From startups to legacy brands, you're making your mark. We're here to help.

-

Innovation Economy

Fueling the success of early-stage startups, venture-backed and high-growth companies.

-

Midsize Businesses

Keep your company growing with custom banking solutions for middle market businesses and specialized industries.

-

Large Corporations

Innovative banking solutions tailored to corporations and specialized industries.

-

Commercial Real Estate

Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

-

Community Impact Banking

When our communities succeed, we all succeed. Local businesses, organizations and community institutions need capital, expertise and connections to thrive.

-

International Banking

Power your business' global growth and operations at every stage.

Key Links

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

-

Asset Based Lending

Enhance your liquidity and gain the flexibility to capitalize on growth opportunities.

-

Equipment Financing

Maximize working capital with flexible equipment and technology financing.

-

Trade & Working Capital

Experience our market-leading supply chain finance solutions that help buyers and suppliers meet their working capital, risk mitigation and cash flow objectives.

-

Syndicated Financing

Leverage customized loan syndication services from a dedicated resource.

-

Commercial Real Estate

Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

-

Employee Stock Ownership Plans

Plan for your business’s future—and your employees’ futures too—with objective advice and financing.

Key Links

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

-

Institutional Investors

Putting your long-tenured investment teams on the line to earn the trust of institutional investors.

-

Markets

Direct access to market leading liquidity harnessed through world-class research, tools, data and analytics.

-

Prime Services

Helping hedge funds, asset managers and institutional investors meet the demands of a rapidly evolving market.

-

Global Research

Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

-

Securities Services Solutions

Helping institutional investors, traditional and alternative asset and fund managers, broker dealers and equity issuers meet the demands of changing markets.

Key Links

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Center for Carbon Transition

J.P. Morgan’s center of excellence that provides clients the data and firmwide expertise needed to navigate the challenges of transitioning to a low-carbon future.

-

Corporate Finance Advisory

Corporate Finance Advisory (“CFA”) is a global, multi-disciplinary solutions team specializing in structured M&A and capital markets. Learn more.

-

Development Finance Institution

Financing opportunities with anticipated development impact in emerging economies.

-

Sustainable Solutions

Offering ESG-related advisory and coordinating the firm's EMEA coverage of clients in emerging green economy sectors.

-

Mergers and Acquisitions

Bespoke M&A solutions on a global scale.

-

Capital Markets

Holistic coverage across capital markets.

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

A uniquely elevated private banking experience shaped around you.

-

Banking

We have extensive personal and business banking resources that are fine-tuned to your specific needs.

-

Investing

We deliver tailored investing guidance and access to unique investment opportunities from world-class specialists.

-

Lending

We take a strategic approach to lending, working with you to craft the right financing solutions matched to your goals.

-

Planning

No matter where you are in your life, or how complex your needs might be, we’re ready to provide a tailored approach to helping your reach your goals.

Whether you want to invest on your own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

-

Invest on your own

Unlimited $0 commission-free online stock, ETF and options trades with access to powerful tools to research, trade and manage your investments.

-

Work with our advisors

When you work with our advisors, you'll get a personalized financial strategy and investment portfolio built around your unique goals-backed by our industry-leading expertise.

-

Expertise for Substantial Wealth

Our Wealth Advisors & Wealth Partners leverage their experience and robust firm resources to deliver highly-personalized, comprehensive solutions across Banking, Lending, Investing, and Wealth Planning.

For Companies and Institutions

-

Commercial Banking

From startups to legacy brands, you're making your mark. We're here to help.

-

Institutional Investing

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

-

Credit & Financing

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

-

Investment Banking

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

For Individuals

-

Private Bank

A uniquely elevated private banking experience shaped around you.

-

Wealth Management

Whether you want to invest on you own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Insights

- Outlook

- Business Leaders Outlook

- 2022 Business Leaders Outlook

(Background music: Welcome page with the J.P. Morgan and Chase logos and an illustration of dozens of skyscrapers. Above the illustration appears “Rising to the challenge: Business Leaders Outlook 2022.” The text and skyscrapers fade off the screen.)

(Rolling text) For nearly two years, midsize U.S. businesses have been rising to the challenges of the COVID-19 economy.

(Background music continues through video. The text fades away, and three animated doughnut charts appear, with scrolling numbers in the center of each.)

(Rolling text) Three issues remain on the minds of midsize business leaders, according to our survey.

68% cited the tight labor market

62% cited clogged supply chains

58% cited the higher cost of business

(The text and doughnut charts float down, then the skyscraper artwork comes up from the bottom of the frame.)

(Rolling text above skyscrapers) Many have stood up to every challenge and shown they will not be defeated. Their resiliency appears to have paid off.

(The text and skyscraper artwork exit downward. An animated line chart in brown, black and blue appears.)

(Rolling text next to line chart) Economic optimism: Looking ahead, business leaders are optimistic overall about the economic landscape of the next 12 months.

Rates of optimism for 2022:

Local: 60%

National: 50%

Global: 34%

(The text and line chart fade away. A doughnut chart and three icons fade in.)

(Text around chart and icons) How businesses expect to grow

Doughnut chart: 95% of business leaders expect their revenues to increase or remain the same in 2022

Globe icon: Expanding into new markets/geographies

Brain icon: Innovating or diversifying products/services

Bar-chart icon: Through decreases in consumer demand

(The text, chart and icons fade away. The skyscraper artwork floats up.)

(Text above skyscrapers) Find these and other insights by taking a deeper dive into the entire survey results.

(Text in green box) Download the full report

(Text and skyline artwork fade out, and J.P. Morgan and Chase logos fade in on conclusion screen.)

(Logos fade out, and JPMorgan Chase & Co. disclaimer fades in.)

For nearly two years, midsize U.S. businesses have been rising to the challenges of the COVID-19 economy. Issues that were considered temporary disruptions have proven to be much longer lasting. But they haven’t been viewed as insurmountable.

Our 2022 Business Leaders Outlook survey indicates that today’s executives are experts at reimagining, renewing and rebuilding their companies. Many have stood up to every challenge and shown they will not be defeated. Their resiliency appears to have paid off—and is fueling near-record levels of optimism for growth.

Midsize U.S. business leaders are more optimistic about their companies now (83% have a positive outlook over the next 12 months) than before the pandemic (76%), according to the survey. And for good reason: 70% of leaders said their businesses have returned to or exceeded pre-pandemic levels of profitability.

Nine out of 10 of those surveyed expect their businesses to grow and thrive over the next year. None of the respondents said they are afraid of going out of business. In fact, capital expenditures and credit needs—typical signs of plans to expand—are both expected to go up significantly from a year ago.

RISING TO THE CHALLENGE

These three business challenges—once thought to be transitory—remain on the minds of midsize business leaders, according to our survey.

-

Tight labor market

Business leaders said the worker shortage is the biggest challenge they’re facing. They believe they’ll need to get creative to fill positions and keep current employees. They also expect to pay higher wages for talent.

-

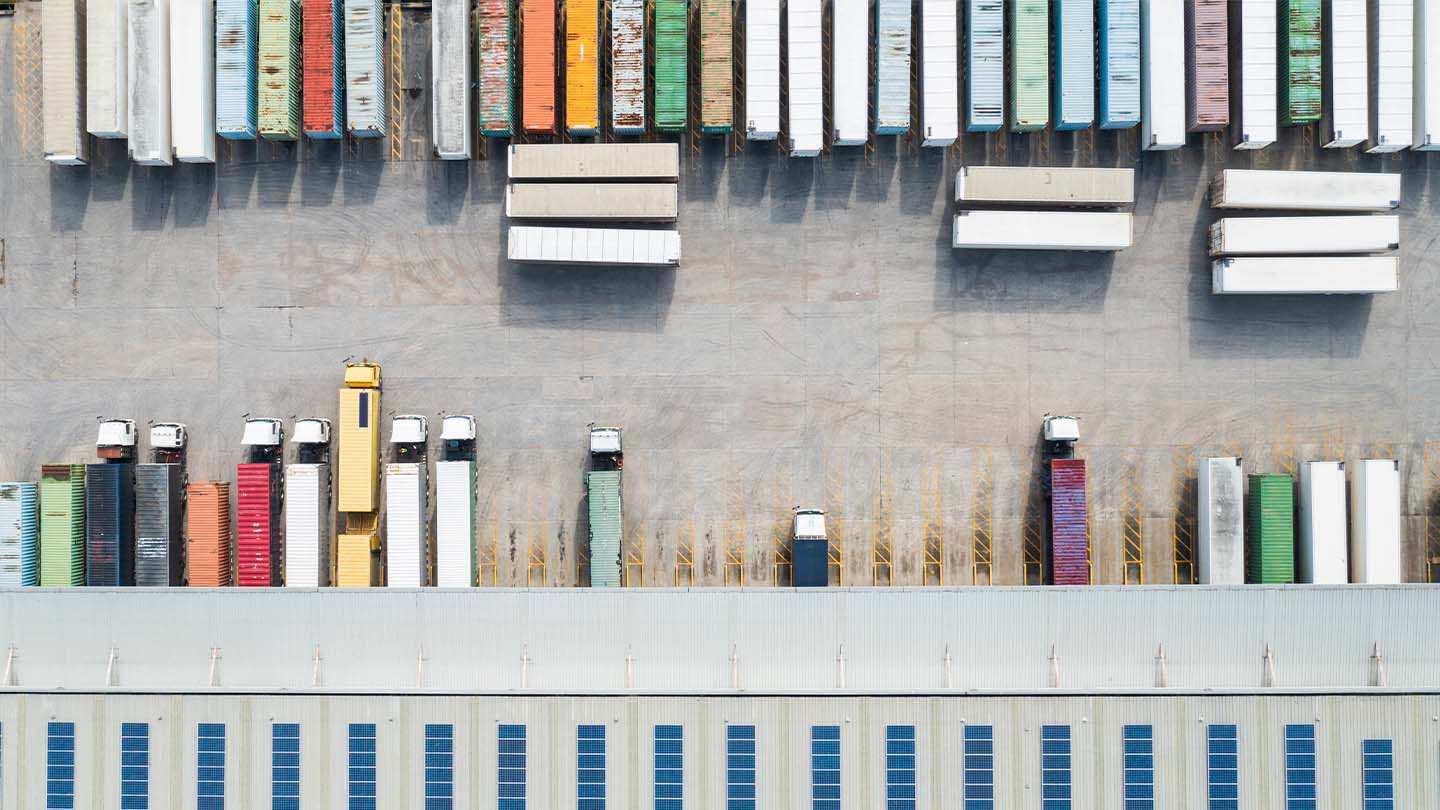

Clogged supply chains

The pandemic forced many midsize businesses to focus on global issues that didn’t affect them before. The supply chain is a prime example—and business leaders see it as a prime opportunity to mitigate risks going forward.

-

Higher cost of business

The math is simple: Labor shortage + supply chain issues = higher costs. But business leaders believe higher expected revenues in the coming year should help their companies keep the inflation equation in check.

© 2022 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/cb-disclaimer for disclosures and disclaimers related to this content.

Related insights

Outlook

Effects of One Big Beautiful Bill and tariffs come into focus

Aug 21, 2025

The One Big Beautiful Bill Act and trade negotiations have left many uncertain of where they stand financially. Here are some main takeaways to carry forward.

Outlook

July 2025 headline inflation rate lower than expected: What it means

Aug 13, 2025

The July 2025 headline Consumer Price Index (CPI) came in slightly below expectations as energy prices fell and shelter costs slowed. What could that mean for the Federal Reserve?

Outlook

July Jobs report highlights US job growth has slowed significantly; markets react negatively

Aug 04, 2025

Job growth slowed in July with only 73,000 new jobs added and earlier months revised sharply lower, showing the labor market has weakened.

Outlook

July 2025 Fed meeting: Rates hold steady once again, potentially setting up fall intrigue

Jul 31, 2025

The Federal Reserve held rates steady once again in July, but the decision wasn’t unanimous. What could that mean for economic policy going forward?

Outlook

H1 2025 Innovation Economy Update

Jul 29, 2025

AI investment drives record funding amid the decade’s lowest deal counts. Our update examines these market contradictions and the exit environment.

Outlook

Biopharma and medtech investments navigate Q2 challenges

Jul 28, 2025

Our Biopharma and Medtech Licensing and Venture Reports explore upfront cash, mergers, acquisitions and other trends seen in the second quarter of 2025.

Outlook

June 2025 CPI report: Tariffs are having an impact on consumer prices

Jul 16, 2025

The recent Consumer Price Index (CPI) report shows how tariffs are reshaping consumer prices, particularly in sectors reliant on imports. Read more here.

Outlook

Macro and markets midyear outlook: 5 key considerations

Jul 10, 2025

Learn from Ginger Chambless, head of research for Commercial Banking, how policy uncertainty and Fed positioning are shaping business decisions in the second half of 2025.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.