- Define objectives

- Assign resources (Treasury, IT, 3rd party)

- Determine budget

Key takeaways

- selection

- implementation

Recent global events have permanently shifted how corporates operate and embrace digitization. To prioritize efficiency, risk management and governance, corporates have a heightened need for automated processes to support day-to-day operations through a streamlined technology platform.

Utilizing a treasury management system (TMS) can provide the clarity and visibility needed to navigate critical financial decisions.

The evolution of the treasury management system landscape

A TMS is no new solution. Historically, organizations have eluded large technology budgets for treasury, but as liquidity risk takes front stage and treasury teams evolve to take on greater strategic roles in their companies, the clear benefits of a TMS have prompted corporates to invest in treasury technology.

A full suite of TMS can help automate the process of managing treasury operations, such as cash flow, assets and investments. Utilizing a treasury management system can help integrate across systems and data inputs, provide real-time cash positioning and cash flow forecasting (both internal and external) and data inputs, provide real-time cash positioning and cash flow forecasting for comprehensive liquidity management, facilitate payments from initiation to reconciliation, manage risk exposures and support investment and debt management activities.

A TMS is also used to support complex treasury structures such as in-house bank and payment factory. By automating and digitizing treasury processes, organizations can gain efficiency from cost and productivity, while strengthening governance by removing manual errors, standardizing formats and providing a full audit trail. To maximize opportunities in implementing a TMS, developing a project management plan is vital.

TMS selection and implementation approach

As a best practice, treasury teams should have an implementation plan prior to execution, which generally includes the following steps:

- Determine functionality / scope down to task level

- Define “must have” vs. “wants” including potential future needs

- Create vendor list

- Conduct vendor presentations/demos

- Consult with IT

- Request proof of concept

- Review references, with emphasis on client service and responsiveness

- Review contract terms and conditions

- Determine implementation resourcing requirements

- Select vendor and system

- Define project team and timeline with vendor

- Determine the connectivity requirements and plan with internal systems and external parties (e.g., banks)

- Gather data required to be loaded into the system

- Configure modules

- Set up accounts and interfaces

- Test connectivity

- Develop test scripts and workflows

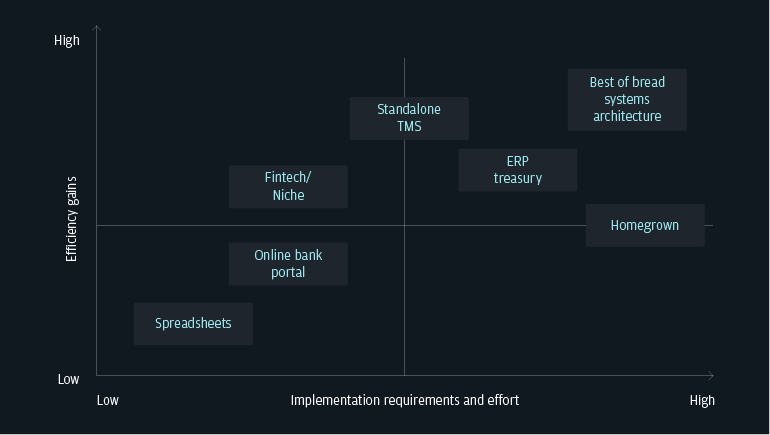

Weighing your options: efficiency gains vs. implementation effort

In weighing the options for a TMS, the key is to start with the company’s profile (e.g., domestic vs. global, growing vs. mature) to determine the required performance level – in addition to the specific requirements and functionalities needed, as well as the investment dollars and expected efficiency gains in the long run.

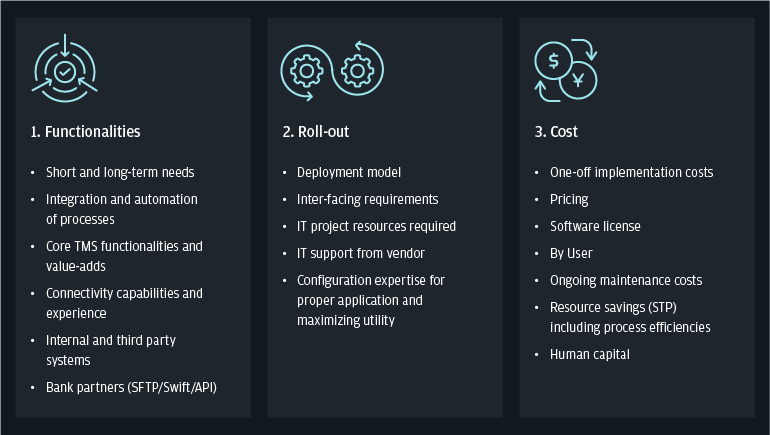

Vendor evaluation and selection should include these three areas of comparison:

Key takeaways – selection

-

Requirements

Develop clarity around your needs and recognize that the vendor’s provision of functionalities should match all of your current and potential future needs. It is also essential to engage your banking partners at this stage to ensure the selected vendor can seamlessly integrate with your bank, reducing your development burden and enabling a faster implementation

-

Options

It is important to note the latest trends in market. ERP providers have in recent years invested into their treasury modules with easier integration with the general ledger and streamlined interfaces as a key driver for adoption. Many corporates in purchasing ERP platform as a bundle may in fact, already have treasury management capabilities currently not in use. Many providers now also offer hosted options on cloud or software-as-a-service to be agile and flexible to meet clients’ needs

-

Models

Multifaceted companies can mix and match models. Many may use a standalone TMS or a treasury module of ERP, but identify specific functionalities of other vendors for best of breed systems architecture (e.g., bank account management can be executed by a cloud based vendor while other capabilities are provided by a hosted vendor)

5 key phases to a successful implementation

Prior to a TMS implementation, a clear strategy of treasury’s current and future responsibilities, as well as target operating model, should be defined. Understanding the root causes of treasury’s pain points is key to ensure an investment in a TMS will deliver the desired improvements.

Early engagement and support from the three stakeholders: treasury, IT (responsible for the system implementation and maintenance) and businesses (who will consume the analytics) is critical to the successful transition to a data-driven treasury.

- Design documentation that includes organization structure, master data, processes, reports, authorizations, interfaces and migration

- Develop a configuration plan with detailed time planning of development tasks (with assignment of durations and dependencies for tracking)

- Static data collection (business partners, bank account, general ledger, market and cash mgmt. master data)

- Configurations are done to support the processes. All configurations are unit tested before being transferred to testing environment

- Create UAT test cases

- Write end user training material

- Cutover plan is created for activities to be performed prior to go-live which includes: Transport of configuration settings to production environment, data conversion (master data and transaction data)

- Key users test all processes configured during the previous phase

- Identify issues during testing and analyse them

- Adjust the configuration of the application to resolve the issue

- Sign-off by steering committee

- Production environment is prepared

- Data tables are populated

- Transactional information is loaded

- Training of all end-users

- Officially go live with the project

- Review the performance of the system

- Engage with aftercare support to quickly resolve any issues

- Ensure alignment to said SLA (service level agreement)

Key takeaways – implementation

-

Due diligence

Engage your banking partners, as well as key stakeholders, especially technology, early in the process – it will bear dividends in the future

-

Focus on the user

Don’t undermine the user aspect of TMS – be mindful of the user experience

-

Systems connectivity

Many use TMS as a stand-alone, but to get full benefits, it should be seamlessly connected to ERP, FX and other systems and software

As businesses evolve, client pain points relating to manual reporting, payment initiation, and reconciliation are more complex than ever. J.P. Morgan has extensive experience working with premier treasury workstations and ERP vendors for complex treasury implementations to enable process standardization and automation as part of corporate technology transformation.

To learn more about how we can support your business, please contact your J.P. Morgan representative.

The statements herein are confidential and proprietary and not intended to be legally binding. Not all products and services are available in all geographical areas. Visit jpmorgan.com/disclosures/payments for further disclosures and disclaimers related to this content.