Key takeaways

- While 3PM offers significant benefits for treasurers, it also brings with it obligations and requirements, especially when it is comprised of multiple currencies.

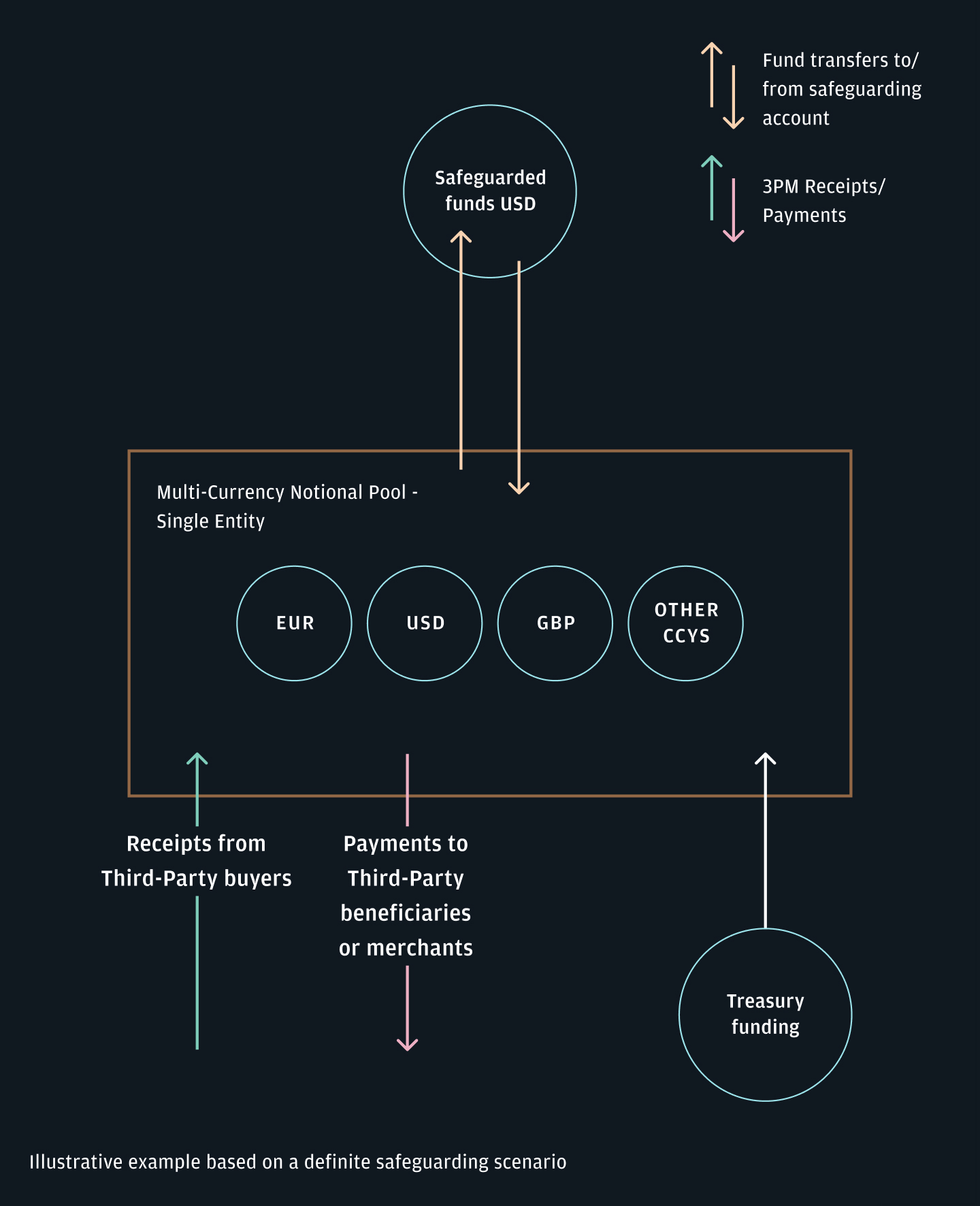

- Multicurrency notional pooling provides account structuring, which is compatible to clients’ segregation and safeguarding obligations.

- 3PM notional pooling is expected to be widely adopted thanks to the efficiencies it delivers.

With the shift to an online, digital-first economy, 3PM has sparked an exciting new frontier of extended responsibility and immense opportunity for treasurers. At the same time, it is adding intricacies for treasury management, as it is different from handling corporate cash, which carries additional obligations.

In response, liquidity techniques, including notional pooling, need to be appropriately configured to comply with the applicable safeguarding requirements. With a 3PM-specific design, it is possible to integrate corporate and third-party fund flows into a single multicurrency notional pooling arrangement in full compatibility with safeguarding requirements. The result is the ability to continue to operate at maximum efficiency even when new obligations are concerned, achieving key benefits such as:

- Visibility and control that allow for managing and efficiently forecasting for corporate versus 3PM payment flows

- Improved functionality in managing diverse fund flows across multiple currencies originating from 3PM activities

- Tailored design that is congruent with segregation and safeguarding obligations

Navigating the changing environment and finding new revenue streams, together

J.P. Morgan is an industry leader, and we understand that managing the 3PM landscape across markets involves different licensing requirements and safeguarding regulations. That’s why we brought together our vast expertise, knowledge and capabilities to help businesses, like yours, navigate smoothly through this changing environment. The result is an innovative liquidity solution which creates a multicurrency management tool specifically designed for the management of 3PM payments flows. Together, we can implement this first-of-its-kind solution that offers improved 3PM liquidity efficiency, while enabling you to manage your safeguarding requirements.

Drive growth with multicurrency 3PM notional pooling

- Operate in multiple currencies within a single notional pooling structure, thereby managing a single net currency position.

- Execute cross-currency position management independently from net pool funding and safeguarding.

- Support operating level activity monitoring with the benefit of central control on funding and safeguarding.

- Manage up to 33 currencies in the same pool.

- Access daily reporting on the performance of the pool, including interest conditions, FX rates, currency positions and more.

Explore the opportunity

Take, for example, a global company that operates a digital commerce platform, connecting buyers with merchants of goods or services that do not originate entirely — or at all — from them. It handles funds denominated in various currencies that belong to third parties (i.e., the merchants) from numerous jurisdictions and countries around the globe.

In order for the company to consolidate multiple currencies within a single liquidity structure, enable netting and keep a single liquidity position across the fund flows, they can rely on the 3PM notional pooling solution. This tailored product design centers on the compatibility between managing safeguarding obligations and the operational benefits of notional pooling. In short, it allows businesses, like yours, to run at optimal efficiency across multiple currencies of 3PM flows.

3PM notional pooling: How it works

The result is the creation of a multicurrency ecosystem for the management and security of 3PM payments flows. It’s an exciting way to meet the demands for better organization of these funds in a multicurrency notional pooling solution, thereby helping your business to thrive.

icon

Loading...