybersecurity need some TLC? With cybercrime on the rise, it’s important to understand how you can keep your business accounts and assets well protected.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.