Export credit agency (ECA) finance is a valuable financing tool, with its associated stability and widening support for a range of sectors and industries. From short-term working capital, to financing medium to long-term capital intensive expenditures and trade flows, ECA-backed financing solutions are resurfacing as a priority.

Five major themes trended positively for ECA-supported financing:

-

Volatility in the capital markets

availability and competitiveness of ECA-supported funding without susceptibility to market “windows”

-

Major capex spend announced across industries

post-pandemic investment and pressure on borrowers’ traditional sources of capital

-

ECA new product support driven by global policy priorities

availability of ECA programs covering raw materials and critical minerals, as well as a focus on “green” projects, both at home and overseas

-

Geopolitical uncertainty leading to focus on reshoring production

tailored ECA programs to support domestic exporters directly for in-country imported goods and services

-

Energy, natural resources & critical minerals security

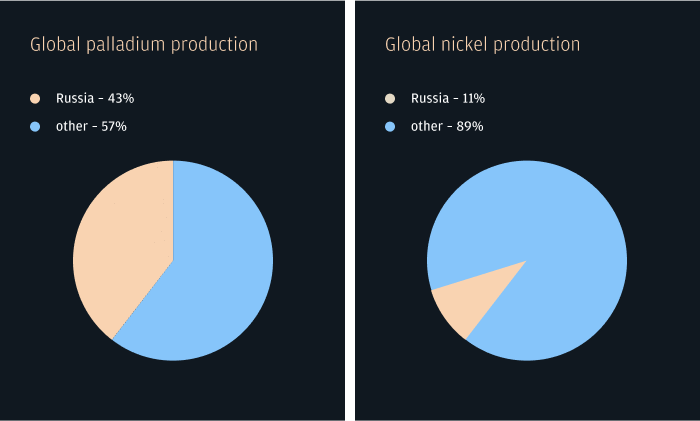

With growth in clean technology, global supply chains impacted by the geopolitical tensions3, and ongoing recovery from the COVID pandemic, challenges have been presented for exporters and borrowers to preserve critical minerals and secure energy supplies. With China producing the most critical minerals worldwide and ongoing trade tensions between the US and China, countries are looking to secure and diversify their supply chains to mitigate any export restrictions imposed by China. Russia is also a large producer of critical minerals and is responsible for 11% of global nickel production and 43% of global palladium production.4 A combination of supply chain disruptions, Russian sanctions, and an uptick in demand versus supply have directly impacted importers of these minerals and the vitality of renewable infrastructure and battery manufacturing.

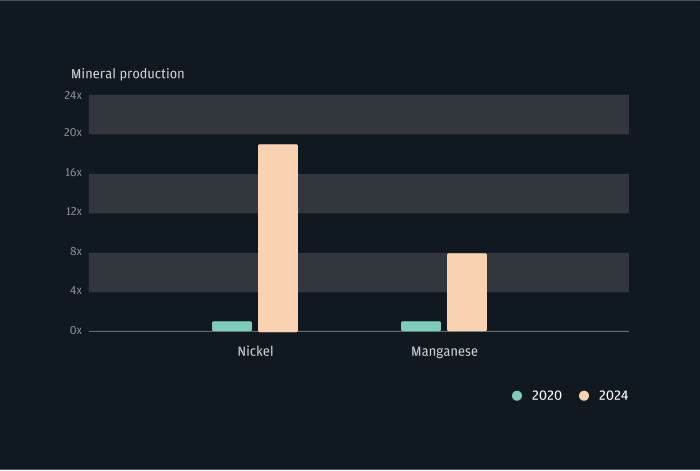

Transitioning towards a green economy

With global policies geared towards a transition to a greener economy (i.e. zero-emission and sustainability) and reducing reliance on oil and gas, many countries are looking to bolster alternate sources of energy production.5 Continued movement towards solar and wind power will lead to increased demand for elements such as chromium, manganese and nickel, with, for example, nickel production forecast to expand by 19x and manganese to increase by 8x from 2020 to 2040.6, 7

Recovery, growth and innovation

Historically, ECAs have been active in times of crisis, and due to recent evolving global challenges, these agencies are now providing wider support than their historical mandate; increasingly extending their remit beyond the safe harbor of the Organization for Economic Co-operation and Development (OECD) Consensus into areas that could come under scrutiny as state aid.8

J.P. Morgan’s Export & Agency Finance offering provides clients with ECA and multilateral agency credit-enhanced solutions, with a particular focus on long-term financing alternatives for their capital-intensive expenditures. The team provides focused global expertise from Abu Dhabi, Dubai, London, New York, Seoul & Singapore.

icon

Loading...