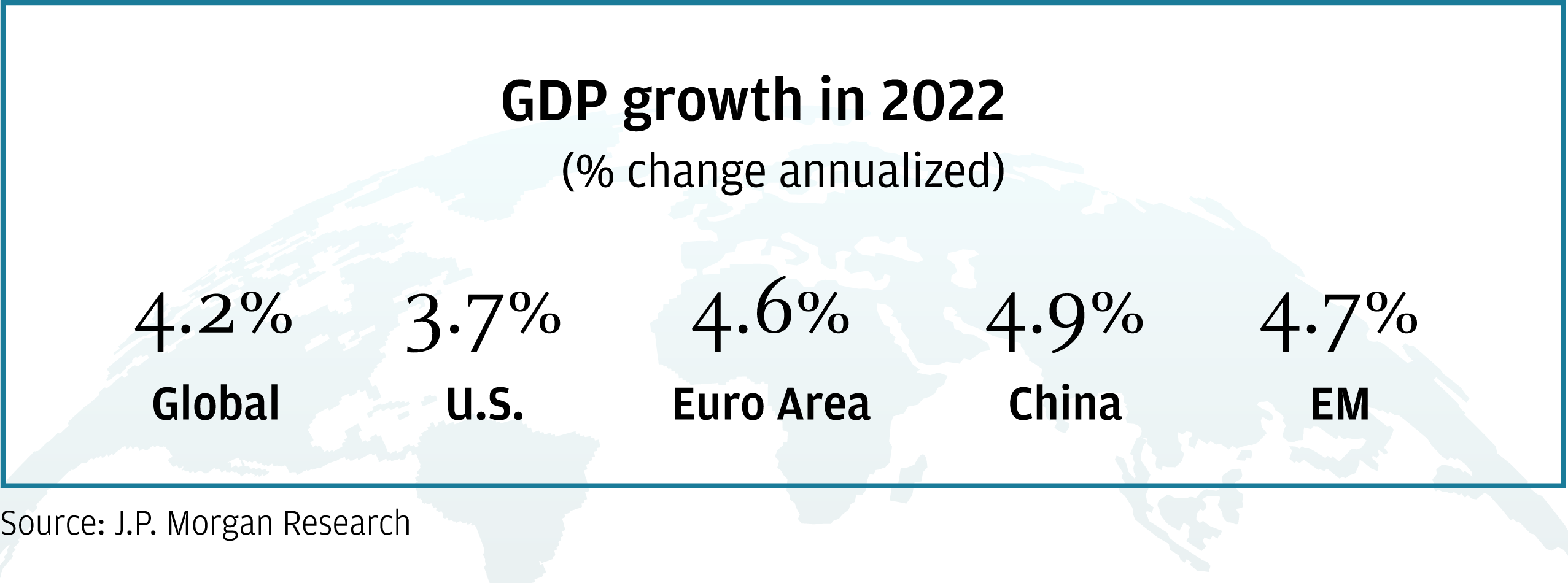

After two years of uncertainty and lockdowns that resulted in the largest drop in global GDP history, the 2022 outlook is looking brighter. As pandemic volatility continues to fade, J.P. Morgan Global Research forecasts are upbeat, with expectations of further equity market upside and above-potential growth. Earnings growth also looks better than expected, supply shocks are easing, the China and Emerging Market (EM) backdrop is set to improve and consumer spending habits should continue to normalize.

"Our view is that 2022 will be the year of a full global recovery, an end of the global pandemic and a return to normal conditions we had prior to the COVID-19 outbreak. We believe this will produce a strong cyclical recovery, a return of global mobility and strong growth in consumer and corporate spending, within the backdrop of still-easy monetary policy. For this reason, we remain positive on equities, commodities and emerging markets and negative on bonds."

Hussein Malik

Chief Global Markets Strategist, Global Co-Heads of Research

Global growth

As 2021 draws to a close, the post-pandemic global rebound is facing its first genuine resiliency test. Supply-side pressures have intensified as supply chain issues and persistent bottlenecks have led to pent-up demand and excess savings. Despite this stiff test, J.P. Morgan Research continues to see global growth accelerating in the final quarter of this year, as it displays the strong underlying fundamentals that will sustain above-potential growth for 2022.

“When the smoke created by pandemic volatility clears, forces promoting a global reflationary tilt will come into focus as healthy private sector fundamentals and growth-oriented policy stances interact with a global economy operating with limited slack.”

Bruce Kasman

Chief global economist, J.P. Morgan

As pandemic-induced uncertainty eases, private sector fundamentals should sustain above potential-growth. Households and corporates have built up excess savings, and credit conditions are easing. At the same time, there is considerable pent-up demand in global services and inventories. The positive interaction of these healthy fundamentals and growth-oriented policies is a recipe for a global reflationary tilt. Governments are moving slowly to unwind pandemic supports and J.P. Morgan Research estimates a modest 0.5 percentage point of GDP fiscal drag next year. While monetary policy is expected to stay fairly accommodative as well, with global policy rates expected to end next year only 68 basis points (bp) above their pandemic levels, with this increase concentrated in Emerging Markets (EM).

While European growth sags, Asia is anticipated to see a bounce as mobility has increased significantly along with vaccination rates. In addition to highlighting the still-substantial global growth impulse from service-sector normalization, global manufacturing should benefit as Asian supply constraints ease. Additional fiscal stimulus is expected to come from Japan that shows Developed Market (DM) policy reaction functions remain growth biased.

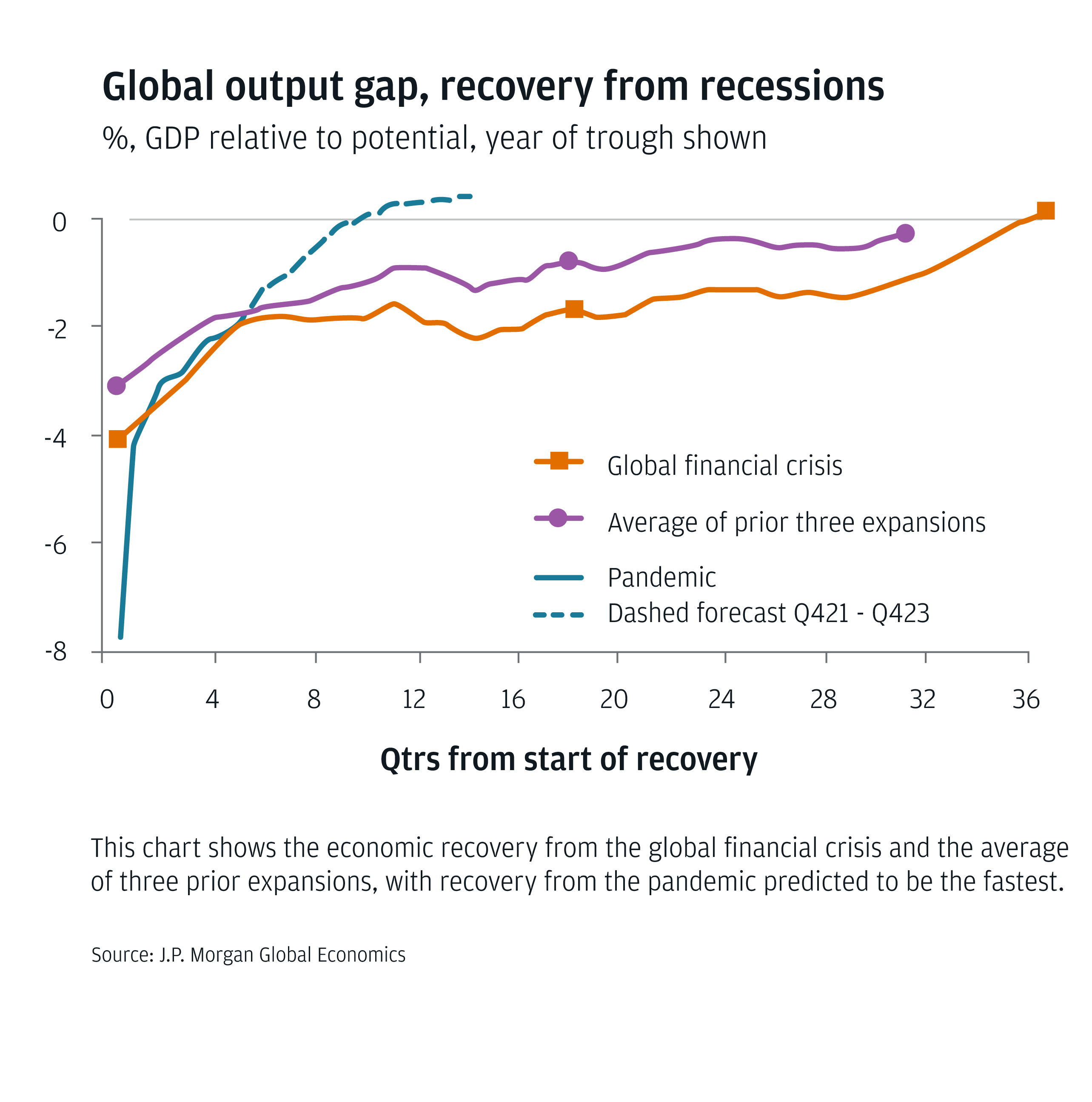

The chart shows the length of time taken for recovery from the global financial crisis, alongside the average of the prior three expansions. Recovery time from the coronavirus pandemic is predicted to be shorter.

Passing this resiliency test will confirm that growth-supportive dynamics have room to run, but tension is brewing in an otherwise upbeat outlook, as the expansion moves forward with relatively weak supply-side dynamics. In the U.S., J.P. Morgan Research forecasts now project the unemployment rate will fall below 4% before the middle of 2022. Overall, the DM output gap is anticipated to close before the end of 2022. By contrast, J.P. Morgan estimates show it took eight years of expansion to close output gaps following the global financial crisis.

Equities

Looking to 2022, J.P. Morgan Research expects to see market upside, though more moderate, on better-than-expected earnings growth with supply shocks easing, China/EM backdrop improving and normalizing consumer spending habits.

Central bank policy is set to remain broadly accommodative despite Federal Reserve (Fed) tapering, with an additional $1.1 trillion in global DM central bank balance sheet expansion through the end of 2022 and a more dovish Fed relative to current market expectations ahead of U.S. midterm elections. While inflation will remain a recurring theme, there is a compelling case to be made for inflation rotation rather than broad-based acceleration in prices. Record corporate liquidity and strong fundamentals should continue to drive capital investment, inventory re-stocking, shareholder return and merger and acquisition (M&A) activity.

"Next year, we expect S&P 500 to reach 5050 on continued robust earnings growth as labor market recovery continues, consumers remain flush with cash, supply chain issues ease, and inventory cycle accelerates off historic lows."

Dubravko Lakos-Bujas

Head of Global Markets Strategy, J.P. Morgan

While there have been sporadic setbacks with COVID-19 variants, this needs to be seen in the context of higher natural and vaccine-acquired immunity, significantly lower mortality and new antiviral treatments. With this in mind, the key risk to this outlook is a hawkish shift in central bank policy - especially if post-pandemic dislocations persist, such as further delay in China reopening or continued supply chain issues.

The S&P 500 reached the J.P. Morgan Research price target of 4,700 (+25% year-to-date, +38% since February 2020 high) on the back of rapid earnings growth driven by rising mobility and generous monetary and fiscal policy.

“Next year, we expect S&P 500 to reach 5050 on continued robust earnings growth as labor market recovery continues, consumers remain flush with cash, supply chain issues ease, and inventory cycle accelerates off historic lows. Most of the equity upside should be realized between now and the first half of 2022. More so, equities have already priced in a more aggressive Fed, while high beta stocks (both high beta growth and value) have significantly de-rated, lowering the bar for equities to outperform” said Dubravko Lakos-Bujas, Chief U.S. Equity Strategist at J.P. Morgan Research.

S&P 500 2022 price target: 5050

Outside of the U.S., European equities have performed strongly this year, up 21% for MSCI Europe, and J.P. Morgan Research forecasts remain bullish on the equity market’s direction into 2022, as central bank policy remains accommodative and another year of expected positive earnings is seen. Japanese stocks are expected to also have moderate upside in 2022 and J.P. Morgan estimates EM equities will return 18% in 2022.

Commodities

Despite a late-November setback, commodities are set for a strong year ahead. While energy stands out as the major outperformer, tight balances across industrial metals and agriculture have also propelled those sectors higher, as supply this year has struggled to keep pace with resurgent demand.

“Commodities are on pace to deliver the strongest year of returns since the early 2000s. A constructive economic outlook, depleted inventory levels and supply still struggling to respond to resurgent demand point to a second consecutive year of positive double-digit commodity returns in 2022,” said Natasha Kaneva, Head of the Global Commodities Strategy at J.P. Morgan.

Looking at the year ahead, the global economic expansion is still in the midst of its first genuine resiliency test, made even more challenging by the emerging, heavily mutated Omicron variant. Barring a material backslide on the COVID-19 front, J.P. Morgan Research economists see strong underlying fundamentals sustaining above-potential global GDP growth in both 2022 and 2023 with pro-growth fiscal policies continuing to support the ongoing recovery. This is the backdrop for three major commodities themes in 2022:

| 1 | Inventories are at depleted levels across nearly all commodity sectors, including oil, natural gas, base metals and agricultural commodities. |

| 2 | A constructive economic outlook is feeding through demand numbers across commodities, resutling in record or near-record demand outlooks in the coming years. |

| 3 | Supply is still struggling to respond to resurgent demand and will likely remain costrained through next year. |

“Looking across the sector, we believe that oil is set to remain a major beneficiary of a continued economic reopening over the course of 2022. The last time consumption was as high as we forecast next year, U.S. shale drillers were pumping flat out and the Organization of the Petroleum Exporting Countries (OPEC) and its allies were locked in a battle for market share,” said Kaneva.

Brent crude prices are predicted to average $88 bbl in 2022 and breach $90 bbl somewhere in Q3 2022. From an average of $1,765/oz in Q1, gold prices are set to steadily decline over the course of next year to a Q4 average of $1,520/oz.

The fundamental outlook also remains constructive across the agricultural complex, as world and major exporter balances show a sustained tightness in inventories through 2021/22 and 2022/23, on low carry-in stocks and strong demand. Industrial metals will still take time to find balance next year, keeping prices supportive over the first half of 2022, however, with relatively middling Chinese demand growth expected, prices could come under more sustained pressure later in the year. An unwinding in ultra-accommodative central bank policy will be most outright bearish for gold and silver over the course of 2022.

Rates and currencies

In 2022, strong growth momentum is expected to continue with persistent but still declining inflation pressure triggering a different response across central banks. Further vaccine rollout and booster deployment will help break the link between the virus and mobility restrictions, with only a gradual adjustment on the monetary policy side and a key focus in DMs on labour markets and wage pressures.

The Federal Open Market Committee (FOMC) has started to lay out the path from removal of accommodation and announced the tapering of the asset purchase taper in November. J.P. Morgan forecasts the Fed to finish tapering by mid-2022 and to start hiking 25bp quarterly in September 2022.

J.P. Morgan Research expects Treasury yields to rise in 2022, with the intermediate sector (bonds with a maturity of 2-10 years) leading the way. With the Fed projected to lift-off in September, but markets pricing a July hike, project 2-year yields rising modestly to 0.7% in Q2 before making a larger move to 1.20% by year end. Meanwhile, given the resilient economic environment, the curve has room to steepen for a short period in early 2022 and 10-year yields are projected to rise to 2% by mid-year and 2.25% by the end of 2022. Finally, long-end yields are expected to rise as well, but only barely retracing to the highs observed earlier this year by late-2022.

"With the economy expected to grow firmly above trend in 2022, inflation expectations are expected to remain well anchored and as the Fed is being patient in raising rates, compared to prior tightening cycles, Treasuries appear mispriced at current yield levels."

Jay Barry

Co-Head of U.S. Rates Strategy, J.P. Morgan

The Bank of England (BoE) should continue their hikes after an expected 15bp hike in December. The European Central Bank (ECB) will likely deliver purchases beyond its pandemic emergency purchase programme (PEPP) at the December meeting, implicitly pushing back any rate lift-off in 2022 via their commitment to sequencing.

“With the economy expected to grow firmly above trend in 2022, inflation expectations are expected to remain well anchored and as the Fed is being patient in raising rates, compared to prior tightening cycles, Treasuries appear mispriced at current yield levels. We expect 10-year yields to rise to 2% by mid-2022 and 2.25% by the end of 2022,” said Jay Barry, Head of USD and Bond Strategy at J.P. Morgan Research.

J.P. Morgan Research is forecasting 1.6% gains in the USD index in 2022. While the euro, Japanese yen, Chinese yuan renminbi and Mexican peso are expected to underperform with G10 commodity currencies likely to outperform.

Emerging markets

2022 will be an uphill struggle for EM asset returns as growth moderates and the Fed starts hiking. The global expansion is set to continue into 2022 at an above trend pace, including for EM economies, but EM and global growth will moderate from the early cycle dynamics of 2021.

"We continue to expect EM opening up and mobility to rise as vaccination rolls out, but the pace will differ based on individual COVID-19 tolerance policies."

Luis Oganes

Head of Currencies, Emerging Markets and Commodities, J.P. Morgan

EM GDP growth will slow to 4.7% next year from 7% in 2021, but will remain above its 2015-19 trend. The main drags will come from moderating DM growth and changes in the drivers of the Chinese economy, the withdrawal of domestic fiscal and monetary policy supports, albeit at a slower pace than in 2021 and lower terms-of-trade trade gains.

“We continue to expect EM opening up and mobility to rise as vaccination rolls out, but the pace will differ based on individual COVID-19 tolerance policies. Although China’s growth momentum is expected to pick up in the first half of 2022 as the impact of policy supports in the second half of this year kick in, for the year as a whole GDP growth will slow from a 8.1% pace this year to 4.9% in 2022,” said Luis Oganes, Head of Emerging Markets, Currencies and Commodities Research.

With the Fed likely to start hiking next year, there is a large hill to climb for EM currencies and J.P. Morgan Research continues its underweight (UW) stance there. EM rates have already seen a sizable move higher this year, but EM local bonds remain market weight. For sovereigns and corporates, the mid-cycle environment is not as disruptive even with Fed tightening and given spread underperformance this year, J.P. Morgan Research remains overweight (OW) into 2022 seeing some spread tightening in the near-term.

Related insights

-

Global Research

Global Research

Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

-

Global Research

The long-term impact of COVID-19? Housing affordability

November 10, 2021

Is housing affordability the next post-pandemic crisis?

MSCI: The MSCI sourced information is the exclusive property of Morgan Stanley Capital International Inc. (MSCI). Without prior written permission of MSCI, this information and any other MSCI intellectual property may not be reproduced, redisseminated or used to create any financial products, including any indices. This information is provided on an 'as is' basis. The user assumes the entire risk of any use made of this information. MSCI, its affiliates and any third party involved in, or related to, computing or compiling the information hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of this information. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in, or related to, computing or compiling the information have any liability for any damages of any kind. MSCI, Morgan Stanley Capital International and the MSCI indexes are services marks of MSCI and its affiliates.

This communication is provided for information purposes only. Please read J.P. Morgan research reports related to its contents for more information, including important disclosures. JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively, J.P. Morgan) normally make a market and trade as principal in securities, other financial products and other asset classes that may be discussed in this communication.

This communication has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy except with respect to any disclosures relative to J.P. Morgan and/or its affiliates and an analyst's involvement with any company (or security, other financial product or other asset class) that may be the subject of this communication. Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument. J.P. Morgan Research does not provide individually tailored investment advice. Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein. Periodic updates may be provided on companies, issuers or industries based on specific developments or announcements, market conditions or any other publicly available information. However, J.P. Morgan may be restricted from updating information contained in this communication for regulatory or other reasons. Clients should contact analysts and execute transactions through a J.P. Morgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of J.P. Morgan. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitutes your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of J.P. Morgan.