Aventura – Aventura Mall

Aventura – Biscayne and 182nd

Boca Raton – Boca Raton Downtown

Boca Raton – Mission Bay Boca Raton

Boca Raton – Yamato and Jog

Boynton Beach – W Boynton Beach Blvd and Lyons Rd

Cooper City – Cooper City

Coral Gables – Coral Gables

Coral Springs – North Coral Springs

Deerfield Beach – East Hillsboro

Delray Beach – Delray Marketplace

Delray Beach – Linton and Federal Hwy

Jupiter – Jupiter Hwy One

Key Biscayne – Key Biscayne

Miami – Brickell Ave and SE 15th Rd

Miami – Coconut Grove

Miami Beach – Alton Rd

Miami Beach – Collins Ave and 69th St

Palm Beach – Palm Beach

Palm Beach – Palm Beach Gardens

Plantation – Plantation

Sunny Isles Beach – Sunny Isles Beach

Weston – Weston

Welcome to J.P. Morgan Private Client

J.P. Morgan Private Client1 is more than a financial partnership—it’s a relationship bringing you the breadth of J.P. Morgan’s expertise and extensive banking and wealth management offerings.

Visit us at one of our locations shown below to learn more about J.P. Morgan Private Client:

Houston – Houston Main

Houston – Kirby

Houston – Bay Area Blvd

Houston – Bellaire Houston

Houston – West University

Houston – Memorial Villages

Houston – Tanglewood Houston

Katy – Cinco Ranch

Kingwood – Kings Crossing

Missouri City – Colony Lakes

Sugar Land – New Territory

Sugar Land – Sugar Land

Sugar Land – Sweetwater

Sugar Land – University and LJ Pkwy

The Woodlands – Alden Bridge

The Woodlands – Six Pines at Market St

Tomball – Creekside Park

Ardsley – Ardsley

Bronxville – Bronxville Station

Croton on Hudson – Croton on Hudson

Eastchester – Eastchester

Larchmont – Larchmont

Mount Kisco – Kirby Plaza

New City – New City New Hempstead

New Rochelle – Quaker Ridge

New York City – Canal St

New York City – Columbus Circle West

New York City – Madison Ave and 56th St

New York City – Rockefeller

Rye – Rye

Scarsdale – Scarsdale Popham Rd

Scarsdale – Vernon Hills Scarsdale

Somers – Somerstown Center

White Plains – White Plains Mamaroneck Ave

Del Mar - Camino Del Mar and 11th St

Encino – Ventura Blvd and Libbit Ave

Manhattan Beach – Sepulveda and 6th St

Menlo Park – Menlo Park Sand Hill

Mountain View – San Antonio

Napa – Napa

Palo Alto – El Camino Real and Cambridge Ave

San Diego – San Diego Downtown Center

San Francisco - Laurel Village

San Francisco – Pine and Front

Walnut Creek – Walnut Creek Growers Sq

Locations coming soon

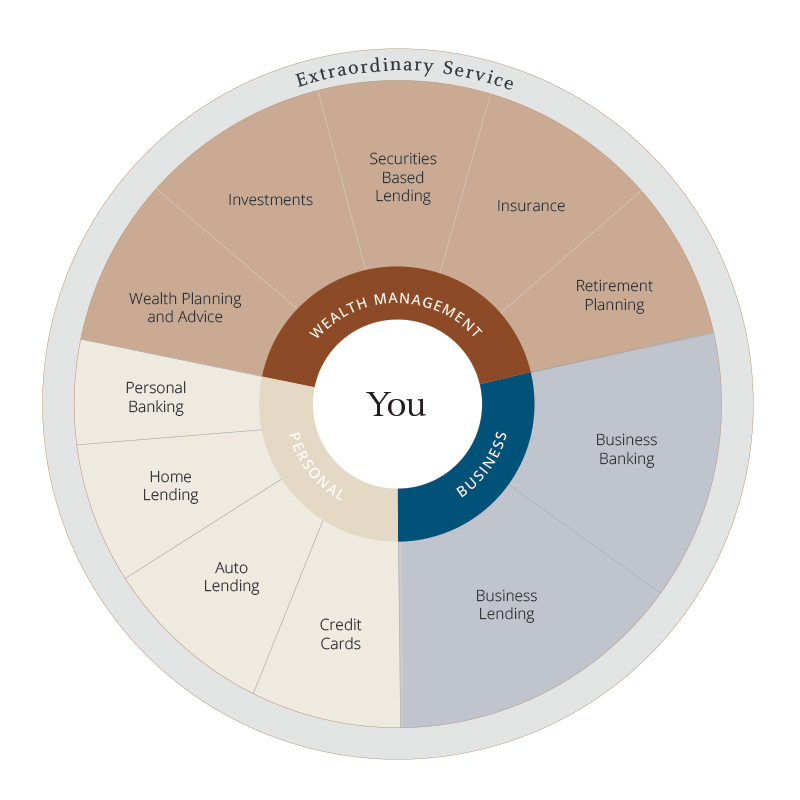

Centered on you

Centered on you

Extraordinary service

As your central point of contact, your dedicated banker delivers highly personalized attention and aims to anticipate your needs across personal banking, business banking, lending, investing and planning.

Own your future

J.P. Morgan Wealth Management advisors can help you tackle the complexities of your growing wealth with customized strategies and a tailored plan to help guide your decisions and resources.

Value beyond banking

Achieving more with your wealth starts with getting more from your bank. We can connect you to exclusive events, experiences and more to help you enjoy the life you’ve achieved.

Discover exceptional service dedicated to your financial future

Your dedicated banker brings a deep understanding of your financial world and can respond quickly to your needs. They provide guidance and thoughtfully-curated offerings in partnership with a team of J.P. Morgan specialists.

We’re here to provide you with extraordinary service centered on you. Connect with your dedicated banker to learn more.

Expertise and products

Personal Banking

Tap into the full breadth of J.P. Morgan’s collective expertise and extensive products, designed to meet you at every stage of your financial journey.

- Tailored products: Open personal checking and savings accounts and certificates of deposit, with benefits ideally suited to your lifestyle and everyday cash requirements.

- Convenient account access: Access your accounts however you prefer—via advanced mobile and online technology, at any Chase branch or ATM, or with personal assistance from your banking service team.

J.P. Morgan Wealth Management

Partner with J.P. Morgan Advisors who can set and evolve customized investment strategies curated for your unique needs and goals.

- Disciplined wealth planning: Planning that supports your objectives, risk tolerance and time horizon.

- Holistic wealth management: Backed by the expertise of our experienced research team.

- Global expertise: Research analysts in 25 countries2 and a breadth of investment strategies that align with your goals.

- Assistance across critical areas of family life: Offering specialized services to support our ultra-high-net-worth clients.

Home Lending

Access lending options to help you capitalize on opportunities that support your goals.

- Full suite of mortgage products: Explore a range of mortgage products to identify options based on your specific needs.

- Team of experts: With a deep understanding of the nuances of local markets, your dedicated banker will work with you and your financial team to create effective, goal-oriented strategies.

Business Banking

Manage your day-to-day cash flow with business banking products and dedicated support.

- Tailored products: Optimize operating cash with solutions designed to support your business structure and size.

- Signature attention: Reach out to your dedicated banking service team for support you can rely on.

- Convenient account access: See all of your accounts in one convenient, secure location through J.P. Morgan Online or Chase.com.

Secure tools and valuable insights

Manage all of your accounts in one place, where you can move money, monitor your portfolio and set up protections to safeguard your assets.

Benefit from the controls and safeguards we put in place to maintain your privacy and the confidentiality of your financial information.

Benefit from 200 years of expertise on market cycles, investment opportunities and industry-leading research from our global network.

Common questions about J.P. Morgan Private Client

J.P. Morgan Private Client is a banking service delivered through a dedicated banker who provides personalized, concierge-level guidance, navigating your needs across personal and business banking, lending, investing, and planning, with accessibility during and beyond normal business hours.

There is currently no fee for this service. Starting in 2026, if you have less than $750,000 in qualifying balances, you will be assessed a fee for J.P. Morgan Private Client.

This fee will be substantially higher than the Monthly Service Fee for other Chase banking products

Yes, your dedicated banker can introduce you to a J.P. Morgan Advisor who can help you navigate the complexities of your wealth with tailored strategies centered around your goals to support your investing needs, and more.

J.P. Morgan Private Client offers clients a dedicated banker who helps navigate the complexities of your growing wealth with our suite of J.P. Morgan banking products and Wealth Management strategies, as well as preferred rates3. With Chase Private Client, clients receive priority service, relationship rates, and access to investing strategies and insights from J.P. Morgan Wealth Management.

References

Products, including underlying accounts, might have certain fees and charges, as well as other requirements, assessed on them. For example, but not limited to, balance requirements to waive Monthly Service Fees. Starting in 2026, if you have less than $750,000 in qualifying balances, you will be assessed a fee for J.P. Morgan Private Client. This fee will be substantially higher than the Monthly Service Fee for other Chase banking products.

n.d. JP Morgan Global Research https://www.jpmorgan.com/insights/research#research-in-numbers

To earn preferred rates, the J.P. Morgan Private Client Savings account must be linked to either a J.P. Morgan Private Client Checking Plus or J.P. Morgan Classic Checking account that had at least five of any of the following types of client-initiated transactions within the monthly statement cycle: ACH, ATM, check, debit card point of sale, internet, teller or wire transfer. The preferred rates will be applied to your savings account throughout the next statement period. Interest on J.P. Morgan Private Client Savings is compounded monthly, and computed on a 365-day basis.

Bank deposit accounts, such as checking and savings, may be subject to approval.

All home lending products are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice. Not all products are available in all states or for all amounts. Other restrictions and limitations apply.

Bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A. products and service are marketed under both the J.P. Morgan and Chase brands.

J.P. Morgan Private Client is a banking and client service offering of JPMorgan Chase Bank, N.A. with access to investment services from J.P. Morgan Wealth Management.

JPMorgan Chase & Co. and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your personal tax, legal and accounting advisors for advice before engaging in any transaction. Past performance is no guarantee of future results.

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. Past performance is not a guarantee of future results.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

INVESTMENT AND INSURANCE PRODUCTS ARE:

• NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

Deposit and home lending products provided by JPMorgan Chase Bank, N.A. Member FDIC.