About

China Unicom Global Limited (China Unicom Global) is a Chinese state-owned telecommunications operator that provides voice calls, broadband and mobile data services, data communications and other related value-added services in 32 markets globally.

The challenge

As China Unicom Global expanded its data solutions to corporate customers globally, it became challenging to manage its growing liquidity and operational risks.

At the regional level – particularly for key markets like Hong Kong, Australia, Singapore and the U.K. – China Unicom Global’s reconciliation processes were highly inefficient. Invoices were manually matched against customer payments received via multiple channels so the process was prone to errors and yielded low invoice match rates. This not only impacted working capital inefficiency, but also led to incorrect follow-up calls to customers who have already settled their bills, resulting in increased complaints.

Globally, China Unicom needed to improve visibility and control of its liquidity across markets and currencies. Its decentralized treasury model meant each subsidiary managed its own liquidity, with cash positions and funding needs manually reported on a monthly basis. This resulted in large sums of local currency balances sitting idly in domestic accounts in Australia, France, Japan, the Netherlands, Singapore, Switzerland and the U.K. where China Unicom had sizable operations, exposing it to significant currency risks.

As China Unicom Global’s offshore treasury hub, the centralized treasury center (CTC) in Hong Kong sought to replace manual in-country workflows and instil tighter control of its liquidity to optimize cash globally.

The solution

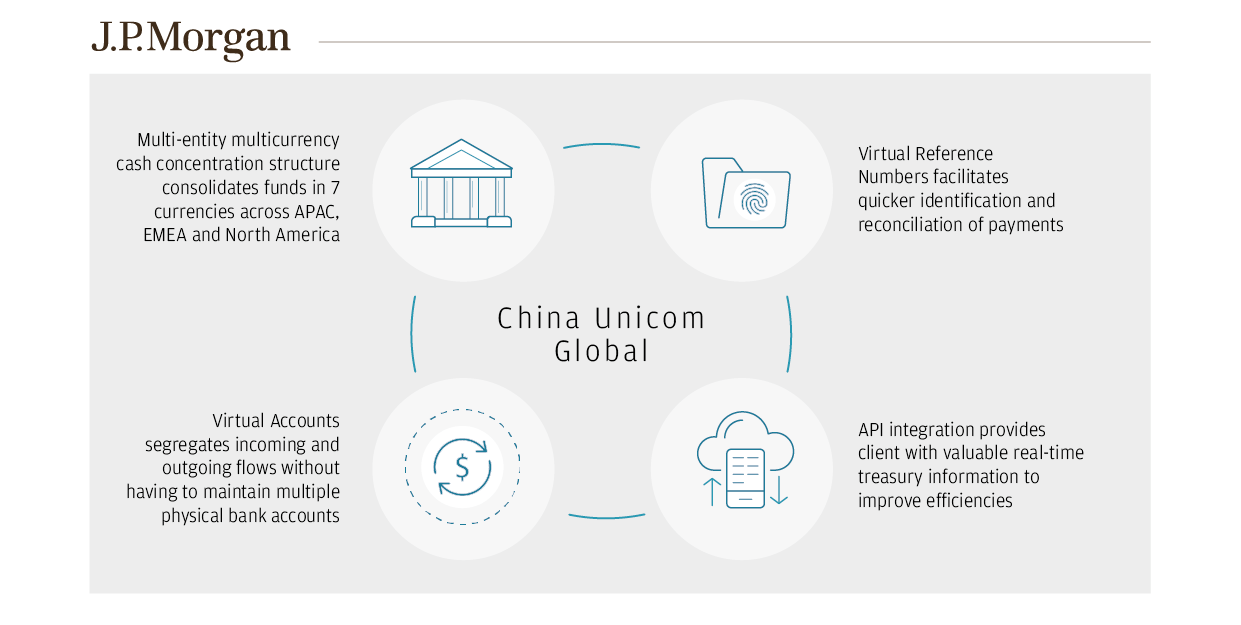

At the regional level, China Unicom Global adopted J.P. Morgan’s Virtual Reference Number (VRN) to automate reconciliations. By assigning each customer a unique VRN to make payments to, the solution facilitates quicker identification of payments and automatically maps them to the relevant customer accounts.

To improve visibility of its global liquidity, J.P. Morgan helped China Unicom Global implement a multi-entity multicurrency cash concentration structure to consolidate cash in seven major currencies and 10 entities across APAC, EMEA and North America. Its entities can draw on the pool for local currency funding, while surplus balances are automatically pooled into the CTC header account in Hong Kong daily to aggregate and hedge FX exposures, and optimize cash returns. The structure is further equipped with unique mechanisms to meet China Unicom Global’s business and regional needs through:

- An EMEA header account to consolidate cash balances in Euro and USD among China Unicom’s four European entities; with excess balances subsequently swept to the CTC account in Hong Kong at the end of the day via cross-border sweeps.

- An automated dual-channel funding model for its APAC and EMEA entities, where domestic entities are primarily funded through the CTC’s multicurrency accounts. Additional local cash needs are further supported by an intraday automated cross-currency sweep through the entity’s in-country USD account.

- An against-the-sun mechanism that facilitates cross-border payments and collections to and from the U.K. to Hong Kong without any loss of value in liquidity due to time zone differences, even for cash coming into Hong Kong after cut-off hours.

- A built-in limit control mechanism that allows China Unicom Global to assign intercompany lending limits to each operating entity.

- A structure that connects the CTC to the firm’s offshore headquarter entity China Unicom (Hong Kong) to draw USD and HKD funding from the CTC as and when needed.

The company also tapped into J.P. Morgan’s Virtual Account Management solution and opened virtual accounts linked to its existing physical accounts, to segregate incoming and outgoing flows. China Unicom Global also connected with the bank through APIs, allowing the firm to access valuable treasury information via its own system to reduce manual intervention and increase operational efficiency. With access to real-time transaction details, China Unicom Global can capture, manage and process data to further evaluate its exposures to credit, FX and payment risks, and determine steps to effectively manage them.

“Since partnering with J.P. Morgan in 2018, China Unicom Global has successfully transformed our treasury function by leveraging automation to enhance our liquidity and mitigate risks globally, to support our growing international business.”

Meng Xin

General Manager – Finance Department, China Unicom Global Limited

The results

- Straight-through processing for reconciliation of incoming collections, achieving over 90% match rate when reconciling outstanding invoices against incoming payments.

- 90% reduction in FX exposures associated with non-functional currencies.

- 15% rationalization in its treasury structure by consolidating banking relationships across regions.

- Lower risk of errors by eliminating manual intervention when reconciling invoices.

- Improved transparency by accessing comprehensive real-time reports to aid cash and liquidity management decisions.

- Better risk management by assigning specific intercompany limits for each operating entity.

- Limited loss in value of funds attributed to the against-the-sun mechanism that enables cash received after cut-off times to be back-dated automatically.

- Enhanced visibility and control of global liquidity through a centralized liquidity approach and minimized operational risk.

- Improved yields as surplus funds are aggregated at the global level to maximize returns.

“As China Unicom Global continued to expand globally, it became increasingly important for the firm to replace manual treasury operations at both the country and global level, to effectively manage its liquidity.

J.P. Morgan helped the firm implement a multi-currency cash pooling structure to pool its global funds, and further introduced innovative digital solutions like virtual reference solution, virtual account management and APIs to streamline its cash management, while ensuring access to real-time treasury data to improve overall efficiencies.”

Timothy Huang

Head of Corporate Banking, China, J.P. Morgan

China Unicom Global is a highly commended winner in the Best Risk Management Solution category at the Treasury Today 2020 Adam Smith Awards Asia – widely known as the industry benchmark for treasury excellence. Listen to episode 14 of the Adam Smith Awards Asia podcast series to learn more.

To learn more about how we can support your business, please contact your J.P. Morgan representative.

This material was prepared exclusively for the benefit and internal use of the JPMorgan client to whom it is directly addressed (including such client’s subsidiaries, the “Company”) in order to assist the Company in evaluating a possible transaction(s) and does not carry any right of disclosure to any other party. In preparing this material, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Company or which was otherwise reviewed by us. This material is for discussion purposes only and is incomplete without reference to the other briefings provided by JPMorgan. Neither this material nor any of its contents may be disclosed or used for any other purpose without the prior written consent of JPMorgan.

J.P. Morgan, JPMorgan, JPMorgan Chase and Chase are marketing names for certain businesses of JPMorgan Chase & Co. and its subsidiaries worldwide (collectively, “JPMC”). Products or services may be marketed and/or provided by commercial banks such as JPMorgan Chase Bank, N.A., securities or other non-banking affiliates or other JPMC entities. JPMC contact persons may be employees or officers of any of the foregoing entities and the terms “J.P. Morgan”, “JPMorgan”, “JPMorgan Chase” and “Chase” if and as used herein include as applicable all such employees or officers and/or entities irrespective of marketing name(s) used. Nothing in this material is a solicitation by JPMC of any product or service which would be unlawful under applicable laws or regulations.

Investments or strategies discussed herein may not be suitable for all investors. Neither JPMorgan nor any of its directors, officers, employees or agents shall incur in any responsibility or liability whatsoever to the Company or any other party with respect to the contents of any matters referred herein, or discussed as a result of, this material. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice or investment recommendations. Please consult your own tax, legal, accounting or investment advisor concerning such matters.

Not all products and services are available in all geographic areas. Eligibility for particular products and services is subject to final determination by JPMC and or its affiliates/subsidiaries. This material does not constitute a commitment by any JPMC entity to extend or arrange credit or to provide any other products or services and JPMorgan reserves the right to withdraw at any time. All services are subject to applicable laws, regulations, and applicable approvals and notifications. The Company should examine the specific restrictions and limitations under the laws of its own jurisdiction that may be applicable to the Company due to its nature or to the products and services referred herein.

Notwithstanding anything to the contrary, the statements in this material are not intended to be legally binding. Any products, services, terms or other matters described herein (other than in respect of confidentiality) are subject to the terms of separate legally binding documentation and/or are subject to change without notice.

Changes to Interbank Offered Rates (IBORs) and other benchmark rates: Certain interest rate benchmarks are, or may in the future become, subject to ongoing international, national and other regulatory guidance, reform and proposals for reform. For more information, please consult: https://www.jpmorgan.com/global/disclosures/interbank_offered_rates.

JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.