SUNGMAHN SEO, EMEA Head of WP Solutions

YOUSIF MOHAMMED, EMEA Head of WP Market Management

The steady, multi-year rise of direct to consumer (“D2C”) entered a new phase in 2020. As niche ‘pure play’ D2C challengers steadily built sizable market shares across consumer staples (see exhibit)1, incumbents across a variety of consumer-led industries have increasingly taken stock of their own D2C strategies to protect market share and lay the groundwork for growth. With the advent of the COVID-19 crisis, the D2C conversation across corporate c-suites has perceptibly shifted from diversification and optionality towards resilience in a world that is irretrievably shifting from ‘offline’ to ‘online’.

While the ongoing crisis has focused minds on this topic, it is clear that the rise of D2C as a credible business model has been driven by a number of structural trends.

On the supply side, the entry of “pure play” D2C challengers has been enabled by lowering barriers to entry across the value chain:

- First, advancement in cloud-based capabilities and “outsourcing platforms” have enabled the emergence of “supply chain as a service” across the product lifecycle, helping reduce upfront capital investments and middle and back-office requirements, but potentially eroding unit margins at scale.

- Second, the rise of social media as a credible marketing channel has enabled targeted advertising of consumers, allowing upstart D2C brands to leapfrog into public consciousness through viral marketing campaigns, albeit with increasingly challenging consumer data protection rules to navigate.

- Third, advanced analytics (including those offered by marketplaces) have helped enable D2C brands to adopt dynamic “just-in-time” inventory models, lower their working capital needs across the cycle and leverage payments data to drive product and strategic decision-making in real time.

On the demand side, consumer expectations are also shifting. With the oldest millennials turning 40 in 2020, the consumer landscape is shifting such that the bulk of spending power will reside with the first “native digital” generation – with an estimated collective spending power of $1.4 trillion in 2020 in the US alone1.

While nuances exist across different countries and markets, consumer surveys of millennial and Generation Z consumers have found consistent themes around the importance they place on customization, credible value propositions and cohesive “brand stories”2 – which are increasingly being met by these D2C challengers.

In the face of this, established consumer and retail players have not stood still. Across multiple categories – including consumer packaged goods and apparel – a number of incumbents have taken an active interest in establishing their own D2C channels. Some have pursued the M&A route of D2C brands (i.e., Unilever’s acquisition of Dollar Shave Club3), whereas others looked to acquire “bolt-on” capabilities to underpin own brand D2C channels (i.e., Nike’s acquisition of Zodiac, a data analytics firm4).

Looking at today’s changed landscape, such strategic decisions appear to have paid-off. Financial results for Q1 2020 retailers with established online D2C channels have been more resilient in their ability to meet consumer demand and protect revenue streams.5

As the dust settles in a post-COVID-19 world, we expect to see a more proactive stance towards pursuing D2C growth as a matter of strategic resilience. A sense of urgency will likely also underpin a wave of M&A actions as incumbents seek to access bolt-on capabilities or recast a digital native D2C acquisition into a platform for rolling out more expansive D2C strategies.

Our ongoing conversations with clients have surfaced the following topics and challenges:

- How to design and deliver multiple pay-in and pay-out methods of payment to reach the widest reach of clients?

- How to manage payment economics as businesses move from “one-to-few” B2B models to “one-to-many”, high-volume and lower-value receivables?

- How to manage liquidity, reconciliation and reporting in a “one-to-many” and high-velocity payments ecosystem?

- How to enable cross-border flows while managing cross-currency risk and access to low cost payment channels?

- How to warehouse and protect consumer data across different jurisdictions?

- How to manage more complex inventory (e.g., retail SKU vs. wholesale packaging)?

While we think addressing these challenges should be a baseline for any treasurer operating in a D2C space, it is also clear that idiosyncratic challenges will be influenced by the company’s starting point, legacy operating model and its chosen D2C strategy.

How different D2C models shape treasury challenges

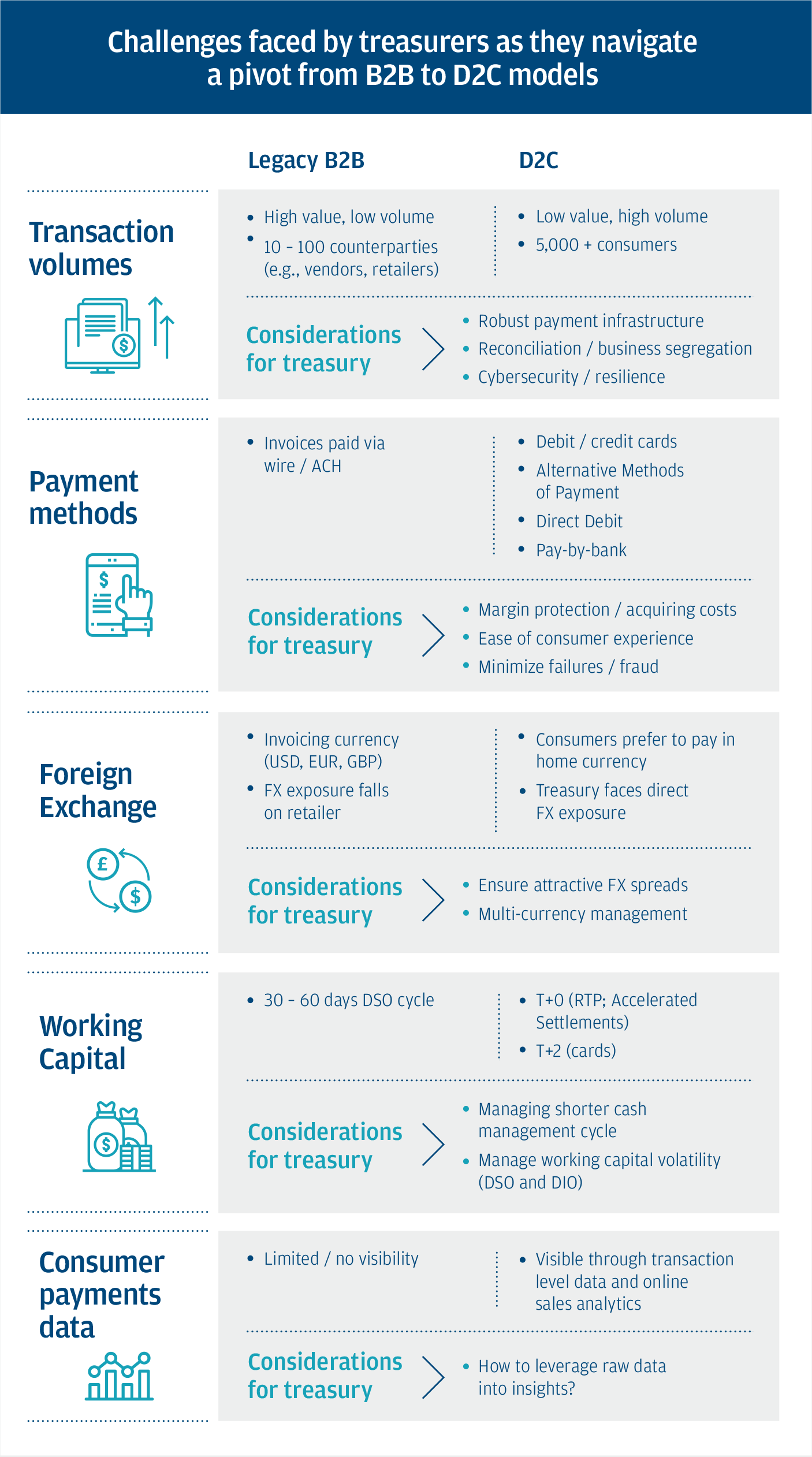

The table below lays out in more detail the scale of challenge faced by treasurers navigating a transition from “legacy” B2B models to D2C models (whether organically developed or via M&A)

Making the pivot to D2C: How to be a partner to your business

More so than ever, what happens in treasury has implications for the business. This is increasingly the case as companies respond to a broader eCommerce disruption, of which D2C is a particular example.

As a treasurer, what should you be thinking about as your company embarks on this journey?

- How to ensure that Treasury is at the table when it comes to the definition and implementation of D2C strategies? With payments at the heart of the consumer experience, we are seeing a rising share of companies embedding treasury representatives alongside strategy, consumer experience and digital leads in D2C delivery projects.

- Building on the overarching insight that payments are a core part of the user journey, treasurers should also consider the following:

- How to provide the flexibility of collection methods that are different in each market while maintaining a consistent user experience

- What is the most cost-effective method of collections which balance convenience, finality of payments and cost per transaction?

- How could emerging payment methods such as real time payments and open banking benefit D2C models?

- How to provide the flexibility of collection methods that are different in each market while maintaining a consistent user experience

- What are pragmatic tools available that do not require an uplift of ERP/TMS capabilities? For example how can you leverage API-powered tools to, for example, inform status of payment receipt and link to release of goods? Is there a role for virtual accounts in simplifying reconciliation in an inherently “one to many” environment across multiple legal and operating entities

- How to devise a D2C infrastructure strategy that balances “go to market” urgency with long-term scalability? While setting up a virtual storefront on an online marketplace or utilizing an “e-shop in a box” platform could help reduce go-to-market timelines, this may not be a sustainable solution in the long-term. This is driven by the cost of ongoing subscriptions and / or commissions, lack of visibility of the end customer and limited flexibility as D2C sales ramp up. Treasurers should therefore set out detailed businesses cases to evaluate which D2C capabilities to build or bring in-house over the medium and long term.

J.P. Morgan understands that each company faces a unique set of challenges and priorities as it considers participation into the D2C space. That’s why we offer a variety of products and services, including innovative treasury and payment tools, to help clients respond to the challenges they face.

In an increasingly complex cross-border environment, we also offer a combination of local capabilities and global reach that can help you tap into the world’s largest growth markets while maintaining your focus on your core business priorities.

To learn more, please contact your J.P. Morgan representative.

References

M&C Saatchi. Inside Trends 2019: Digital Disruption is being driven by DTC brands. <https://www.mcsaatchiperformance.com/news/inside-trends-2019-digital-disruption-is-being-driven-by-dtc-brands/>

Accenture. Who are the Millennial Shoppers? And what do they really want? <https://www.accenture.com>

Accenture. Who are the Millennial Shoppers? And what do they really want? <https://www.accenture.com/>

Inside the Success of Dollar Shave Club and Why DTC Changed the Retail Landscape < https://www.inc.com/magazine/202004/lawrence-ingrassia/billion-dollar-brand-club-direct-consumer-dtc-book.html>

NIKE, Inc. Acquires Data Analytics Leader Zodiac < https://news.nike.com/news/nike-data-analytics-zodiac>

"eCommerce Helped Nike Mitigate Lost Sales In China”. PYMNTS.com <https://www.pymnts.com/news/retail/2020/ecommerce-helped-nike-mitigate-lost-sales-in-china/>

This material was prepared exclusively for the benefit and internal use of the JPMorgan client to whom it is directly addressed (including such client’s subsidiaries, the “Company”) in order to assist the Company in evaluating a possible transaction(s) and does not carry any right of disclosure to any other party. This material is for discussion purposes only and is incomplete without reference to the other briefings provided by JPMorgan. Neither this material nor any of its contents may be disclosed or used for any other purpose without the prior written consent of JPMorgan.

J.P. Morgan, JPMorgan, JPMorgan Chase and Chase are marketing names for certain businesses of JPMorgan Chase & Co. and its subsidiaries worldwide (collectively, “JPMC”). Products or services may be marketed and/or provided by commercial banks such as JPMorgan Chase Bank, N.A., securities or other non-banking affiliates or other JPMC entities. JPMC contact persons may be employees or officers of any of the foregoing entities and the terms “J.P. Morgan”, “JPMorgan”, “JPMorgan Chase” and “Chase” if and as used herein include as applicable all such employees or officers and/or entities irrespective of marketing name(s) used. Nothing in this material is a solicitation by JPMC of any product or service which would be unlawful under applicable laws or regulations.

Investments or strategies discussed herein may not be suitable for all investors. Neither JPMorgan nor any of its directors, officers, employees or agents shall incur in any responsibility or liability whatsoever to the Company or any other party with respect to the contents of any matters referred herein, or discussed as a result of, this material. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice or investment recommendations. Please consult your own tax, legal, accounting or investment advisor concerning such matters.

Not all products and services are available in all geographic areas. Eligibility for particular products and services is subject to final determination by JPMC and or its affiliates/subsidiaries. This material does not constitute a commitment by any JPMC entity to extend or arrange credit or to provide any other products or services and JPMorgan reserves the right to withdraw at any time. All services are subject to applicable laws, regulations, and applicable approvals and notifications. The Company should examine the specific restrictions and limitations under the laws of its own jurisdiction that may be applicable to the Company due to its nature or to the products and services referred herein.

Notwithstanding anything to the contrary, the statements in this material are not intended to be legally binding. Any products, services, terms or other matters described herein (other than in respect of confidentiality) are subject to the terms of separate legally binding documentation and/or are subject to change without notice.

JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.