JPMorganChase provides fixed- and adjustable-rate loan programs from $1 million for the purchase or refinance of retail properties.

Best-in-class retail financing solutions

We offer dedicated service from an expert that comes with competitive rates and low fees.

Why JPMorganChase

JPMorganChase has the largest commercial real estate portfolio in the nation1 for a reason: We’re focused on building lasting relationships, not just closing loans.

Whether you’re refinancing a neighborhood shopping center or purchasing a specialty store, our experienced professionals are dedicated to your success.

Retail property financing solutions

Retail property financing solutions

Term Loans

Experience a straightforward process and exceptional customer service when financing retail and other commercial buildings through our fixed- and adjustable-rate term loans.

Refinancing

We offer refinancing options for retail properties through fixed- and adjustable-rate loan programs starting at $1 million.

Subscription lending

JPMorganChase commercial real estate and subscription finance specialists work alongside our clients to provide credit facilities that help them navigate the evolving landscape.

Syndicated financing

Our team has extensive knowledge and experience providing syndicated loans for commercial real estate, including entity-level corporate financings and single asset transactions.

Construction loans

We provide short-term construction loans, construction-to-permanent loans and other retail property financing to fit your business’s unique needs.

Real Estate

What’s driving neighborhood retail’s success

Dec 01, 2023

As many employees continue working hybrid schedules, retail centers in densely populated urban and suburban areas are seeing a jump in sales—regardless of market conditions.

Read more

Access firmwide resources

When you work with JPMorganChase, you not only benefit from our commercial real estate expertise. Our team can connect you with end-to-end financial solutions from across the firm—including Private Bank and Asset Management services—to help your business succeed.

FAQs

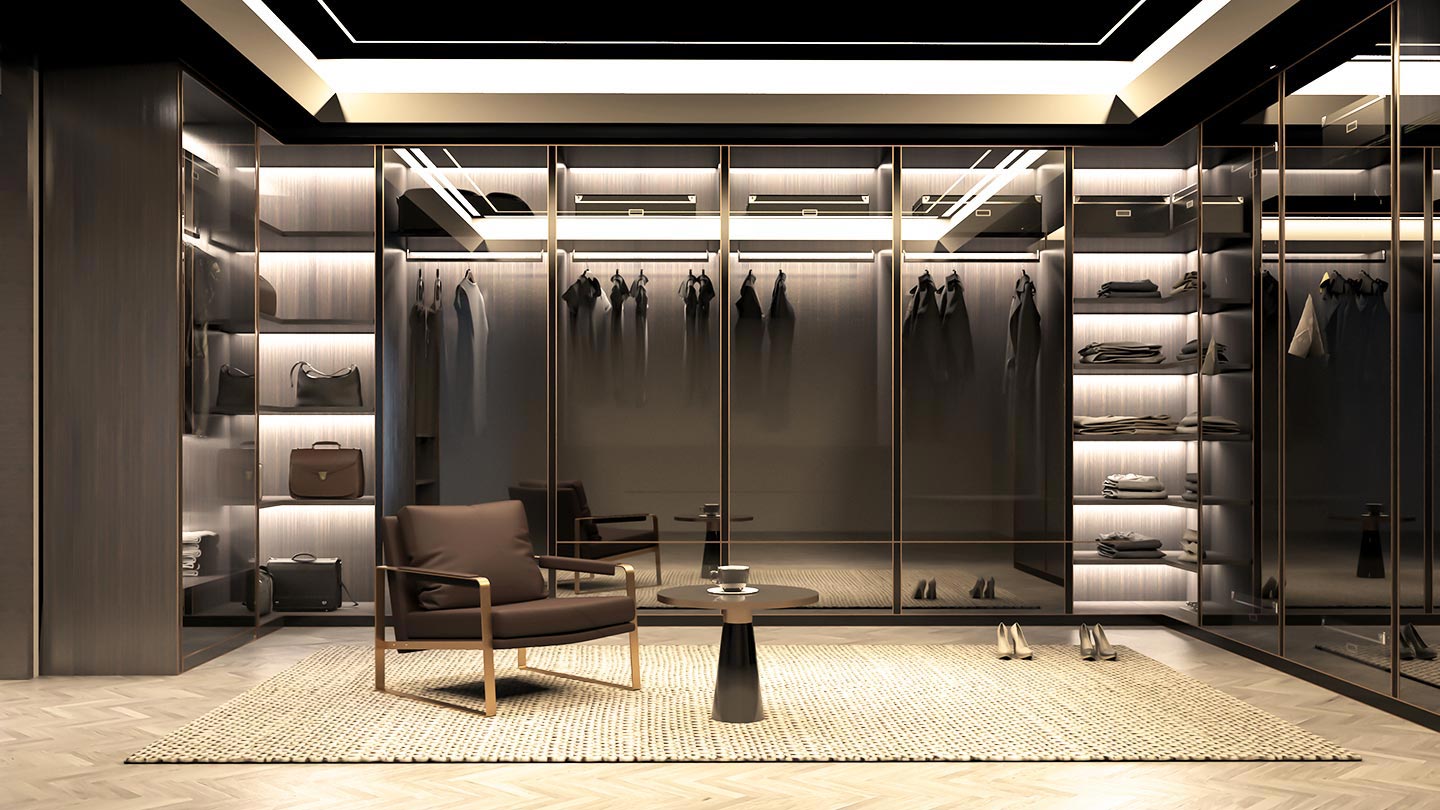

We’re dedicated to offering the best financing solutions to owners of stabilized retail properties, including grocery-anchored strip malls, small boutiques, luxury open-air malls and more.

Please take a moment to complete the form below.

Related insights

Real Estate

Protecting commercial properties from cybersecurity threats

Feb 06, 2026

Learn how to protect your payments and data from common cybersecurity threats affecting commercial real estate owners and operators.

Read more

Real Estate

Navigating interest rate uncertainty

Feb 03, 2026

At its January meeting, the Fed held interest rates steady. Learn more about the factors behind the decision

Read more

Real Estate

The role of cap rates in real estate

Feb 02, 2026

This common metric can help investors assess the potential value of a property.

Read moreReferences

#1 ranking per Home Mortgage Disclosure Act (HMDA) Data, United States Consumer Financial Protection Bureau