Streamlining the commercial property financing experience

Experience an easy loan process when financing office, mixed use, industrial and retail properties through our fixed and adjustable rate loan programs from $1 million to more than $25 million.

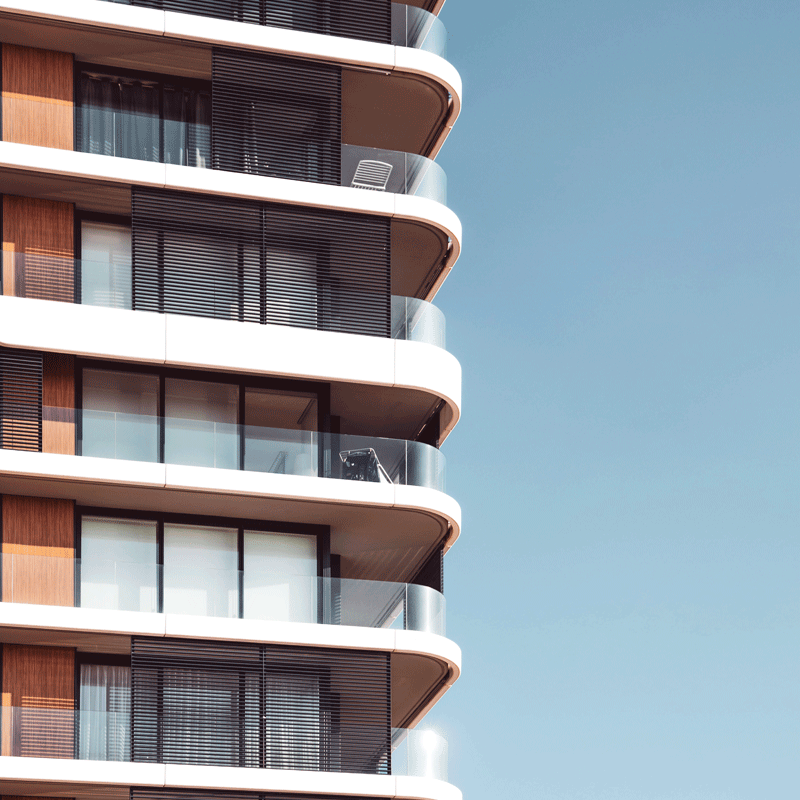

Benefit from our multifamily lending expertise

Working with Chase, you can expect competitive rates, low fees and a reliable process on your next $500,000–$25 million loan for an apartment building with five or more units.

What we do

Your success determines our success. Receive exceptional client service with speed and certainty of execution from a team dedicated to delivering the results your business needs to thrive.

Helping you build for tomorrow

Benefit from a lender that’s focused on building lasting relationships, not just closing loans. Gain a competitive advantage from working with a local team that keeps you connected to innovative financial solutions, research and market expertise—helping ensure you are prepared for challenges and ready to capitalize on opportunities throughout all real estate cycles.

Get things done remarkably fast

Our goal is to be the easiest bank to do business with so you can get back to managing your portfolio. We know that a big part of that is making sure you’re able to move nimbly and swiftly. With local decision-making and a streamlined loan process already in place, you can expect our new origination system, CREOS, to cut your loan processing time in half.

Access solutions when you need them

Work with a collaborative team of specialists who can give you access to financial solutions and resources from across our entire firm so you can efficiently run your business. This includes payables and receivables solutions, liquidity management, fraud protection, credit and more.

Work with us on your terms

We’re in the business of making your deals happen. Each time you borrow is an opportunity for us to quickly and efficiently meet your financing needs and deliver a superior customer experience.

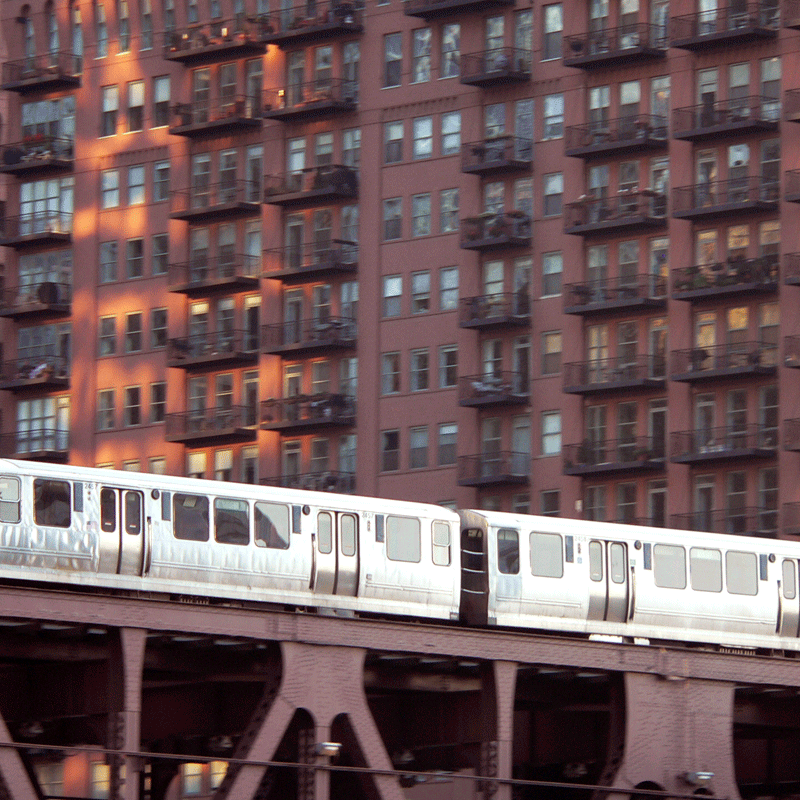

Our local knowledge is your advantage

We are experts with roots in real estate and in your neighborhood. Our team members live and work in the same communities in which you build and invest—so we have a deep understanding of your market and its opportunities, influences, and local codes and regulations.

Related insights

Real Estate

Protecting commercial properties from cybersecurity threats

Feb 06, 2026

Learn how to protect your payments and data from common cybersecurity threats affecting commercial real estate owners and operators.

Read more

Real Estate

Navigating interest rate uncertainty

Feb 03, 2026

At its January meeting, the Fed held interest rates steady. Learn more about the factors behind the decision

Read more

Real Estate

The role of cap rates in real estate

Feb 02, 2026

This common metric can help investors assess the potential value of a property.

Read moreWho we are

Ed Ely

Co-Head of Commercial Term Lending

Will Oehler

Managing Director, Northeast Multifamily Lending

Kaj Lea

Managing Director, Pacific Northwest & Central Multifamily Lending

Greg Newman

Managing Director, California Multifamily Lending

Jake Bade

Managing Director, Commercial Mortgage Lending

Additional resources

Find a local office

Northeast

Boston

New York

Washington D.C.

Central

West

Los Angeles

Orange County

Portland

Sacramento

San Diego

San Francisco

Seattle

-

Changes to Interbank Offered Rates (IBORs) and other benchmark rates: Certain interest rate benchmarks are, or may in the future become, subject to ongoing international, national and other regulatory guidance, reform and proposals for reform. For more information, please consult: https://www.jpmorgan.com/IBOR.

© 2025 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. Deposits held in non-U.S. branches, are not FDIC insured. Non-deposit products are not FDIC insured. Visit jpmorgan.com/cb-disclaimer for additional disclosures and disclaimers related to this content.

References

Commitment: The firm will finance the creation and preservation of 100,000 affordable rental units through $14 billion in new loans, equity investments and other efforts.

CFO Magazine’s 2017 Commercial Banking Survey awarded us the #1 spot in perceived satisfaction.

Our focus is on being the easiest bank to do business with, which is why we're investing billions in technology to enhance your banking experience.