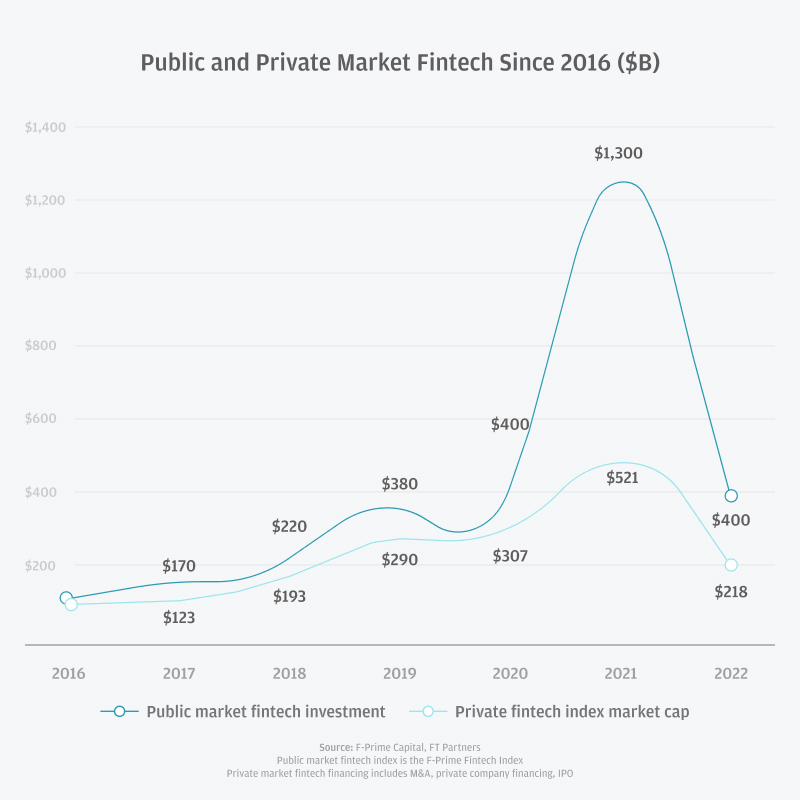

After a decade of unprecedented growth and record high fintech valuations, mid-2021 and beyond presented a multitude of challenges and uncertainties for fintech. As the macro environment factors changed, and following fears of a recession, fintech funding dried up and investors became significantly more cautious. Valuations of even the largest fintech behemoths dropped by as much as 50 to 85 percent (see chart below). This downward cycle also coincided with instances of fraud (notably FTX and Wirecard) and fall of notable fintech banks that sent shockwaves through the industry. The environment has not recovered yet, and many industry stakeholders expect this uncertainty to last for the near future.

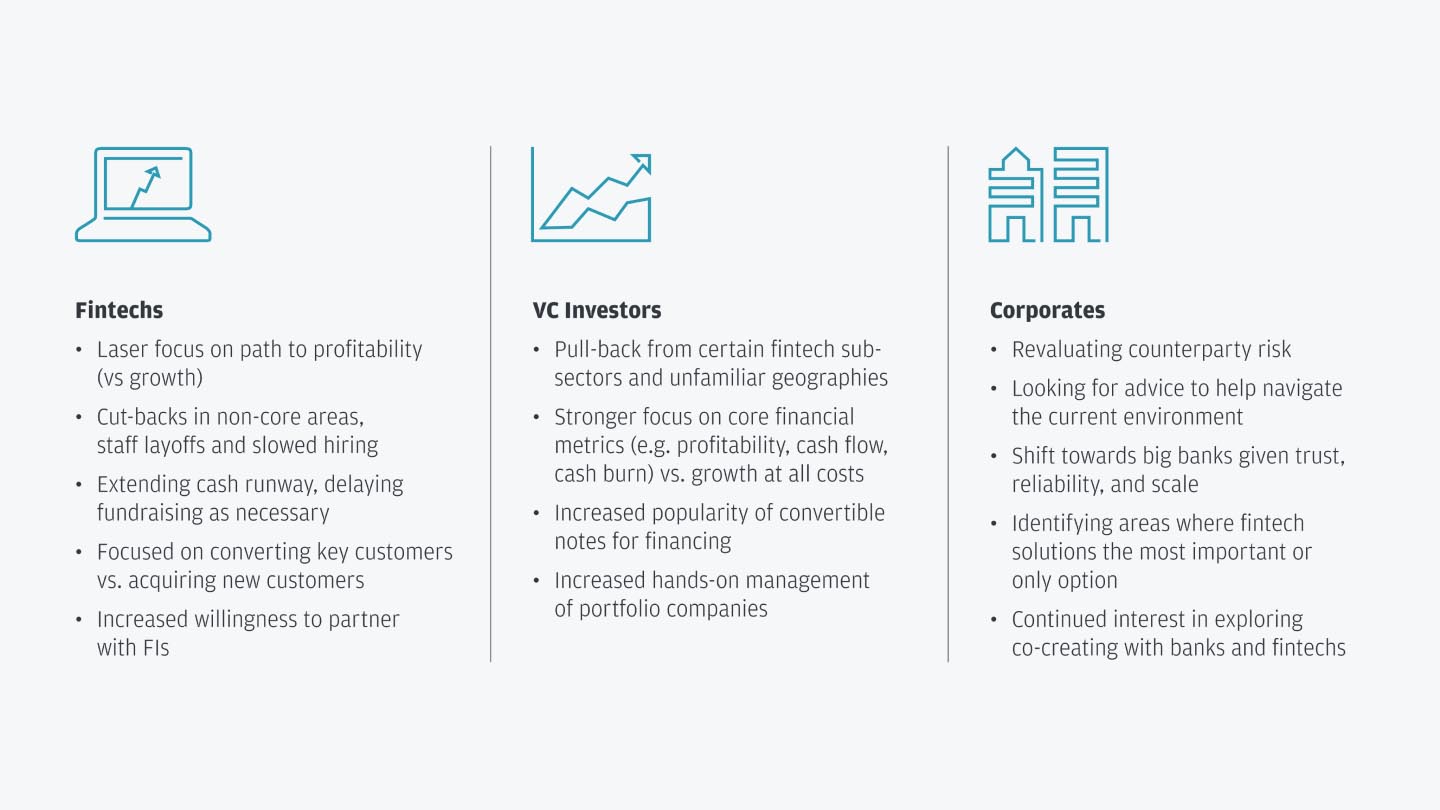

Fintechs and VC investors have adjusted their practices to navigate this turbulent environment (see table below). How might corporates who work with fintechs navigate this moment? How can banks help merchants and corporates safely partner with fintechs to deliver cutting edge solutions to their customers?

How fintech stakeholders are navigating this environment

J.P. Morgan Payments believe it’s our responsibility to exceed the expectations of our customers and their clients in a rapidly changing landscape. That’s why we’re doubling down on partnerships and creating one of the world’s largest treasury and payments ecosystem.

Helping businesses navigate fintech partnerships

Bank and fintech partnerships can play a critical role in scaling new innovations. Despite the recent reset in fintech, the pace of innovation continues to accelerate and emerging technologies continue to advance rapidly; the increased focus on AI following the release of ChatGPT is a good example of this.

While payments is a global business, different payment preferences and schemes make it a local business as well. Corporates and merchants expect their treasury and payments providers to strike the balance between providing global solutions while catering to local customer needs and expectations. No single provider can be expected to lead continuous change organically while addressing the complexities of the industry. While many fintechs are facing challenges in the current environment, many others are prospering and using innovative approaches to overcome age-old industry pain points.

Banks are uniquely positioned to help corporates and merchants navigate the ever-changing landscape, bring innovative, scalable, and secure solutions to market, and reduce the risk of working directly with fintechs. Most corporates and merchants we speak with prefer to access fintech solutions through their existing bank providers.

How payments ecosystems can thrive with banks

Effective ecosystems play a central role in helping corporations discover holistic solutions that help drive short-and long-term growth. Treasury and payment solutions are not siloed features, instead they are integral components of a company’s business model and, as such, must work seamlessly with a corporate’s existing software system. And in this digital era, where APIs are the norm, pre-integration and ease of implementation are critical.

Payments is also fundamentally a network business, and ecosystems can play an important role in driving the adoption of new payment methods. Effective ecosystems can also play an important role in spurring new innovations, as has been evidenced by the software ecosystems that have been championed by many large technology companies.

As trusted partners of both corporates and fintechs, banks are the natural orchestrators of successful treasury and payments ecosystems. The vast majority of our clients leverage J.P. Morgan Payments solutions in concert with third-party hardware and software: treasury management systems, enterprise resource planning software providers, point-of-sale hardware solutions, payment gateways, and more. This empowers our clients to scale efficiently by tapping into our curated ecosystem and strong relationships.

The J.P. Morgan Payments approach

Consider treasury and payments platform. We partner with innovative fintechs to launch new J.P. Morgan Payments solutions, have developed an ecosystem of hundreds of third parties that are integrated with J.P. Morgan Payments, and we regularly invest to reinforce strategic partners & acquire key capabilities.

Our dedicated global Payments Partnership team offers deep local expertise in payments and engagement in the fintech ecosystem, focusing on identifying, executing, and managing our strategic partnerships. We are passionate about co-creation, facilitating collaboration between clients, fintech, and J.P. Morgan to accelerate the innovation process and design better solutions.

Working with fintechs can involve risk, especially in the current market environment. We believe our structured partnership process balances agility, speed, innovation, and risk management. We focus strongly on driving long-term success through multi-layered partnership governance starting at the Founder / CEO level, the ability to make strategic equity investments, and take Board seats.

Despite the recent turmoil in fintech, we believe our commitment and approach to partnerships places us in an ideal position to help merchants and corporations harness the power of innovative fintechs through the safety, security, and scalability of a large global bank.

Talk to us about our J.P. Morgan Payments partnerships and discover our ecosystem of integration partners at J.P. Morgan Payments Partner Network.