For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Insights

- Treasury

- Liquidity Management

- New frontier solutions for corporate treasurers

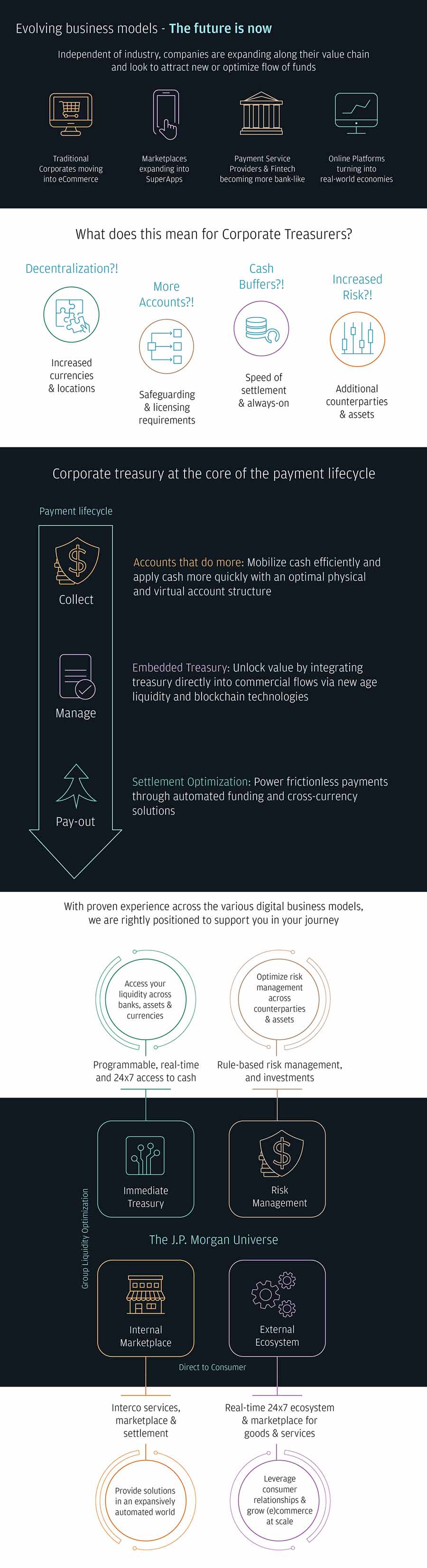

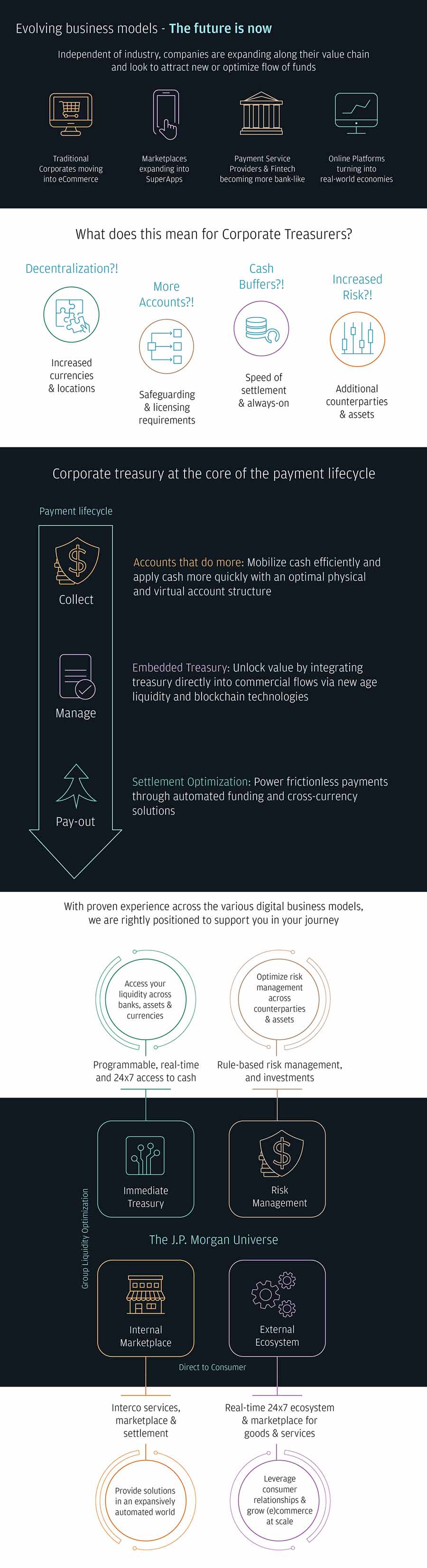

Evolving business models – The future is now

Independent of industry, companies are expanding along their value chain and look to attract new or optimize flow of funds

- Traditional corporates moving into ecommerce

- Marketplaces expanding into superapps and platforms

- Payment service providers and fintechs becoming more bank-like

- Online platforms turning into real-world economies

What does this mean for corporate treasurers?

- Decentalization?! Same day value required for increased currencies and locations

- More accounts?! Safeguarding and licensing requirements

- Cash buffers?! Availability and speed of settlement require pre-funding or just-in-time

- Increased risk?! Increased counterparties and assets

Corporate treasury at the core of the payment lifecycle

Payment lifecycle:

Collect, Manage, Pay-out

Accounts that do more: Mobilize cash efficiently and apply cash more quickly with an optimal physical and virtual account structure

Embedded treasury: Unlock value by integrating treasury directly into commercial flows via a new age liquidity and blockchain technologies

Settlement optimization: Power frictionless payments through automated funding and cross-currency solutions

With proven experience across the various digital business models, we are rightly positioned to support you in your journey.

- Access your liquidity across banks, assets and currencies – Programmable, real-time and 24x7 access to cash

- Optimize risk management across counterparties and assets – Rule-based risk management and investments

The J.P. Morgan Universe:

Group liquidity optimization:

- Immediate treasury, Risk management

Direct to consumer:

- Internal marketplace, external ecosystem

Interco services, marketplace and settlement – Provide solutions in an expansively automated world

Real time 24x7 ecosystem and marketplace for goods and services – Leverage consumer relationships and grow (e)commerce at scale

Connect with your J.P. Morgan representative to find the right Liquidity & Account Solutions for your business

Implementing a true global intraday liquidity platform

Accelerating change was critical for J.P. Morgan client Dana, who were eager to unlock the value of their global liquidity hampered by a fragmented banking landscape and legacy platforms.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of J.P. Morgan, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed to be reliable. Neither the author nor J.P. Morgan makes any representations or warranties as to the information’s accuracy or completeness. The information contained herein has been provided solely for informational purposes and does not constitute an offer, solicitation, advice or recommendation, to make any investment decisions or purchase any financial instruments, and may not be construed as such.

JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.

Related insights

Treasury

9 practical steps for setting up a regional treasury center

Feb 02, 2026

Establishing a regional treasury center (RTC) is a strategic imperative for multinational businesses. The process is complex, but manageable. Get started with our guide.

Treasury

A strategic planning framework for Corporate Treasury to remain pragmatic as well as forward-looking, to capture key drivers of innovation and growth in the years to come

Treasury

Connect ERP and treasury systems for automated workflows

Jan 29, 2026

Eliminate manual data entry and payment delays by integrating your ERP with treasury systems. Get real-time cash visibility and automated workflows that reduce errors.

Treasury

Understanding the cash application process

Jan 12, 2026

Optimizing your cash application process can help fuel your company’s success. Find out how.

Treasury

Enhance your corporate treasury's risk management with FX exposure netting solutions

Nov 24, 2025

Discover how virtual netting can provide a scalable framework for currency risk management, optimizing treasury operations and driving financial performance in a complex global landscape.

Treasury

The check is dead, long live the check

Nov 13, 2025

Wholesale lockbox may not mean much to the average consumer, but to businesses across the US, this method of check and payment processing is a critical part of driving business efficiencies and profitability.

Treasury

Your cash conversion cycle—what it is and how to optimize it

Oct 14, 2025

Discover how the cash conversion cycle impacts business efficiency and learn strategies to optimize cash flow management.

Treasury

Being resilient relies on connected treasury tools

Oct 10, 2025

In the face of a variety of obstacles, businesses are looking to improve their resiliency. Having a trusted treasury partner can help.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.