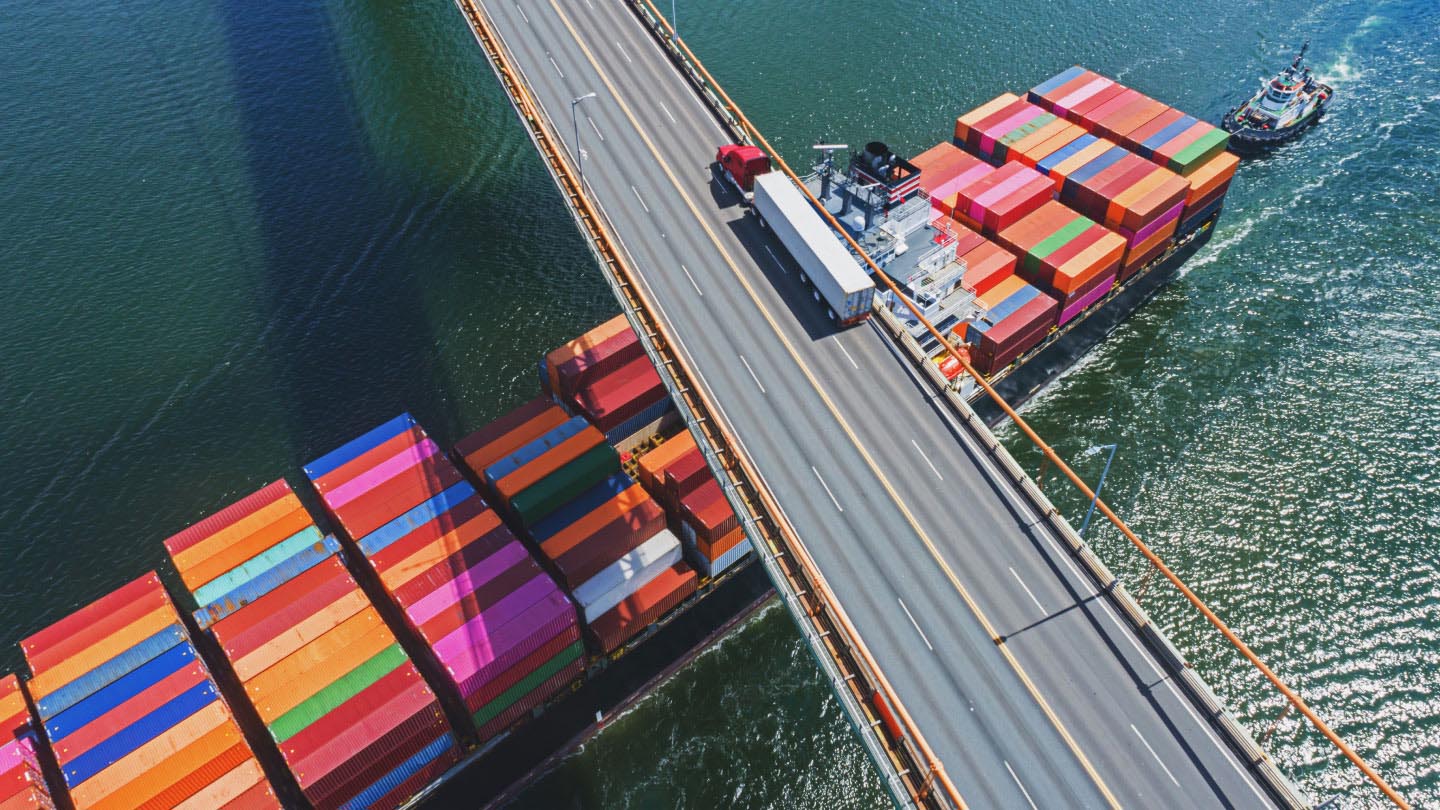

With receivables financing solutions in over 50 countries across the Americas, Europe, Africa, the Middle East and Asia, our global reach allows for funding across regions to help your business scale.

Receivables Financing

Tailored receivables financing solutions address working capital challenges for your business - and your clients.

Rethink your receivables financing strategy with J.P. Morgan Payments

Your business receives upfront payment to improve liquidity, shorten sales cycles, and accelerate revenue growth. Your clients pay over time with structured buy now, pay later receivables solutions and you benefit from dedicated sales support throughout the entire transaction cycle.

Unlock working capital with receivables financing solutions

Mitigate risk

Simplify internal billing and collections, and collect upfront payments for your receivables financing.

Mitigate risk and manage counterparty exposures.

Improve sales and grow your business

Accelerate deal closing and improve sales with buy now, pay later solutions and extended payment terms for your customers.

Minimize upfront costs for your customers with deferred cash flow solutions.

Reduce days sales outstanding and improve your cash conversion cycle.

Accelerate cash flow

Unlock liquidity and accelerate cash flow by monetizing outstanding receivables financing.

Leverage an alternative source of funds with off-balance sheet financing.

Solutions to help your business grow

Invoice finance

Simple, straightforward purchase of receivables (invoices) on a single obligor and portfolio basis helps drive growth, manage liquidity, reduce days sales outstanding, and improve cash flow.

Contract monetization

Our contract monetization solution is designed for subscription-based or “as-a-service” product models, including subscription arrangements, intellectual property licensing and cloud space. Monetize long term contracts with buy now, pay later programs to unlock working capital, accelerate cash flow and simplify procurement.

Inventory finance

Our inventory finance solutions provide off-balance sheet treatment to unlock working capital trapped in inventory, reduce days inventory outstanding, and maintain critical stock levels to build resiliency in your supply chain and help your business grow, even in time of economic uncertainty.

E-commerce finance

Our e-commerce finance solution helps originators and marketplace platforms provide working capital support to their small and medium-sized business merchants, improving profitability and revenue with e-commerce finance. Learn how Wayflyer used flexible e-commerce finance solutions to increase short-term working capital here.

Government receivables

Transform receivables into upfront capital while offering flexible payment terms for your customers with structured receivables solutions tailored to government agencies.

What problem can we solve together?

With millions invested annually into innovative technology coupled with the flexibility and stability of our fortress balance sheet, J.P. Morgan Payments can help your business grow.

Simplify payment complexities by offering customers fixed billing amounts on a quarterly or yearly basis.

Contract monetization: the key to freeing up working capital for as-a-service providers

J.P. Morgan’s Contract monetization solution provides the ability to utilize a buy now, pay later program to unlock working capital, accelerate cash flow, and drive revenue.

© 2025 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. Deposits held in non-U.S. branches are not FDIC insured. Non-deposit products are not FDIC insured. The statements herein are confidential and proprietary and not intended to be legally binding. Not all products and services are available in all geographical areas. Visit jpmorgan.com/paymentsdisclosure for further disclosures and disclaimers related to this content.