Driving forces behind the treasury evolution

When the landline telephone was first introduced, it took 75 years for it to reach 50 million users. Electricity took 46 years to achieve the same milestone. Twitter hit the 50-million-user milestone in under two years, while the mobile game Angry Birds took just 35 days1.

This progression of mass adoption illustrates just how exponential the pace of technological change is today. Across the treasure function, there has been a deluge of payment innovations in the last few years alone, leveraging new technologies like robotics, artificial intelligence and blockchain. Virtual accounts and real-time payments have been successful in creating efficiencies by streamlining account structures and delivering straight-through transactions, while automation and data analytics are helping to improve speed, accuracy and forecasting.

The explosive growth of mobile commerce is also rapidly changing business models. The global cash management industry is expected to grow significantly over the next five due to the rise in e-wallets and super-apps, together with the continuing surge in smartphone penetration particularly in developing markets. This means it’s becoming inevitable for companies with traditional payment methods to migrate to online payment platforms to adapt to the unique demands of mobile consumers.

With cross-border transaction flows expected to continue increasing, the management of different and dynamic regulatory environments is becoming more complex especially for treasurers operating in multinational firms. Anti-money laundering and know-your-clients disciplines continue to be a focus for regulators, and treasurers are increasingly being asked to provide information about creditors, beneficiaries, and the purpose for which money is moving between countries. Ensuring data privacy is also front and center today, with personal data being used to facilitate online transactions.

Rise of the self-driving & strategic treasurer

To adapt to the fast-changing industry, treasurers are gravitating towards being increasingly self-driving through automation and becoming more centrally strategic to the company's growth goals. According to the 2017 AFP Strategic Role of Treasury Survey reported by Marsh & McLennan, 80 percent of finance professionals said treasury has played a more strategic role at their organizations and another 80 percent believe the role of the treasury function will continue to grow and become even more strategic.

WE EXPECT TO SEE A GROWING BIFURICATION

Self-Driving Treasury

Operational treasury tasks automated

Recommended actions proposed by sophisticated AI

Exceptional management vs preparation and initiation

Thought Leadership & Tools

- Treasury Operations

- Coding/Programming

- Governance & Controls

- Test & Learn

Strategic Treasury

Internal consultant to the business

Support the business to achieve its growth goals

Leverage the power of financial flows of data to provide unique insights

Thought Leadership & Tools

- Strategic Thinking

- Business Development

- Relationship Management

- Data Analysis

Currently, the role of treasurers in many large multinationals is still centered on the manual tasks of reconciling daily positions, across numerous account structures in multiple markets. With technological innovation however, the treasury function is evolving. For example, solutions like Just-in-Time Funding will eventually render the role of funding accounts to bots, while open banking will provide easy access to financial data from different banks, freeing up the treasurer to deliver more value-add.

With sophisticated insights on payments provided by virtual assistants and data analytics, treasurers will be able to optimize liquidity, increase efficiencies and improve risk management, ultimately taking on a more strategic role to the business.

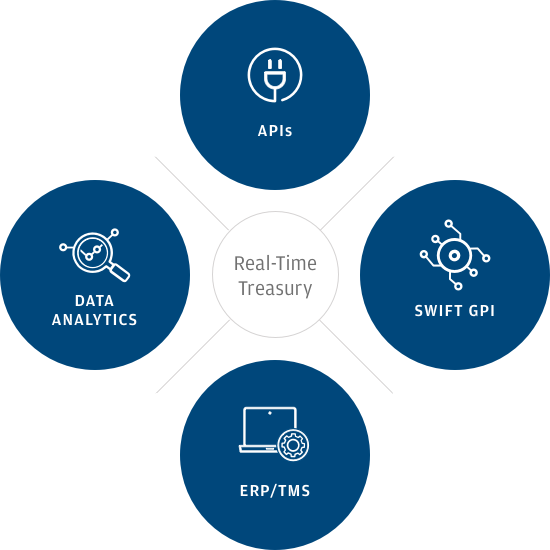

Get ready for real-time treasury

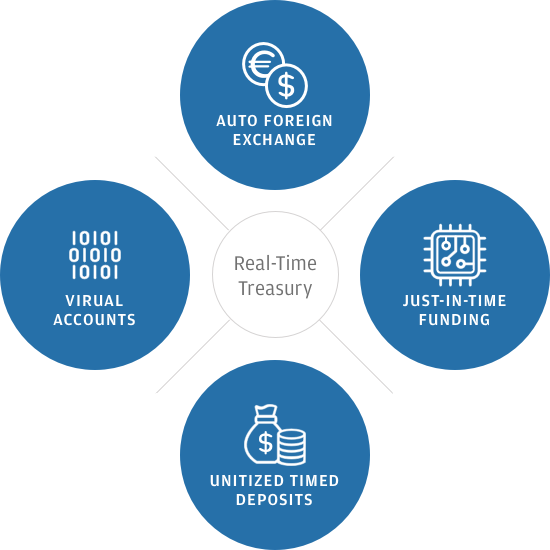

The key to the future state of cash management is the concept of real-time treasury in which time is no longer a barrier for transactions. Cash is being sent and received 24/7, automatically reconciled and posted into accounts. Movement of funds is completely transparent across related entities and surplus cash can be automatically invested, all while keeping FX exposures in check.

The good news is, real-time treasury is no longer fictional but a mere few years from becoming a reality. Some industries and companies will get there faster than others, but there are three essential components to this journey for treasurers:

Data visibility

Ensure Data Visibility

Real-time treasury requires unfettered access to company information from banks, quickly and in a usable format. Some treasury departments already work with their banks to obtain intraday reporting, while a number of banks are able to stream transaction data in real-time via application programming interfaces (APIs). The advent of open banking will further bolster this trend.

Treasurers can also partner with banks to further integrate data analytics into their function. J.P. Morgan’s DataLab is designed to provide a bird’s eye view of clients’ transaction flows to generate sophisticated data analytics and convey business intelligence that’s digestible and easy to access. At the same time, initiatives such as SWIFT global payments innovation (gpi) can further help clients track and trace end-to-end payments and transfer information amongst correspondent parties in real-time.

Data processing

Be Well-Equipped for Processing

Ensuring internal processes are automated and streamlined will be key as treasurers capture, process, post and reconcile incoming payments in a timely manner. Companies can leverage the Virtual Branch2 to manage supporting documents for tax and cross-border payments, while benefiting from straight-through processing and reconciliations of payments and receipts using virtual accounts3.

J.P. Morgan is currently developing a Global Gateway ecosystem that will provide clients with complete access to payment rails; connecting all payment types and networks seamlessly so funds can be moved across borders in real-time to support the exponential growth of mobile commerce.

Data intelligence

Automate for After-Hours

With cash settlements taking place around the clock, there is a need to manage liquidity after-hours. Next generation virtual accounts can help treasurers automatically centralize cash across subsidiaries and regions. For treasurers operating across borders and currencies, innovative solutions such as Auto FX can help streamline the way FX transactions are executed, ensuring conversions are processed automatically and in real-time. Automated investment solutions such as unitized time deposits and automated money market fund sweeps will further support dynamic, real-time liquidity management by maximizing yields on surplus funds at all times.

Day in the Life of a Digital Treasurer in 2025

-

Automated Forecasting, Exception Management

Forecast your cash flows with a full suite of analytics tools that’s visual and data rich. Focus on exception management, investigating trends that deviate from the norm.

-

Real-Time Cash Visibility & Market Updates

Start the day with full visibility of cash positions and receive highly curated market updates that are dynamic and in real-time via a customized multi-bank dashboard.

-

Automated Forecasting, Exception Management

Forecast your cash flows with a full suite of analytics tools that’s visual and data rich. Focus on exception management, investigating trends that deviate from the norm.

-

Automated Payments, Foreign Exchange Investments

Use biometrics to approve payments from your mobile device in real-time. Maximize surplus cash with full automated FX investment solutions.

-

Channel & Network Management

Manage electronic banking channels (e.g. APIs, SWIFT) and networks (blockchain).

-

Strategic Projects & Business Engagement

Engage with the business and sales teams on strategic projects that require treasury advisory, for example around investments or M&A deals.

-

Automated Reporting, Data Analytics

Generate automated intercompany and regulatory reports and review analytics on transactional data to drive actionable insights.

-

Risk Events, Cyber & Bots Governance

Combat potential fraud with self-service tools that analyzes risk events; leverage bots for cyber security governance.

To learn more, please contact your J.P. Morgan Treasury Services representative.

This material was prepared exclusively for the benefit and internal use of the JPMorgan client to whom it is directly addressed (including such client’s subsidiaries, the “Company”) in order to assist the Company in evaluating a possible transaction(s) and does not carry any right of disclosure to any other party. This material is for discussion purposes only and is incomplete without reference to the other briefings provided by JPMorgan. Neither this material nor any of its contents may be disclosed or used for any other purpose without the prior written consent of JPMorgan.

J.P. Morgan, JPMorgan, JPMorgan Chase and Chase are marketing names for certain businesses of JPMorgan Chase & Co. and its subsidiaries worldwide (collectively, “JPMC”). Products or services may be marketed and/or provided by commercial banks such as JPMorgan Chase Bank, N.A., securities or other non-banking affiliates or other JPMC entities. JPMC contact persons may be employees or officers of any of the foregoing entities and the terms “J.P. Morgan”, “JPMorgan”, “JPMorgan Chase” and “Chase” if and as used herein include as applicable all such employees or officers and/or entities irrespective of marketing name(s) used. Nothing in this material is a solicitation by JPMC of any product or service which would be unlawful under applicable laws or regulations.

Investments or strategies discussed herein may not be suitable for all investors. Neither JPMorgan nor any of its directors, officers, employees or agents shall incur in any responsibility or liability whatsoever to the Company or any other party with respect to the contents of any matters referred herein, or discussed as a result of, this material. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice or investment recommendations. Please consult your own tax, legal, accounting or investment advisor concerning such matters.

Not all products and services are available in all geographic areas. Eligibility for particular products and services is subject to final determination by JPMC and or its affiliates/subsidiaries. This material does not constitute a commitment by any JPMC entity to extend or arrange credit or to provide any other products or services and JPMorgan reserves the right to withdraw at any time. All services are subject to applicable laws, regulations, and applicable approvals and notifications. The Company should examine the specific restrictions and limitations under the laws of its own jurisdiction that may be applicable to the Company due to its nature or to the products and services referred herein.

Notwithstanding anything to the contrary, the statements in this material are not intended to be legally binding. Any products, services, terms or other matters described herein (other than in respect of confidentiality) are subject to the terms of separate legally binding documentation and/or are subject to change without notice.

JPMorgan Chase Bank, N.A. Member FDIC. JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.

* according to the Wall Street Journal.