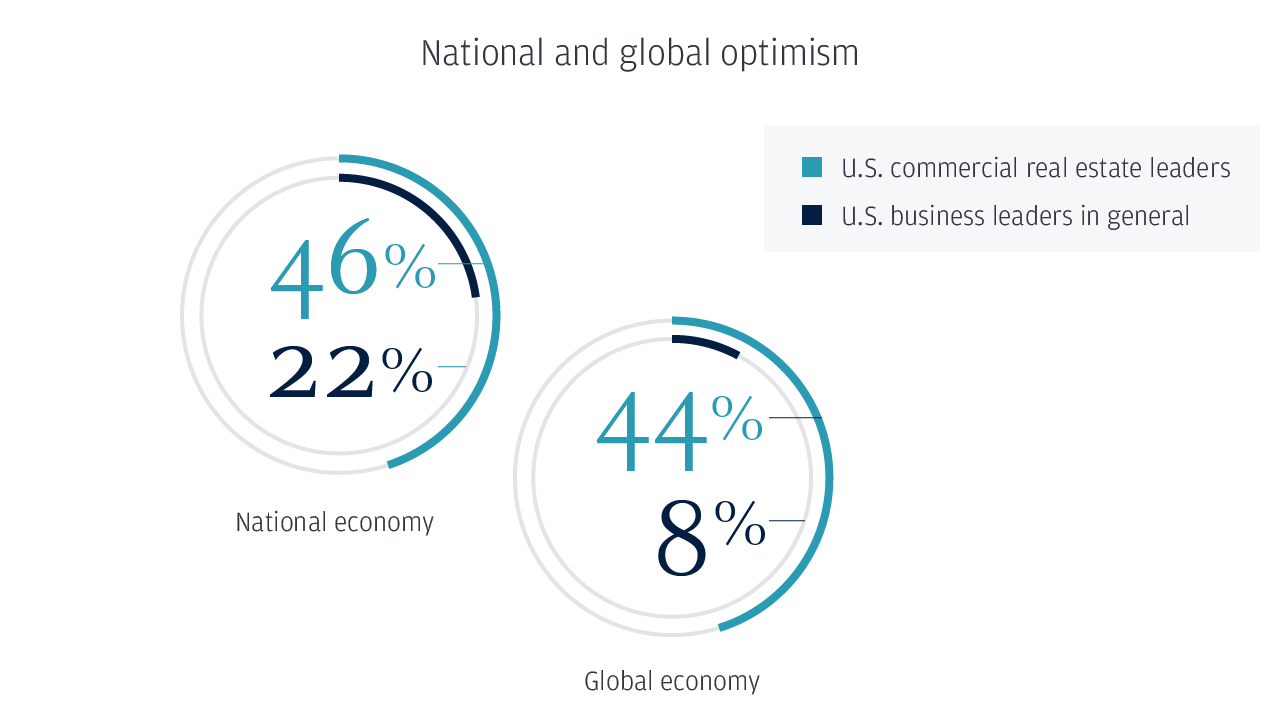

Commercial real estate professionals are slightly more optimistic about the year ahead than U.S. leaders overall, according to our 2023 Business Leaders Outlook survey.

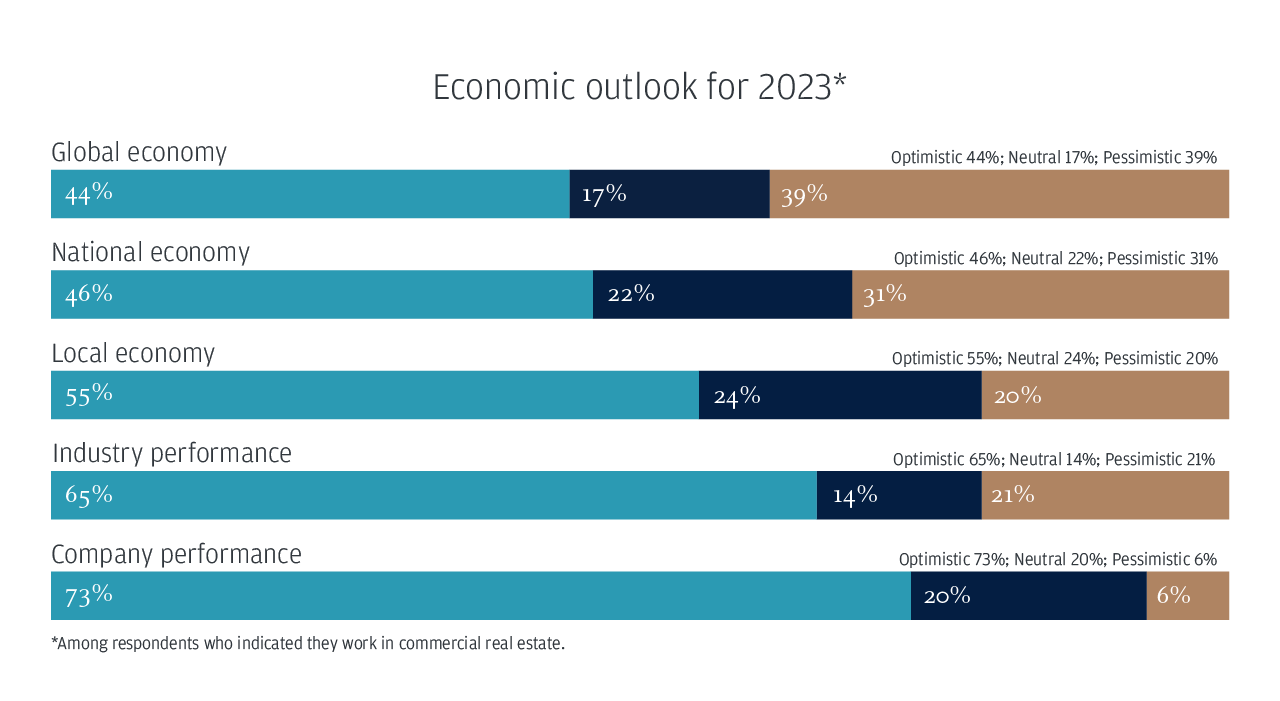

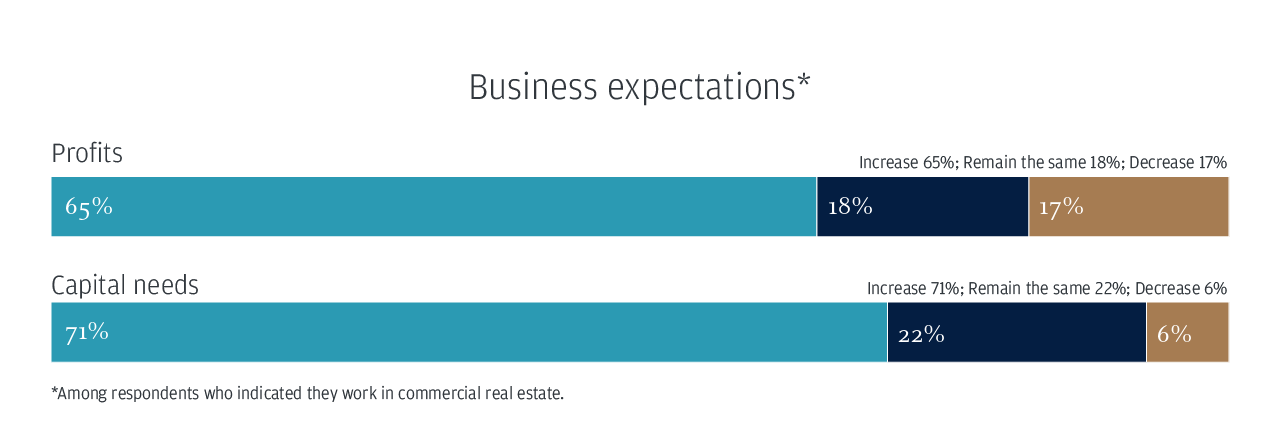

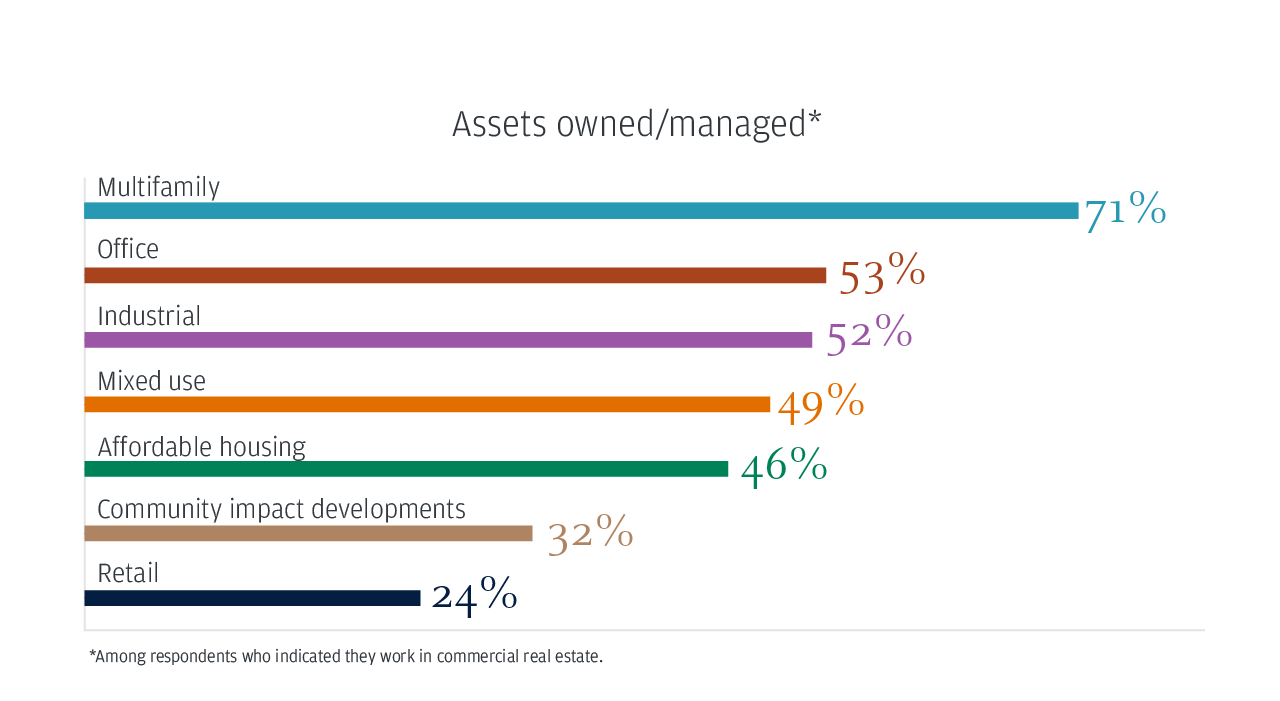

The commercial real estate leaders surveyed hold various assets, with a concentration in multifamily. Nearly three quarters of these professionals expect increases in their revenue/sales and capital needs (both at 71%)—significantly higher rates than U.S. business leaders in general. Almost half of real estate leaders are optimistic about the global (44%) and national economy (46%). Nearly two-thirds (65%) are also optimistic about the industry’s performance in 2023, with 73% optimistic about their own company’s performance.

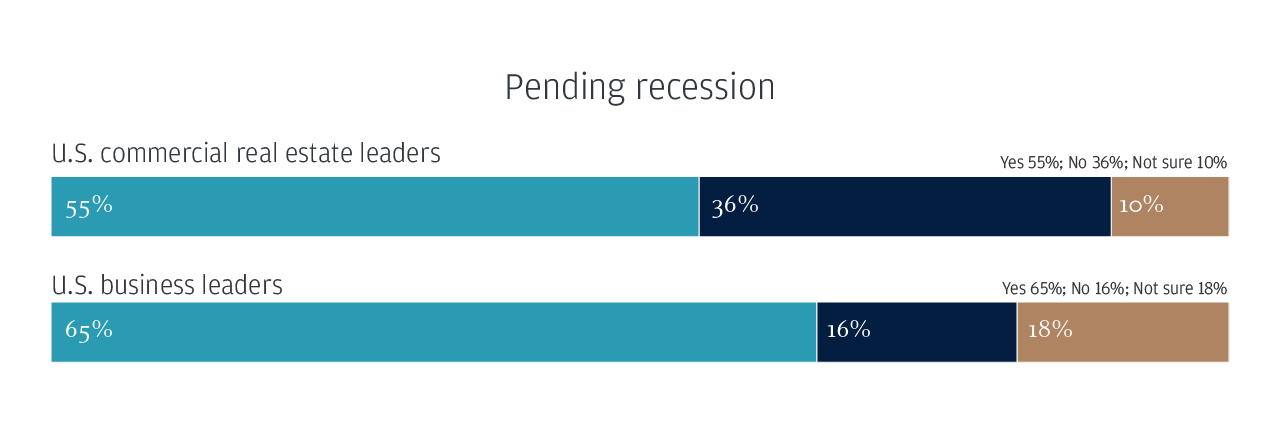

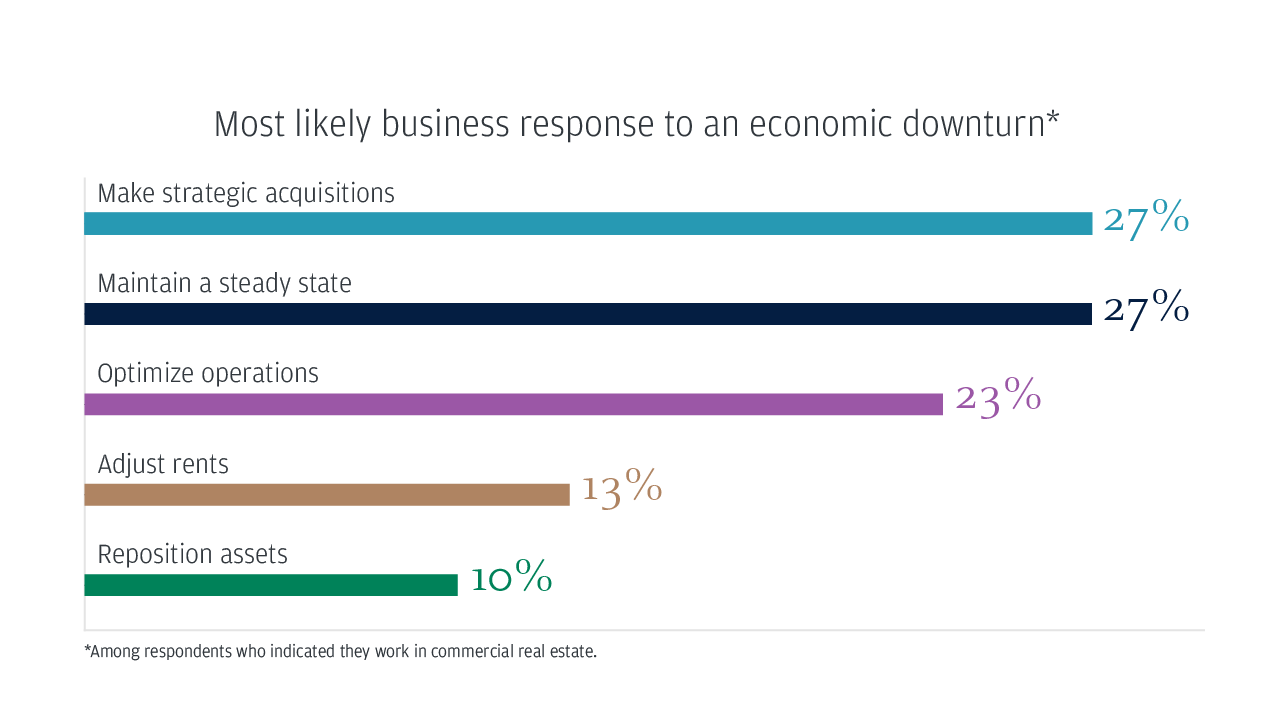

Leaders still anticipate challenges ahead—55% expect a recession in 2023. If an economic downturn occurs, real estate professionals were evenly divided on their first action: making strategic acquisitions (27%) or maintaining a steady state (27%).

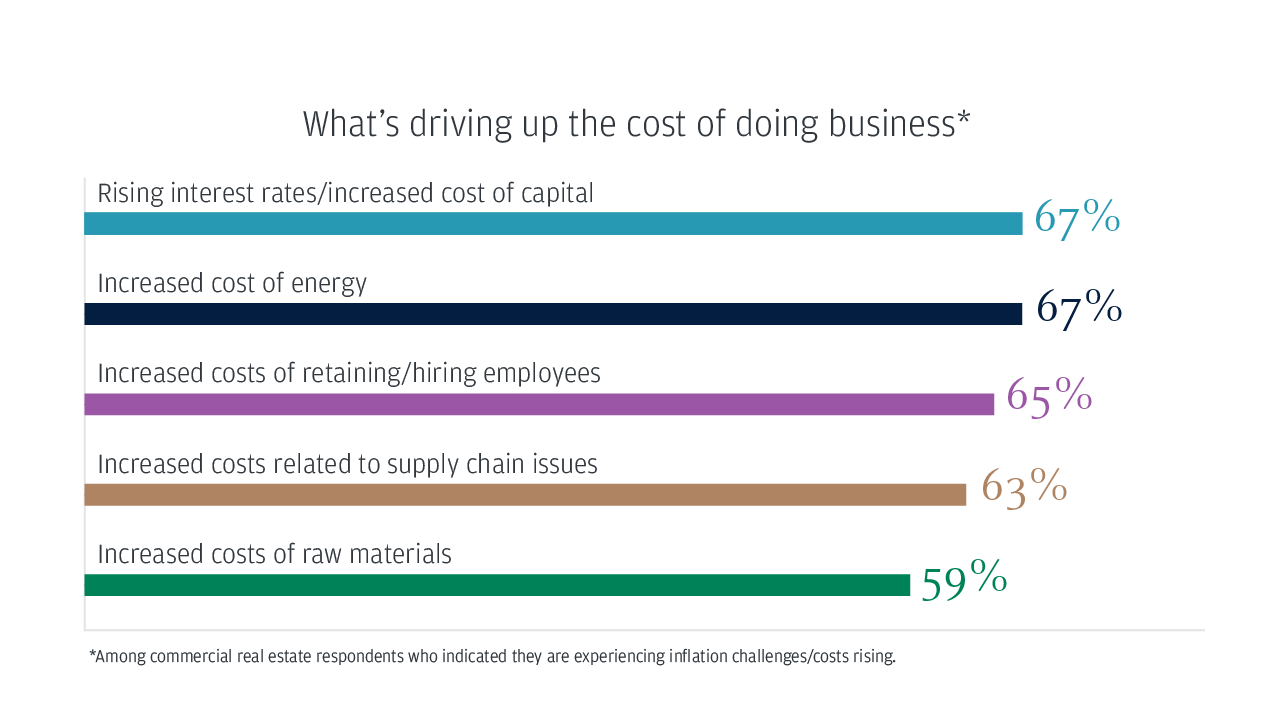

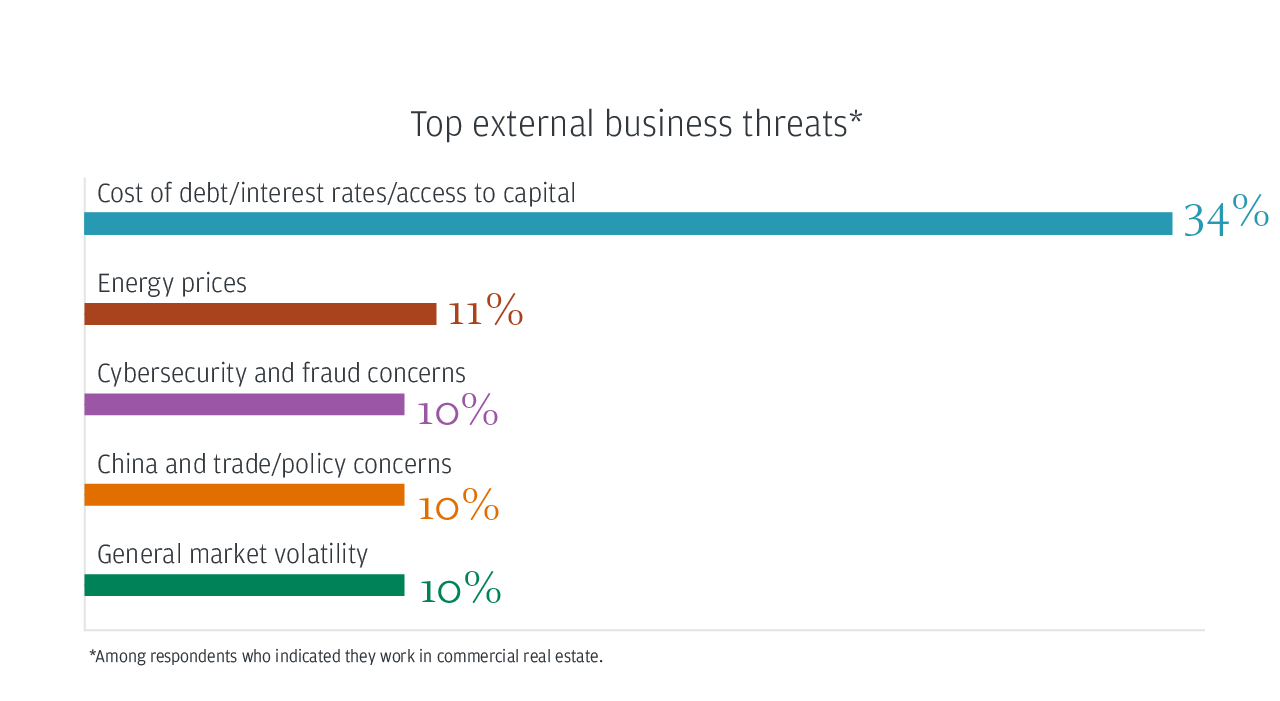

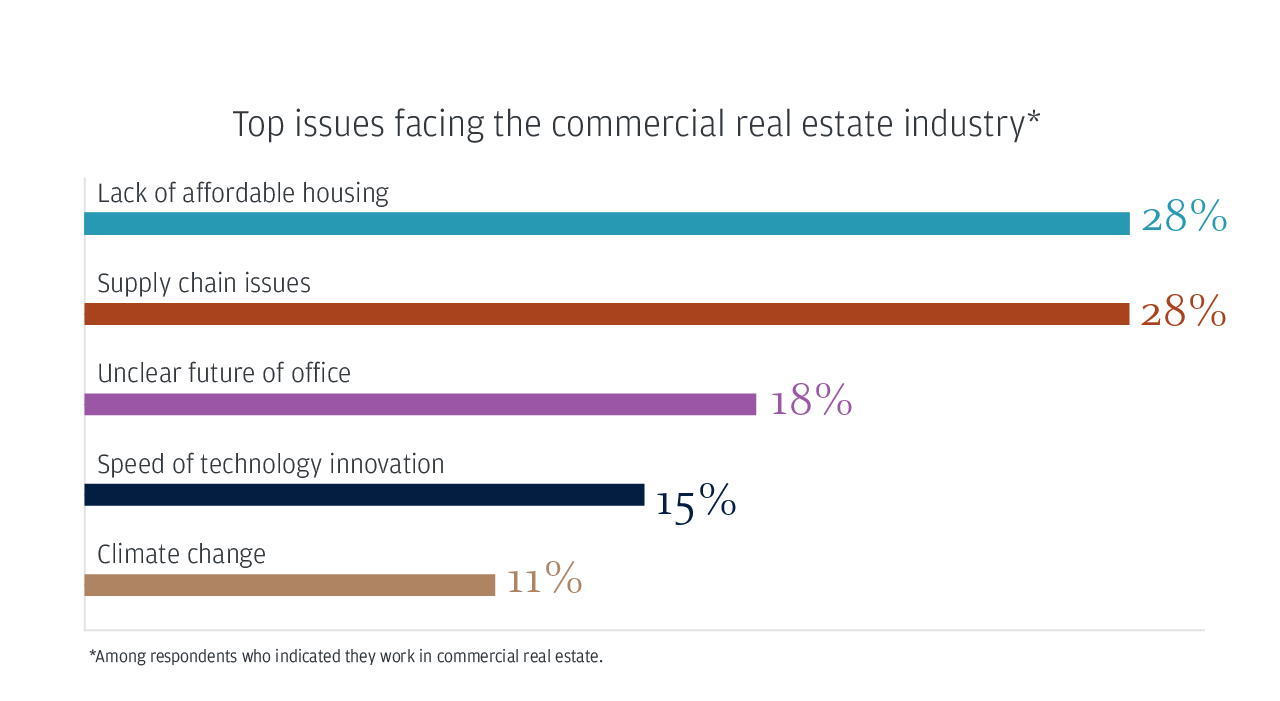

Interest rates remain a prominent issue; 67% of respondents said rising interest rates/increased cost of capital are driving up business costs. Aside from the rate environment, leaders said the most pressing concerns facing the industry are lack of affordable housing (28%) and supply chain issues (28%).

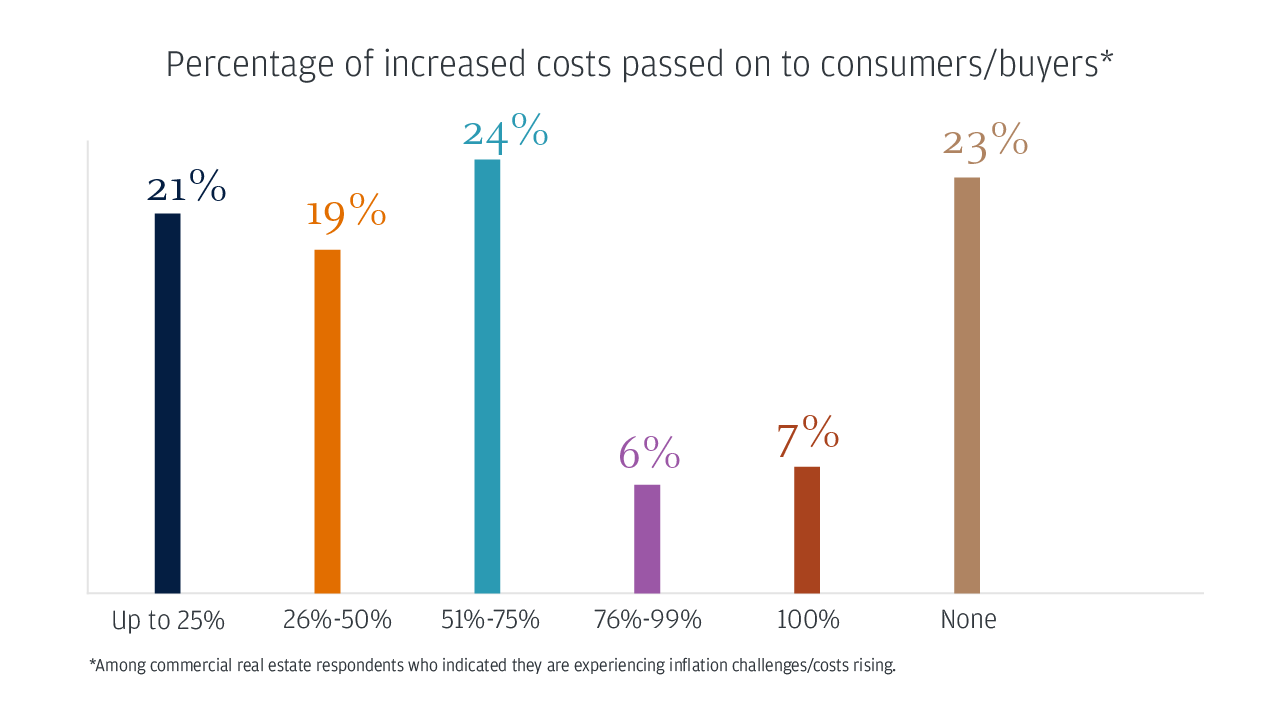

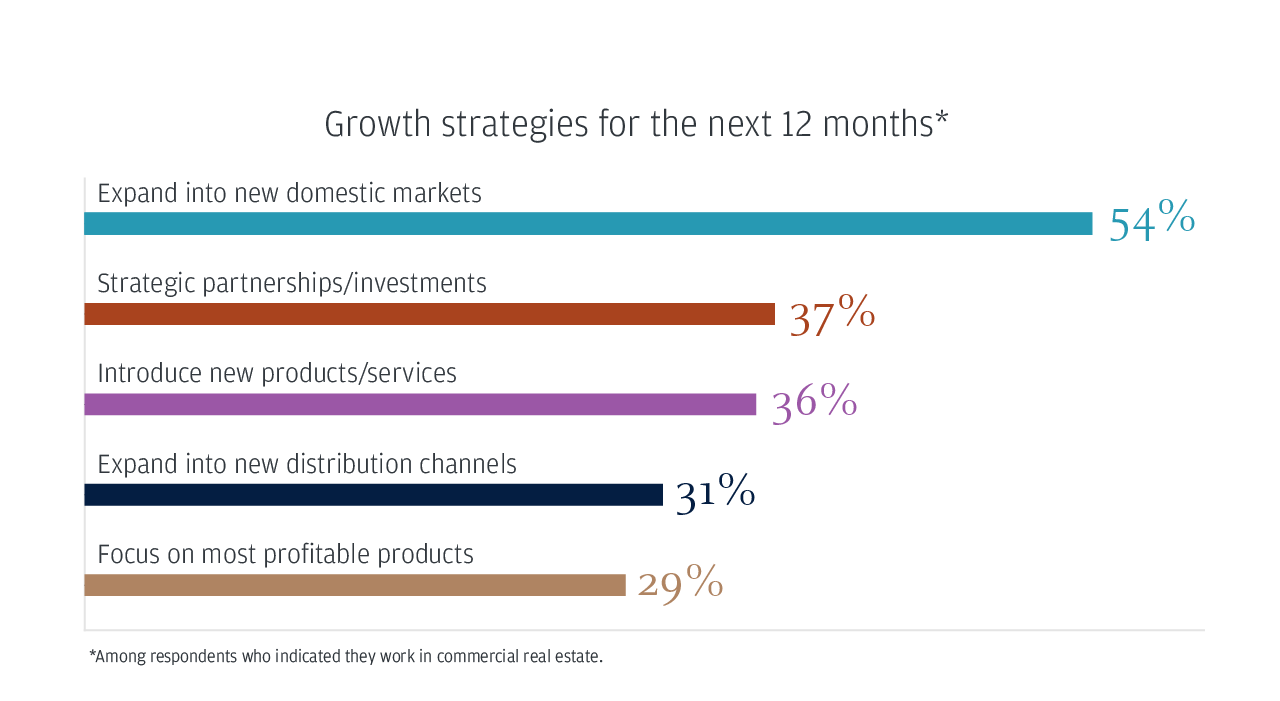

Most respondents are also experiencing inflation challenges and rising costs (72%) but at a lesser degree than the total U.S. sample (91%). These challenges, however, may not hinder their growth; more than half of leaders plan to expand into new domestic markets.

About the survey

Started in 2011, the annual and midyear Business Leaders Outlook survey series provides snapshots of the challenges and opportunities facing executives of midsize companies in the United States.

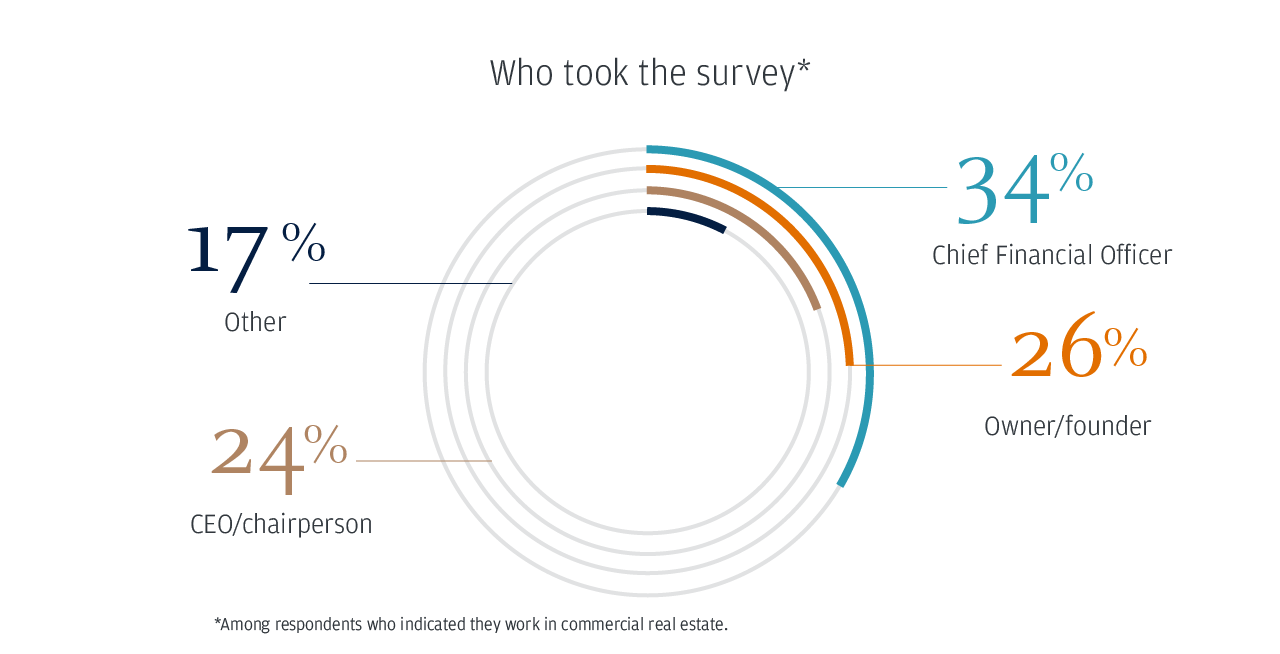

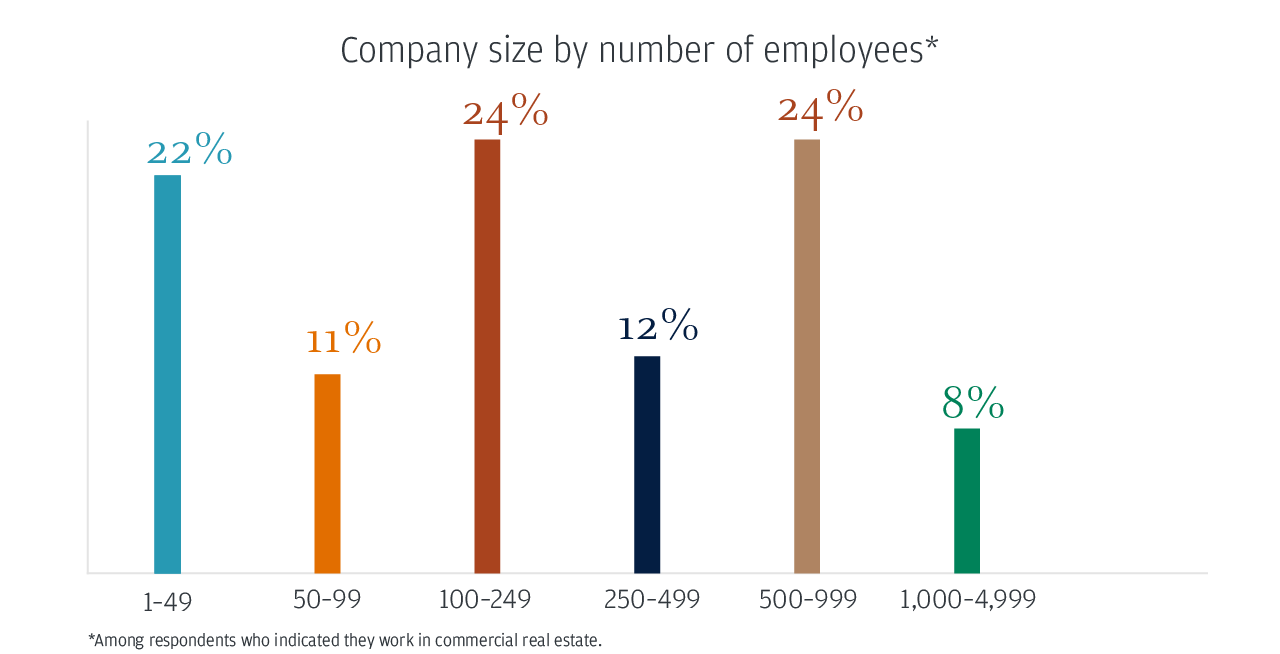

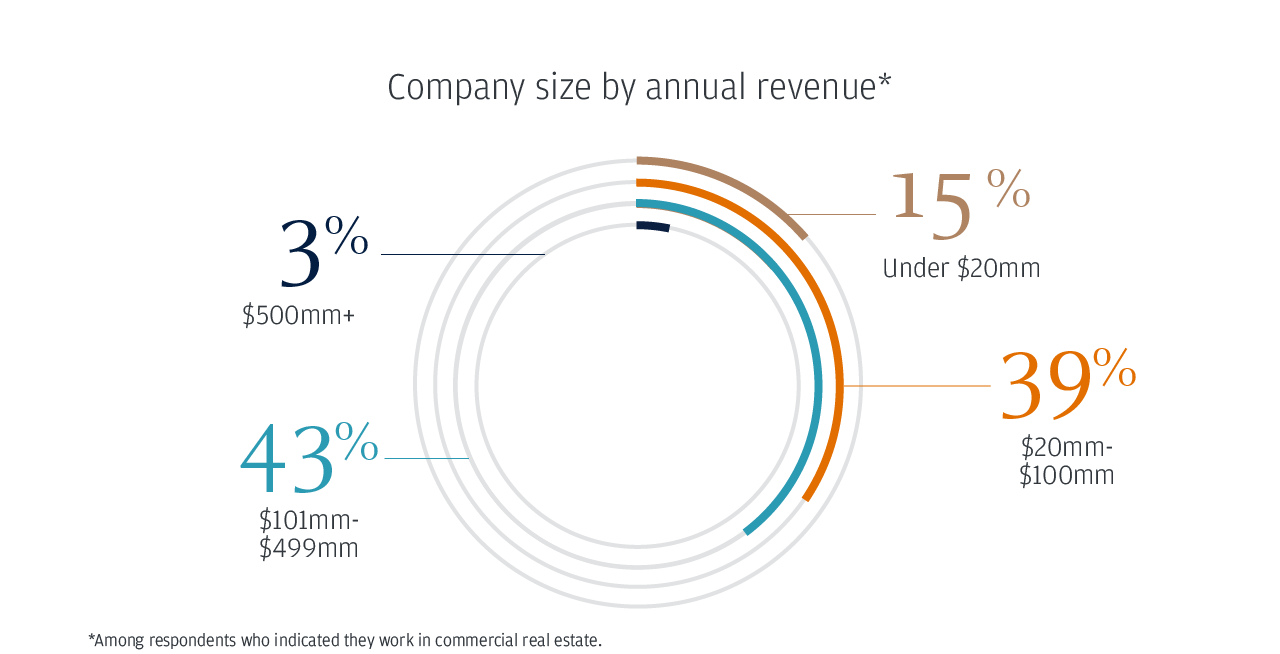

This year, 791 respondents completed the online survey between Nov. 29 and Dec. 13, 2022. Of those respondents, 157 self-identified as working in commercial real estate. The 2023 survey captures those responses for the inaugural Business Leaders Outlook: Commercial Real Estate.

Results are within statistical parameters for validity; the error rate is plus or minus 7.9% at the 95% confidence interval.

Bullish on their own businesses

Nearly two-thirds of real estate leaders expect their profits to increase in 2023. Most expect their capital needs to increase as well.

Inflation challenges

Inflation is increasing business costs. The majority of commercial real estate leaders are passing those expenses onto consumers.

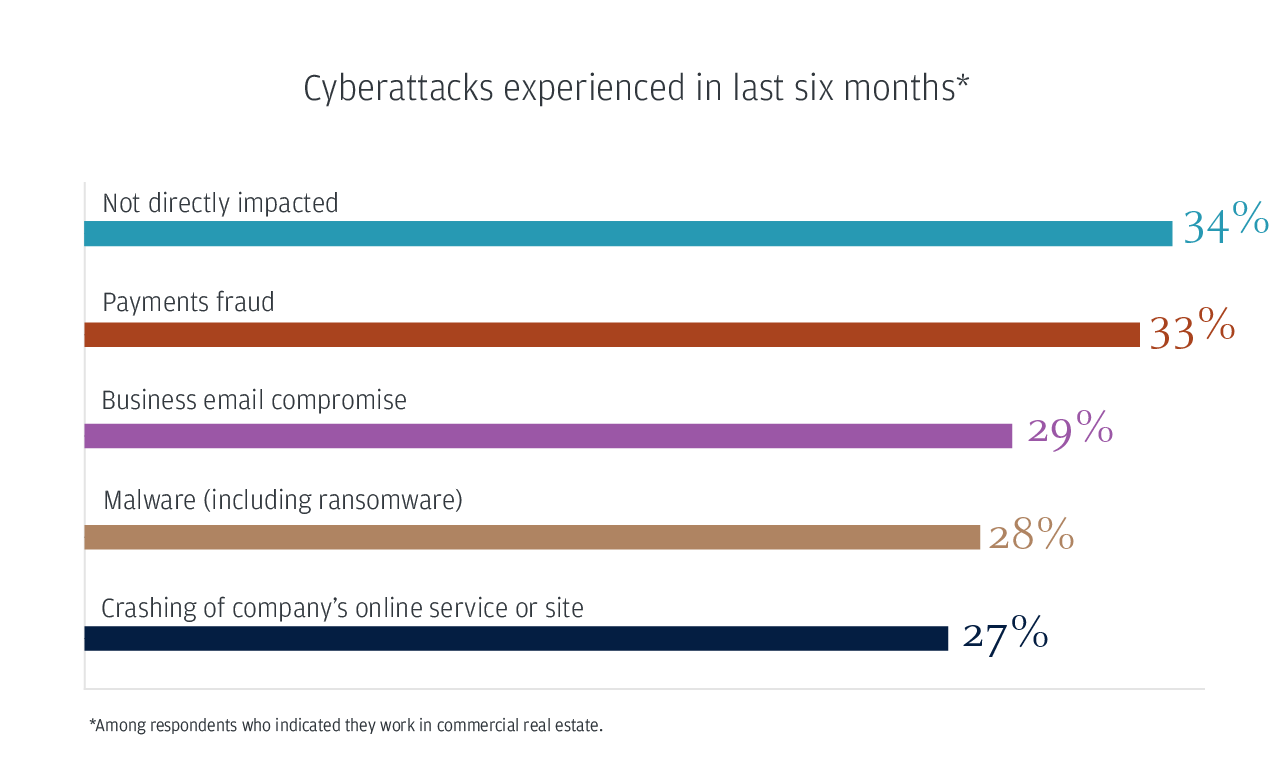

Business challenges

Leaders in real estate face a litany of challenges, including rising interest rates, supply chain issues and cyberattacks.

Business growth plans

More than half of leaders are planning to expand into new domestic markets. More than a third count strategic partners/investments, new products/services and new distribution channels among their growth strategies.

Corporate responsibility

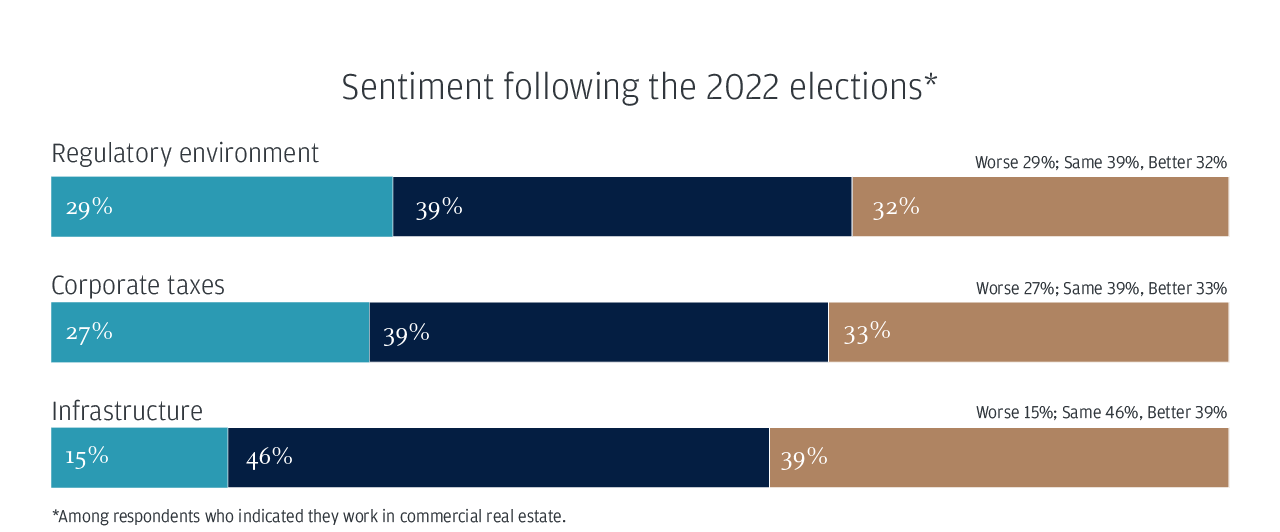

Election effects

From the regulatory environment to infrastructure, most real estate leaders feel the same or better about key issues after the midterm elections.

Survey demographics

Note: Some numbers may not equal 100% due to rounding.

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/cb-disclaimer for disclosures and disclaimers related to this content.