Analyze a rich universe of financial data, market data and proprietary J.P. Morgan content with DataQuery. The application offers an extensive history and broad asset coverage, including unique datasets developed and leveraged by our own global research and trading franchises.

Create, interrogate and share custom queries, market behaviors and trade strategies using DataQuery's dynamic web interface. The tool’s suite of integrated analytics tools enable you to easily construct, visualize, validate and share your investment analysis.

Let DataQuery support you at every stage of your data journey.

650

Datasets

130m+

Historical timeseries

20+

Data sources

15,000

Active users on the platform

350+

Batch files delivered per day

4 billion+

Hits per year – 75% API

Data

Access cross-asset data from J.P. Morgan and selected third parties

J.P. Morgan’s desk marked day weights and daily vols for forward-dated market impacting events across 40+ currency pairs.

J.P. Morgan’s volatility surfaces in benchmark expiries for over 300+ FX direct and cross currency pairs with +20 years of data history.

J.P. Morgan’s volatility surface for Global Indices and Index ETF with forward levels derived from J.P. Morgan dividend estimates, spot and fair value levels used for Variance Swaps.

J.P. Morgan’s Options and volatility surface data for Swaptions, IR Caps & Floors, Seven-point smile for benchmark terms and expiries, Mid-Curve Options and Yield Curve Spread Options.

Market timing signals for the US equity market based on fundamental and derived external positioning data.

A powerful service that makes it easy to use quantitative-fundamental (quantamental) information for algorithmic trading, as well as discretionary trading support tools.

Gain insight into equity performance and valuation with a comprehensive set of indices that supports analysis of expected returns, construction of tactical timing models and identification of sector trends over time.

Scores for over 8,000 stocks are generated by applying a proprietary algorithm against a news dataset to reflect the involvement of individual stocks in a theme.

J.P. Morgan’s proprietary Economic forecasts, nowcasters, revision indices and quant signals by J.P. Morgan Economic Research, with extensive history and covering over 50 economies.

J.P. Morgan Benchmark Indices spanning global Macro, Securitized, Credit and Emerging Markets with coverage including flagship EMBI, CEMBI, GBI and JESG Index families.

Global Fixed Income Benchmarks and Cash Securities, Outright and Forward Curves, Money Market, Reference Rates, Index Spreads, Issuance and Liquidity related series.

Global Fixed Income Benchmarks and Cash Securities, Outright and Forward Curves, Money Market, Reference Rates, Index Spreads, Issuance and Liquidity related series.

US Securitized Mortgage Credit including MBS, TBA, ABS, RMBS, CMBS product coverage. J.P Morgan Research MBS Pre-payment Analytics, Issuance and Liquidity related series.

Global FX Spot and forward rates for 60+ currency pairs. JPM FX Research Effective FX and Emerging Market Indices, Implied FX Yields/Returns and Liquidity related series.

Global DM & EM Credit Cash bonds, CDS Single Name, Index, Index Options and CDS Bond Basis indices. J.P. Morgan US Credit JULI and High Yield Index families and constituents.

Global EM Government, Sovereign, Corporate bonds and J.P Morgan EM Benchmark indices. EM Interest Rate Swaps, Cross Currency swaps, and EM Credit CDS and Indices.

J.P. Morgan Research Commodity Forecasts and Commodity Curve Index Family (JPMCCI).

Connectivity

Optimize how you use and extract data with flexible channel connectivity

Features and capabilities

Features and solutions to help you extract maximum value from your data

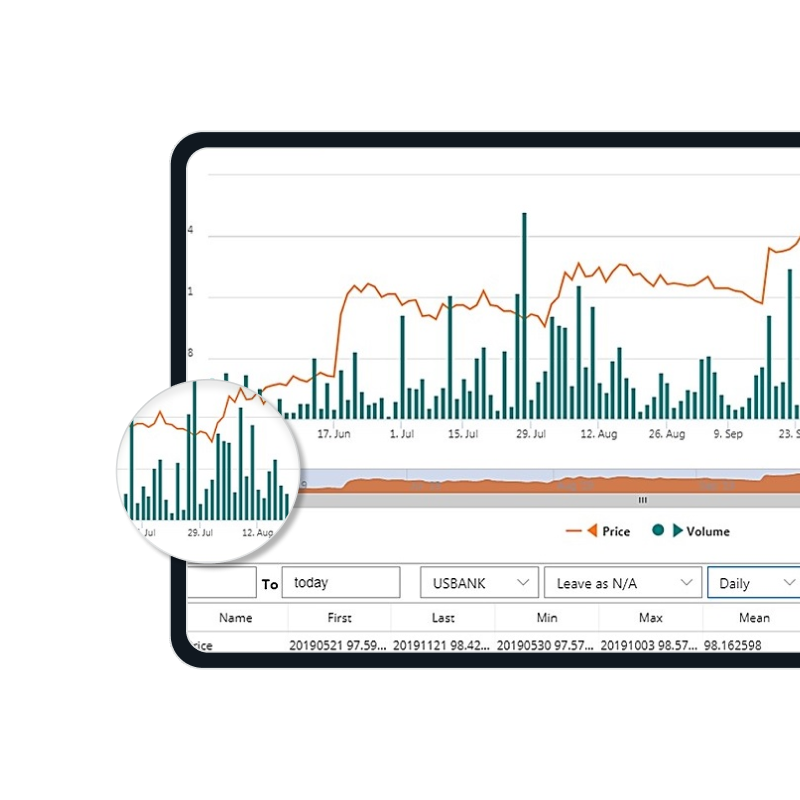

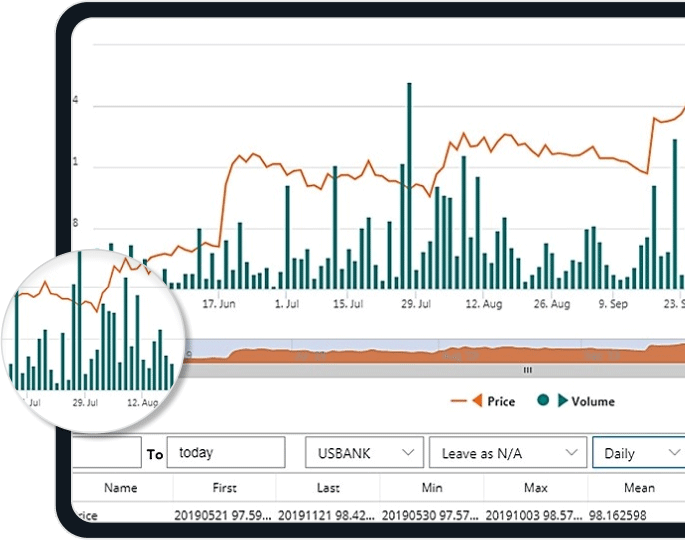

Data Analysis

Advanced analytics capabilities and data visualization to help you validate your trade ideas. Built-in functionality enables you to transform data and choose from multiple data visualizations, including XY charts, cycle charts, and bubble charts.

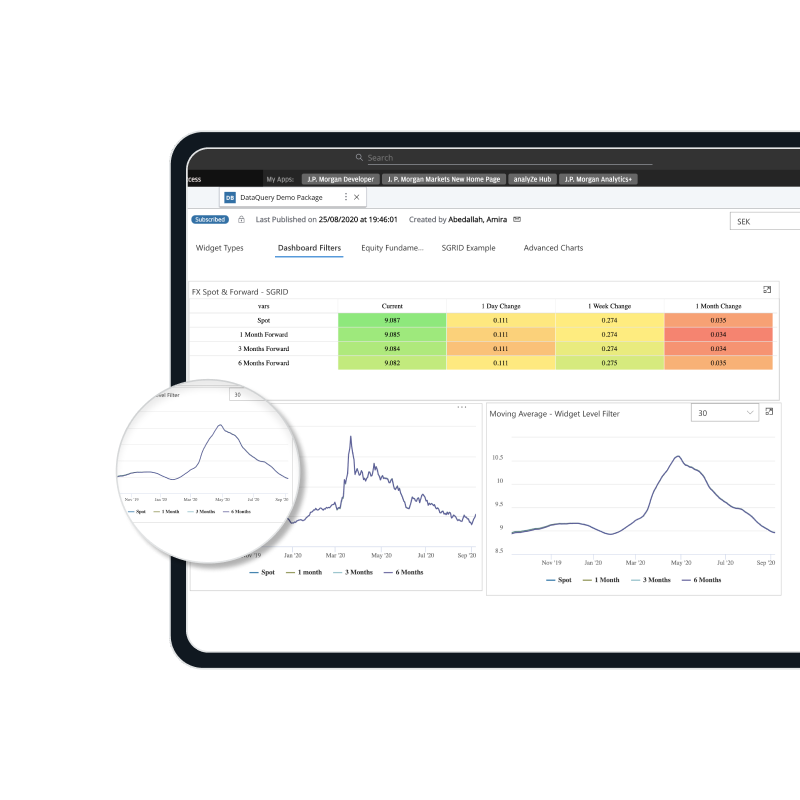

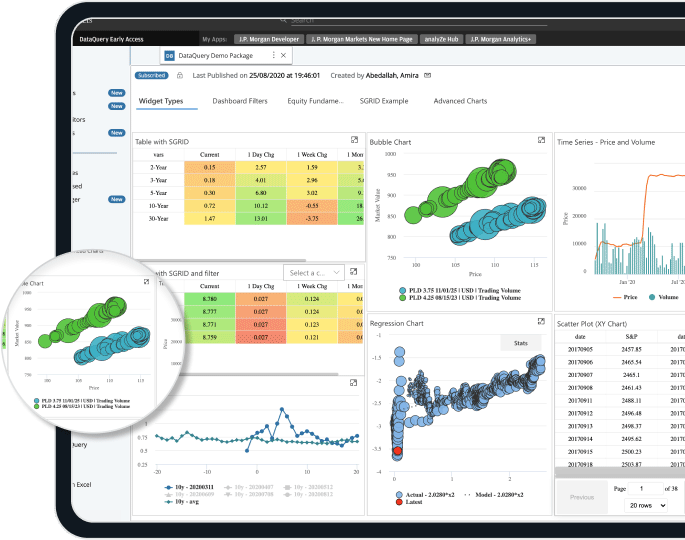

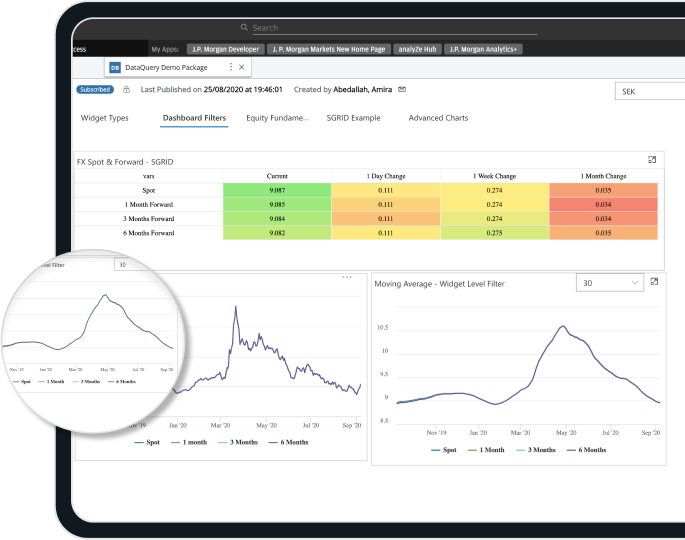

Data Dashboards

Data visualization and collaboration capabilities that enable you to enhance your analysis and convey your market perspective. Dynamically view and interrogate custom queries, market behaviors, and trade ideas.

Data Insights

A unique opportunity to interrogate data studies created by J.P. Morgan.

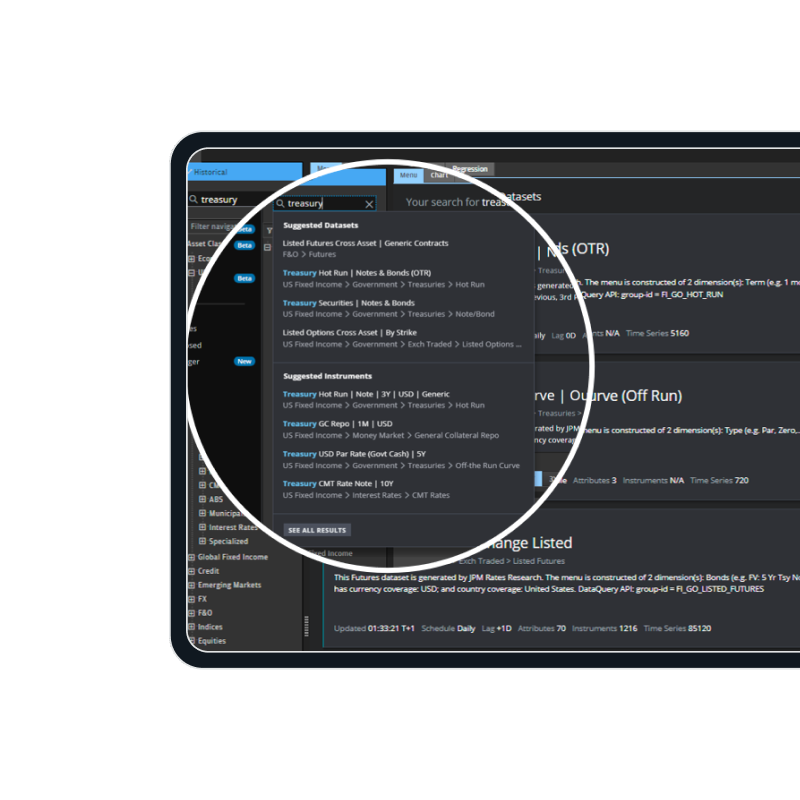

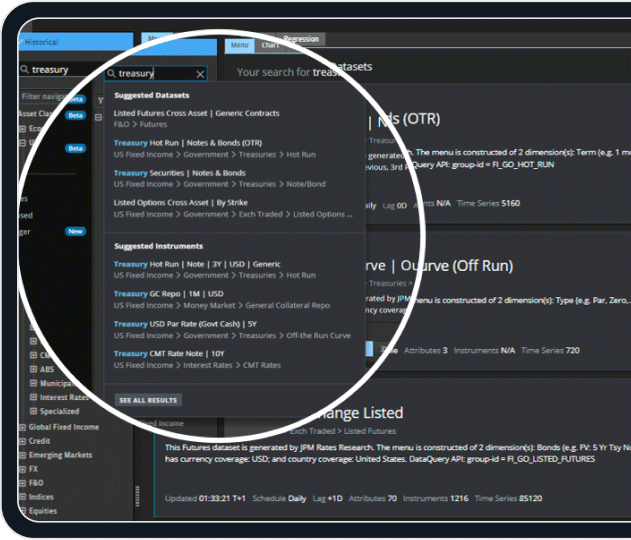

Open Data Exploration

Browse the full catalog of datasets and instruments via DQ Web or DQ API search, without restrictions.

Data Analysis

Advanced analytics capabilities and data visualization to help you validate your trade ideas. Built-in functionality enables you to transform data and choose from multiple data visualizations, including XY charts, cycle charts, and bubble charts.

Data Dashboards

Data visualization and collaboration capabilities that enable you to enhance your analysis and convey your market perspective. Dynamically view and interrogate custom queries, market behaviors, and trade ideas.

Data Insights

A unique opportunity to interrogate data studies created by J.P. Morgan.

Open Data Exploration

Browse the full catalog of datasets and instruments via DQ Web or DQ API search, without restrictions.

Get in touch

For more information, speak to a member of our team:

FOR INSTITUTIONAL & PROFESSIONAL CLIENTS ONLY

J.P. Morgan is a marketing name for businesses of JPMorgan Chase & Co. and its subsidiaries and affiliates worldwide. JPMorgan Chase Bank, N.A., organized under the laws of the U.S.A. with limited liability, is authorized by the Office of the Comptroller of the Currency in the jurisdiction of the U.S.A., as well as the regulations of the countries in which it or its affiliates undertake regulated activities.

The content of this website is provided for informational purposes only and is not intended as a recommendation or an offer or solicitation for the purchase or sale of any security or financial instrument. Any data and other information contained herein are not warranted as to completeness or accuracy and are subject to change without notice. Nothing on this website should be construed as legal, regulatory, tax, accounting, investment or other advice. The recipient must make an independent assessment of any legal, credit, tax, regulatory and accounting issues and determine with its own professional advisors any suitability or appropriateness implications and consequences of any transaction in the context of its particular circumstances. J.P. Morgan disclaims any responsibility or liability to the fullest extent permitted by applicable law, whether in contract, tort (including, without limitation, negligence), equity or otherwise, for any loss or damage arising from any reliance on or the use of any information on this website.

The products and services described on this website are offered by JPMorgan Chase Bank, N.A. or its affiliates subject to applicable laws and regulations and service terms. Not all products and services are available in all locations. Eligibility for particular products and services will be determined by JPMorgan Chase Bank, N.A. and/or its affiliates.

The products and services described in this website are produced and distributed on behalf of the entities offering Corporate and Investment Banking activities including but not limited to JPMorgan Chase Bank N.A. (including through its authorized branches), J.P. Morgan AG, J.P. Morgan Bank Luxembourg S.A. (including its authorised branches), J.P Morgan Bank (Ireland) Plc, J.P. Morgan (Suisse) SA, J.P. Morgan Europe Limited and its authorised branches, J.P. Morgan Securities LLC and J.P. Morgan Securities plc. For additional regulatory disclosures regarding these entities, please consult: www.jpmorgan.com/disclosures.