For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Insights

- Payments

- Payments Security & Trust

- Staying ahead of payments fraud and cybersecurity threats: Trends to watch

Digital payments, social engineering and business email compromise (BEC) are all payments fraud trends on the rise. Read on to explore the latest insights from the Association for Financial Professionals (AFP) 18th Annual Payments Fraud Survey that details these trends with tips to keep your organization safe.

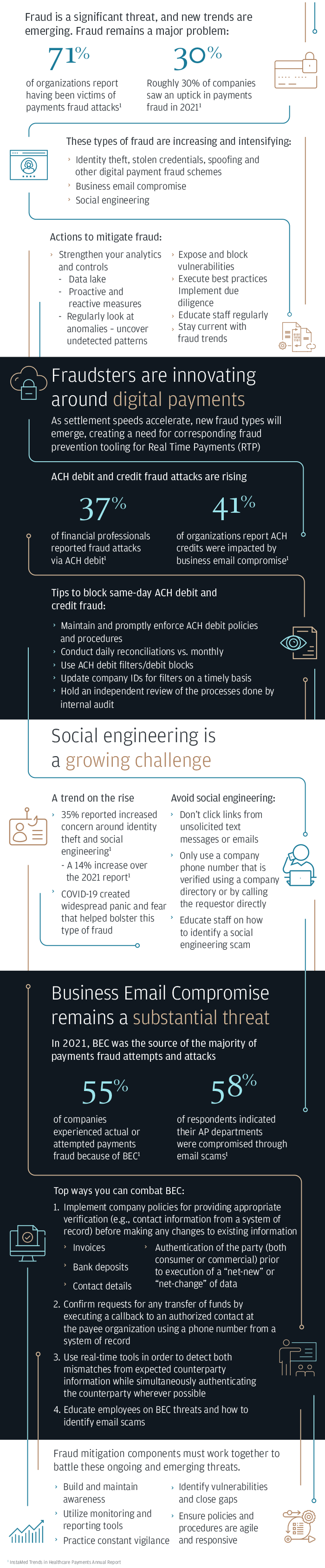

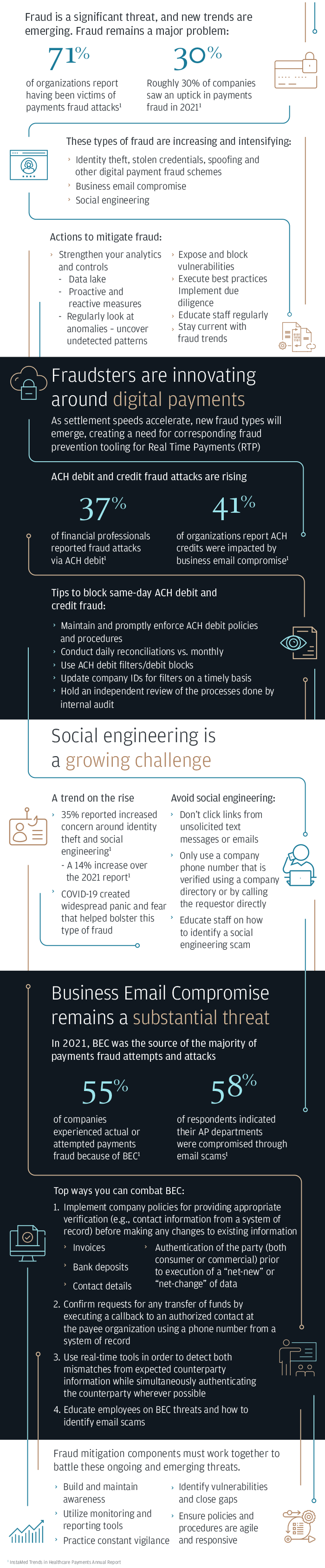

Fraud is a significant threat, and new trends are emerging. Fraud remains a major problem:

- 71% of organizations report having been victims of payments fraud attacks1

- 30% Roughly 30% of companies saw an uptick in payments fraud in 20211

These types of fraud are increasing and intensifying:

- Identity theft, stolen credentials, spoofing and other digital payment fraud schemes

- Business email compromise

- Social engineering

Actions to mitigate fraud:

- Strengthen your analytics and controls

Data lake

Proactive and reactive measures

Regularly look at anomalies – uncover undetected patterns

- Expose and block vulnerabilities

- Execute best practices Implement due diligence

- Educate staff regularly

- Stay current with fraud trends

Fraudsters are innovating around digital payments

As settlement speeds accelerate, new fraud types will emerge, creating a need for corresponding fraud prevention tooling for Real Time Payments (RTP)

ACH debit and credit fraud attacks are rising

- 37% of financial professionals reported fraud attacks via ACH debit1

- 41% of organizations report ACH credits were impacted by business email compromise1

Tips to block same-day ACH debit and credit fraud:

- Maintain and promptly enforce ACH debit policies and procedures

- Conduct daily reconciliations vs. monthly

- Use ACH debit filters/debit blocks

- Update company IDs for filters on a timely basis

- Hold an independent review of the processes done by internal audit

Social engineering is a growing challenge

A trend on the rise

- 35% reported increased concern around identity theft and social engineering1

A 14% increase over the 2021 report1

- COVID-19 created widespread panic and fear that helped bolster this type of fraud

Avoid social engineering:

- Don’t click links from unsolicited text messages or emails

- Only use a company phone number that is verified using a company directory or by calling the requestor directly

- Educate staff on how to identify a social engineering scam

Business Email Compromise remains a substantial threat

In 2021, BEC was the source of the majority of payments fraud attempts and attacks

- 55% of companies experienced actual or attempted payments fraud because of BEC1

- 58% of respondents indicated their AP departments were compromised through email scams1

Top ways you can combat BEC:

1. Implement company policies for providing appropriate verification (e.g., contact information from a system of record) before making any changes to existing information

- Invoices

- Bank deposits

- Contact details

- Authentication of the party (both consumer or commercial) prior to execution of a “net-new” or “net-change” of data

2. Confirm requests for any transfer of funds by executing a callback to an authorized contact at the payee organization using a phone number from a system of record

3. Use real-time tools in order to detect both mismatches from expected counterparty information while simultaneously authenticating the counterparty wherever possible

Educate employees on BEC threats and how to identify email scams

Fraud mitigation components must work together to battle these ongoing and emerging threats.

- Build and maintain awareness

- Utilize monitoring and reporting tools

- Practice constant vigilance

- Identify vulnerabilities and close gaps

- Ensure policies and procedures are agile and responsive

1InstaMed Trends in Healthcare Payments Annual Report

For more fraud insights visit: jpmorgan.com/fraudprotection

View the full Association for Financial Professionals 18th Annual Payments Fraud Survey results here.

Contact your local J.P. Morgan representative to learn more about trends in payments fraud and cybersecurity threats.

All rights reserved. The statements herein are confidential and proprietary and not intended to be legally binding. Not all products and services are available in all geographical areas.

Visit jpmorgan.com/paymentsdisclosure for further disclosures and disclaimers related to this content.

Related insights

Payments

How Klook optimized cross-border & FX payments with J.P. Morgan

Jan 28, 2026

With a tailored API-powered FX platform from J.P. Morgan Payments, Klook now delivers streamlined, real-time cross-border payments—empowering travelers and merchants worldwide.

Payments

J.P. Morgan Payments and Docker foster autonomy and problem-solving within developer communities

Jan 15, 2026

Developers need easy and secure access to a rich ecosystem of tools and solutions in order to approach and solve challenges.

Payments

Strategic insights: Navigating the future of payments

Jan 07, 2026

Explore how emerging payment technologies—from real-time rails to biometrics—are reshaping business agility, security and client experience.

Payments

Cargill and J.P. Morgan Payments transform agricultural payments in Brazil

Dec 15, 2025

Learn how the global agricultural leader is supporting financial stability for farmers with real-time payments.

Payments

We’re putting developers in the driver’s seat

Dec 05, 2025

Discover the J.P. Morgan Payments Developer Portal, where you can access APIs, tools, and resources to help build secure and robust treasury and payment solutions.

Payments

Plan for the holiday season ahead: How shoppers are redefining retail expectations

Nov 21, 2025

Recent Customer Insights data shows Gen Z is driving new trends in retail, payment preferences and omnichannel shopping. Retailers who adapt to these evolving habits may be better positioned to benefit from future spending this holiday season.

Payments

Bridging the gap: G20's vision for inclusive and efficient global payments

Nov 18, 2025

The G20 and Financial Stability Board, supported by key industry players like J.P. Morgan, are focused on improving cross-border payments by making them faster, cheaper, more transparent and more accessible.

Payments

JDS Industries unlocks 10% savings and 50% faster processing with J.P. Morgan

Nov 05, 2025

Discover how JDS Industries leveraged J.P. Morgan Commerce Solutions to streamline operations and drive strategic growth.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.