Liquidity centralization in EMEA

J.P. Morgan’ Liquidity and Account Solutions team in EMEA has the global capabilities, industry expertise, and transformative technology to support clients at every stage of their cash management journey. Recent launches in EMEA continue to help treasurers achieve control, gain visibility and optimize their working capital.

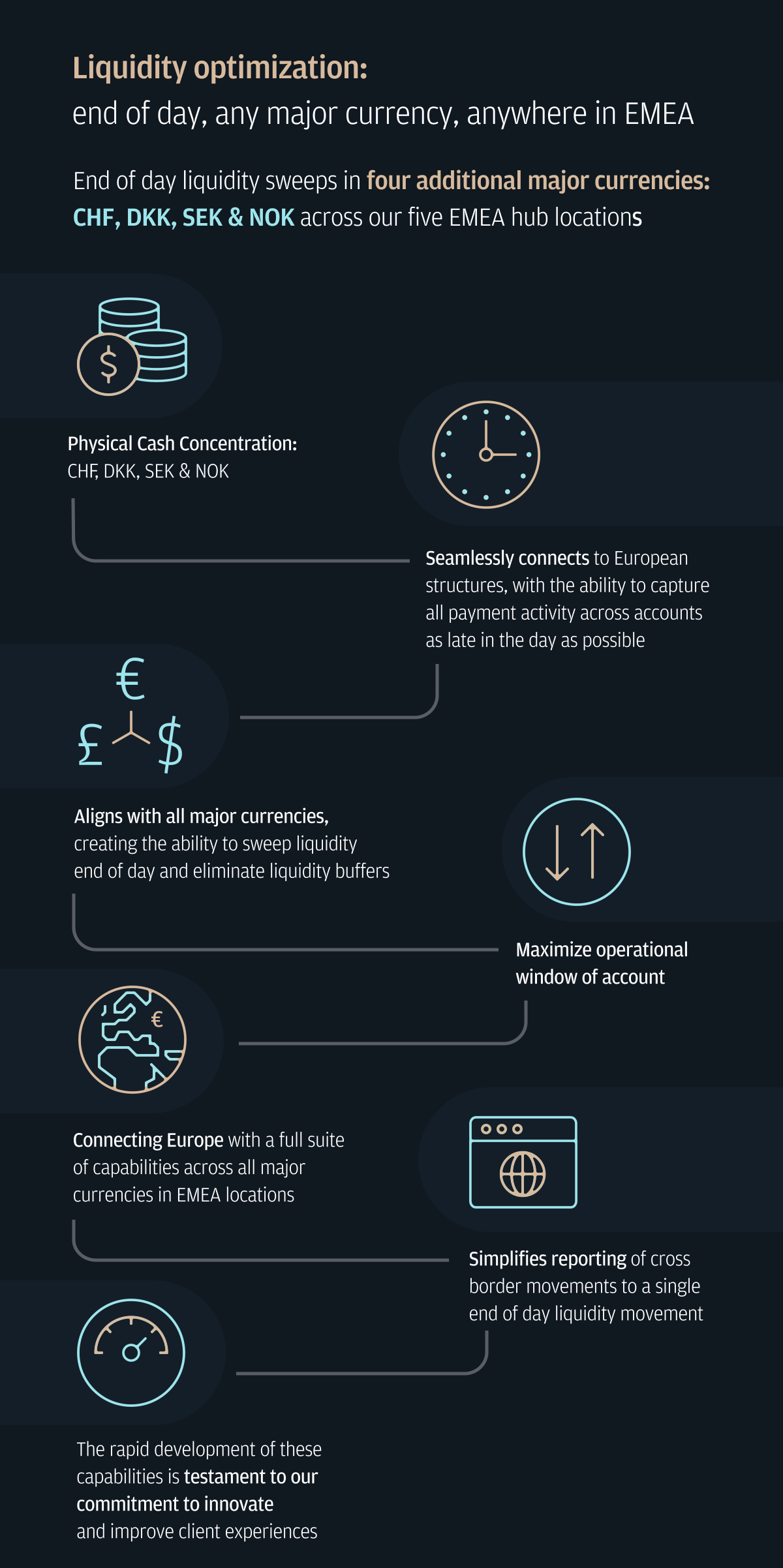

Martijn Stoker, EMEA Head of Liquidity and Account Solutions for J.P. Morgan, says treasurers in the region now have the benefit of further optimizing their liquidity. “Our wide range of Physical Cash Concentration solutions allows treasurers to seamlessly move funds across the globe on the same day with no loss of value. Treasury teams will benefit from the capability to automatically move funds between J.P. Morgan locations at either intraday or end-of-day in the same currency or convert balances to a desired currency with full transparency as part of your multicurrency management.

With our continued commitment to enhance our existing suite of solutions, we have recently expanded our end of day capabilities in four additional major currencies – CHF, DKK, NOK & SEK, helping enable true end-of-day sweeping across our EMEA hub locations. This allows treasurers to optimize their liquidity further and maximize the operational window account for treasury teams.”

Whether it is for large multinationals or small business enterprises, J.P. Morgan can support businesses through every stage of growth with award-winning1 client service, global reach and local expertise. Our advancements in technology enable us to scale up and provide our clients with a single platform, simplified payments to allow them to focus on their primary goal, their businesses.

Connect with your J.P. Morgan representative to find the right Liquidity & Account Solutions for your business

Implementing a true global intraday liquidity platform

Accelerating change was critical for J.P. Morgan client Dana, who were eager to unlock the value of their global liquidity hampered by a fragmented banking landscape and legacy platforms.

Stay informed and stay ahead with our monthly newsletter

Receive key updates and news with relevant actionable insights and best practices — including the latest intelligence on payments trends, digital innovation, regulatory change, ESG and sustainable financing and much more.

Subscribe to THE MONTH IN…Treasury & Payments

References

J.P. Morgan earned the Coalition Greenwich Excellence Award for Customer Service in the 2021 U.S. Large Corporate Cash Mgmt.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of J.P. Morgan, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed to be reliable. Neither the author nor J.P. Morgan makes any representations or warranties as to the information’s accuracy or completeness. The information contained herein has been provided solely for informational purposes and does not constitute an offer, solicitation, advice or recommendation, to make any investment decisions or purchase any financial instruments, and may not be construed as such.

JPMorgan Chase Bank, N.A. Member FDIC

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.