For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Insights

- Payments

- Embedded Finance & Banking-as-a-Service (BaaS)

- Evolving the connected mobility economy

Evolving the Connected Mobility Economy

“The journey to a connected economy starts here, and the transformation will change everything.” The infographic shows how connected vehicles are becoming an effective way to pay for goods and services.

The top Illustration shows a portion of a globe with icons superimposed, representing different types of apps for shopping and paying for items. Headline titled “Evolving the Connected Mobility Economy” Smaller headline underneath says, “The journey to a connected economy starts here, and the transformation will change everything.”

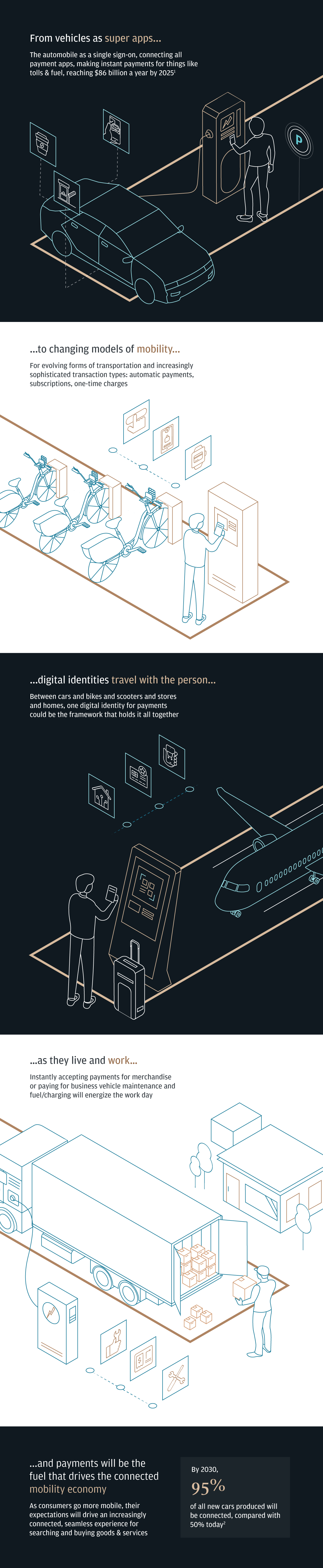

The next illustration shows a car hooked up to a charging station, and icons superimposed representing paying for the charging, food and travel purchases. The first text box has a small headline that reads “From vehicles as super apps…” with supporting text underneath that reads “The automobile as a single sign-on, connecting all payment apps, making instant payments for things like tolls and fuel, reaching 86 billion dollars a year by 2025.” The statistic comes from Juniper Research, September 2020. ‘In-vehicle payment spend to exceed $86 billion in 2025, as partnerships improve ecosystem viability.’

Available at: https://www.juniperresearch.com/press/in-vehicle-payments-spend-to-exceed-86-billion. Accessed August 2022.1

The next illustration shows electric bikes in a charging station with a person renting them. The smaller headline says “…to changing models of mobility…” with supporting text underneath that reads “For evolving forms of transportation and increasingly sophisticated transaction types: automatic payments, subscriptions, one-time charges”

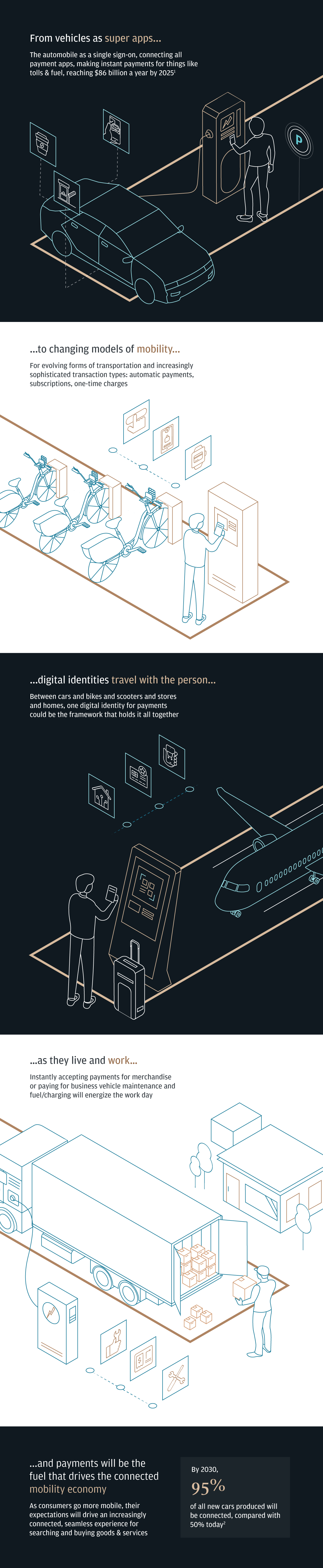

The next illustration shows a person at an airport at a kiosk next to a plane, showing various things they can purchase. The smaller headline reads “…digital identities travel with the person…” and the supporting text underneath reads “Between cars and bikes and scooters and stores and homes, one digital identity for payments could be the frame that holds it all together.”

The next illustration shows an electric truck being charged, with a person unloading merchandise out of the back. The continuing small headline reads “…as they live and work…” and the supporting text underneath reads “Instantly accepting payments for merchandise or paying for business vehicle maintenance and fuel or charging will energize the work day.”

The final block of text has a headline that reads, “…and payments will be the fuel that drives the connected mobility economy” with supporting text underneath that reads, “As consumers go more mobile, their expectations will drive an increasingly connected, seamless experience for searching and buying goods and services.”

Next to this is a statistic that reads, By 2030, 95% of all new cars produced will be connected, compared with 50% today. The statistic comes from McKinsey, February 2021. ‘Unlocking the full life-cycle value from connected-car data.’

Available at: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/unlocking-the-full-life-cycle-value-from-connected-car-data. Accessed August 2022.2

Contact your J.P. Morgan representative to learn more about how we can support your business.

References

Juniper Research, September 2020. ‘In-vehicle payment spend to exceed $86 billion in 2025, as partnerships improve ecosystem viability.’ Available at: https://www.juniperresearch.com/press/in-vehicle-payments-spend-to-exceed-86-billion. Accessed August 2022.

McKinsey, February 2021. ‘Unlocking the full life-cycle value from connected-car data.’

Available at: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/unlocking-the-full-life-cycle-value-from-connected-car-data. Accessed August 2022.

J.P. Morgan, JPMorgan, and JPMorgan Chase are marketing names for certain businesses of JPMorgan Chase & Co. and its subsidiaries worldwide (including without limitation all and any joint-ventures as well as companies or enterprises in which JPMorgan Chase & Co. holds a direct or indirect participation) (collectively, “JPMC”). Products or services may be marketed and/or provided by commercial banks such as JPMorgan Chase Bank, N.A., securities, payments, or other non-banking affiliates or other JPMC entities (including without limitation all and any joint-ventures as well as companies or enterprises in which JPMorgan Chase & Co. holds a direct or indirect participation). J.P. Morgan Mobility Payments Solutions S.A. provides payments platform solutions for the auto industry.

Related insights

Payments

How Klook optimized cross-border & FX payments with J.P. Morgan

Jan 28, 2026

With a tailored API-powered FX platform from J.P. Morgan Payments, Klook now delivers streamlined, real-time cross-border payments—empowering travelers and merchants worldwide.

Payments

J.P. Morgan Payments and Docker foster autonomy and problem-solving within developer communities

Jan 15, 2026

Developers need easy and secure access to a rich ecosystem of tools and solutions in order to approach and solve challenges.

Payments

Strategic insights: Navigating the future of payments

Jan 07, 2026

Explore how emerging payment technologies—from real-time rails to biometrics—are reshaping business agility, security and client experience.

Payments

Cargill and J.P. Morgan Payments transform agricultural payments in Brazil

Dec 15, 2025

Learn how the global agricultural leader is supporting financial stability for farmers with real-time payments.

Payments

We’re putting developers in the driver’s seat

Dec 05, 2025

Discover the J.P. Morgan Payments Developer Portal, where you can access APIs, tools, and resources to help build secure and robust treasury and payment solutions.

Payments

Plan for the holiday season ahead: How shoppers are redefining retail expectations

Nov 21, 2025

Recent Customer Insights data shows Gen Z is driving new trends in retail, payment preferences and omnichannel shopping. Retailers who adapt to these evolving habits may be better positioned to benefit from future spending this holiday season.

Payments

Bridging the gap: G20's vision for inclusive and efficient global payments

Nov 18, 2025

The G20 and Financial Stability Board, supported by key industry players like J.P. Morgan, are focused on improving cross-border payments by making them faster, cheaper, more transparent and more accessible.

Payments

JDS Industries unlocks 10% savings and 50% faster processing with J.P. Morgan

Nov 05, 2025

Discover how JDS Industries leveraged J.P. Morgan Commerce Solutions to streamline operations and drive strategic growth.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.