For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Insights

- Payments

- Payments Data & Intelligence

- Eight ways to balance revenue and fraud mitigation priorities

By Jenifer Smith

Product Manager, J.P. Morgan

By Jenifer Smith

The financial impact of fraud on U.S. merchants continues to grow, with the number of attempted and successful fraud attacks on the rise from 2019 to 2020.

Such are the findings of a report from research firm Nexis Lexis who interviewed hundreds of retail and e-commerce executives in the U.S. and Canada. In addition to an increase in fraud attacks, a merchant's costs to remediate an attack increased 7.3% from 2019 to 2020—now every dollar of fraud is estimated to cost a merchant $3.36.

With these stark statistics as a backdrop, J.P. Morgan's fraud experts share eight best practices for avoiding, detecting and mitigating card-based payment fraud.

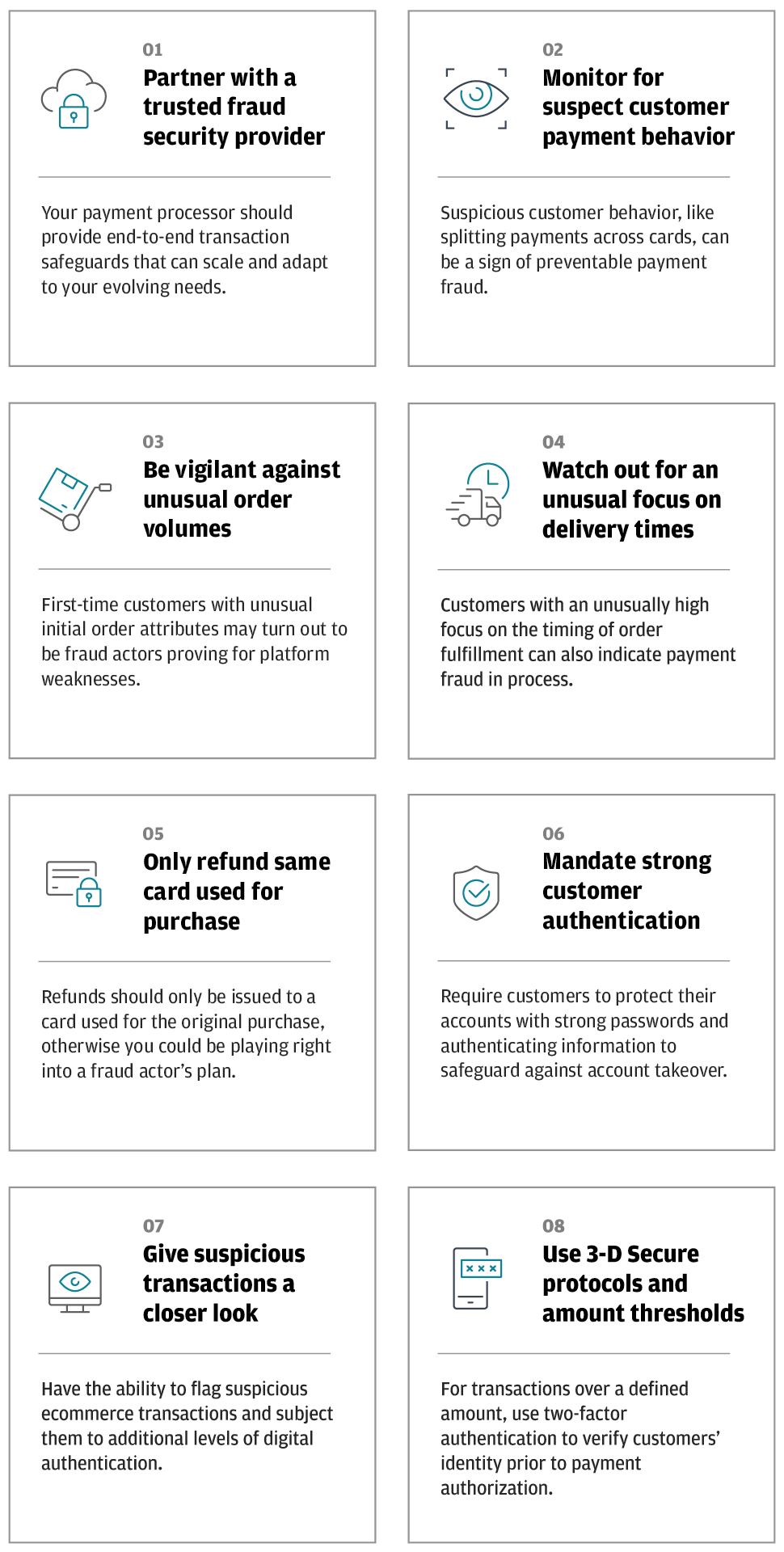

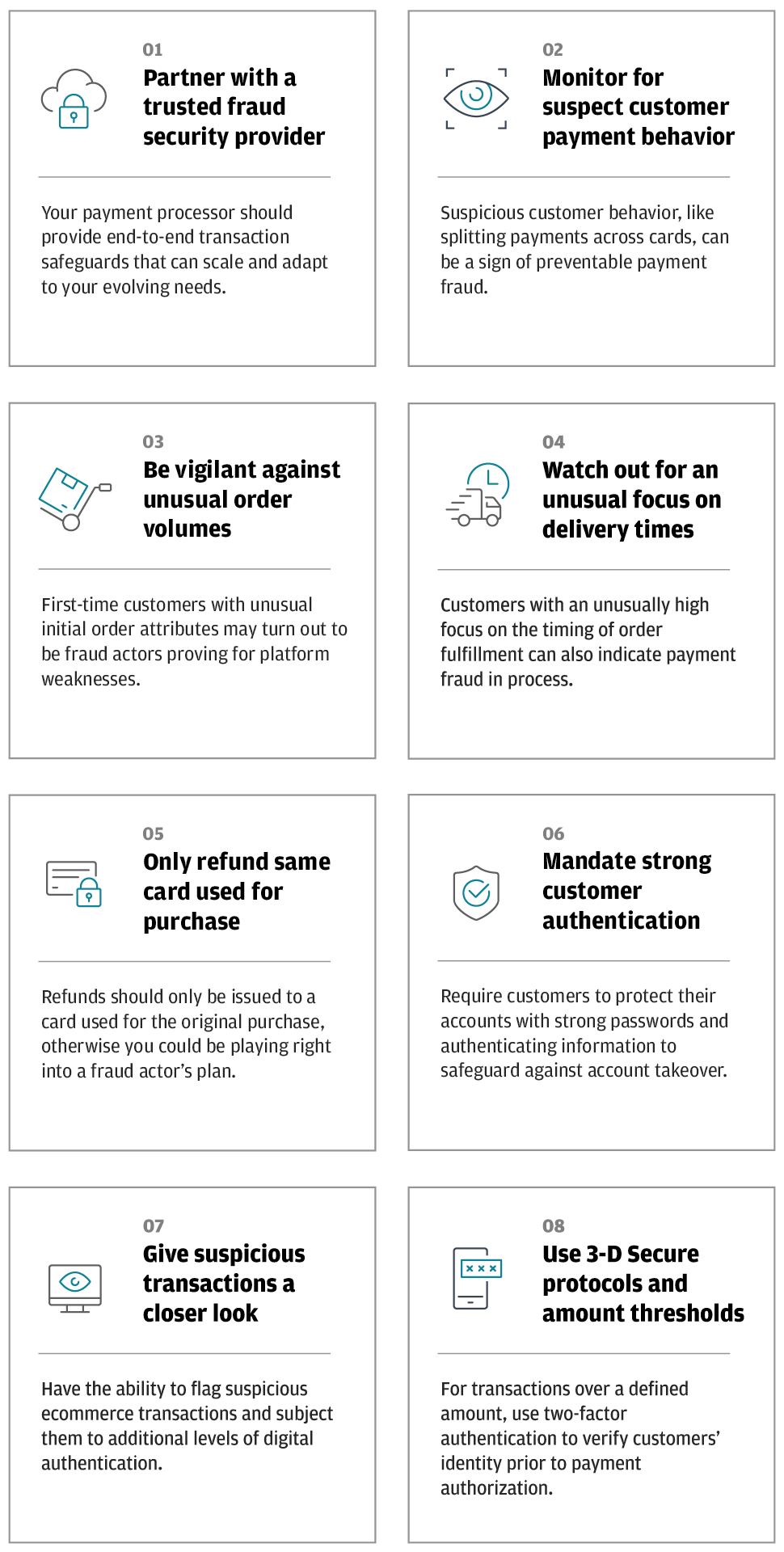

Here are eight ways merchants can keep revenue and fraud mitigation priorities in balance:

01 Partner with a trusted fraud security provider.

Your payment processor should provide end-to-end transaction safeguards that can scale and adapt to your evolving needs.

02 Monitor for uncommon customer payment behavior.

Suspicious customer behavior, like splitting payments across cards, can be a sign of preventable payment fraud.

03 Be vigilant against unusual order volumes.

First-time customers with unusual initial order attributes may turn out to be fraud actors proving for platform weaknesses.

04 Watch out for an unusual focus on delivery times.

Customers with an unusually high focus on the timing of order fulfillment can also indicate payment fraud in process.

05 Only refund same card used for purchase.

Refunds should only be issued to a card used for the original purchase, otherwise you could be playing right into a fraud actor’s plan.

06 Mandate strong customer authentication.

Require customers to protect their accounts with strong passwords and authenticating information to safeguard against account takeover.

07 Give suspicious transactions a closer look.

Have the ability to flag suspicious ecommerce transactions and subject them to additional levels of digital authentication.

08 Use 3-D Secure protocols and amount thresholds.

For transactions over a defined amount, use two-factor authentication to verify customer’s identity prior to payment authorization.

JENIFER SMITH, PRODUCT MANAGER, J.P. MORGAN

Jenifer has been in the payments industry for more than 20 years, with the majority of those years dedicated to product management across a range of solutions including reporting, point-of-sale terminals, mobile payment applications and currency services. Most recently at J.P. Morgan, Jenifer has overseen the Safetech encryption and tokenization suite of tools with a focus on maximizing merchant benefits as the digitization of sales channels rapidly accelerates.

Need a turnkey fraud solution? Safetech Fraud Tools delivers.

Using artificial intelligence and machine learning, our powerful fraud mitigation solution features multi-layer device fingerprinting, proxy piercing, dynamic order linking, dynamic risk scoring, custom rules management and auto-decisioning.

Safetech's Identity Trust Global Network and machine learning algorithms can immediately alert merchants of signs of card testing attacks. Best of all, Safetech can be implemented quickly and rapidly provide e-commerce fraud protection.

To learn more, please contact your J.P. Morgan representative.

Related insights

Payments

How Klook optimized cross-border & FX payments with J.P. Morgan

Jan 28, 2026

With a tailored API-powered FX platform from J.P. Morgan Payments, Klook now delivers streamlined, real-time cross-border payments—empowering travelers and merchants worldwide.

Payments

J.P. Morgan Payments and Docker foster autonomy and problem-solving within developer communities

Jan 15, 2026

Developers need easy and secure access to a rich ecosystem of tools and solutions in order to approach and solve challenges.

Payments

Strategic insights: Navigating the future of payments

Jan 07, 2026

Explore how emerging payment technologies—from real-time rails to biometrics—are reshaping business agility, security and client experience.

Payments

Cargill and J.P. Morgan Payments transform agricultural payments in Brazil

Dec 15, 2025

Learn how the global agricultural leader is supporting financial stability for farmers with real-time payments.

Payments

We’re putting developers in the driver’s seat

Dec 05, 2025

Discover the J.P. Morgan Payments Developer Portal, where you can access APIs, tools, and resources to help build secure and robust treasury and payment solutions.

Payments

Plan for the holiday season ahead: How shoppers are redefining retail expectations

Nov 21, 2025

Recent Customer Insights data shows Gen Z is driving new trends in retail, payment preferences and omnichannel shopping. Retailers who adapt to these evolving habits may be better positioned to benefit from future spending this holiday season.

Payments

Bridging the gap: G20's vision for inclusive and efficient global payments

Nov 18, 2025

The G20 and Financial Stability Board, supported by key industry players like J.P. Morgan, are focused on improving cross-border payments by making them faster, cheaper, more transparent and more accessible.

Payments

JDS Industries unlocks 10% savings and 50% faster processing with J.P. Morgan

Nov 05, 2025

Discover how JDS Industries leveraged J.P. Morgan Commerce Solutions to streamline operations and drive strategic growth.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.