To call 2020 a “unique year” for life sciences companies would be an understatement. The COVID-19 pandemic transformed the industry, creating immense opportunities for institutions and investors to drive healthcare through innovation.

Peter Meath, Co-Head of Healthcare and Life Sciences for Commercial Banking, notes that investment in life sciences reached record-high levels across almost every category and subsector—despite unprecedented business challenges. Here are a few of the highlights:

- 3Q 2020 was the largest quarter on record in terms of dollars for venture investment in life sciences

- Alternative sources of capital rose as well, including:

- Corporate venture capital (CVC) and corporate partnerships

- Up-front payments and deal terms on partnership deals

- Non-traditional investors, including individuals, angels, family offices, corporates and even hedge funds

Mega rounds—VC funding in excess of $100 million—continued to increase across biopharma, medical technology, and tools and diagnostics. Meath says the “go big” trend of larger fund sizes, i.e., mega funds, could continue to play a larger role in the funding ecosystem as well.

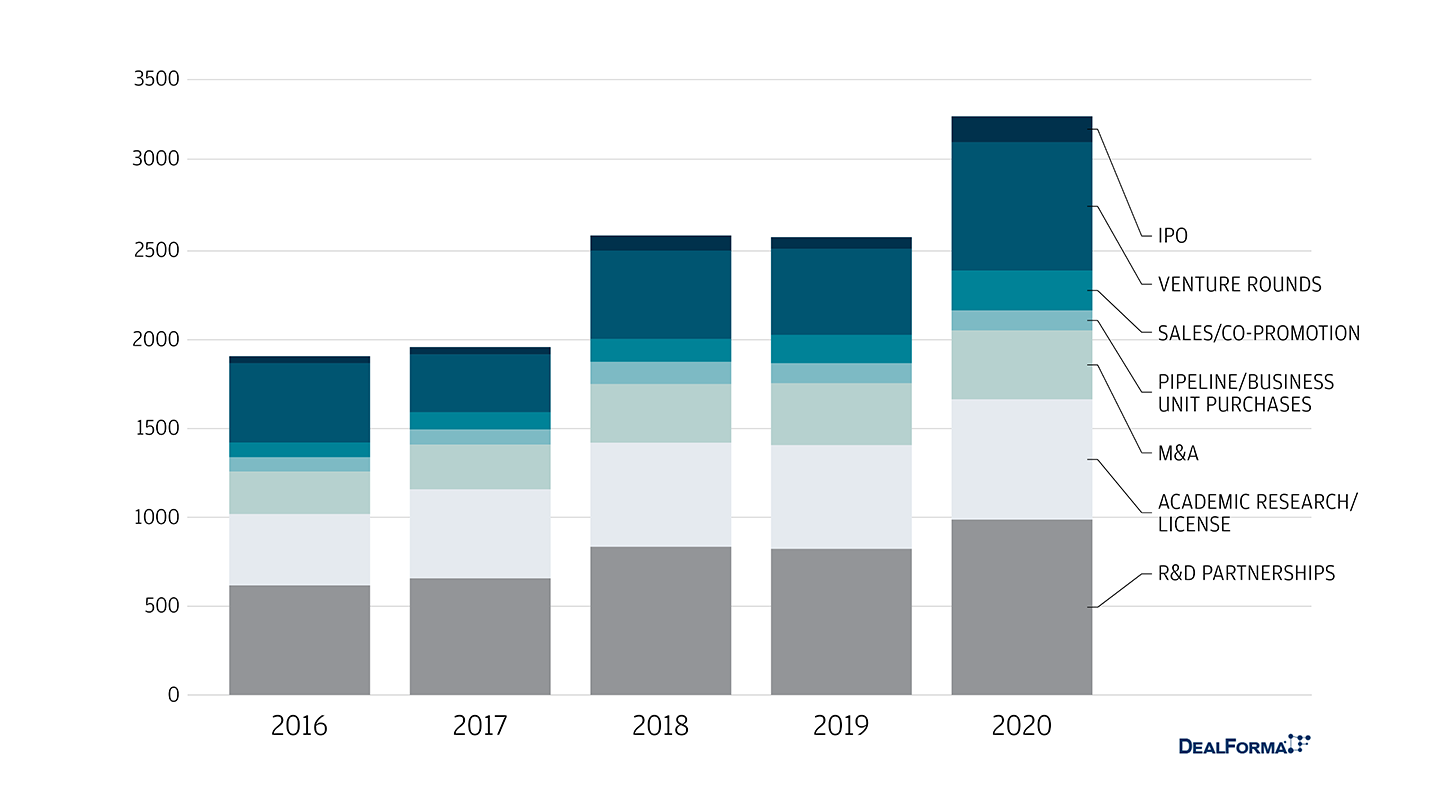

Number of Healthcare and Life Sciences Deals by General Deal Structure1

Activity within life sciences subsectors evolved as investors adjusted to the ebb and flow of the economic and business landscape during the pandemic.

“Biopharma notably had a banner year, and we’ve seen some interesting moves in tools and diagnostics, pharma services and healthcare IT funding, not just among our clients, but in the industry overall,” Meath says.

Take a deeper dive into these subsectors along with the DealForma data below.

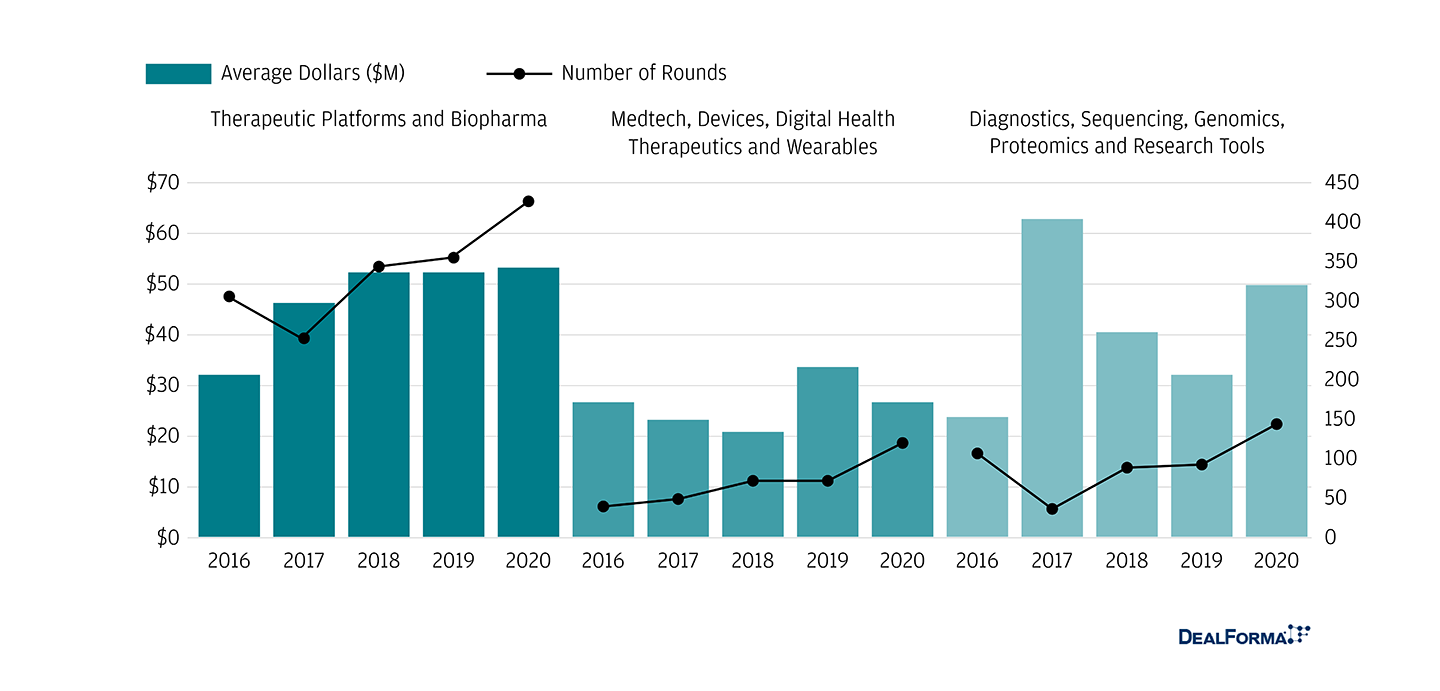

Venture Round Averages by Subsector2

Biotech and Biopharma

Biopharma continues to dominate the industry landscape in terms of dollars invested and number of funding rounds. Investors are indicating record-high levels of innovation at a faster pace than before the pandemic.

- Increasing activity in Series A and early rounds, as well as mezzanine financing, as companies and investors map to strong public market sentiment.

- Crossovers are increasingly contributing to earlier rounds, expanding their Series A participation to all-time highs.

- Oncology and platform companies continue to be hot, while central nervous system drugs have grown in importance.

- One surprise has been the decline in funding for orphan or rare diseases, perhaps signaling that investors diverted activity elsewhere during the pandemic.

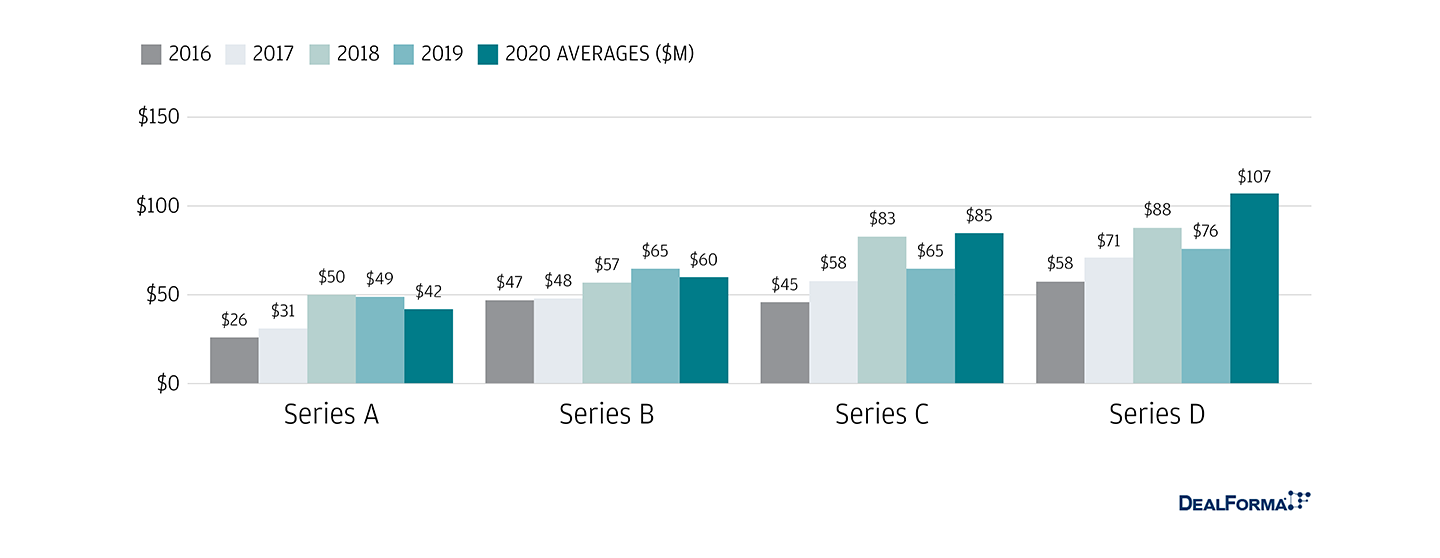

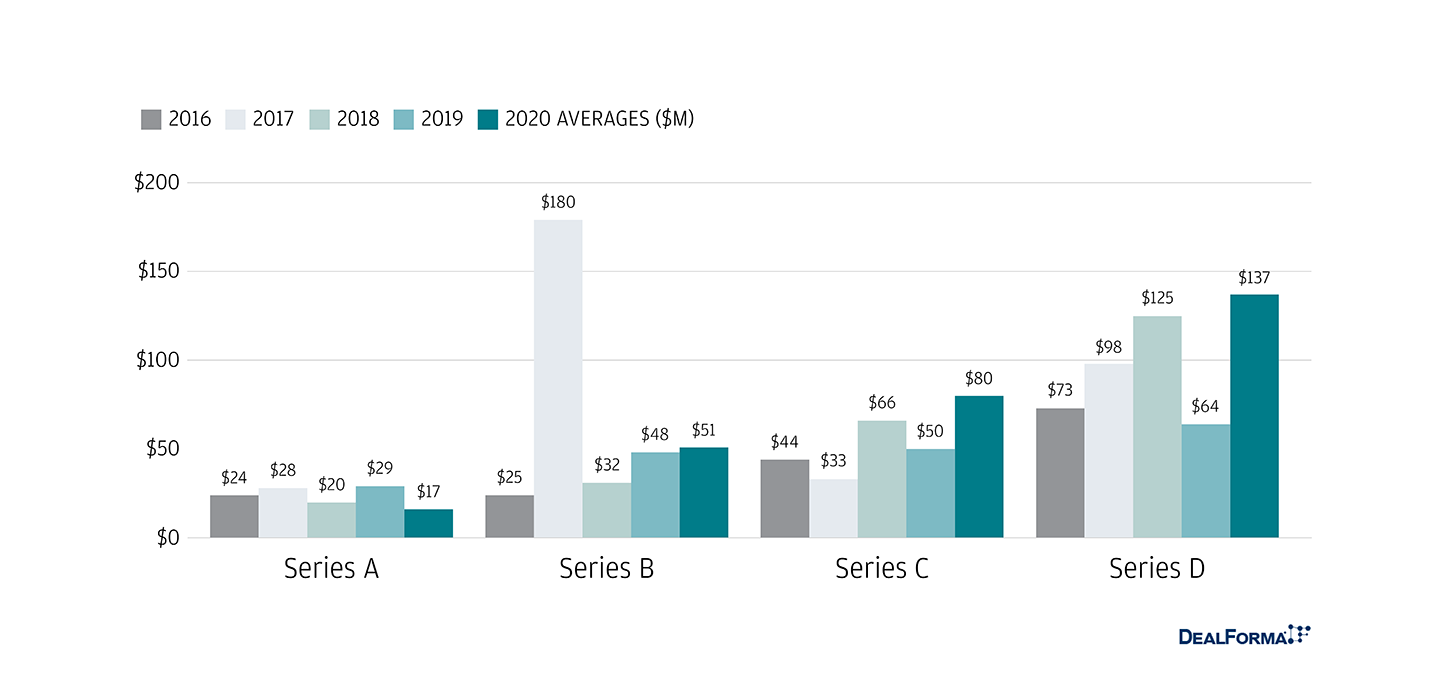

Average Venture Round by Series: Therapeutic Platforms and Biopharma ($M)3

Tools and Diagnostics

The diagnostic space continues to take in new capital from tech investors who have only recently emerged on the life sciences scene. Meath says this is due, in part, to a growing crossover subsector that uses data, AI and machine learning in combination with diagnostic tools to better drive value delivery and clinical outcomes.

- Series A funding was a bit flat in the second half of 2020, but record levels of later-stage and mezzanine financing is still flowing in—especially for COVID-19 innovations.

- There’s more investor receptivity to growth stories, once again riding COVID-19 tailwinds as well as data, AI and machine learning trends.

- The market has valued the vaccine side of the COVID-19 wave but is still determining impacts on the tools and diagnostics segment. Meath says many larger partners may be looking for increased capacity building, and novel approaches continue to attract investor interest.

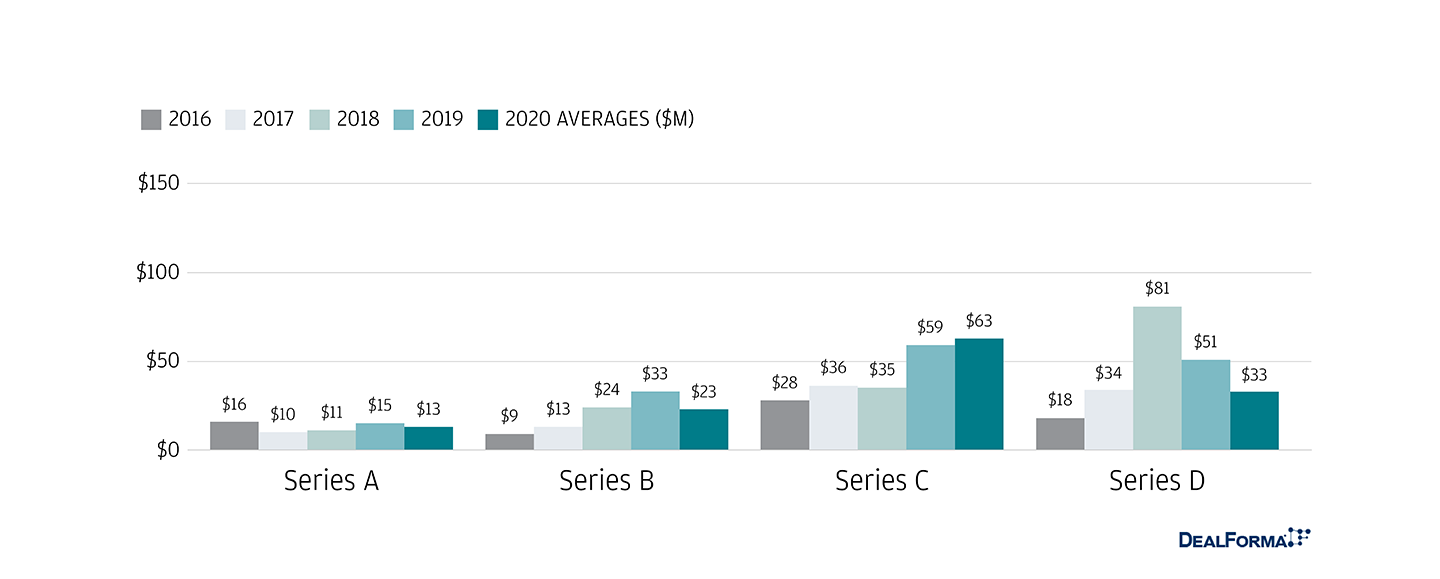

Average Venture Round by Series: Diagnostics, Sequencing, Genomics, Proteomics and Research Tools ($M)4

Pharma Services

COVID-19 has made the public, the market and investors rethink the pharma supply chain and its capacity to solve fast-moving problems.

- Early disruption in supply chains for pharma led many to focus on building in more resiliency and redundancy, as well as evaluating multi-channel approaches to delivery.

- The accelerating advent of innovations such as cell and gene therapies and other new modalities has pushed companies to find novel approaches to development and manufacturing. These approaches can also narrow supply chains and require new solutions for delivery.

- Meath says companies are taking advantage of these supply chain and therapy trends, which may lead to a market that is more fragmented but also more resilient and receptive to innovation.

- More consolidation may also occur, while still leaving the door open to newcomers.

Healthcare IT

The healthcare IT space expanded rapidly last year as telehealth visits and other forms of virtual healthcare skyrocketed, setting the stage for continued growth and innovation in 2021.

- Funding dollars hit an all-time high, boosted by the virtual care surge.

- Series A funding was flat to slightly down, but overall dollars were up, signaling a shift in focus to market-ready solutions and later-stage, mezzanine-focused COVID-19 ventures.

- Both fully virtual and hybrid platforms dominate the space, while provider and clinical trial solutions continue to perform well.

Medical Devices

If there was one soft spot in life sciences investment in the latter half of 2020, it was in the medical devices space. Demand for medical devices—and funding—likely dipped, Meath says, due to patients delaying elective procedures to reduce COVID-19 exposure, coupled with the pandemic’s strain on healthcare systems.

- Based on a two-year trend, Series A funding declined overall, although investments in certain areas, including cardiology and neurology, remained strong and continue to increase.

- Investors tended to focus on later-stage and commercialized investments.

- Despite these challenges, Meath notes that deals with more innovative and novel medical device companies—those using AI or machine learning, for example—could see a rebound in 2021 given the overall dollars going into the space.

Average Venture Round by Series: Medtech, Devices, Digital Health Therapeutics and Wearables ($M)5

Meath says the major question for this space is: “How long will COVID-specific moves last and how will their value be created and retained long term?”

No matter what comes next, we’re here to keep you informed. Our team of Life Sciences bankers and specialists focus on solutions for pioneering life sciences companies at all stages—from startups to established companies, pre-clinical through commercialization.

Learn more about our insights and how we help companies like yours.

References

DealForma, data as of 1/7/2021. Healthcare and Life Sciences sector coverage across biopharma, medtech, device, diagnostics, tools, CDMOs, and related companies. Financials based on disclosed figures. M&A are for whole company acquisitions (or majority acquisitions) and not product, pipeline, or business unit purchases. Excludes terminated offers. Partnerships involving development and commercialization, joint ventures, options to license, partnerships with an option to acquire the company, and research partnerships. Excludes regional sales/distribution only and academic/government deals.

Source: DealForma, data as of 1/7/2021. Healthcare and Life Sciences sector coverage across biopharma, medtech, device, diagnostics, tools, CDMOs, and related companies. Financials based on disclosed figures. Multiple tranches of the same Series are counted as one together.

Source: DealForma, data as of 1/7/2021. Biopharma companies developing therapeutics and technology platforms engaged in drug discovery, clinical R&D, and commercialization. Financials based on disclosed figures. Multiple tranches of the same Series are counted as one together

Source: DealForma, data as of 1/7/2021. Companies developing diagnostics, biomarkers, lab based assays, and research technologies. Financials based on disclosed figures. Multiple tranches of the same Series are counted as one together.

Source: DealForma, data as of 1/7/2021. Companies developing medical technologies, therapeutic devices, digital health therapeutics, and wearables with a clinical diagnostic or therapeutic focus. Financials based on disclosed figures. Multiple tranches of the same Series are counted as one together.

This material is provided to you for informational purposes only and any use for any other purpose is disclaimed. It is a summary and does not purport to set forth all applicable terms or issues. It is not intended as an offer or solicitation for the purchase or sale of any financial product and is not a commitment by JPMorgan Chase as to the availability of any such product at any time. The information herein is not intended to provide, and should not be relied on for, legal, tax, accounting advice or investment recommendations. JPMorgan Chase makes no representations as to such matters or any other effects of any transaction. You should consult with your own advisors regarding such matters and the suitability, permissibility and effect of any transaction. In no event shall JPMorgan Chase be liable for any use of, for any decision made or action taken in reliance upon, or for any inaccuracies or errors in, or omissions from, the information herein.

The above statistics have been obtained from external sources deemed to be reliable, but we do not guarantee their accuracy or completeness.