For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Insights

- Real Estate

- Community Development Banking

- The Historic Tax Credit program, explained

Historic buildings are part of what make neighborhoods unique, and preserving these buildings can spur economic activity as developers create jobs to revitalize aging properties.

Through the Historic Tax Credit (HTC) program, federal tax law provides an income tax credit to developers, who own historic buildings that undergo substantial rehabilitations into income-producing uses, such as housing.

“The Historic Tax Credit program is important to the firm, and most of our investments of tax credit for historic preservation are in areas that are changing, developing or undergoing some renaissance,” says Tim Karp, Head of Historic Tax Credit Equity at JPMorgan Chase.

Learn how to navigate the process for obtaining historic rehabilitation tax credits at the federal and state levels.

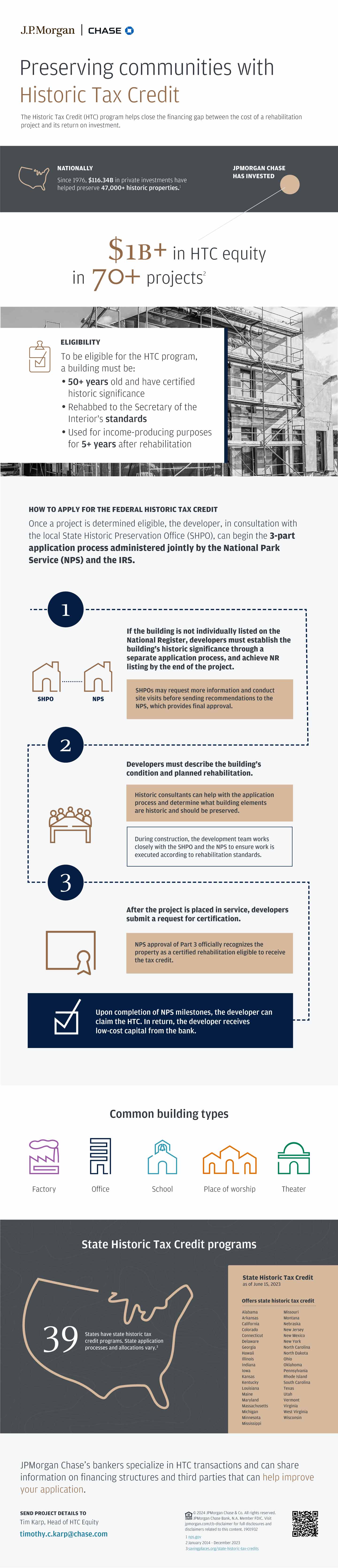

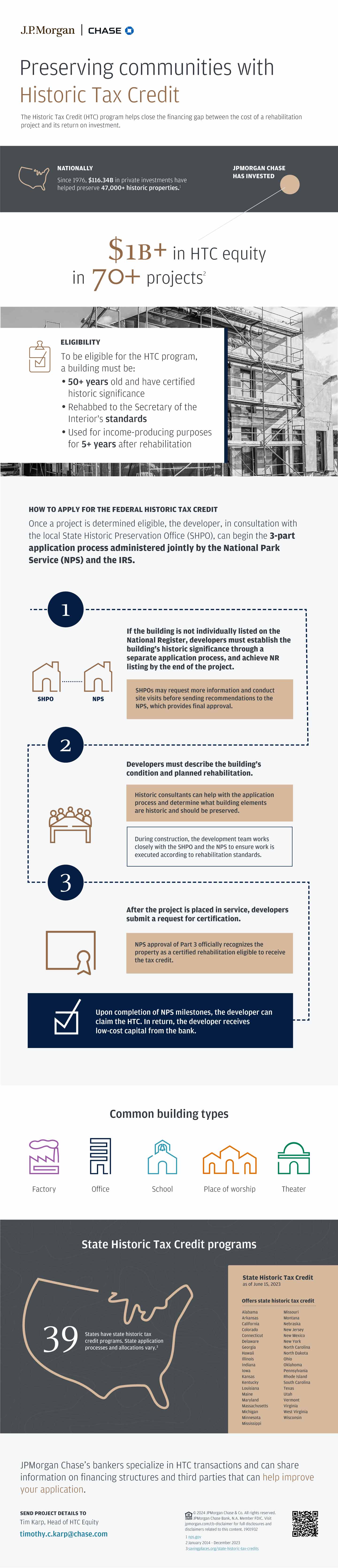

Preserving communities with Historic Tax Credit

The Historic Tax Credit (HTC) program helps close the financing gap between the cost of a rehabilitation project and its return on investment.

Graphic: a map icon of the United States

NATIONALLY

Since 1976, $116.34B in private investments have helped preserve 47,000+ historic properties. Source: nps.gov

JPMORGAN CHASE HAS INVESTED

Graphic: A white line extends from a beige circle to statistics

$1B+ in HTC equity in 70+ projects from January 2014 to December 2023

Graphic: A clipboard icon with a check mark on it, along with text, is placed over the image of a building under renovation with scaffolding along the exterior.

ELIGIBILITY

To be eligible for the HTC program, a building must be:

• 50+ years old and have certified historic significance

• Rehabbed to the Secretary of the Interior’s standards

• Used for income-producing purposes for 5+ years after rehabilitation

HOW TO APPLY FOR THE FEDERAL HISTORIC TAX CREDIT

Once a project is determined eligible, the developer, in consultation with the local State Historic Preservation Office (SHPO), can begin the 3-part application process administered jointly by the National Park Service (NPS) and the IRS.

Graphic: A dotted line connects each part of the process of applying for the federal Historic Tax Credit. For Part 1, the number 1 appears inside a navy blue circle above two building icons, one labeled SHPO and one labeled NPS, with a dotted line connecting them.

If the building is not individually listed on the National Register, developers must establish the building’s historic significance through a separate application process, and achieve NR listing by the end of the project.

SHPOs may request more information and conduct site visits before sending recommendations to the NPS, which provides final approval.

Graphic: For Part 2, the number 2 appears inside a navy blue circle above an icon of a group of people gathered around a table.

Developers must describe the building’s condition and planned rehabilitation.

Historic consultants can help with the application process and determine what building elements are historic and should be preserved.

During construction, the development team works closely with the SHPO and the NPS to ensure work is executed according to rehabilitation standards.

Graphic: For Part 3, the number 3 appears inside a navy blue circle above a certificate icon.

After the project is placed in service, developers submit a request for certification.

NPS approval of Part 3 officially recognizes the property as a certified rehabilitation eligible to receive the tax credit.

Graphic: An icon of a box with a check mark on it

Upon completion of NPS milestones, the developer can claim the HTC. In return, the developer receives low-cost capital from the bank.

Common building types

Graphic: Icon of a building with a smokestack

Factory

Graphic: Icon of a multi-story building

Office

Graphic: Icon of a building with a bell

School

Graphic: Icon of a building with three entrances

Place of worship

Graphic: Icon of a building with a dome

Theater

State Historic Tax Credit programs

Graphic: An outline of the United States with text inside

39 states have state historic tax credit programs. State application processes and allocations vary. Source: savingplaces.org/state-historic-tax-credits

State Historic Tax Credit

as of June 15, 2023

Offers state historic tax credit

Alabama

Arkansas

California

Colorado

Connecticut

Delaware

Georgia

Hawaii

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Pennsylvania

Rhode Island

South Carolina

Texas

Utah

Vermont

Virginia

West Virginia

Wisconsin

JPMorgan Chase’s bankers specialize in HTC transactions and can share information on financing structures and third parties that can help improve your application.

SEND PROJECT DETAILS TO

Tim Karp, Head of HTC Equity

timothy.c.karp@chase.com

Graphic: Equal Housing Opportunity logo.

© 2024 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/cb-disclaimer for full disclosures and disclaimers related to this content. 1901932

Related insights

Real Estate

What to know about office-to-residential conversion

Feb 27, 2026

Adaptive reuse can turn aging offices into much-needed housing. Learn what makes properties strong candidates for conversion and explore financing tools to support redevelopment.

Real Estate

Protecting commercial properties from cybersecurity threats

Feb 06, 2026

Learn how to protect your payments and data from common cybersecurity threats affecting commercial real estate owners and operators.

Real Estate

Navigating interest rate uncertainty

Feb 03, 2026

At its January meeting, the Fed held interest rates steady. Learn more about the factors behind the decision

Real Estate

The role of cap rates in real estate

Feb 02, 2026

This common metric can help investors assess the potential value of a property.

3:00 - Real Estate

How tax credit equity helped Dupaco return to its roots

Jan 30, 2026

See how both Historic and New Markets Tax Credit from J.P. Morgan helped transform a vacant manufacturing facility and spur community development in Dubuque, Iowa.

Real Estate

How a government shutdown impacts multifamily

Jan 21, 2026

When the federal government shuts down, multifamily housing—especially affordable—often feels the greatest impact through program delays and payment disruptions.

Real Estate

Streamline real estate financial reporting with APIs

Jan 12, 2026

Learn how your bank’s data-syncing tools can make financial reporting and reconciliation more efficient while reducing opportunities for costly manual errors.

Real Estate

What’s driving sustainable real estate demand

Jan 08, 2026

Amid rising insurance costs and climate change, investing in sustainable real estate can help increase returns and give investors a competitive advantage.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.