About

Headquartered in Regensburg, Germany, Vitesco Technologies is an automotive supplier of drivetrain and powertrain technologies. It was formerly known as Continental Powertrain, which was founded in 2019 as a spinoff company from German automotive-parts maker Continental. Vitesco Technologies has 40,000 employees and generated revenues of 8 billion euros in 2020.

China is a key market for Vitesco Technologies, which opened its regional headquarters in Shanghai in March 2021. It operates several production, research and development sites across the country with its latest R&D facility in Tianjin established in November 2021.

The challenge

After its spinoff from Continental Powertrain, Vitesco Technologies became a fully independent entity that had to rebuild its cash management infrastructure from scratch, and it needed to do this within a short period of time as per its transition agreement with Continental Powertrain. In addition, Vitesco had high levels of idle cash in China. Despite strong revenue in the market, China’s strict regulatory requirements governing cross-border movement of funds prevented the organization from seamlessly transferring surplus funds back to its headquarters in Frankfurt. Hence, Vitesco desired a cash management solution that would enable the firm to facilitate the mobility of funds in and out of China seamlessly.

The solution

With J.P. Morgan’s help, Vitesco Technologies implemented a comprehensive and complete cash management structure in China that comprises a combination of innovative host-to-host connectivity mechanisms, cross-border sweeping, and unique cash pooling.

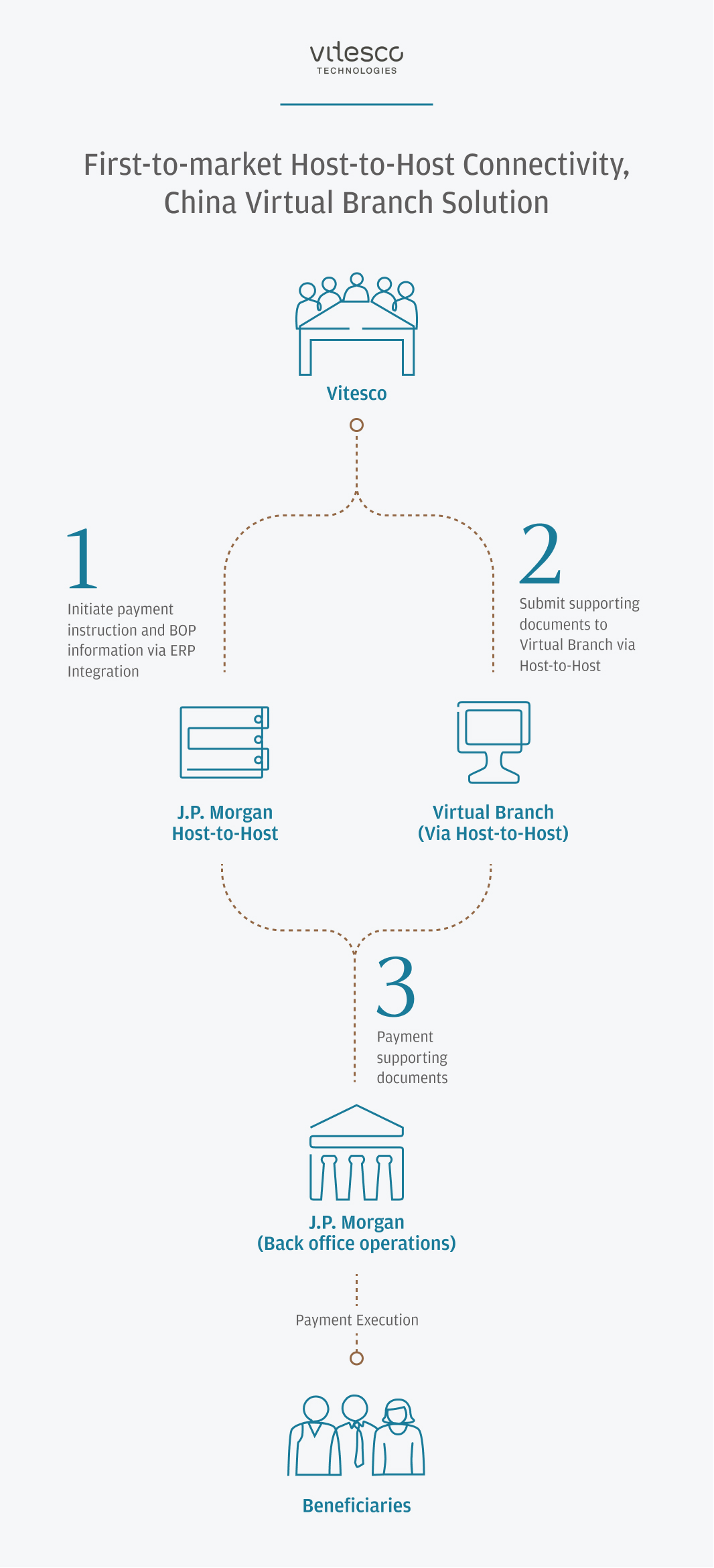

- Host-to-host connectivity mechanisms: The solution boasts two host-to-host (H2H) connections between Vitesco Technologies’ ERP and J.P. Morgan’s Access banking platform. The first one enables the end-to-end automated delivery of payments instructions and reports through to the bank’s Virtual Branch, while the second is a first-to-market H2H connectivity in China that enables the transmission in bulk of supporting documents, a regulatory requirement for all cross-border payments by corporates in China. The unique offering means the process for cross-border transactions is now completely paperless and the bulk process further enhances efficiencies.

- Cross-border sweeping: With the H2H connectivity – part of J.P. Morgan’s proprietary model of using artificial intelligence (AI) to monitor cross-border transaction data – Vitesco Technologies is now well positioned to be eligible for the China’s Cross-border Simplification Program, a new initiative by regulator State Administration of Foreign Exchange. Companies accepted under this program are no longer required to submit supporting documents to effect cross-border payments, so long as they have a banking partner with a demonstrated ability to properly govern these transactions and with the appropriate controls in place.

- Cash pooling: The structure involves a Renminbi (RMB) domestic cash pool to concentrate all the surplus cash of the four Vitesco Technologies entities in China, so their funding needs can be managed centrally. And to enable the seamless transfer of funds between the Chinese entities and Vitesco’s headquarters in Frankfurt, a special account compliant with central bank regulations was set up in Shanghai, connecting the RMB domestic cash pool to the group treasury in Frankfurt via a cross-border sweeping facility. While the sweeping facility was being put in place, Vitesco Technologies managed to secure a special arrangement with J.P. Morgan to provide lending to its headquarters to cover any urgent cash needs until the sweeping capability was activated.

Through our banking relationship with J.P. Morgan, we have quickly set up a comprehensive and independent cash management infrastructure, which has allowed us to improve our operational efficiency and concentrate our domestic liquidity in China, while providing our HQ with access to cash for funding as required.

Jeremy Zhu

Head of Central Finance and Controlling, Vitesco Technologies China

The results

With the solution, close to CNY 2 billion in trapped cash has been mobilized from China via cross-border sweeping since the solution went live in May 2021. Other benefits include:

- Quick and seamless migration after a spinoff to a full and complete cash management infrastructure covering payments, collections and liquidity management consisting of domestic and cross-border pooling structures

- Flexible and multiple cross-border funding arrangements available to support funding requirement of its headquarters

- Improved visibility with the ability to track cash balances and intercompany positions in real time

- Enhanced efficiencies due to fully digitized and streamlined payment processes, freeing up manhours and resulting in cost savings

Corporate spinoffs can often be very challenging, but Vitesco Technologies demonstrated treasury excellence by putting in place an efficient cash management structure within an extremely short period of time to minimize business disruptions. With J.P. Morgan’s solution, Vitesco can seamlessly and efficiently move funds between its domestic entities in China and to its group treasury in Frankfurt, while ensuring efficiencies in the cross-border payments documentation process.

Rani Gu

Head of Payments for Greater China, J.P. Morgan

To learn more about how we can support your business, please contact your J.P. Morgan representative.

This material was prepared exclusively for the benefit and internal use of the JPMorgan client to whom it is directly addressed (including such client’s subsidiaries, the “Company”) in order to assist the Company in evaluating a possible transaction(s) and does not carry any right of disclosure to any other party. In preparing this material, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Company or which was otherwise reviewed by us. This material is for discussion purposes only and is incomplete without reference to the other briefings provided by JPMorgan. Neither this material nor any of its contents may be disclosed or used for any other purpose without the prior written consent of JPMorgan.

J.P. Morgan, JPMorgan, JPMorgan Chase and Chase are marketing names for certain businesses of JPMorgan Chase & Co. and its subsidiaries worldwide (collectively, “JPMC”). Products or services may be marketed and/or provided by commercial banks such as JPMorgan Chase Bank, N.A., securities or other non-banking affiliates or other JPMC entities. JPMC contact persons may be employees or officers of any of the foregoing entities and the terms “J.P. Morgan”, “JPMorgan”, “JPMorgan Chase” and “Chase” if and as used herein include as applicable all such employees or officers and/or entities irrespective of marketing name(s) used. Nothing in this material is a solicitation by JPMC of any product or service which would be unlawful under applicable laws or regulations.

Investments or strategies discussed herein may not be suitable for all investors. Neither JPMorgan nor any of its directors, officers, employees or agents shall incur in any responsibility or liability whatsoever to the Company or any other party with respect to the contents of any matters referred herein, or discussed as a result of, this material. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice or investment recommendations. Please consult your own tax, legal, accounting or investment advisor concerning such matters.

Not all products and services are available in all geographic areas. Eligibility for particular products and services is subject to final determination by JPMC and or its affiliates/subsidiaries. This material does not constitute a commitment by any JPMC entity to extend or arrange credit or to provide any other products or services and JPMorgan reserves the right to withdraw at any time. All services are subject to applicable laws, regulations, and applicable approvals and notifications. The Company should examine the specific restrictions and limitations under the laws of its own jurisdiction that may be applicable to the Company due to its nature or to the products and services referred herein.

Notwithstanding anything to the contrary, the statements in this material are not intended to be legally binding. Any products, services, terms or other matters described herein (other than in respect of confidentiality) are subject to the terms of separate legally binding documentation and/or are subject to change without notice.

Changes to Interbank Offered Rates (IBORs) and other benchmark rates: Certain interest rate benchmarks are, or may in the future become, subject to ongoing international, national and other regulatory guidance, reform and proposals for reform. For more information, please consult: https://www.jpmorgan.com/global/disclosures/interbank_offered_rates.

JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.