For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Insights

- Treasury

- Liquidity Management

- 2025 M&A Holdback Escrow Study: Year-over-year trends and highlights

Corporate mergers and acquisitions. If you’re the buyer, the risks can be significant. Enter M&A holdback escrows: the risk mitigation tool that allows you as the buyer to retrieve funds should problems arise during a purchase.

Now, J.P. Morgan has gathered data from more than 2,400 transactions from over the past three years to produce the 2025 M&A Holdback Escrow Study. From end to end, it offers you an analysis of:

- Trends and characteristics of M&A holdback escrows

- Behavioral differences between financial and strategic counterparties

- Insights into dispute resolution in the holdback escrow market

…Due to market uncertainty, escrow continued to be heavily used by companies in need of extensive, flexible and low-cost claim coverage.

Are businesses like yours taking advantage of holdback escrows?

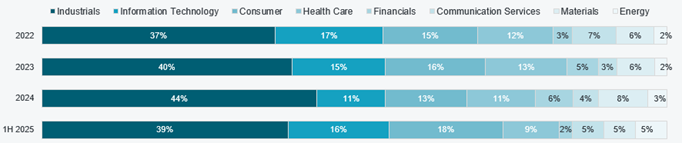

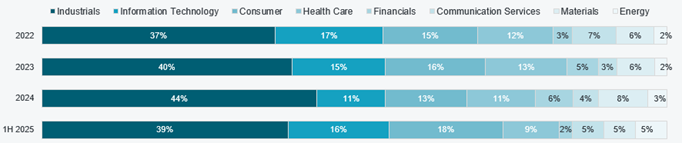

What were the target sectors for M&A? Based on our data, here’s what we discovered:

Image describes dominant mergers and acquisitions sectors.

The four dominant sectors for M and A were industrials, information technology, healthcare, and consumer.

The largest increase versus the prior year was in information technology and consumer at five percent.

The largest decrease over the forty-two month period was in information technology at three percent.

This is a horizontal bar chart with 4 rows for years 2022, 2023, 2024, and first half 2025.

2022 shows 37 percent industrials. 17 percent information technology. 15 percent consumer. 12 percent healthcare. 3 percent financials. 7 percent communication services. 6 percent materials. 2 percent energy.

2023 shows 40 percent industrials. 15 percent information technology. 16 percent consumer. 13 percent healthcare. 5 percent financials. 3 percent communication services. 6 percent materials. 2 percent energy.

2024 shows 44 percent industrials. 11 percent information technology. 13 percent consumer. 11 percent healthcare. 6 percent financials. 4 percent communication services. 8 percent materials. 3 percent energy.

First half 2025 shows 39 percent industrials. 16 percent information technology. 18 percent consumer. 9 percent healthcare. 2 percent financials. 5 percent communication services. 5 percent materials. 5 percent energy.

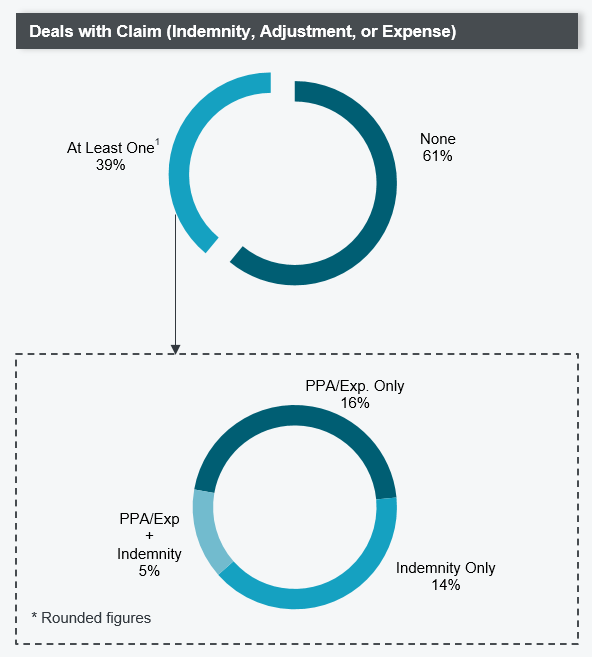

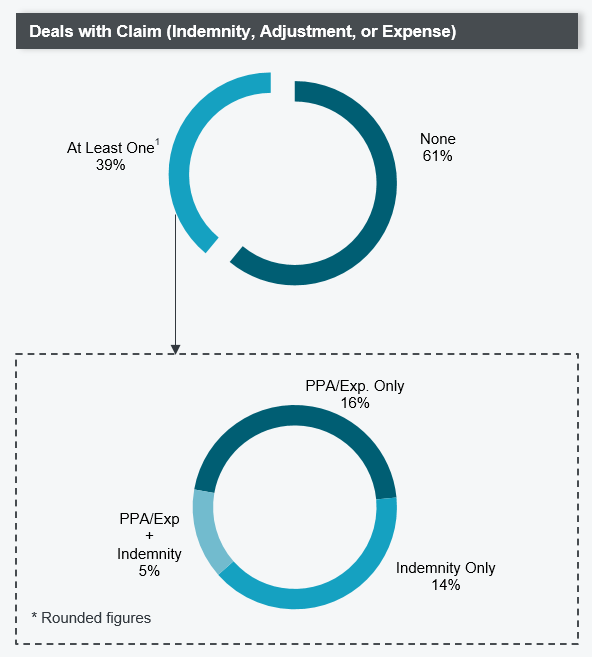

Explore the claim facts

Covenant breaches. Post-closing purchase price adjustments. Pension underfunding issues. Unpaid taxes. Environmental liabilities. These are just a few of the risks that can be alleviated with escrow claim coverage. And it’s particularly important for you as the buyer seeking to mitigate risk during acquisition.

39%: Deals with at least one claim (indemnity, purchase price adjustment or expense)

Chart title: Deals with Claim (Indemnity, Adjustment or Expense)

There are two pie charts. The chart on top has two slices showing none at 61 percent and at least one at 39 percent.

The chart on the bottom expands on the items that fall under at least one at 39 percent.

There are 3 slices. PPA/EXP plus Indemnity at 5 percent, PPA/Exp Only at 16 percent, and Indemnity Only at 14 percent.

There is a note that these are rounded figures.

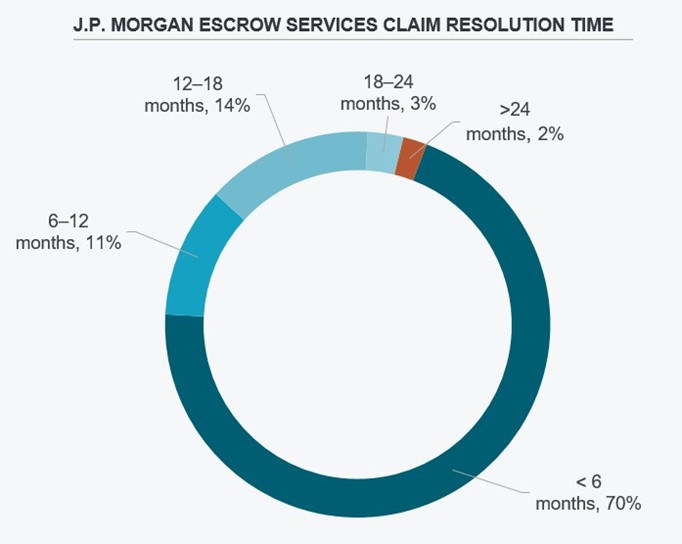

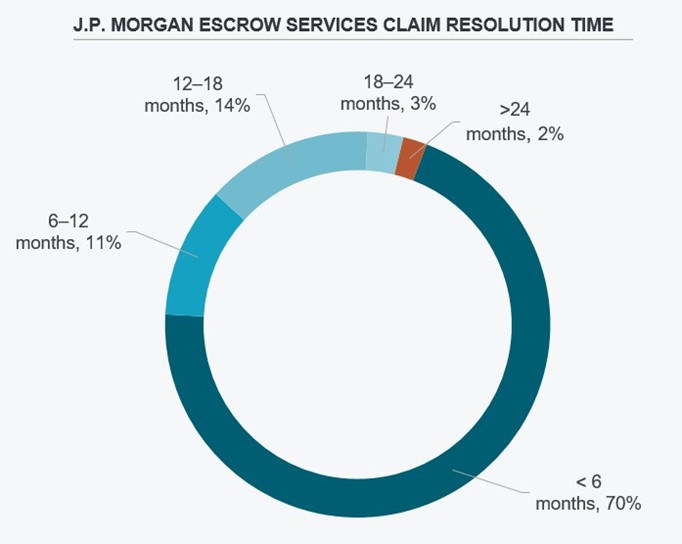

70%: Claims received that were resolved in less than six months

81%: Resolved within 12 months - this resolution speed is faster on average than representations and warranties insurance1

Chart title: J.P. Morgan Escrow Services Claim Resolution Time

There is one pie chart with 5 slices. 70 percent at less than 6 months. 11 percent at 6 to 12 months. 14 percent at 12 to 18 months. 3 percent at 18 to 24 months. 2% at over 24 months.

Contact our Escrow services professionals today for help with your M&A, debt capital markets financing, litigation and more.

Experience faster, more streamlined engagement, tracking and management of escrow accounts with our Escrow Direct online platform.

References

Source: Lowenstein Sandler LLP–R&W Insurance Claims Report 2023

Not all products and services are available in all geographic areas. Eligibility for particular products and services is subject to final determination by JPMC and or its affiliates. This material does not constitute a commitment by any JPMC entity to extend or arrange credit or to provide any other products or services and JPMC reserves the right to withdraw at any time. All services are subject to applicable laws, regulations, and applicable approvals and notifications.

Notwithstanding anything to the contrary, the statements in this material are confidential and proprietary to JPMC and are not intended to be legally binding. Any products, services, terms or other matters described herein (other than in respect of confidentiality) are subject to, and superseded by, the terms of separate legally binding documentation and/or are subject to change without notice. J.P. Morgan is the marketing name for J.P. Morgan Payments business of JPMorgan Chase Bank, N.A. and its affiliates worldwide.

JPMorgan Chase Bank, N.A. Member FDIC. Deposits held in non-U.S. branches are not FDIC insured.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.

Related insights

Treasury

9 practical steps for setting up a regional treasury center

Feb 02, 2026

Establishing a regional treasury center (RTC) is a strategic imperative for multinational businesses. The process is complex, but manageable. Get started with our guide.

Treasury

A strategic planning framework for Corporate Treasury to remain pragmatic as well as forward-looking, to capture key drivers of innovation and growth in the years to come

Treasury

Connect ERP and treasury systems for automated workflows

Jan 29, 2026

Eliminate manual data entry and payment delays by integrating your ERP with treasury systems. Get real-time cash visibility and automated workflows that reduce errors.

Treasury

Understanding the cash application process

Jan 12, 2026

Optimizing your cash application process can help fuel your company’s success. Find out how.

Treasury

Enhance your corporate treasury's risk management with FX exposure netting solutions

Nov 24, 2025

Discover how virtual netting can provide a scalable framework for currency risk management, optimizing treasury operations and driving financial performance in a complex global landscape.

Treasury

The check is dead, long live the check

Nov 13, 2025

Wholesale lockbox may not mean much to the average consumer, but to businesses across the US, this method of check and payment processing is a critical part of driving business efficiencies and profitability.

Treasury

Your cash conversion cycle—what it is and how to optimize it

Oct 14, 2025

Discover how the cash conversion cycle impacts business efficiency and learn strategies to optimize cash flow management.

Treasury

Being resilient relies on connected treasury tools

Oct 10, 2025

In the face of a variety of obstacles, businesses are looking to improve their resiliency. Having a trusted treasury partner can help.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.