Nearly 77 percent of funds available in J.P. Morgan’s credit facilities were drawn down during the global pandemic, which suggests businesses were left holding a significant portion of idle cash and missing opportunities to leverage that cash to redeploy or re-invest. Businesses also consistently seek additional sources of funding and opportunities to optimize costs or returns by strategically mobilizing cash, which becomes even more relevant in an environment where cost of borrowing will increase. These situations highlight the need for stronger strategies to optimize liquidity and multi-currency management—strategies that will make your business more resilient in the future and reap benefits of the return to normalcy.

Among those strategies, treasurers should prioritize real-time visibility into their business’ cash positions, as well as enable the ability to deploy liquidity in the right location and currency. Additionally, treasurers should review their debt management and funding strategies to prepare for increasing interest rates. For many businesses, though, to ensure they have access to their internal cash as a vehicle for funding, growth and value creation, this may mean tapping into the more restricted markets and currencies in the Asia Pacific region.

Businesses seek solutions to manage currency risk, drive efficiencies

The increased volatility in Asian currencies is leading firms to find alternative ways to manage currency risk and adopt automated systems for maximum efficiency—whether it is to move, convert, or to draw-down against funds. With the help of automated solutions and working alongside your banking partner, you can begin to integrate the more restricted markets into a holistic liquidity solution or funding ecosystem and increase cash mobilized within the group.

As part of this integration, it is important to recognize the potential benefits that a regional liquidity solution brings—this could then ultimately connect to a global structure. Centralizing Asian currencies in Asia Pacific would provide enhanced interest or FX conditions and extended settlement windows. As well, clients could potentially benefit from a favorable regulatory environment and potential tax incentives for regional treasury centers in their banking partner’s regional hub locations.

Finding the right liquidity and multi-currency management strategy

When thinking about how to optimize your liquidity and multi-currency management, consider these six questions to help frame your discussion:

- How much of your cash do you consider restricted?

- Do you have centralized or decentralized treasury operations in Asia?

- Are you manually triggering the movement of funds and foreign exchange transactions?

- How do you currently manage the restricted currency exposures?

- Are balances seasonal or shifting from cash short to revenue generating post capital rejection?

- Are you funding with the right amount at the right time, or do you prefund?

Three strategies to optimize liquidity and multi-currency management

The best way to think about optimizing liquidity and multi-currency management is across three different actions:

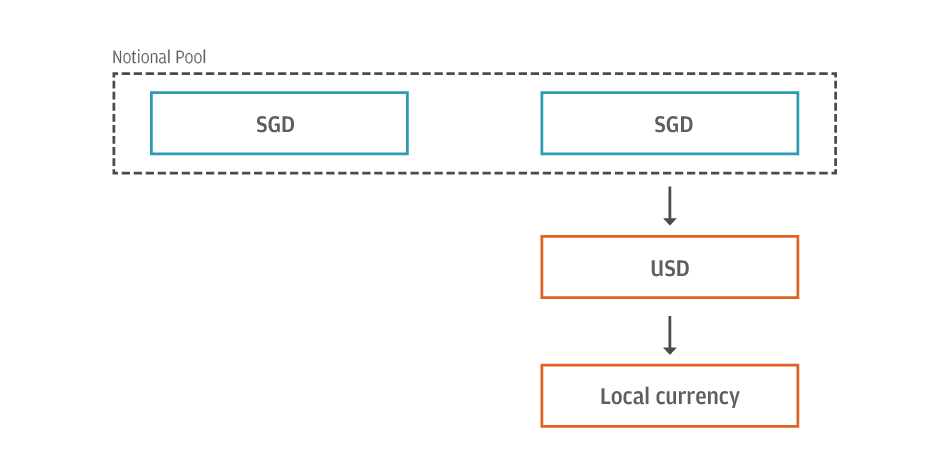

Automate funding to ensure my business can fulfill its payment obligations at the right time and in the right currency

A short term strategy, with the goal of reducing pre-funding buffers and costs associated to forecasting errors.

- Automate funding in fungible and restricted currencies without, in most cases, the need for regulatory approvals.

- Manage position mismatches in a notional pool by being able to draw down in one account or currency versus another.

- Optimize cut-off and value dating with onshore FX conversion on a manual or an automated basis.

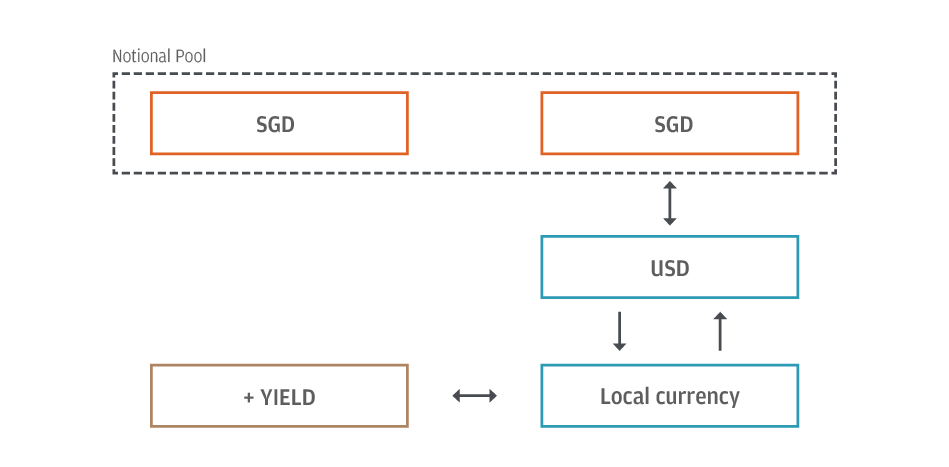

Extract excess cash for further mobilization within the group while getting the best return on balances that remain locally

A medium term strategy, this unlocks additional liquidity by tapping into restricted markets.

- Optimize intercompany reporting and/or segregate flows with virtual accounts.

- Automate cash extraction of excess cash while leaving a certain balance in-country to offset payment obligations in the local currency and thus optimize FX exposure.

- Enhance yield on restricted cash balances while funds remain fully liquid.

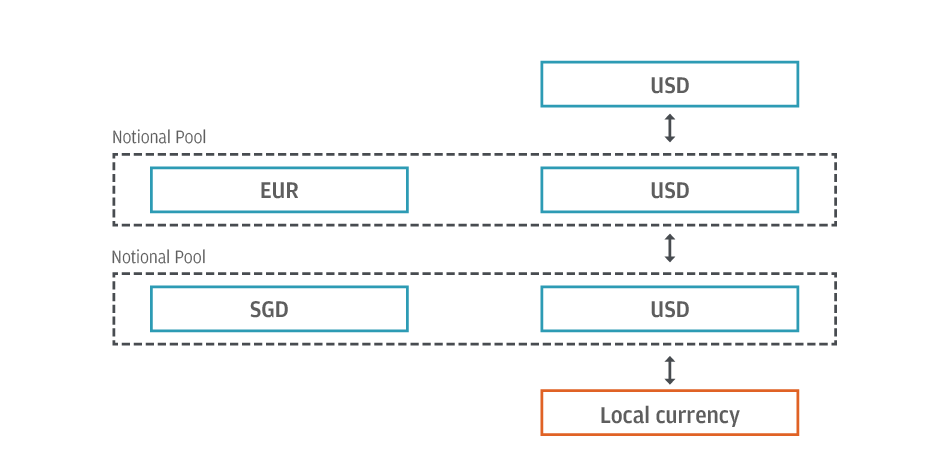

Scale and consolidate some of your activities in one location or entity—all to better manage currency risk and prepare your treasury organization for future volatility

A long term strategy, your aim is to integrate your global business through scalable efficiency and synchronized currency risk management, all of which strengthens control of your global cash positions and payments.

- Transform from an FX Agent or Treasury Center to an Inhouse Bank, centralizing payment initiation and decision making on funding, foreign exchange and investments.

- Define repatriation or in-country redeployment strategies for the more restricted markets.

- Integrate your global business though a scalable liquidity and multi-currency solution.

Take the next steps to mastering your liquidity challenges

As the world continues along its path to normal, mastering your liquidity challenges to build a more resilient business is imperative. But you do not have to go on this journey alone. Combining our expertise in the Asia Pacific region with our liquidity and multi-currency solutions, we can create a potent formula for businesses like yours.

Connect with your J.P. Morgan representative to get started today.

This material was prepared exclusively for the benefit and internal use of the JPMorgan client to whom it is directly addressed (including such client’s subsidiaries, the “Company”) in order to assist the Company in evaluating a possible transaction(s) and does not carry any right of disclosure to any other party. In preparing this material, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Company or which was otherwise reviewed by us. This material is for discussion purposes only and is incomplete without reference to the other briefings provided by JPMorgan. Neither this material nor any of its contents may be disclosed or used for any other purpose without the prior written consent of JPMorgan.

J.P. Morgan, JPMorgan, JPMorgan Chase and Chase are marketing names for certain businesses of JPMorgan Chase & Co. and its subsidiaries worldwide (collectively, “JPMC”). Products or services may be marketed and/or provided by commercial banks such as JPMorgan Chase Bank, N.A., securities or other non-banking affiliates or other JPMC entities. JPMC contact persons may be employees or officers of any of the foregoing entitles and the terms “J.P. Morgan”, “JPMorgan”, “JPMorgan Chase” and “Chase” if and as used herein include as applicable all such employees or officers and/or entities irrespective of marketing name(s) used. Nothing in this material is a solicitation by JPMC of any product or service which would be unlawful under applicable laws or regulations.

Investments or strategies discussed herein may not be suitable for all investors. Neither JPMorgan nor any of its directors, officers, employees or agents shall incur in any responsibility or liability whatsoever to the Company or any other party with respect to the contents of any matters referred herein, or discussed as a result of, this material. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice or investment recommendations. Please consult your own tax, legal, accounting or investment advisor concerning such matters.

Not all products and services are available in all geographic areas. Eligibility for particular products and services is subject to final determination by JPMC and or its affiliates/subsidiaries. This material does not constitute a commitment by any JPMC entity to extend or arrange credit or to provide any other products or services and JPMorgan reserves the right to withdraw at any time. All services are subject to applicable laws, regulations, and applicable approvals and notifications. The Company should examine the specific restrictions and limitations under the laws of its own jurisdiction that may be applicable to the Company due to its nature or to the products and services referred herein.

Notwithstanding anything to the contrary, the statements in this material are not intended to be legally binding. Any products, services, terms or other matters described herein (other than in respect of confidentiality) are subject to the terms of separate legally binding documentation and/or are subject to change without notice.

Changes to Interbank offered Rates (IBORs) and other Benchmark rates: Certain interest rate benchmarks are, or may in the future become, subject to ongoing international, national and other regulatory guidance, reform and proposals for reform. For more information, please consult: https:/lwww.jprnorgan.mm/global/disclosures/interbank_offered_rates.

JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.