Companies can benefit from corporate card programs’ extended working capital, improved operational efficiencies, and expense and fraud controls.

Corporate Card

Increase purchasing oversight, reduce costs and streamline your payments process.

Corporate Card

Streamline company travel expenses

J.P. Morgan Corporate Card provides an integrated, configurable travel and entertainment expense (T&E) solution for your organization with broad acceptability and reliability for cardholders.

Corporate Card benefits

Empower your business travelers with the corporate credit card that makes it easy to track and manage expenses.

Maximize value with increased T&E efficiency

Leverage J.P. Morgan’s expertise and analytics to assess past performance and implement an optimized expense-management program.

Help protect your business against fraud

Take advantage of cardholder alerts—one of the fastest, easiest ways for cardholders to spot and prevent fraud on their accounts.

Give cardholders a hassle-free way to pay

Access your corporate credit card from your mobile wallet and pay vendors across the globe.

Travel with confidence

Benefit from extensive travel, emergency assistance, and employee misuse coverage.

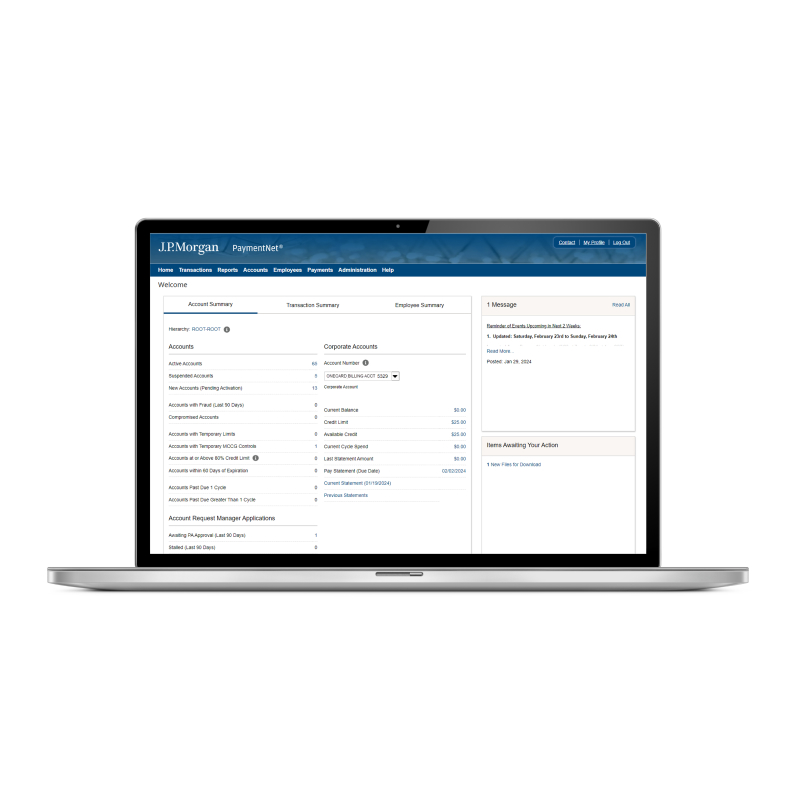

Tools for effective program management

Gain greater transparency

Leverage customizable reports to give you visibility into spend and gain actionable insights.

Automate processes

Automate administrative functions, simplify cardholder tasks and streamline account reconciliation.

Support for administrators and cardholders

Dedicated resources for program setup

Our dedicated onboarding team works side by side with your team during program implementation.

Administrator training and support

Support doesn’t end with implementation. We offer ongoing training for program administrators, including weekly and monthly webinars.

Hear from our clients

Treasury

One Card helps Ashton Woods excel in growing digitized payments environment

Sep 06, 2022

Ashton Woods leveraged a leading commercial card solution to facilitate online transactions, support operations and growth, and reap benefits from the card’s cutting-edge rebate program.

Read more

Treasury

With a strong relationship focus, North Dakota strengthens statewide commercial card program

Oct 13, 2020

Learn how J.P. Morgan helped the state of North Dakota improve its commercial card program and kept payments flowing during COVID-19.

Read more

Treasury

Fresh Clean Threads enhances liquidity & maximizes rewards with One Card

Feb 10, 2023

Learn how Fresh Clean Threads leveraged J.P. Morgan’s commercial One Card program to propel online growth, manage expenses and capitalize on marketing spend with a rich rewards program.

Read moreDriving commercial card program success

When you begin a Corporate Card program with us, we’ll dive deep into program design, push hard on control measures and sweat the details to help you achieve your goals. Even if you have an existing program, our industry experts can offer a fresh look at your goals and help you deliver stronger results.

Design

Our consultative, tailored approach can help you determine the best setup for your organization’s specific needs.

Build

Our team does the heavy lifting so you don’t have to. We’ll dig into program configuration details, including systems integration and reporting.

Launch

Before the program goes live, benefit from training, communications templates and best practices to share across your company.

Treasury

A Payments win-win for a supplier and their buyers

March 22, 2023

Construction company Ricon sought a streamlined way to move from accepting paper checks to electronic payments. Despite a lack of experience with digital payments, the company was able to implement a successful virtual card platform—and reap the benefits of faster payments and improved cash flow.

Read moreFAQs

Corporate cards are not just for the largest companies. Eligibility for a corporate card depends on a company’s organizational structure, as well as its revenue, spending and employee card needs. Contact us and we’ll help determine the right solution for your business.

Corporate cards are ideal for businesses looking to simplify their T&E expenses. Corporate cards can improve your organization's performance by increasing your purchasing oversight, helping to reduce costs and streamlining your payment process.

Businesses may be solely responsible for corporate cards or may involve individual or joint liability with employees. J.P. Morgan offers corporate liability on our commercial card products, not individual or joint liability.

Related insights

Payments

What is PCI compliance?

Mar 25, 2025

Protect your business and customer relationships through strong payment security. Learn how PCI DSS requirements safeguard card data and help prevent fraud while building trust.

Read more

Payments

What are card-issuing APIs?

Mar 20, 2025

Card issuing application programming interfaces (APIs) can help enhance the efficiency, security and overall management of corporate credit card programs.

Read more