Expedition 1 docked at the International Space Station on November 2, 2000, carrying an American commander and two

Russian cosmonauts. Humans have lived continuously in low-Earth orbit ever since then. The vast majority of these

have been government astronauts, but a few of them have flown as space tourists. These private fliers required no

means of making payments in space, because they purchased all of their needs in advance of their stay on the

station, which is operated by the United States, Russia, and about a dozen other governments.

But the proportion of tourists will start to change. It is probably safe to expect that one or two private space

stations will be flying before the end of the decade. NASA and other national space agencies will likely be

customers, but these facilities will also be open to private citizens. The possibilities range from basic space

tourism to much more exotic uses. One of the four companies developing a private station is Texas-based Axiom Space.

They have already announced plans with a United Kingdom-based media company, Space Entertainment Enterprise, to

attach an ‘entertainment arena’ and ‘content studio’ to the Axiom station. Later this decade, this large, spherical

module will allow artists and producers to live stream content from orbit, creating a unique space for making videos

or music, and perhaps even enabling new types of sporting contests designed for a weightless environment.

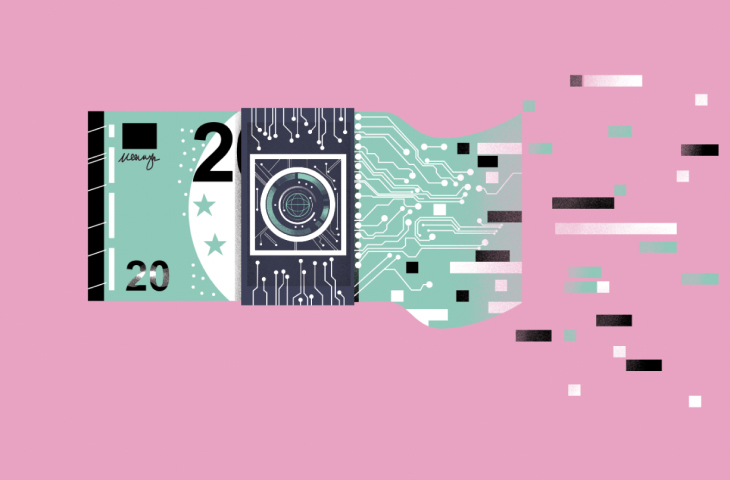

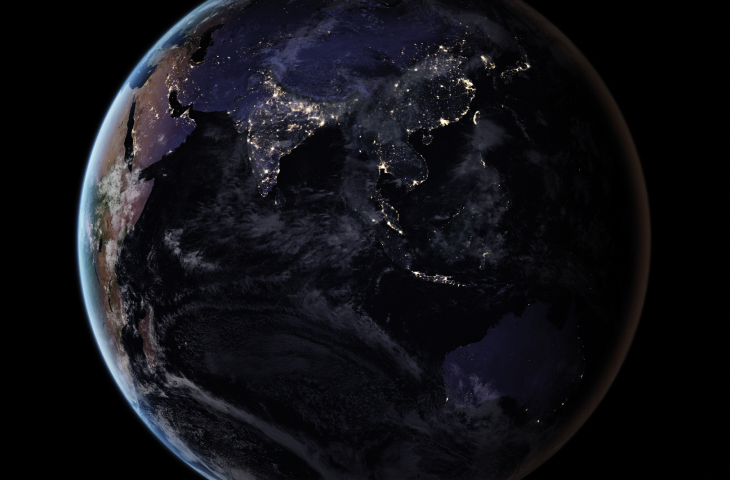

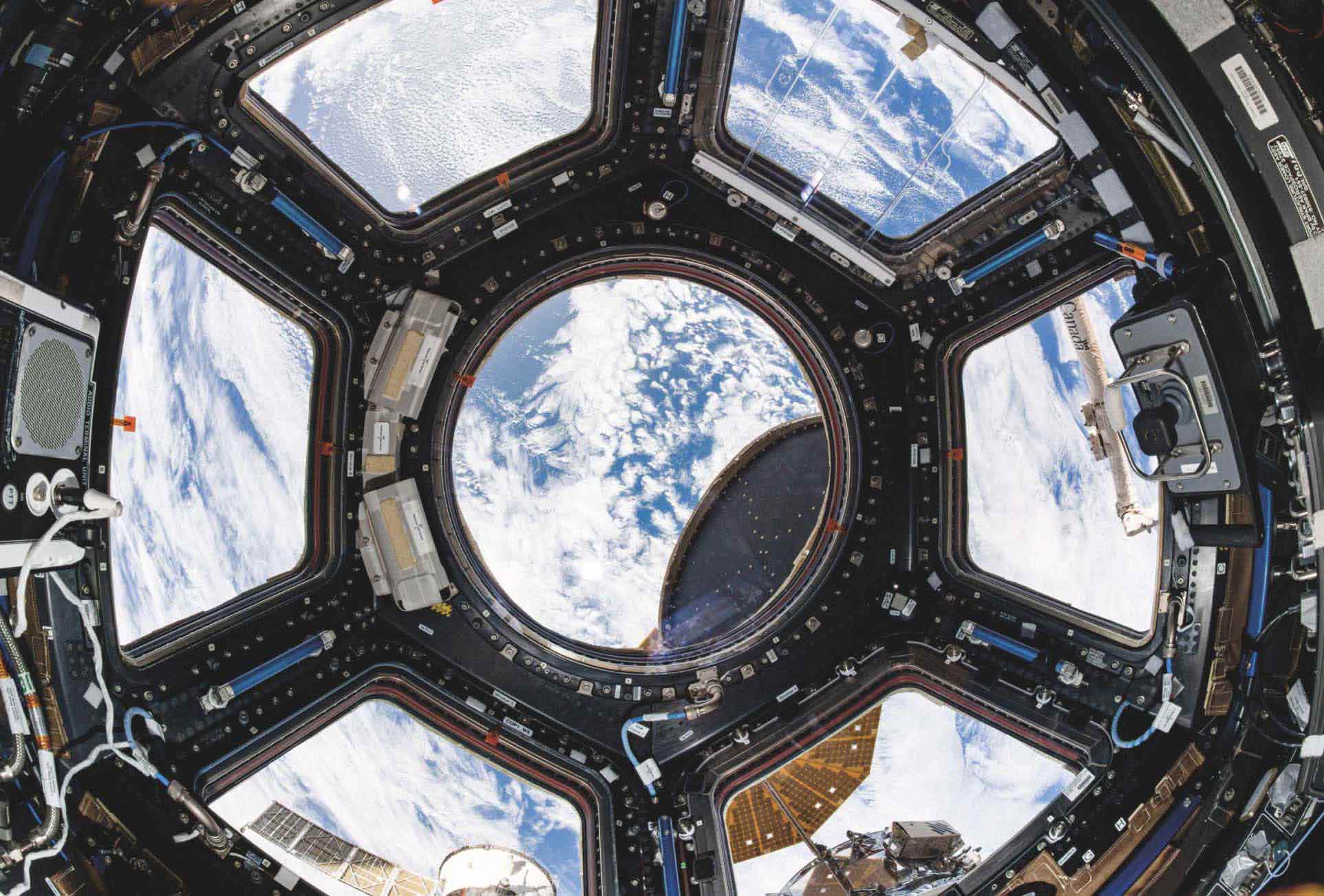

Payments in low-Earth orbit are likely to co-opt the ever evolving payment rails we use here on Earth. Astronauts on

board the International Space Station have internet access. That means they can connect to their terrestrial bank

accounts and pay bills. This is likely also to be the custom for space tourists, who will want to be connected to

the web as they look out windows at the blue marble below and snap selfies. It’s likely that space-based operators

will sell perks such as showers and spacewalks that tourists will want in orbit. If these or other services aren’t

paid for in advance or with a pre-loaded charge card, then in theory these tourists can connect to the internet and

make use of digital wallets, credit-card networks and other payment processors—although it could be a slow and

painful experience until connectivity improves.

Beyond low-Earth orbit, however, space payments are going to require new approaches. Around two dozen countries have

signed on to NASA’s Artemis Program, which aims to return humans to the Moon later this decade. China, too, has the

Moon in its sights. Both countries have the long-term goal of establishing a settlement there, and encouraging

commercial growth as well. It is, therefore, not all that far fetched to imagine Moon bases within the next two

decades. This is the next logical step, because the Moon is relatively close to Earth, just under 400,000 km away.

Initially, this activity will be government-led, so any private transactions and payments would be limited. But over

time, there would likely be commercial businesses that operate primarily on the Moon. These could be tourist

businesses, or they might be enterprises engaged in harvesting raw materials. Ice at the lunar poles, for example,

could potentially be melted for drinking or irrigation, or broken down to create breathable oxygen or rocket fuel.

Or consider the ample silica in the Moon’s soils, which could be used to build large solar arrays to provide power.

And that’s when the payments situation becomes more complex, says Gonzalo Martín de Mercado, a business development

officer at the European Space Agency (ESA). “The situation becomes quite interesting, because on Earth we are used

to constantly being able to communicate with one another,” he says. “But it probably will not be viable to do that

on the Moon back to Earth.”

This is a challenge for financial transactions. When a credit card is swiped on Earth, the transaction happens almost

instantaneously, confirming the validity of the card, and its funds, and transferring money to the vendor. On the

Moon, there is at least a two- to three-second time delay in communications due to the time it takes light to travel

back to Earth, which could lead to a timeout of traditional credit-card transactions.

Perhaps more importantly, the cost of data transfer will be high between the Earth and the Moon. Firstly, data

throughput will be limited by latency effects. Secondly, there’s the cost of the infrastructure required to

facilitate these communications—either line-of-sight antennas or satellite relays in orbit around the Moon. The

government may build some of this infrastructure for its own communications, but private sector investment will

likely be necessary for commercial use. Lockheed Martin, for example, is working on a communication service called

Parsec that will use a satellite network around the Moon to facilitate communications between lunar settlements and

Earth. Infrastructure like that will not come cheap, and one would expect the cost of data transfer will be passed

onto users. For this reason, phoning home for every financial transaction could cost more than the goods or services

being purchased on the Moon.

This will likely necessitate a separate banking entity. This entity would conduct local transactions, and later have

to synchronize that activity with a ledger, or financial institutions, back on Earth. One way this might work is

through blockchain. Proponents argue that blockchains have the potential to simplify the infrastructure and

jurisdictional requirements of the traditional banking system, and so may provide an appropriate framework for

off-world banking. Space, after all, is unlikely to be dominated by any one nation. What’s more, if a blockchain

served as an intermediate record between Earth and settlements off-Earth, it could help prohibit fraud – an obvious

concern when transactions are being reconciled in different locations at different times.

Banks are already thinking about how blockchains could be used to facilitate space transactions. In 2021, J.P. Morgan

partnered with a satellite company called GomSpace to demonstrate the concept. It installed blockchain technology on

several satellites to show that it was possible establish and maintain a ledger between the objects. Then, the

engineers executed transactions between two satellites in low-Earth orbit. “We were trying to identify what payments

in space could actually look like, and how we would enable that,” says Tyrone Lobban, Co-Head of Kinexys. “We wanted to prove specifically that if we had this network that was

completely divorced and dislocated from the payments systems on Earth, that you could actually make value movements

between satellites. We achieved that.”

However, extending such a system through space is not easy, Lobban says. Present-day satellites have limited power

and memory capabilities, which are needed for lots of blockchain transactions. And blockchains require constant

synchronization of transactions across the network, which will pose problems if large constellations of

blockchain-enabled satellites are not established.