This article was originally published in ACTA Exchange Magazine.

APIs are set to play a fundamental role in transforming the future of treasury. Their power to drive business growth through greater efficiency, accuracy and speed has never been more crucial given today’s economic environment.

Yet fundamental treasury areas, such as cash forecasting and real-time visibility, remain inherently challenging. As we heard from various panel discussions at the 2024 ACTA Conference, many companies today are still Excel-reliant, and business cases for investment in treasury systems need to be robust in order to compete against other business priorities.

Poor quality data is often spread across different systems in different formats. Internal IT resources can be limited. Meanwhile, multiple banking providers can have differing standards, which also weighs down accuracy.

However, there may be a simple solution that doesn’t require a massive system overhaul: APIs. APIs can act as a bridge—creating an opportunity to leapfrog competitors by digitalizing and transforming the treasury function and pushing business growth to new levels.

Better cashflow visibility

APIs are a fundamental way to meld bank transaction data with applications such as Treasury Management Systems (TMS) and Enterprise Resource Planning (ERP) systems.

By bringing these systems together with API plug-ins, traditional next-day visibility can be transformed into real-time visibility and batch-based reconciliations into real-time reconciliations.

This real-time cashflow visibility can reveal market movements that treasurers can take advantage of. Meanwhile, cash forecasting immediately improves because calculations are now based on up-to-date data rather than the previous day’s balances.

Powering real-time payments and rich data

It has never been more important in a world where real-time payments and its rich data are becoming standard. Customers now expect immediate transfers, which in some cases has become a central part of a company’s service.

J.P. Morgan’s real-time payments system was built on the ISO 20022 standard, which defines how rich data is used, providing another avenue for transformation. APIs can bring this rich data across systems to provide faster and more accurate reconciliations.

Meet rising competition from business

An API-powered, data-rich ecosystem also provides a foundation for basic tasks to be automated.

It allows businesses to gain a competitive edge, especially with the rise of cross-border payments. Countries across Asia are increasingly creating direct links with each other’s real-time payment infrastructure, such as Singapore and Thailand. Other countries are expected to follow as real-time payments become more deeply embedded across the payments landscape.

Easy-to-implement APIs provide fast solutions

APIs provide more than a connection. They are now part of a comprehensive solution that includes a user-friendly interface, with real-time data still delivered to treasury departments via Excel spreadsheets or ERP plug-ins if they prefer.

They’re also simple to integrate.

The benefit of API plug-ins is they don’t require a fundamental change to a company’s existing ERP ecosystem. Banks such as J.P. Morgan already have a full suite of APIs that work with all major systems. Full implementation can be achieved in weeks rather than months.

J.P. Morgan also offers a Payments Developer Portal, a tool designed to accelerate and simplify the API implementation process. The Payments Developer Portal serves as an inventory that includes well-documented API specifications, business scenarios, a test environment and self-service project module.

The Payments Developer Portal delivers a better experience to API developers by:

- Unifying the developer platform experience

- Improving self-service and testing

- Increasing developer engagement and support

- Ensuring solutions remain simple and scalable

Learn more about how J.P. Morgan Payments can help transform and future proof your business.

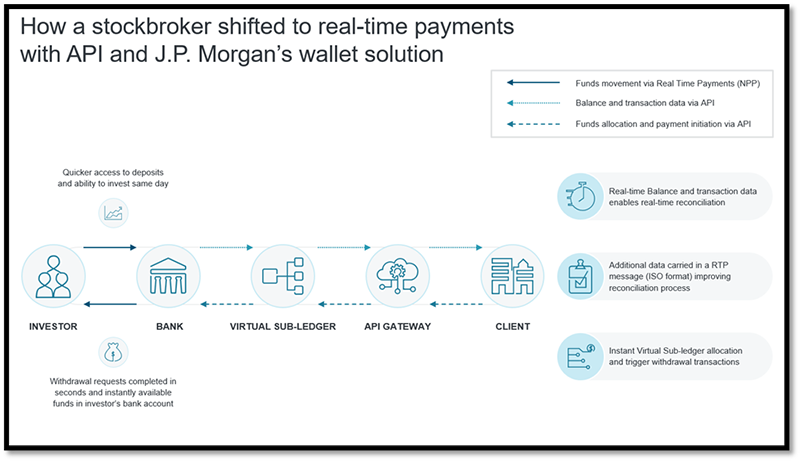

How J.P. Morgan APIs allowed a stockbroker’s clients to fund their accounts in real-time

Retail and wholesale investors need to move fast, given market volatility can strike at any time. It can take up to two days for ACH, wire, or BPAY transfers to hit their personal trading accounts—but it doesn’t have to.

A major Australian stockbroker recently collaborated with J.P. Morgan to transform their clients’ experience by offering real-time inbound and outbound fund transfers.

The solution relied on real-time payment APIs and credit confirmation APIs, which connects the stockbroker’s systems, allowing its clients to trade as quickly as possible. Meanwhile, the extra data attached to real-time payments in the ISO 20022 format improves the stockbroker’s reconciliation process.

Trading volumes have been ramping up as more clients become aware of the real-time transfer capability, which also applies when they withdraw funds.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of J.P. Morgan, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed to be reliable. Neither the author nor J.P. Morgan makes any representations or warranties as to the information’s accuracy or completeness. The information contained herein has been provided solely for informational purposes and does not constitute an offer, solicitation, advice or recommendation, to make any investment decisions or purchase any financial instruments, and may not be construed as such.