Transactional cash holdings help to fund the mismatch between payments and receipts, supporting the asset conversion cycle by paying for day-to-day operations in tandem with supplementary credit arrangements.

There’s never been a more appropriate time for multinational corporate treasuries to improve their global liquidity management. Inflationary pressures are increasing operating costs, and the consequent rising interest rates make it prudent to reduce the use of external debt. Uncertainty concerning how to respond to tighter monetary policies, continuing supply chain disruptions and increasing geopolitical risks are also creating foreign exchange (FX) volatility, increasing the complexity and cost of active currency hedging operations.

Treasury can make a significant contribution to both funding and FX cost challenges by employing automated liquidity management solutions. The fundamental role of these tools is to mobilize the maximum amount of idle cash across a multinational’s multiple currency accounts. A tailored global application can also reduce currency exposure and associated volatility risk.

From a broader, organizational perspective, a significant benefit is the centralized visibility and control created by automating liquidity management. This gives treasury the opportunity to optimize cash management by moving cash up the conversion cycle. Automated tools provide a comprehensive view of cash balances that allows treasurers to determine how much needs to be pumped back into the operating cycle and how much is truly surplus, making it available for constructive deployment elsewhere. We explore some key strategies below.

Optimizing cash asset allocation

Balance sheet cash is held for one of three reasons:

This refers to the amount of cash that is typically put aside for precautionary reasons, to be used reactively for unspecified contingencies. Usually, reasons for these payments are known in advance, but a cash cushion is required because timings and exact amounts are uncertain.

Ideally, a corporate is also building a strategic reserve for internal capital investment or for expansion by M&A; and perhaps to help fund debt repayment or provide for share buybacks.

The identification and segregation of cash for these needs is straightforward in theory. But in practice, this is not the case where a multinational corporation’s cash is held in multiple currencies that are on deposit in a vast number of disparate bank accounts across many jurisdictions. This fragmentation of liquidity can lead to a sub-optimal allocation from a global perspective, caused by the potential for a build-up in both short-term and structural positive balances that could be better utilized elsewhere.

This is where optimal multi-currency management comes in. Cash allocation can be optimized with the visibility and mobilization provided by automated liquidity tools. Idle balances across the globe become immediately visible and accessible, allowing the treasury center to allocate the appropriate amount of cash to fund selected operational transactions and to see any residual amounts. These cash sizes are genuine excess liquidity. This surplus can then be allocated to precautionary balances or to longer-term strategic reserves. Conversely, treasury can also see when and where it is appropriate and cost-effective to liquidate some reserve assets to support day-to-day operations.

This is the fundamental role of liquidity solutions—to accurately identify and move cash surpluses to fund operations most efficiently, and to give treasury the ability to move the maximum amount of cash up the liquidity spectrum into assets that generate income for the business, while they wait to be deployed. These holdings are a combination of lower yielding assets, such as call deposits that serve as accessible precautionary balances; and longer-tenor, higher yielding assets that sit on the balance sheet ready to be liquidated to fund planned strategic needs. The need to identify and allocate excess liquidity to reserves has become increasingly important in the current rising rate, recessionary environment.

The desired ratio between holdings across the liquidity spectrum obviously varies significantly both between industry sectors and between individual corporates, depending on a range of unique circumstances, such as scale and credit rating. These are also key drivers that determine how much total cash a corporate wants to keep on the balance sheet. Regardless, a robust and automated liquidity solution can enable optimal deployment of funds across the three categories of cash held on the balance sheet.

Improving liquidity management in a multi-currency environment through payment optimization

To get the most out of your cash, it is important to recognize the inter-operability of liquidity management tools and the payment operating models that many corporates already run today. Both work hand in hand to ensure that working capital is minimized and excess cash is maximized.

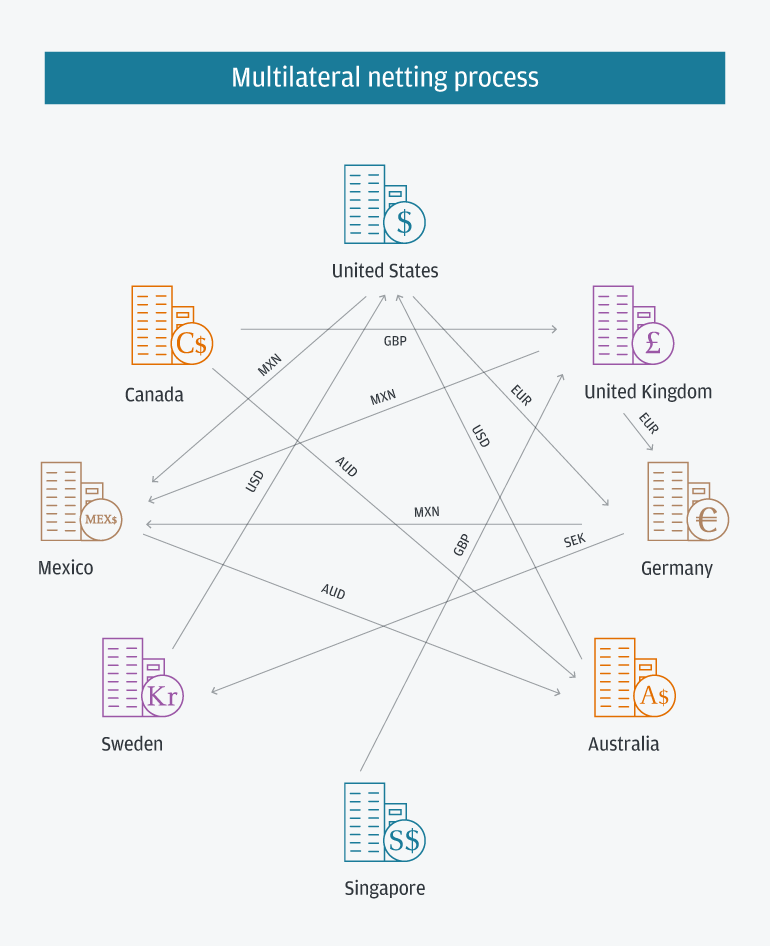

Multinationals usually run a global operating model that uses a payments concentration arrangement to reduce internal cashflows between subsidiaries. Streamlining intra-group payments ensures that the maximum amount of cash can be mobilized via automated liquidity solutions, while these solutions enable payments to go out seamlessly. There are multiple ways to achieve payment efficiency and multilateral netting is one of them. Multilateral netting involves aggregating multiple transactions between the relevant parties to arrive at a net obligation amount, such that the overall number and frequency of transactional cashflows is reduced.

This creates visibility, assists planning and reduces operating costs to help improve a company’s liquidity profile.

These intra-corporate account settlements typically result in operational cash sitting in multiple currency deposits that are controlled by a central netting center. However, netting settlements across numerous currencies still create a lot of internal FX accounting, with its accompanying costs and balance sheet risk exposures.

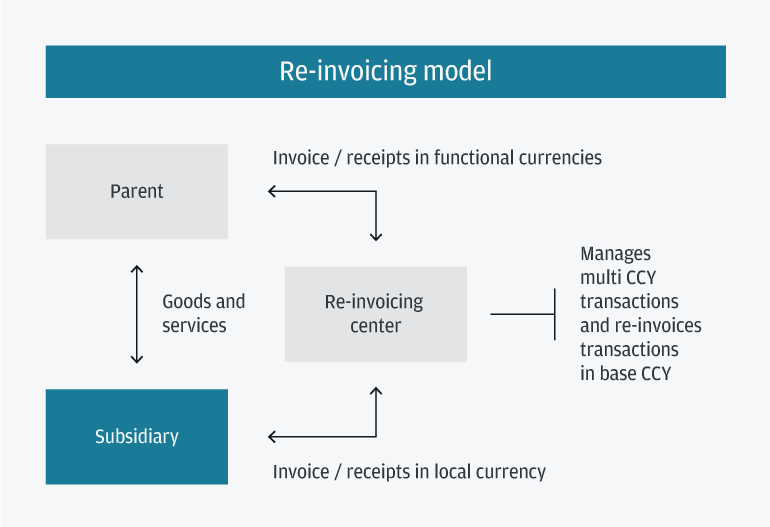

The more advanced re-invoicing center operating model uses a dedicated entity that purchases and re-sells between subsidiaries. The center manages the funds from both subsidiaries, receiving and processing invoices in various currencies. This moves FX exposures and liquidity management to the re-invoicing center, lowering overall costs due to economies of scale and bringing greater clarity and efficiency to risk management, especially in the restricted markets.

Automated liquidity solutions provide synergistic benefits in combination with such centralizing transactional operating models. A multi-currency notional pool (MCNP) allows for payment drawdowns in the desired currencies without physical conversion. This can reduce FX management costs and risk exposures far more than a netting or re-invoicing structure achieves by itself. The MCNP simultaneously mobilizes all fungible currency deposits, which can optimize funding of the intracompany cashflow mismatches that are tactically managed by the netting or re-invoicing centers.

Adding a MCNP overlay to any internal transaction concentration system also reduces bank transfer costs and improves available reporting information for accounting and reconciliation purposes.

Unlocking business value

Automated liquidity solutions can be integrated into any treasury operating model to allow regional centers or the global center to achieve their key objectives of liquidity management: visibility, control and optimization. They will be able to view and deploy all available internal cash with speed and accuracy to where it can be best put to work. Available cash is clearly visible for optimum allocation. External funding needs and costs can be reduced.

FX needs and management costs are also cut, ultimately increasing the bottom line. Cash surpluses for reserves become clearly identifiable, and so they can be maximized, increasing the balance sheet’s income returns and providing a war chest that improves both a company’s growth potential and its resilience in uncertain times. This is how a treasury with a consolidated multi-currency global view and reach can leverage the cash value chain and unlock significant financial value to contribute to greater corporate profitability.

Connect with your J.P. Morgan representative to get started today.

JPMorgan Chase & Co. Member FDIC. Deposits held in non-U.S. branches are not FDIC insured. All rights reserved. The statements herein are confidential and proprietary and not intended to be legally binding. Not all products and services are available in all geographical areas. Visit jpmorgan.com/disclosures/payments for further disclosures and disclaimers related to this content.