About

A top flavored carbonated soft drink (CSD) company in the Americas, this firm’s manufacturing and distribution centers employ nearly 20,000 employees across North America. In addition, the brand, which is primarily focused on the carbonated mineral water, flavored CSD, bottled water and vegetable juice categories, operates hundreds of third-party bottlers and distributors.

At a glance

- J.P. Morgan is the company’s main core cash management provider, with 90% of all of its regional business in the United States, Mexico and Canada

- J.P. Morgan facilitated the group’s payment centralization, integrating its Mexico operations into its North America shared service center

- J.P. Morgan increased the firm’s liquidity by offering overnight investment with a preferential rate

The challenge

The company’s goal was to optimize liquidity in order to obtain greater visibility and control over its cash. It needed an integrated banking solution that allowed it to centralize payments and reconciliation processes at the headquarter level via host-to-host.

The J.P. Morgan solution

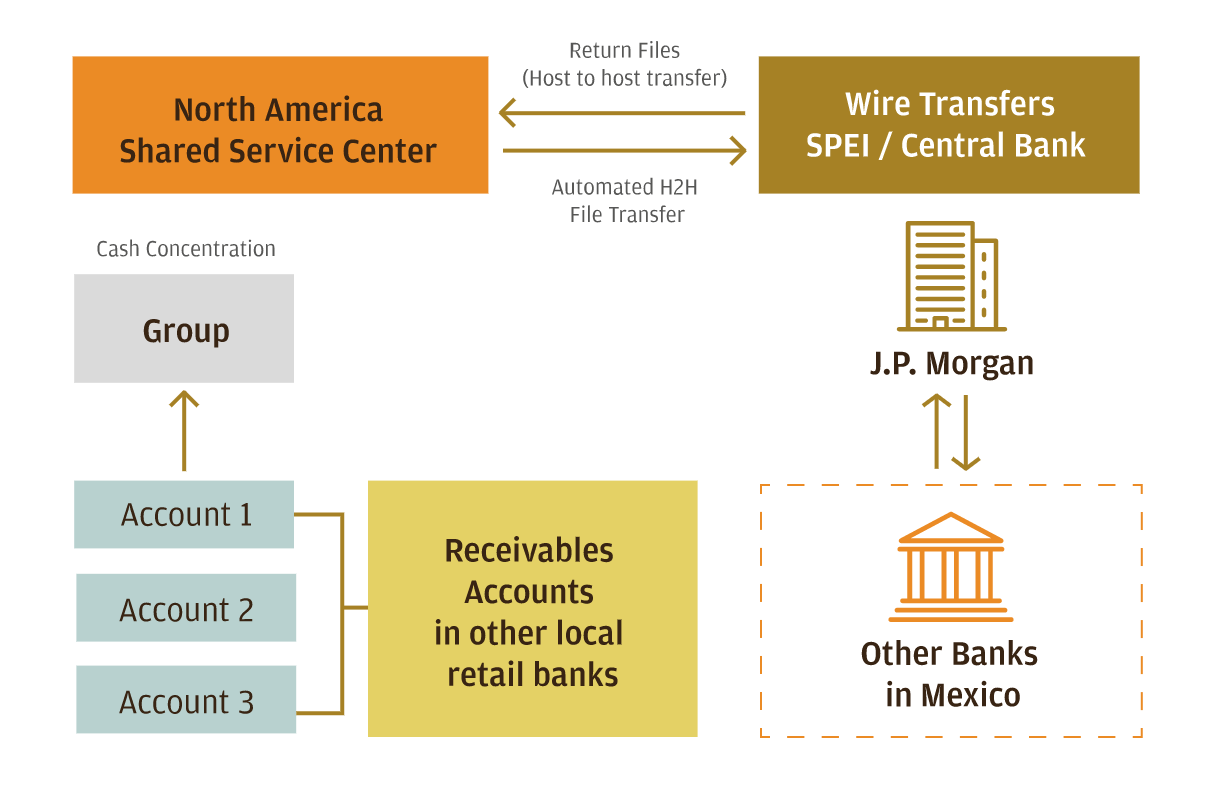

J.P. Morgan developed a comprehensive cash management solution through J.P. Morgan Host-to-Host. This offers a wide range of automated payment and reporting services using the latest industry-standard file format. In this case, file format GFF was used. This provided the company with a single point of access to effectively manage its local payments online with a secure connection to J.P. Morgan’s processing platforms in Mexico.

The liquidity proposal considered a cash concentration and an Intercompany Report module to manage the treasury flows and active passive rates between the eight local interest-bearing accounts (IBAs) with preferential overnight rates. To maximize the impact of this liquidity model, the total balances that the client manages in all its subsidiaries in Mexico were considered.

The structure enabled the group to:

- Centralize its regional treasury operations in its shared service center in North America

- Gain transparency and control into its bank account information in Mexico for better visibility and reconciliation of the entire payment process

- Improve liquidity management by having overnight investment with a preferential rate

- Automate the intercompany rates calculation across the entire cash concentration structure

The success of the relationship with the concerned group lies in our understanding of their objectives, working closely together to deliver innovative solutions that add value to their cash management operation.

Alexandra Lugo

Mexico Treasury Services Coverage

The impact

J.P. Morgan leveraged its regional capabilities, offering a comprehensive liquidity and payment solution in order to generate efficiencies in the client’s corporate treasury area by standardizing its operations in Mexico.

This webpage was prepared exclusively for the internal use of the J.P.Morgan client to whom it is addressed (including the client’s affiliates, the “Company”). This webpage is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by J.P. Morgan.

This webpage is confidential and proprietary to J.P. Morgan and is not intended to be legally binding. J.P. Morgan makes no representations as to the legal, regulatory, tax or accounting implications of the matters referred to in this presentation. The products and services described in this webpage are ordered by Banco J.P.Morgan, S.A., Institución de Banca Múltiple, J.P.Morgan Grupo Financiero and/or its affiliates, subject to applicable laws, regulations and service terms.

J.P. Morgan is a marketing name for the Treasury Services businesses of JPMorgan Chase Bank, N.A. and its affiliates worldwide.