About

Based in Switzerland, Autoneum is a tier one supplier of thermal and acoustic insulation for the automotive industry. Its innovative product range helps to make vehicles quieter, lighter and more economical. As a worldwide leader in this space, Autoneum operates across roughly 25 countries with approximately 12,500 employees.1

The challenge

From a financial point of view, consolidated Autoneum is in a net debt position and, as an original equipment manufacturer (OEM) is constantly under cost pressure. As a result, the business operates a centralised treasury model to help it keep a tight control on cash. But Autoneum is also a major international manufacturer.

Gaining real-time visibility over its cash balances in its global subsidiaries was a challenge and was impacting its treasury management. Many of these operations work on a plus one day basis via MT940s. However, the treasury department wanted greater transparency and faster access to transaction data, especially during critical times where there were large volumes of transactions, or in periods were there is major disruption such as during the recent COVID-19 crisis.

Autoneum needed a treasury solution that could provide this enhanced visibility and could also be set-up quickly and integrated with its existing software platform. It was especially important that it had strong fraud and cybersecurity protocols, such as allowing easy monitoring and tracking of users.

Historically it was hard to keep some global treasury teams aligned with us. We wanted to be faster to the business, closer to the business and have greater transparency.

Janko Hahn

Head of Treasury Operations, Autoneum

The solution

J.P Morgan is Autoneum’s main bank for its Canadian and American subsidiaries.

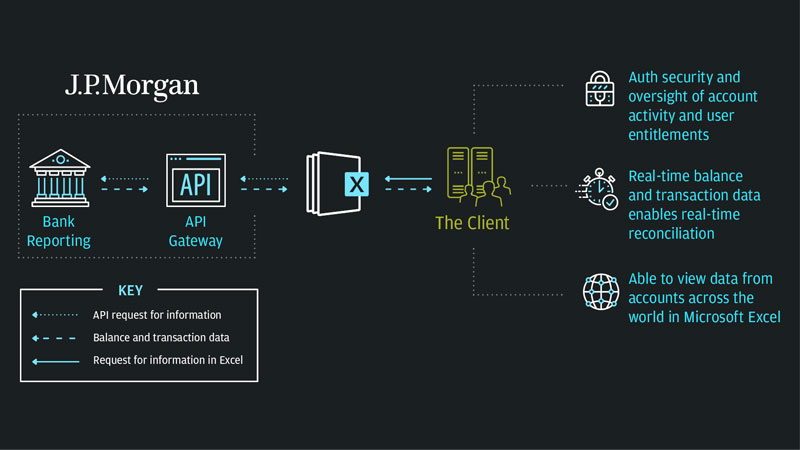

After a number of exploratory and technical discussions, Autoneum opted to use one of our API plug-ins to increase visibility over its account data. APIs essentially act as a bridge and allow two unconnected and incompatible systems to talk to each other and share data. As part of its product range, J.P Morgan has built multiple APIs that integrate with the major Treasury Management Systems (TMS) and Enterprise Resource Planning (ERP) systems. As a result, we were able to install, test and launch the plug-in for Autoneum within four weeks.

In the end the integration was much easier than expected, as we started with an Excel plug-in. It was surprisingly easy: it took us a few weeks only.

Janko Hahn

Head of Treasury Operations, Autoneum

The solution provided the Autoneum treasury team with real-time visibility into its balances and transactions both in North America and globally. To simplify the user experience, the API also utilises an Excel plug-in, allowing Autoneum to retrieve treasury data at the click of a button. This has greatly improved its reconciliation and forecasting processes, while providing insight into its cash positions.

J.P. Morgan’s approach also gave Autoneum greater oversight into their electronic banking system, such as who can make payments, who can authorise payments and who the digital users are. The user-friendly interface, coupled with these strong cybersecurity and fraud protections, makes it a truly unique and modern system.

So, when you think about a treasury of tomorrow–it’s about real time banking, more intelligent automation, more efficiency. How do you get your data when you need it? How do you bring the best banking experience to your ecosystem without going into multiple banking portals?

Mario Benedict

Head of EMEA Digital Channels and Connectivity, J.P. Morgan Payments

The results

J.P Morgan’s API solution has helped Autoneum move towards a real-time, automated, intelligent treasury model. Some of the key benefits are:

- Optimized cash management – Autoneum can now get on-demand visibility into the cash balances at any of its global subsidiaries, allowing it to tightly manage its cash positions.

- Enhanced security – Autoneum can view all account activity in real-time allowing it to prevent fraudulent access and activity.

- Speed and efficiency – By opting for an API plug-in, Autoneum did not have to fundamentally amend its existing ERP ecosystem. Full implementation was completed in four weeks.

- Ease-of-use – All data is imported directly into Excel, which contributes to easier reconciliation, forecasting, and integration with existing processes. Additionally, all data is materialised in pre-configured templates, further enhancing the ease of use.

- Increased resilience – Improved connectivity and visibility over its cash positions gives Autoneum greater resilience and agility when responding to disruptive events.

To learn more about how we can support your business, please contact your J.P. Morgan representative.

Interested in learning more?

Read on to learn how APIs are delivering real-time data for corporate treasurers.

References

J.P. Morgan is the marketing name for the Wholesale Payments business of JPMorgan Chase Bank, N.A. and its affiliates worldwide.

The products and services described in this document are offered by JPMorgan Chase Bank, N.A. or its affiliates subject to applicable laws and regulations and service terms. Not all products and services are available in all locations. Eligibility for particular products and services will be determined by JPMorgan Chase Bank, N.A. or its affiliates.