Key takeaways

- Without a centralized treasury structure, Bridgestone Asia Pacific (Bridgestone) was unable to access its large volumes of internal cash in APAC.

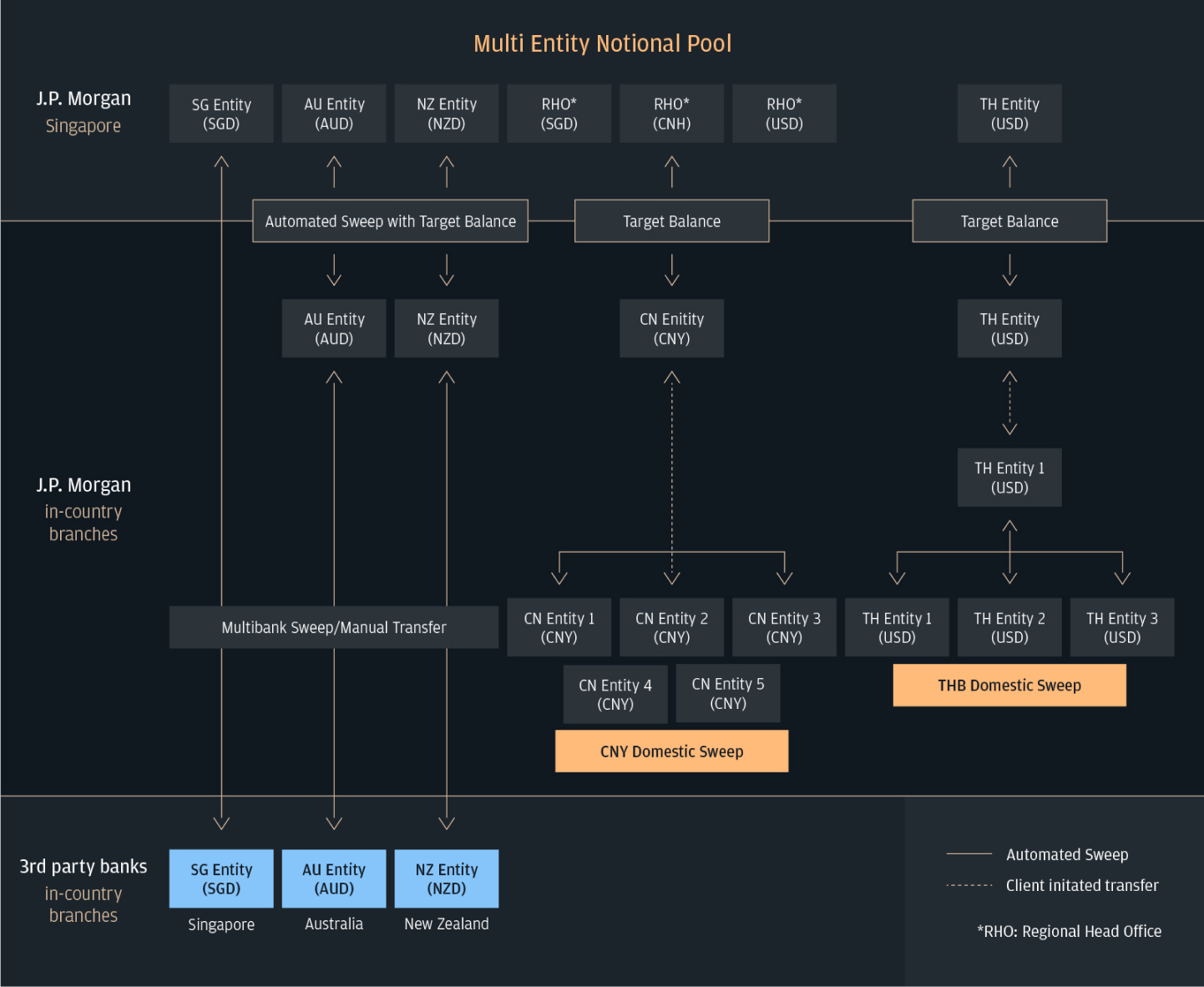

- Bridgestone established a multi-entity, multi-currency notional pool with J.P. Morgan, to connect its largest tire entities across China, Thailand, Australia, New Zealand and Singapore.

- Bridgestone has centralized and mobilized over $620 million in surplus funds, with nearly $1 million in incremental income to fund future strategic growth investments.

About

Bridgestone Corporation is a global leader in tires and rubber building on its expertise to provide solutions for safe and sustainable mobility. Headquartered in Tokyo, the company offers a diverse product portfolio of premium tires and advanced solutions backed by innovative technologies, improving the way people around the world move, live, work and play.

In the Asia Pacific (APAC) region, Bridgestone locates its regional headquarters in Singapore, overseeing the operations of tire production and safe facilities, as well as supplying its products across more than 20 over countries in the region. APAC and Japan as its headquarter, contributed almost 40 percent of those profits at year-end 2021.1.

20

Supplies its products across more than 20 countries in the region

40%

APAC and Japan contributed almost 40% of profits

The challenge

Even as Bridgestone Group's business evolved significantly over its 90-year history, its treasury and banking infrastructure in APAC remained decentralized, manual and sub-optimal; the platforms and systems used by markets and lines of business across its vast organization there were highly manual. Each market maintained multiple local banking providers, resulting in disparate payments processes that required extensive and manual reconciliation on Bridgestone’s end.

Bridgestone Asia Pacific Pte. Ltd. had not deployed optimal structures due to the complexity presented by the highly diverse set of markets, currencies and regulatory regimes in the region. Without a centralized treasury structure, Bridgestone was unable to access an estimated $900 million trapped in APAC that was needed to fund strategic projects across 10 regional markets.

In order to support the management’s vision to restructure the company‘s strength, it was time for a major overhaul of its treasury and banking infrastructure.

“Within a short span of time, the multi-entity, multicurrency cash pool has delivered automation, centralization and optimization for us at the regional treasury level, and will serve as a central structure for us as we embark on the next phase of our transformation.”

The solution

In October 2020, Bridgestone’s regional treasury team embarked on a multi-year treasury transformation. To start, the team’s liquidity centralization project consolidated its regional cash with two primary banks, which optimized liquidity and returns across 10 APAC markets.

As a first step towards centralization, Bridgestone established a multi-entity, multi-currency notional pool (MEMNCP) in Singapore. By collaborating with J.P. Morgan, the firm connected its largest tire entities across the region including China, Thailand, Australia, New Zealand and Singapore.

The MEMNCP enables Bridgestone to optimize the region’s cash efficiency as entities with excess cash can transfer funds to entities with cash needs, for borrowing purposes. A few of MEMNCP’s layers of pooling and sweeping structures are noted below:

- A domestic THB cash pool to centralize funds across three cash-rich entities in Thailand.

- A domestic CNY cash pool to facilitate consolidation of cash across five entities in China.

- An improved connection between entities in Thailand and Singapore to streamline movement of cash across borders.

- Subject to regulator’s approval, an improved connection between its domestic structures in China with the regional pool in Singapore to facilitate movement of cross-border cash.

- An automated multibank sweep solution in Australia and New Zealand to centralize liquidity while maintaining accounts with local third-party banks.

Figure 1: Bridgestone’s multi-entity multicurrency notional pool structure supported by J.P. Morgan

“By understanding Bridgestone’s objectives – which centered around automation, centralization, optimization, and governance – we customized a robust foundational structure that would enable Bridgestone to efficiently centralize and manage liquidity in Asia Pacific, and serve as a critical first step towards their multi-year treasury transformation journey.”

The results

To date, the new structure has helped Bridgestone Asia Pacific centralize and mobilize over $620 million in surplus funds, with nearly $1 million in incremental income interest yielded which will help fund future strategic growth investment. Bridgestone Asia Pacific can now also monitor cash positions via a single platform – J.P. Morgan Access© — allowing visibility and control to optimize liquidity.

With the success of the MEMNCP, Bridgestone Asia Pacific will be expanding the structure to its non-tire entities, as part of the second phase of its liquidity centralization project.