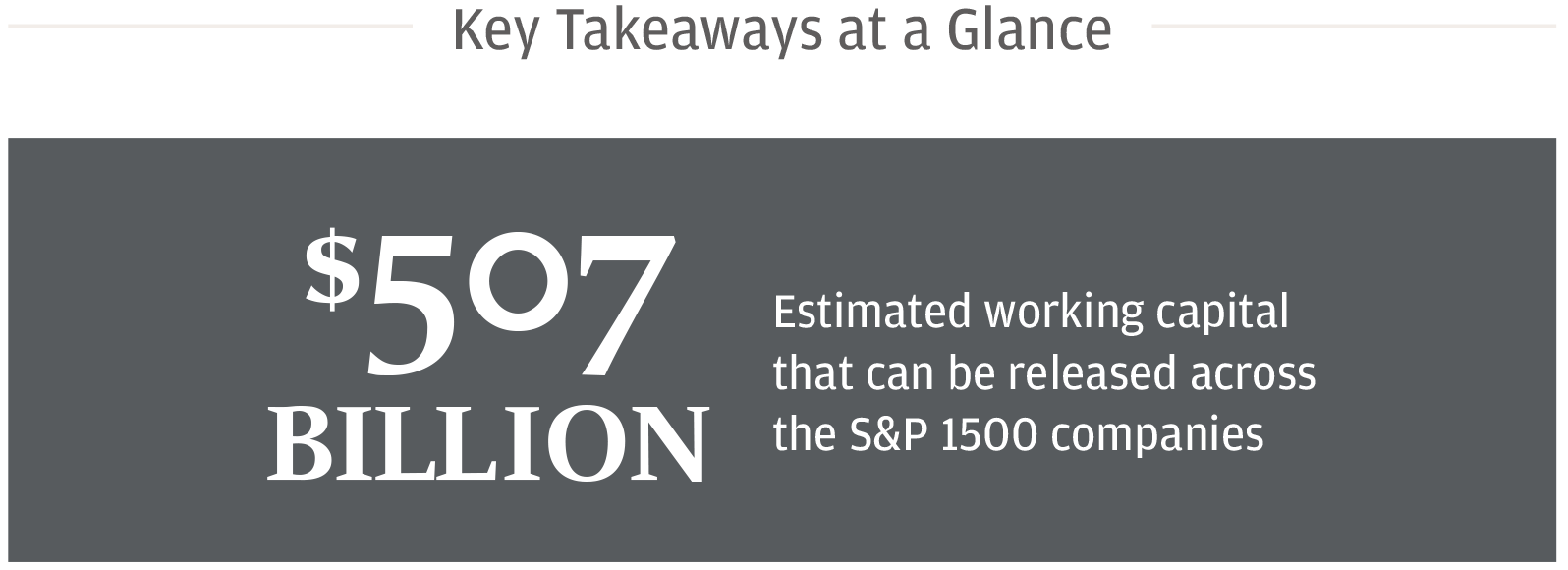

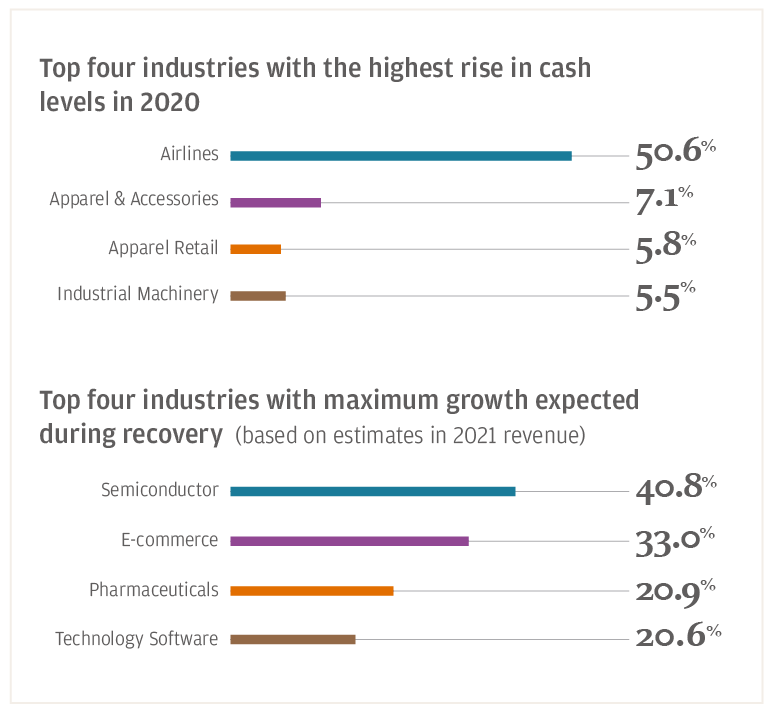

J.P. Morgan’s 2021 Working Capital Index report provides treasury and finance professionals with insights into the working capital performance of the S&P 1500 companies in the past year. We also assess the impact of the pandemic outbreak across industries and focus on how companies can better manage liquidity risks going forward.

The report captures trends from the Working Capital Index, Cash Index and Cash Conversion Cycles (CCC) of the S&P 1500 from 2011 to 2020.

What is a cash conversion cycle?

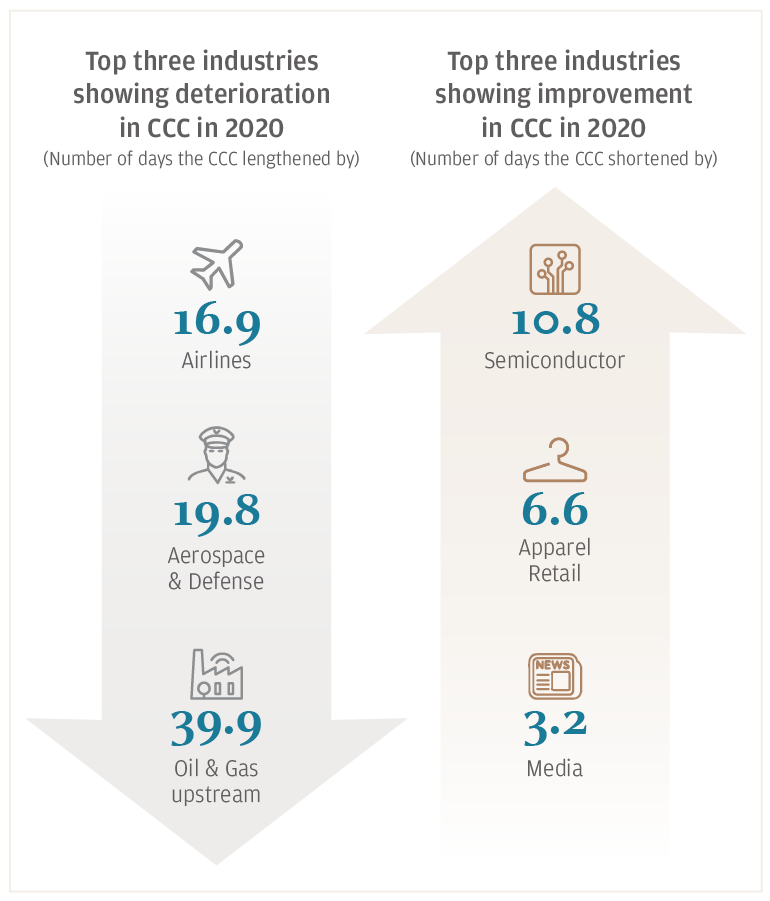

CCC helps in quantifying how efficiently a company is managing its working capital. It measures the amount of time it takes to convert inventory purchases into cash flows. CCC is represented as:

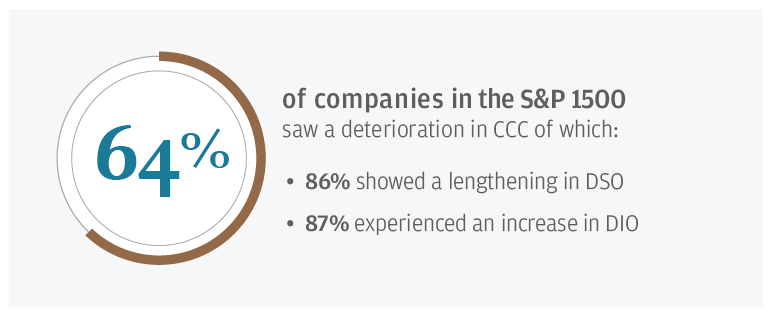

The Cash Conversion Cycle (CCC) is the number of days it takes to convert inventory purchases into cash flows from sales. The CCC is a metric that helps quantify the working capital efficiency of a company and is derived from three different components:

- Days Sales Outstanding (DSO) or the number of days taken to collect cash from customers

- Days Inventory Outstanding (DIO) or the number of days the company holds its inventory before selling it

- Days Payable Outstanding (DPO) or the number of days from the time a company procures raw materials to payment to suppliers

This material was prepared exclusively for the benefit and internal use of the JPMorgan client to whom it is directly addressed (including such client’s subsidiaries, the “Company”) in order to assist the Company in evaluating a possible transaction(s) and does not carry any right of disclosure to any other party. This material is for discussion purposes only and is incomplete without reference to the other briefings provided by JPMorgan. Neither this material nor any of its contents may be disclosed or used for any other purpose without the prior written consent of JPMorgan.

This material has NOT been prepared by J.P. Morgan’s Research Department and therefore, has not been prepared in accordance with legal requirements to promote the independence of research. It is not a research report and is not intended as such. It is for distribution to institutional and professional clients only and is not intended for retail customer use.

Unless otherwise specifically stated, any views or opinions expressed herein are solely those of the individual author(s) and/or the specific Treasury Services area from which it originates and may differ from the views or opinions expressed by other areas of J.P. Morgan, including the Research Department.

J.P. Morgan, JPMorgan, JPMorgan Chase and Chase are marketing names for certain businesses of JPMorgan Chase & Co. and its subsidiaries worldwide (collectively, “JPMC”). Products or services may be marketed and/or provided by commercial banks such as JPMorgan Chase Bank, N.A., securities or other non-banking affiliates or other JPMC entities. JPMC contact persons may be employees or officers of any of the foregoing entities and the terms “J.P. Morgan”, “JPMorgan”, “JPMorgan Chase” and “Chase” if and as used herein include as applicable all such employees or officers and/or entities irrespective of marketing name(s) used. Nothing in this material is a solicitation by JPMC of any product or service which would be unlawful under applicable laws or regulations.

Investments or strategies discussed herein may not be suitable for all investors. Neither JPMorgan nor any of its directors, officers, employees or agents shall incur in any responsibility or liability whatsoever to the Company or any other party with respect to the contents of any matters referred herein, or discussed as a result of, this material. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice or investment recommendations. Please consult your own tax, legal, accounting or investment advisor concerning such matters.

Not all products and services are available in all geographic areas. Eligibility for particular products and services is subject to final determination by JPMC and or its affiliates/subsidiaries. This material does not constitute a commitment by any JPMC entity to extend or arrange credit or to provide any other products or services and JPMorgan reserves the right to withdraw at any time. All services are subject to applicable laws, regulations, and applicable approvals and notifications. The Company should examine the specific restrictions and limitations under the laws of its own jurisdiction that may be applicable to the Company due to its nature or to the products and services referred herein.

Notwithstanding anything to the contrary, the statements in this material are not intended to be legally binding. Any products, services, terms or other matters described herein (other than in respect of confidentiality) are subject to the terms of separate legally binding documentation and/or are subject to change without notice.

JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.